Berry Petroleum Company (NYSE:BRY) reported a net loss of $52.5

million, or $0.98 per diluted share, for the first quarter of 2011.

Oil and gas revenues were $187 million during the quarter and

discretionary cash flow totaled $85 million.

Net income for the quarter was impacted by a non-cash loss on

hedges and other items. In total, for the first quarter of 2011,

these items decreased net income by approximately $74.7 million, or

$1.35 per diluted share for an adjusted first quarter net income of

$22.2 million, or $0.41 per diluted share.

For the first quarter of 2011 and fourth quarter of 2010,

average net production in BOE per day was as follows:

First Quarter Ended Fourth Quarter

Ended March 31 December 31 2011

Production 2010 Production Oil (Bbls) 22,648

66 % 22,679 66 % Natural Gas (BOE)

11,757 34 %

11,805 34 % Total BOE per

day 34,405 100 % 34,484 100 %

Robert F. Heinemann, president and chief executive officer,

said, “During the first quarter, Berry executed on its 2011 capital

program drilling a total of 125 wells with two rigs in the

diatomite and four rigs in the Permian. We began injecting steam

into our new diatomite wells late during the first quarter and

field-wide production has begun to respond in line with our

expectations. We remain on track to reach 5,000 BOE/D by mid-year

2011. We have also entered into agreements to purchase

approximately 6,000 additional net acres in the Wolfberry for

approximately $123 million. This acquisition will increase our

total inventory to approximately 470 wells on 40-acre spacing after

this year. We now plan to run five rigs in the Permian for the

balance of the year and expect our 2011 capital will increase to

between $400 million and $450 million at current prices and expect

our total average production for 2011 to be between 37,500 BOE/D

and 39,500 BOE/D. Strong commodity prices and a narrow differential

to WTI in California contributed to an excellent operating margin

of $38 per BOE during the first quarter. Late in the first quarter,

California crude oil began to trade at a premium to WTI and this

premium is about $5 per barrel today. We should see the full impact

of this premium in our operating margins during the second

quarter.”

Operational Update

Michael Duginski, executive vice president and chief operating

officer, stated, “Berry drilled approximately 75 wells on our

diatomite property in the first quarter. In addition to injecting

steam in these new wells, we have reestablished continuous

operations and have increased steam injection throughout the field

to over 40,000 BSPD. Production and reservoir temperatures are

responding as expected. Current diatomite production is 3,000

BOE/D, up from an average of 2,250 BOE/D in the first quarter. We

have submitted documentation to the California Division of Oil, Gas

and Geothermal Resources and continue to expect approval of our

development project in the second quarter. In the Permian, we

drilled 14 wells during the quarter and results continue to be in

line with our expectations. Production in the Permian increased by

35% during the quarter and averaged approximately 3,000 BOE/D.”

Financial Update

David Wolf, executive vice president and chief financial

officer, stated, “We completed our credit facility borrowing base

redetermination in April and raised our borrowing base from $875

million to $1.4 billion. While we did not increase lender

commitments, the increased borrowing base gives us the flexibility

to increase our liquidity by adding commitments as needed in the

future. In addition to the increased borrowing base we reduced the

pricing on our facility to be in line with the current market,

extended the maturity by six months and added the flexibility to

refinance our 2016 notes. Liquidity under our credit facility at

the end of the first quarter was $633 million. Our per barrel

results for the first quarter were generally in line with guidance

with higher operating costs being impacted by a legal settlement

accrual and increased workover activity during the quarter and our

general and administrative expenses reflecting the impact of annual

compensation awards.”

2011 Guidance

For 2011 the Company is issuing the following per BOE

guidance:

Anticipated Three Months range in 2011 3/31/11

Operating costs-oil and gas production $ 16.50 - 18.50 $ 18.43

Production taxes 2.00 - 2.50 2.39 DD&A 16.00 - 18.00 16.83

G&A 3.75 - 4.25 5.26 Interest expense 5.25 – 6.25

5.06 Total $ 43.50 - 49.50 $ 47.97

Explanation and Reconciliation of

Non-GAAP Financial Measures

Discretionary Cash Flow ($

millions)

