Mutual Fund Summary Prospectus (497k)

August 05 2013 - 3:34PM

Edgar (US Regulatory)

Pear Tree Columbia Small Cap Fund

|

|

Ordinary Shares: USBNX Institutional Shares: QBNAX

|

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at

www.peartreefunds.com/fund-literature

. You may also obtain this information at no cost by calling 1-800-326-2151 or by sending an email to

info@peartreefunds.com

. The current prospectus and statement of additional information dated August 1, 2013 are incorporated by reference into this summary prospectus.

Investment Objective:

Maximum long-term capital appreciation.

Fee Table and Expenses of Small Cap Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of Small Cap Fund.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

|

Ordinary Shares

|

Institutional Shares

|

|

Management Fees

|

1.00%

|

1.00%

|

|

Distribution (12b-1) Fees

|

0.25%

|

None

|

|

Other Expenses

|

0.38%

|

0.38%

|

|

Acquired Fund Fees and Expenses*

|

0.17%

|

0.17%

|

|

Total Annual Fund Operating Expenses

|

1.80%

|

1.55%

|

*Fees and expenses incurred indirectly by Small Cap as a result of investment in shares of other investment companies.

Example

This example is intended to help you compare the cost of investing in Small Cap Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in Small Cap Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5 percent return each year and that Small Cap Fund’s operating expenses remain the same as set forth in the table above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

1 year

|

3 years

|

5 years

|

10 years

|

|

Ordinary Class

|

$183

|

$567

|

$977

|

$2,120

|

|

Institutional Class

|

$158

|

$491

|

$847

|

$1,850

|

Portfolio Turnover

Small Cap Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect Small Cap Fund’s performance. During the most recent fiscal year, Small Cap Fund’s portfolio turnover rate was 54 percent of the average value of its portfolio.

Principal Investment Strategies

Under normal market conditions, Small Cap Fund invests at least 80 percent of its net assets (plus borrowings for investment purposes) in equity securities of small-cap companies. Small Cap Fund considers a small-cap company to be a company having at time of purchase a market capitalization of an issuer in the Russell 2000® Index (at the time of the index’s most recent rebalancing, stocks with capitalizations of approximately $100 million to $3 billion).

The sub-adviser to Small Cap Fund utilizes a series of well-defined, established processes in order to select and reevaluate securities in the growth and value categories. The sub-adviser begins with a universe of securities. Each security in that universe is then evaluated using a series of proprietary screens involving fundamental, quantitative, qualitative and technical analysis. Once a security has been subjected to those analytical filters, the sub-adviser performs a detailed assessment; develops an investment thesis; sets a price target and initiates a portfolio position. From time to time, holdings may be diversified by company and industry, although Small Cap Fund is not obligated to remain diversified. While most assets are typically invested in U.S. common stocks, Small Cap Fund may invest in American Depositary Receipts, or ADRs, and other foreign stocks traded on U.S. exchanges in keeping with Small Cap Fund’s objectives.

The sub-adviser generally considers growth stocks to be equity securities issued by companies that have sustainable competitive advantages and products or services that potentially could generate significantly greater-than-average revenue and earnings growth. The sub-adviser generally considers value stocks to be equity securities issued by companies that have underappreciated but stable earnings and cash flow and where there are visible and imminent inflection points and catalysts that will result in increased earnings and cash flow, driving stock appreciation.

Small Cap Fund may lend its securities. Small Cap Fund may hold cash, or it may manage its cash by investing in cash equivalents and money market funds. Small Cap Fund also may take temporary defensive positions that are inconsistent with its principal investment strategies.

Principal Investment Risks

It is possible to lose money by investing in Small Cap Fund. An investment in Small Cap Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Market, Industry and Specific Holdings.

The share price of Small Cap Fund may fall because of weakness in the stock markets, generally, weaknesses with respect to a particular industry in which Small Cap Fund has significant holdings, or weaknesses associated with one or more specific companies in which Small Cap Fund may have substantial investments.

Liquidity Risk.

Small Cap Fund may not be able to sell some or all of its securities at desired prices or may be unable to sell the securities at all.

Active Management Risk.

The sub-adviser’s judgments about the attractiveness, value, or potential appreciation of Small Cap Fund’s investments may prove to be incorrect.

Small-Capitalization Securities.

Investments in small-capitalization companies typically present greater risks than investments in larger companies and, as a result, the performance of Small Cap Fund may be more volatile than a fund that invests in large-cap stocks.

Growth and Value Stock Investing

. Different investment styles periodically come into and fall out of favor with investors. Growth stocks generally are more volatile than the overall stock market. Value stocks generally carry the risk that the market will not recognize their intrinsic value or that they are actually appropriately priced at a low level.

Foreign Investing.

Small Cap Fund’s investments in foreign securities (including ADRs) may be adversely affected by political and economic conditions overseas, reduced liquidity, or decreases in foreign currency values relative to the U.S. dollar.

Sector.

Small Cap Fund currently has significant investments in one or more specific industry sectors, subjecting it to risks greater than general market risk.

Non-Diversification.

Small Cap Fund is “non-diversified,” which means that it may invest a higher percentage of its assets in a small number of issuers. When Small Cap Fund is not diversified, a decline in the value of the securities of one issuer could have a significant negative effect on the value of Small Cap Fund’s portfolio.

