UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-37385

Baozun Inc.

No. 1-9, Lane 510, West Jiangchang Road

Shanghai 200436

The People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Baozun Inc. |

| |

|

|

| |

By: |

/s/ Arthur Yu |

| |

Name: |

Arthur Yu |

| |

Title: |

Chief Financial Officer |

Date: November 22, 2023

Exhibit Index

Exhibit 99.1

Baozun Announces Third Quarter 2023 Unaudited

Financial Results

SHANGHAI, China, November 22, 2023 - Baozun Inc.

(Nasdaq: BZUN and HKEX: 9991) (“Baozun”, the “Company” or the “Group”), a leading brand e-commerce

solution provider and digital commerce enabler in China, today announced its unaudited financial results for the third quarter ended September

30, 2023.

Mr. Vincent Qiu, Chairman and Chief Executive

Officer of Baozun, stated, “I am pleased that Baozun Group is collectively demonstrating significant progress in our transformation

efforts. Despite macro headwinds, we grew revenue 5% year-over-year, and achieved significant year-over-year improvement in operating

cash flow. BBM is executing well on its transformation of GAP Shanghai, accomplishing a wide array of successes, including new products,

new store openings, and increased brand marketing and visibility. These “premium-ization of GAP” efforts ensure the success

of shifting from a discount-driven approach to one that focuses on building consumer love for our brand and products. During the quarter,

we successfully launched our new Retail Operating Platform for Gap Shanghai, establishing a solid foundation for Gap’s continuous

digital transformation.”

“We are also excited to announce a contemplated

51% equity acquisition of Hangzhou Location Information Technology Co., Ltd. ("Location"), a top-tier Douyin partner specializing

in Apparel and Accessories. Location was one of the first movers in the Douyin ecosystem, and a pioneer in the livestreaming space. We’re

thrilled about the synergistic blend of our market leadership in creative content, compelling portfolio of brand partners and profound

e-commerce operating experiences with Location’s exceptional skills and insights in daily livestreaming. This synergy solidifies

our leadership in the Douyin ecosystem and expands on our success in other major brand e-commerce platforms, representing another important

milestone in our strategic transformation.” Mr. Qiu concluded.

Mr. Arthur Yu, Chief Financial Officer of Baozun and President of BEC,

commented, “Despite a weaker economic environment and stronger seasonality, we are making notable progress in our business transformation.

This marks the first third quarter since our IPO that Baozun achieved positive operating cash flow, largely driven by business optimization,

cost reduction, and improved working capital efficiency. Additionally, we continue to make progress in developing our omni-channel network,

achieving double-digit GMV growth from both the Tencent mini-program and Douyin ecosystems during the quarter. Now, with the strategic

alliance with Location, we believe we are even stronger in the dynamic e-commerce environment, further enhancing our value proposition

to our brand partners.”

Third Quarter 2023 Financial Highlights

| · | Total net revenues were RMB1,823.6 million (US$1250.0

million), representing an increase of 4.7% compared with RMB1,741.3 million in the same quarter of last year. |

| · | Loss from operations was RMB135.7 million (US$18.6

million), compared with RMB26.3 million in the same quarter of last year.

Operating margin was negative 7.4%, compared with negative 1.5% for the same

period of 2022. |

1 This announcement contains translations

of certain Renminbi (RMB) amounts into U.S. dollars (US$) at a specified rate solely for the convenience of the reader. Unless otherwise

noted, the translation of RMB into US$ has been made at RMB7.2960 to US$1.00, the noon buying rate in effect on September 29, 2023 as

set forth in the H.10 Statistical Release of the Federal Reserve Board.

| · | Non-GAAP loss from operations2

was RMB90.4 million (US$12.4 million), compared with non-GAAP income from operations RMB16.9 million in the same quarter of last year.

Non-GAAP operating margin was negative 5.0%, compared with positive 1.0% for the same period of 2022. |

| · | Adjusted

operating loss of E-Commerce3 was RMB40.3 million (US$5.5 million). |

| · | Adjusted operating loss of Brand Management3

was RMB50.1 million (US$6.9 million). |

| · | Net loss attributable to ordinary shareholders

of Baozun was RMB126.4 million (US$17.3 million), compared with RMB168.9 million for the same period of 2022. |

| · | Non-GAAP net loss attributable to ordinary shareholders

of Baozun4 was RMB76.4 million (US$10.5 million), compared withRMB13.1 million for the

same period of 2022. |

| · | Basic and diluted net loss attributable to ordinary

shareholders of Baozun per American Depositary Share (“ADS5”) were both

RMB2.12 (US$0.29), compared with both RMB2.88 for the same period of 2022. |

| · | Basic and diluted non-GAAP net loss attributable

to ordinary shareholders of Baozun per ADS6 were both RMB1.28 (US$0.18), compared with

both RMB0.22 for the same period of 2022. |

| · | Cash and cash equivalents, restricted cash, and

short-term investments totaled RMB2,930.7 million (US$401.7 million), as of September 30, 2023, compared with RMB3,141.1 million as of

December 31, 2022. |

Reconciliations of GAAP measures to non-GAAP measures

presented above are included at the end of this results announcement.