Three Months Ended 3/31/11 12/31/10 Net cash

provided by operating activities

$

100.4

$ 48.7 Add back: Net increase (decrease) in current assets 14.7 7.4

Add back: Net decrease (increase) in current liabilities including

book overdraft (30.2 ) 17.7 Add back: Unwind of interest rate swaps

- 10.8 Discretionary cash flow $ 84.9 $ 84.6

Reconciliation of First Quarter Net

Income ($ millions)

Three Months Ended 3/31/11 Adjusted net earnings $

22.2 After tax adjustments: Non-cash hedge losses (74.6 ) Legal

Settlement Accruals (0.7 ) Acquisition related items 0.6

Net loss, as reported $ (52.5 )

Reconciliation of First Quarter

Operating Margin Per BOE

Three Months Ended 3/31/11 Average Sales Price $

59.01 Operating costs 18.43 Production taxes

2.39 Operating Margin $ 38.19

Teleconference Call

An earnings conference call will be held Thursday, April 28,

2011 at 10:00 a.m. Eastern Time (8:00 a.m. Mountain Time). Dial

800-260-8140 to participate, using passcode 33881600. International

callers may dial 617-614-3672. For a digital replay available until

April 28, 2011 dial 888-286-8010 passcode 79887394. Listen live or

via replay on the web at www.bry.com.

About Berry Petroleum Company

Berry Petroleum Company is a publicly traded independent oil and

gas production and exploitation company with operations in

California, Colorado, Texas and Utah. The Company uses its web site

as a channel of distribution of material company information.

Financial and other material information regarding the Company is

routinely posted on and accessible at

http://www.bry.com/index.php?page=investor.

Safe harbor under the “Private Securities Litigation Reform

Act of 1995”

Any statements in this news release that are not historical

facts are forward-looking statements that involve risks and

uncertainties. Words such as “estimate,” “expect,” “would,” “will,”

“target,” “goal,” and forms of those words and others indicate

forward-looking statements. These statements include but are not

limited to forward-looking statements about acquisitions and the

expectations of plans, strategies, objectives and anticipated

financial and operating results of the Company, including the

Company’s drilling program, production, hedging activities, capital

expenditure levels and other guidance included in this press

release. These statements are based on certain assumptions made by

the Company based on management’s experience and perception of

historical trends, current conditions, anticipated future

developments and other factors believed to be appropriate. Such

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond the control of the Company,

which may cause actual results to differ materially from those

implied or expressed by the forward-looking statements. Important

factors which could affect actual results are discussed in the

Company’s filings with the Securities and Exchange Commission,

including its Annual Report on Form 10-K under the headings “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations.”

CONDENSED INCOME STATEMENTS (In thousands, except per

share data) (unaudited)

Three Months

3/31/11 12/31/10 Revenues

Sales of oil and gas

$ 187,389 $ 168,605 Sales of

electricity

6,412 7,427 Gas marketing

3,685 3,968

Interest and other, net

128

980 Total

197,614 180,980

Expenses Operating costs – oil & gas

57,083

49,949 Operating costs – electricity

6,113 6,566 Production

taxes

7,391 6,515 Depreciation, depletion & amortization

- oil & gas

52,109 50,456 Depreciation, depletion &

amortization - electricity

501 818 Gas marketing

3,516 3,687 General and administrative

16,291 14,457

Realized and unrealized loss on derivatives, net

127,516

62,330 Interest

15,655 17,168 Extinguishment of debt

- 572 Bargain purchase gain

(1,046 ) - Dry

hole, abandonment, impairment & exploration

113 89 Total

285,242

212,607 Earnings (loss) before income

taxes

(87,628 ) (31,627 ) Income tax (benefit)

provision

(35,131 )

(10,481 ) Net (loss)

earnings

$ (52,497

) $ (21,146

) Basic (loss) earnings per share

$ (0.98

) $ (0.40

) Diluted (loss) earnings per share

$ (0.98

) $ (0.40

) Cash dividends per share

$

0.075 $ 0.075

CONDENSED BALANCE SHEETS

(In thousands) (unaudited)