Securities Lending

. Securities lending involves two primary risks: investment risk and borrower default risk. Investment risk is the risk that Small Cap Fund will lose money from the investment of the cash collateral received from the borrower. Borrower default risk is the risk that Small Cap Fund will lose money due to the failure of a borrower to return a borrowed security in a timely manner.

Please refer to “Fund Objectives, Strategies and Risks” in the Prospectus for further details.

Performance

The following bar charts and tables provide some indication of the risks of investing in Small Cap Fund by showing changes in the Fund’s performance over time. The tables also compare Small Cap Fund’s performance to a broad measure of market performance that reflects the type of securities in which Small Cap Fund invests. Past performance does not necessarily indicate how Small Cap Fund will perform (before and after taxes) in the future.

Updated performance information is available at

www.peartreefunds.com.

Annual Return Ordinary Class

(Calendar year ended December 31) Returns for Institutional Shares will differ from the Ordinary Share returns due to differences in expenses between the classes.

|

2003

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

|

43.08%

|

22.87%

|

9.08%

|

21.03%

|

0.18%

|

-49.30%

|

33.35%

|

26.93%

|

-4.53%

|

13.39%

|

Calendar year-to-date return of the Ordinary Shares of Small Cap Fund as of 6/30/2013 is 14.91%

|

Best Quarter:

|

Q3 2009

|

17.75%

|

|

Worst Quarter:

|

Q4 2008

|

(33.47)%

|

Average Annual Total Returns for the periods ended December 31, 2012

|

|

|

1 Year

|

|

5 Years

|

|

10 Years

|

|

Ordinary Shares Before Taxes

|

|

|

13.39

|

%

|

|

|

(1.46)

|

%

|

|

|

8.01

|

%

|

|

Ordinary Shares After Taxes on Distributions

|

|

|

13.39

|

%

|

|

|

(1.51)

|

%

|

|

|

7.54

|

%

|

|

Ordinary Shares After Taxes on Distributions and Sale of Fund Shares

|

|

|

8.71

|

%

|

|

|

(1.25)

|

%

|

|

|

7.08

|

%

|

|

Institutional Shares Before Taxes

|

|

|

13.64

|

%

|

|

|

(1.23)

|

%

|

|

|

8.40

|

%

|

|

Russell 2000 Index

(Reflects no deductions for fees, expenses or taxes)

|

|

|

16.35

|

%

|

|

|

3.56

|

%

|

|

|

9.72

|

%

|

After-tax returns.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state or local taxes. Actual after-tax returns may differ depending on your individual circumstances and may differ from those shown. The after-tax returns shown are not relevant if you hold your shares in a retirement account or in another tax-deferred arrangement. After-tax returns are shown only for Ordinary Shares and after-tax returns for Institutional Shares may vary. Actual after-tax returns may differ depending on your individual circumstances.

Management

Small Cap Fund is managed by Pear Tree Advisors, Inc. Small Cap Fund is sub-advised by Columbia Partners, L.L.C., Investment Management (“Columbia”). The following employees of Columbia serve as the portfolio managers of Small Cap Fund:

|

Investment Team

|

Position at Columbia

|

Manager of the Fund Since

|

|

Robert A. von Pentz, CFA

|

Chief Investment Officer, Senior Equity Portfolio Manager and Research Analyst

|

1996

|

|

Rhys Williams, CFA

|

Senior Equity Portfolio Manager and Research Analyst

|

1997

|

Buying and Selling Fund Shares

You may buy or sell shares of Small Cap Fund on any business day by contacting the Pear Tree Funds, through mail or by phone, or through your broker or financial intermediary. Purchase and redemption orders with respect to Fund shares are processed at the net asset value next calculated after an order is received.

|

Initial Investment Minimum

Ordinary Class: $2,500 or

Ordinary Class Retirement Accounts: $1,000

Institutional Class: $1,000,000

|

Contact Information

Mail:

Pear Tree Funds

Attention: Transfer Agent

55 Old Bedford Road, Suite 202

Lincoln, MA 01773

Telephone:

1-800-326-2151

Website:

www.peartreefunds.com

|

|

Ongoing Investment Minimum

Both Classes: 50 shares

|

Tax Information

Small Cap Fund’s distributions may be taxable as ordinary income or capital gains, except when your investment is through an IRA, 401(k) or other tax-advantaged investment plan. These tax-advantaged plans may be taxed upon withdrawal at a later date based upon your individual circumstances.

Payments to Broker-Dealers and other Financial Intermediaries

If you purchase shares of Small Cap Fund through a broker-dealer or other financial intermediary (such as a bank), Small Cap Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend Small Cap Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

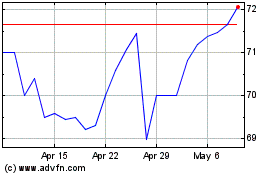

Bel Fuse (NASDAQ:BELFA)

Historical Stock Chart

From Jun 2024 to Jul 2024

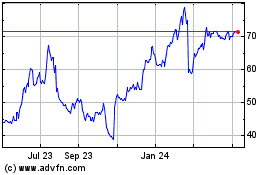

Bel Fuse (NASDAQ:BELFA)

Historical Stock Chart

From Jul 2023 to Jul 2024