Berry Petroleum Announces Pricing of $300 Million of 6.75% Senior Notes Due 2020

October 27 2010 - 3:58PM

Business Wire

Berry Petroleum Company (NYSE:BRY) announced today that it has

priced an underwritten public offering of $300 million aggregate

principal amount of senior notes due 2020, which will bear interest

at a rate of 6.75% per year. The notes are being sold at par. Berry

expects to close the sale of the notes on November 1, 2010, subject

to the satisfaction of customary closing conditions. The offering

is being made under Berry’s effective shelf registration statement

previously filed with the Securities and Exchange Commission

(SEC).

Berry intends to use approximately $175 million of the net

proceeds from the offering to finance the purchase price of the

planned acquisition of certain properties in the Wolfberry trend of

West Texas and to use the remainder to reduce outstanding

borrowings under its senior secured revolving credit facility.

Wells Fargo Securities, LLC, BNP Paribas Securities Corp., J.P.

Morgan Securities LLC, RBS Securities Inc. and SG Americas

Securities, LLC are acting as joint book-running managers for the

offering. A prospectus supplement relating to the offering will be

filed with the SEC and may be found on its website at www.sec.gov.

Alternatively, the underwriters will arrange to send you the

prospectus supplement and related base prospectus if you request

them by contacting Wells Fargo Securities at 550 South Tryon

Street, 7th Floor, MAC D1086-070, Charlotte, NC 28202, or

cmclientsupport@wellsfargo.com, or by calling 1-800-326-5897; BNP

Paribas Securities Corp. at 787 Seventh Avenue, New York, New York

10019 or by calling 1-800-854-5674; J.P. Morgan Securities LLC at

383 Madison Avenue, New York, New York 10179, Attention: High Yield

Syndicate Desk, or by calling 212-270-1200; RBS Securities Inc. at

600 Steamboat Road, Greenwich, CT 06830, Attention: High Yield

Syndicate, or by calling 1-866-884-2071; or SG Americas Securities,

LLC at 1221 Avenue of the Americas, New York, NY 10020, Attention:

David C. Sharp, Managing Director Capital Markets & Syndicate -

Americas, david-c.sharp@sgcib.com, Tel: 212-278-7128, Fax:

212-278-2072.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any state in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any state. The notes will be offered only by

means of a prospectus, including the prospectus supplement relating

to the notes, meeting the requirements of Section 10 of the

Securities Act of 1933, as amended.

About Berry Petroleum Company

Berry Petroleum Company is a publicly traded independent oil and

gas production and exploitation company with operations in

California, Utah, Colorado and Texas.

Safe harbor under the “Private Securities Litigation Reform

Act of 1995”

Any statements in this news release that are not historical

facts are forward-looking statements that involve risks and

uncertainties. Words such as “estimate,” “expect,” “would,” “will,”

“target,” “goal” and “intend” and forms of those words and others

indicate forward-looking statements. These statements include but

are not limited to forward-looking statements about the offering,

the use of the net proceeds from the offering and the planned

acquisition of properties in West Texas, including whether the

acquisition is consummated in whole or in part. These statements

are based on certain assumptions made by the Company based on

management's experience and perception of historical trends,

current conditions, anticipated future developments and other

factors believed to be appropriate. Such statements are subject to

a number of assumptions, risks and uncertainties, many of which are

beyond the control of the Company, which may cause actual results

to differ materially from those implied or expressed by the

forward-looking statements. Important factors which could affect

actual results are discussed in Berry's 2009 Form 10-K filed with

the Securities and Exchange Commission on February 25, 2010, as

updated in the Company’s 10-Q filings subsequent to such date,

under Part 1, Item A, Risk Factors and in Part II, Item 7

Management's Discussion and Analysis of Financial Condition and

Results of Operations.

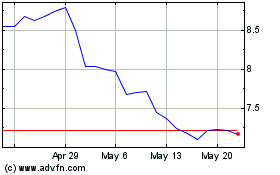

Berry (NASDAQ:BRY)

Historical Stock Chart

From May 2024 to Jun 2024

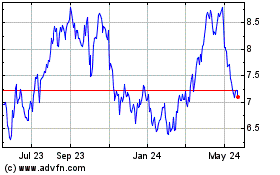

Berry (NASDAQ:BRY)

Historical Stock Chart

From Jun 2023 to Jun 2024