3/31/11

12/31/10 Assets Current assets

$

189,258 $ 142,866 Property, buildings & equipment, net

2,725,567 2,655,792 Derivative instruments

1,562

2,054 Other assets

35,742

37,904 $

2,952,129 $ 2,838,616

Liabilities & Shareholders’ Equity Current liabilities

$

339,357 $ 270,651 Deferred income taxes

322,990

329,207 Long-term debt

1,144,624 1,108,965 Derivative

instruments

87,035 33,526 Other long-term liabilities

73,751 71,714 Shareholders’ equity

984,372 1,024,553

$ 2,952,129 $

2,838,616 CONDENSED STATEMENTS OF

CASH FLOWS (In thousands) (unaudited)

Three

Months 3/31/11

12/31/10 Cash flows from operating activities: Net

(loss) earnings

$ (52,497 ) $ (21,146 )

Depreciation, depletion & amortization (DD&A)

52,610

51,274 Gain on purchase of oil and natural gas properties

(1,047 ) - Extinguishment of debt

- 572

Amortization of debt issuance costs and net discount

2,099

2098 Dry hole & impairment

- 1 Unrealized loss on

derivatives

124,459 51,609 Stock-based compensation

3,052 2,252 Deferred income taxes

(44,321 )

(12,834 ) Other, net

680 (12 ) Cash paid for abandonment

(103 ) (2 ) Change in book overdraft

4,736

(7,781 ) Net changes in operating assets and liabilities

10,766 (17,314

) Net cash provided by operating activities

100,434 48,717 Cash flows from investing activities

Capital Expenditures

(130,672 ) (79,184 ) Property

acquisitions

(2,413 ) (179,892 ) Capitalized Interest

(10,392 )

(7,919 ) Net cash used in investing

activities

(143,477 ) (266,995 ) Net cash

provided by financing activities

42,845

218,502 Net increase

(decrease) in cash and cash equivalents

(198 ) 224

Cash and cash equivalents at beg of year

278 54 Cash

and cash equivalents at end of period

$

80 $ 278

COMPARATIVE OPERATING STATISTICS

(unaudited)

Three Months

3/31/11 12/31/10

Change Oil and gas: Heavy Oil Production

(Bbl/D)

16,226 16,548 Light Oil Production (Bbl/D)

6,422 6,131

Total Oil Production (Bbl/D)

22,648 22,679 Natural Gas

Production (Mcf/D)

70,542

70,828 Total (BOE/D)

34,405 34,484

Per BOE: Average realized sales price

$ 60.26

$ 53.55 13 % Average sales price including cash derivative

settlements

$ 59.01 $ 53.75 10 % Oil, per Bbl:

Average WTI price

$ 94.60 $ 85.20 11 % Price

sensitive royalties

(3.57 ) (3.37 ) Gravity

differential and other

(5.68 ) (9.16 ) Crude oil

derivatives non cash amortization

(7.06

) (3.22 ) Oil

revenue

78.29 69.45 13 % Add: Crude oil derivatives non cash

amortization

7.06 3.22 Crude Oil derivative cash settlements

(10.24 )

(4.35 ) Average realized oil price

$ 75.11 $ 68.32 10 % Natural gas price:

Average Henry Hub price per MMBtu

$ 4.11 $ 3.80 8 %

Conversion to Mcf

0.21 0.19 Natural gas derivatives non cash

amortization

(0.01 ) 0.05 Location, quality

differentials and other

(0.09

) (0.14 )

Natural gas revenue per Mcf

4.22 3.90 8 % Less: Natural gas

derivatives non cash amortization

0.01 (0.05 ) Natural gas

derivative cash settlements

0.41

0.50 Average realized natural gas price

per Mcf

4.64 4.35 7 % Operating costs

$

18.43 $ 15.73 17 % Production taxes

2.39 2.05 17

% Total operating costs

20.82 17.78 17 % DD&A -

oil and gas

16.83 15.89 6 % General & administrative

expenses

5.26 4.55 16 % Interest expense

$

5.06 $ 5.41 -6 %

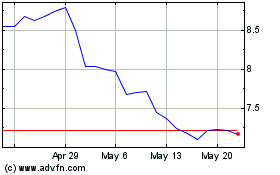

Berry (NASDAQ:BRY)

Historical Stock Chart

From May 2024 to Jun 2024

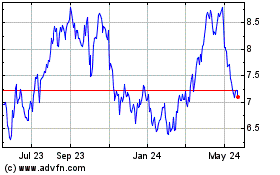

Berry (NASDAQ:BRY)

Historical Stock Chart

From Jun 2023 to Jun 2024