Adjusted operating profits/losses are included

in the Segments data of Segment Information.

2 Non-GAAP income (loss) from operations is a non-GAAP

financial measure, which is defined as income (loss) from operations excluding the impact of share-based compensation expenses, amortization

of intangible assets resulting from business acquisition and acquisition-related expenses.

3 Following the acquisition of Gap Shanghai, the Group

updated its operating segment structure resulting in two segments, which were (i) E-Commerce; (ii) Brand Management, for more information,

please refer to Supplemental Information.

4 Non-GAAP net income (loss) attributable to ordinary shareholders

of Baozun is a non-GAAP financial measure, which is defined as net income (loss) attributable to ordinary shareholders of Baozun excluding

the impact of share-based compensation expenses, amortization of intangible assets resulting from business acquisition, acquisition-related

expenses, impairment of goodwill and investments, loss on variance from expected contingent acquisition payment, cancellation fees of

repurchased ADSs and returned ADSs, fair value loss on derivative liabilities, loss on disposal of subsidiaries and investment in equity

investee, and unrealized investment loss.

5 Each ADS represents three Class A ordinary shares.

6 Basic and diluted non-GAAP net income (loss) attributable

to ordinary shareholders of Baozun per ADS are non-GAAP financial measures, which are respectively defined as non-GAAP net income (loss)

attributable to ordinary shareholders of Baozun divided by weighted average number of shares used in calculating basic and diluted net

income (loss) per ordinary share multiplied by three, respectively.

Business Highlights

Baozun e-Commerce, or “BEC”

BEC includes our China e-commerce businesses,

such as brands’ store operations, customer services and value-added services in logistics and supply chain management, IT and digital

marketing. During the quarter, revenue from store operations of Apparel and Accessories delivered year-over-year growth driven by solid

industry momentum and incremental value-added services penetration.

Omni-channel expansion remains a key theme for

our brand partners. Gross Merchandise Volume (GMV)7

generated from non-TMALL marketplaces and channels accounted for approximately 40.2% of total GMV during the quarter, compared with 31.1%

for the same period of 2022. By the end of the third quarter, approximately 45.0% of our brand partners engaged with us for store operations

of at least two channels, compared with 42.4% a year ago.

Baozun Brand Management, or “BBM”

BBM engages in holistic brand management, including

strategy and tactic positioning, branding and marketing, retail and e-commerce operations, supply chain and logistics and technology empowerment.

We aim to leverage our portfolio of technologies to forge longer and deeper relationships with brands.

In the third quarter of 2023, BBM continued to

focus on transforming Gap Shanghai – from a discount-driven approach to one that focuses on building consumer love for our brand

and products. During the quarter, product sales for BBM totaled RMB296.3 million. Gross profit margin of product sales for BBM in the

third quarter of 2023 was 55.5%, further improved from previous quarters.

Third Quarter 2023 Financial Results

Total net revenues were RMB1,823.6 million

(US$250.0 million), an increase of 4.7% from RMB1,741.3 million in the same quarter of last year. The increase in total net revenues was

mainly due to the incremental revenue contribution from BBM, a new line of business the Company launched in the first quarter of 2023.

Total product sales revenue was RMB707.9

million (US$97.0 million), compared with RMB497.1 million in the same quarter of last year, of which,

| · | Product sales revenue of E-Commerce was RMB411.6 million (US$56.4 million), a decrease of 17.2

% from RMB497.1 million in the same quarter of last year. The decrease was primarily attributable to the macro-economic weakness, along

with stronger seasonality in e-commerce industry this year, as well as the Company’s optimization of its product distribution model. |

7 GMV includes value added tax and

excludes (i) shipping charges, (ii) surcharges and other taxes, (iii) value of the goods that are returned and (iv) deposits for purchases

that have not been settled.

