- Current report filing (8-K)

June 16 2010 - 8:28AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 15, 2010

BERRY PETROLEUM COMPANY

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

DELAWARE

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

1-9735

(Commission File Number)

|

|

77-0079387

(IRS Employer

Identification Number)

|

|

|

|

|

|

1999 BROADWAY, SUITE 3700, DENVER, COLORADO

(Address of Principal Executive Offices)

|

|

80202

(Zip Code)

|

Registrant’s telephone number, including area code:

(303) 999-4400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry in A Material Definative Agreement.

On June 15, 2010, Berry Petroleum Company (“Berry”) entered into that certain Stipulation and Agreed Order (the “Stipulation”) with Flying J Inc. and certain of its affiliates (collectively “Flying J”), regarding resolution of Berry’s claim in Flying J’s pending bankruptcy. Pursuant to the Stipulation, each of Berry and

Flying J agreed that the total amount owed to Berry by Flying J arising out of Flying J’s voluntary bankruptcy filed December 22, 2008 is $60,500,000, with $11,827,697.23 being an administrative claim pursuant to 11 U.S.C. § 503(b)(9), and the remaining balance of $48,672,302.77 designated as a general unsecured claim.

The amounts contemplated by the Stipulation are subject to the approval and confirmation of the Bankruptcy Court with the matter to be heard on July 6, 2010 concurrent with Flying J’s Motion for Bankruptcy Court approval of its Disclosure Statement and Plan Confirmation, which, if approved and fully performed by the satisfaction of all conditions precedent, would allegedly result in payment in full in cash of all approved claims against Flying J.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereto duly authorized.

|

|

|

|

|

|

|

|

BERRY PETROLEUM COMPANY

|

|

|

|

By:

|

/s/ Kenneth A. Olson

|

|

|

|

|

Kenneth A. Olson

|

|

|

|

|

Corporate Secretary

|

|

|

|

Date: June 16, 2010

- 2 -

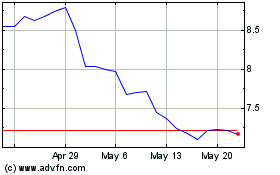

Berry (NASDAQ:BRY)

Historical Stock Chart

From May 2024 to Jun 2024

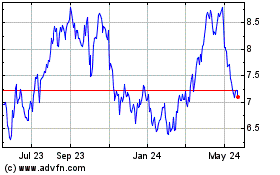

Berry (NASDAQ:BRY)

Historical Stock Chart

From Jun 2023 to Jun 2024