Berry Petroleum Enters Agreements to Purchase Wolfberry Oil Assets for $180 Million

October 25 2010 - 8:30AM

Business Wire

Berry Petroleum Company (NYSE:BRY) announced that it has entered

into agreements with a group of sellers to acquire their interests

in properties on approximately 9,300 net acres in the Wolfberry

trend in West Texas for a combined purchase price of $180 million

in cash. Berry’s proved plus probable reserve estimates associated

with the forty-acre development of the properties are approximately

35 million barrels of oil equivalent (MMBOE) with crude oil

comprising 76% of these volumes. Upon completion of the

acquisitions, the properties are expected to add approximately

2,200 barrels of oil equivalent per day (BOED) to Berry’s

production during 2011.

Since entering the Permian basin in March of 2010, Berry has

accumulated approximately 19,350 net acres in the Wolfberry trend.

The $313 million of acquisitions in 2010 is expected to provide a

five-year drilling inventory in the Wolfberry of 400 locations on

forty-acre spacing with an additional 400 potential locations on

twenty-acre spacing.

Robert Heinemann, president and chief executive officer, stated,

"We are pleased to bring additional scalable, high margin oil

assets into the portfolio which complements our base oil assets in

California and Utah. We believe these acquisitions enhance our

overall Permian operations with a contiguous 6,800 net acre block

and strong per well recoveries of 180 MBOE. The first three years

of expected production on these assets has a hedging floor of

approximately $87 WTI which should allow these assets to generate

operating margins of $62 per barrel. The Company’s existing

Wolfberry assets, acquired earlier in 2010, are performing in line

with expectations and production is 1,700 BOED today. With the

acquisitions announced today, we now expect production from our

Permian assets will grow to 9,000 BOED during the next four

years.”

David Wolf, executive vice president and chief financial

officer, stated “We expect to fund this acquisition under our

credit facility and on a pro forma basis we will have liquidity of

over $500 million. With this acquisition, our leverage should be in

the range of 2.25 to 2.5 times EBITDA in 2011.”

The effective date of the transaction is October 1, 2010 with

closing expected in December 2010 and is subject to customary

closing conditions. Production from the properties to be acquired

is expected to be approximately 1,200 BOED at closing. Contribution

to the Company’s fourth quarter 2010 production will be minimal

given the expected closing date.

2010 Capital Update

The Company expects 2010 capital spending will range from $290

million to $310 million. Additional capital requirements are

attributable to the expedited development of the Company’s

diatomite asset, an incremental 14 wells in the Uinta basin and

increased costs in the Company’s East Texas operations.

2011 Capital Outlook

Assuming completion of the acquisitions in 2010, the Company

plans to run four drilling rigs in the Permian basin during 2011

and spend approximately $130 million to drill approximately 75

wells. The Company’s capital budget for 2011, based on $75 WTI, is

expected to be between $375 million and $425 million and should be

fully funded from cash flow. Approximately 90% of the 2011 capital

is expected to be directed towards the Company’s oil assets

targeting oil production growth of at least 20%. Berry expects its

total average 2011 production to be between 37,000 and 39,000 BOED.

Of the expected 2011 production growth of approximately 15%, the

acquired assets should contribute 6% with organic growth comprising

9%. Production volumes are expected to be 70% oil, which should

drive corporate operating margins to $33 per BOE.

Safe harbor under the “Private Securities Litigation Reform

Act of 1995”

Any statements in this news release that are not historical

facts are forward-looking statements that involve risks and

uncertainties. Words such as “estimate”, “expect”, "would," "will,"

"target," "goal," and forms of those words and others indicate

forward-looking statements. These statements include but are not

limited to forward-looking statements about acquisitions and the

expectations of plans, strategies, objectives and anticipated

financial and operating results of the Company, including the

Company's drilling program, production, hedging activities, capital

expenditure levels and other guidance included in this press

release. These statements are based on certain assumptions made by

the Company based on management's experience and perception of

historical trends, current conditions, anticipated future

developments and other factors believed to be appropriate. Such

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond the control of the Company,

which may cause actual results to differ materially from those

implied or expressed by the forward-looking statements. Important

factors which could affect actual results are discussed in Berry's

2009 Form 10-K filed with the Securities and Exchange Commission on

February 25, 2010, as updated in the Company’s 10-Q filings

subsequent to such date, under Part 1, Item A, Risk Factors and in

Part II, Item 7 Management's Discussion and Analysis of Financial

Condition and Results of Operations.

Oil and gas reserves disclaimer

The SEC requires oil and gas companies, in filings made with the

SEC, to disclose proved reserves, which are those quantities of oil

and gas, which, by analysis of geoscience and engineering data, can

be estimated with reasonable certainty to be economically

producible – from a given date forward, from known reservoirs,

under existing economic condition, operating methods, and

governmental regulations. Beginning with year-end reserves for

2009, the SEC permits the optional disclosure of probable and

possible reserves. The SEC defines "probable" reserves as "those

additional reserves that are less certain to be recovered than

proved reserves but which, together with proved reserves, are as

likely as not to be recovered." Berry applies this definition in

estimating probable reserves. Statements of reserves are only

estimates and may not correspond to the ultimate quantities of oil

and gas recovered.

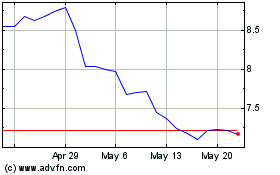

Berry (NASDAQ:BRY)

Historical Stock Chart

From May 2024 to Jun 2024

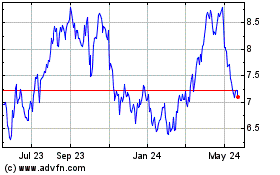

Berry (NASDAQ:BRY)

Historical Stock Chart

From Jun 2023 to Jun 2024