The following table sets forth a breakdown of product sales

revenues of E-Commerce by key categories 8

for the periods indicated:

| | |

For the three months ended September 30, | |

| | |

2022 | | |

2023 | | |

| |

| | |

RMB | | |

% of

Net Revenues | | |

RMB | | |

US$ | | |

% of

Net Revenues | | |

YoY

Change | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(In millions, except for percentage) | |

| Product Sales of E-Commerce | |

| | |

| | |

| | |

| | |

| | |

| |

| Appliances | |

| 212.2 | | |

| 13 | % | |

| 179.5 | | |

| 24.6 | | |

| 11 | % | |

| -15 | % |

| Beauty and cosmetics | |

| 76.2 | | |

| 4 | % | |

| 76.3 | | |

| 10.5 | | |

| 4 | % | |

| 0 | % |

| Fast moving consumer goods | |

| 66.1 | | |

| 4 | % | |

| 31.7 | | |

| 4.3 | | |

| 2 | % | |

| -52 | % |

| Electronics | |

| 50.5 | | |

| 3 | % | |

| 25.8 | | |

| 3.5 | | |

| 1 | % | |

| -49 | % |

| Others | |

| 92.1 | | |

| 5 | % | |

| 98.3 | | |

| 13.5 | | |

| 5 | % | |

| 7 | % |

| Total net revenues from product sales of E-Commerce | |

| 497.1 | | |

| 29 | % | |

| 411.6 | | |

| 56.4 | | |

| 23 | % | |

| -17 | % |

| · | Product sales revenue of Brand Management was RMB296.3 million (US$40.6 million), which mainly

comprised retail revenue from Gap Shanghai business, including both offline store sales and online sales. |

Services revenue was RMB1,115.8 million

(US$152.9 million), a decrease of 10.3% from RMB1,244.2 million in the same quarter of last year. The decrease was primarily due to revenue

reduction of RMB65.7 million from warehousing and fulfillment due to lower volume of warehousing business and the disposal of a loss-making

subsidiary during the third quarter of 2022, and a reduction of RMB44.3 million from Digital marketing and IT solutions, due to fewer

performance-marketing initiatives during the quarter, partially offset by increasing revenue from value-added content driven marketing

and revenue streams from IT monetization.

The following table sets forth a breakdown of services revenue by business

models for the periods indicated:

| | |

For the three months ended September 30, | |

| | |

2022 | | |

2023 | | |

| |

| | |

RMB | | |

% of

Net Revenues | | |

RMB | | |

US$ | | |

% of

Net Revenues | | |

YoY

Change | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(In millions, except for percentage) | |

| Services revenue | |

| | |

| | |

| | |

| | |

| | |

| |

| Online store operations | |

| 347.9 | | |

| 20 | % | |

| 340.7 | | |

| 46.7 | | |

| 19 | % | |

| -2 | % |

| Warehousing and fulfillment | |

| 492.4 | | |

| 28 | % | |

| 431.7 | | |

| 59.1 | | |

| 23 | % | |

| -12 | % |

| Digital marketing and IT solutions | |

| 403.9 | | |

| 23 | % | |

| 362.7 | | |

| 49.7 | | |

| 20 | % | |

| -10 | % |

| Inter-segment

eliminations9 | |

| - | | |

| - | | |

| (19.3 | ) | |

| (2.6 | ) | |

| -1 | % | |

| n/a | |

| Total net revenues from services | |

| 1,244.2 | | |

| 71 | % | |

| 1,115.8 | | |

| 152.9 | | |

| 61 | % | |

| -10 | % |

8 Key categories refer to the categories

that accounted for no less than 10% of product sales revenues during the periods indicated.

9 The inter-segment eliminations mainly

consist of revenues from online store operations, digital marketing and IT services provided by E-Commerce to Gap, a brand under Brand

Management.

Breakdown of total net revenues of online store

operations of services by key categories 10

of services for the periods indicated:

| | |

For the three months ended September 30, | |

| | |

2022 | | |

2023 | | |

| |

| | |

RMB | | |

% of

Net Revenues | | |

RMB | | |

US$ | | |

% of

Net Revenues | | |

YoY

Change | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(In millions, except for percentage) | |

| Online store operations in Services revenue | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Apparel and accessories | |

| 231.9 | | |

| 13 | % | |

| 248.4 | | |

| 34.0 | | |

| 14 | % | |

| 7 | % |

| - Luxury | |

| 92.9 | | |

| 5 | % | |

| 86.3 | | |

| 11.8 | | |

| 5 | % | |

| -7 | % |

| - Sportswear | |

| 80.4 | | |

| 5 | % | |

| 101.3 | | |

| 13.9 | | |

| 6 | % | |

| 26 | % |

| - Other apparel | |

| 58.6 | | |

| 3 | % | |

| 60.8 | | |

| 8.3 | | |

| 3 | % | |

| 4 | % |

| Others | |

| 116.0 | | |

| 7 | % | |

| 92.3 | | |

| 12.7 | | |

| 5 | % | |

| -20 | % |

| Inter-segment

eliminations11 | |

| - | | |

| - | | |

| (11.2 | ) | |

| (1.5 | ) | |

| -1 | % | |

| n/a | |

| Total net revenues from online store operations in services | |

| 347.9 | | |

| 20 | % | |

| 329.5 | | |

| 45.2 | | |

| 18 | % | |

| -5 | % |

Total operating expenses were RMB1,959.4

million (US$268.6 million), compared with RMB1,767.5 million in the same quarter of last year. The increase in operating expense is mainly

attributing to the acquisition of Gap Shanghai. Besides operating expense from GAP Shanghai, the remaining operating expenses decreased

by RMB137.9 million, representing a 7.8% decrease compared with the same quarter of last year.

| · | Cost of products was RMB491.2 million (US$67.3 million), compared with RMB414.8 million in the

same quarter of last year. The increase was primarily due to the incremental cost of product of RMB130.5 million related to Gap Shanghai,

a subsidiary the Company acquired in the first quarter of 2023. |

| · | Fulfillment expenses were RMB513.0 million (US$70.3 million), compared with RMB575.9 million in

the same quarter of last year. The decrease was primarily due to a decrease in revenue from warehouse and logistics business and a reduction

of RMB27.7 million in freight expenses resulting from the Company’s divesture of a subsidiary of its warehouse and supply chain

businesses in the third quarter of 2022 and additional savings in customer services expenses resulting from the Company’s expanding

use of regional service centers. |

| · | Sales and marketing expenses were RMB637.5 million (US$87.4 million), compared with RMB602.4 million

in the same quarter of last year. The increase was mainly due to the incremental sales and marketing expenses of RMB81.7 million related

to Gap Shanghai, a subsidiary the Company acquired in the first quarter of 2023. |

10 Key categories refer to the categories

that accounted for no less than 10% of services revenue during the periods indicated.

11 The inter-segment eliminations

mainly consist of revenues from store operation services provided by E-Commerce to Gap, a brand under Brand Management.

| · | Technology and content expenses were RMB120.4 million (US$16.5 million), compared with RMB98.3

million in the same quarter of last year. The increase was mainly due to the Company’s ongoing investment in technological innovation

and productization, partially offset by the Company’s cost control initiatives and efficiency improvements. |

| · | General and administrative expenses were RMB214.5 million (US$29.4 million), compared with RMB97.7

million in the same quarter of last year. The increase was primarily due to an incremental expense of RMB110.2 million related to Brand

Management, including the expenses related to Gap Shanghai, a subsidiary the Company acquired in the first quarter of 2023, as well as

strategic investments expenses in Creative Content to Commerce business unit and brand management. |

Loss from operations was RMB 135.7 million

(US$18.6 million), compared with RMB26.3 million in the same quarter of last year. Operating margin was negative 7.4%, compared with negative

1.5% in the same quarter of last year.

Non-GAAP loss from operations was RMB90.4

million (US$12.4 million), compared with non-GAAP income from operations RMB16.9 million in the same quarter of last year. The decrease

was mainly due to the loss generated from Gap Shanghai, a subsidiary the Company acquired in the first quarter of 2023, which has been

significantly narrowed on a comparable basis, along with lower profitability in BEC businesses due to weak macro conditions and stronger

seasonality.

Adjusted operating loss of E-Commerce was

RMB40.3 million (US$5.5 million), compared with adjusted operating profit of RMB16.9 million in the same quarter of last year. Adjusted

operating loss of Brand Management was RMB50.1 million (US$6.9 million).

Unrealized investment loss was RMB7.8 million

(US$1.1 million), compared with RMB8.2 million in the same quarter of last year. The unrealized investment loss of this quarter was mainly

related to the decrease in the trading price of Lanvin Group, a company successfully listed on the New York Stock Exchange in December

2022 that the Company invested in June 2021.

Net loss attributable to ordinary shareholders

of Baozun was RMB126.4 million (US$17.3 million), compared with RMB168.9 million in the same quarter of last year.

Basic and diluted net loss attributable to

ordinary shareholders of Baozun per ADS were both RMB2.12 (US$0.29), compared with both RMB2.88 for the same period of 2022.

Non-GAAP net loss attributable to ordinary

shareholders of Baozun Inc. was RMB76.4 million (US$10.5 million), compared with RMB13.1 million in the same quarter of last year.

Basic and diluted non-GAAP net loss attributable

to ordinary shareholders of Baozun per ADS were both RMB1.28 (US$0.18), compared with both RMB0.22 for the same period of 2022.

Segment Information

| (a) | Description of segments |

Following the acquisition of Gap Shanghai, the Group

updated its operating segments structure resulting in two segments, which were (i) E-Commerce and (ii) Brand Management;

The following summary describes the operations in

each of the Group’s operating segment:

| (i) | E-Commerce focuses on Baozun traditional e-commerce service business and comprises two business lines, BEC (Baozun E-Commerce)

and BZI (Baozun International). |

| a> | BEC includes our mainland China e-commerce businesses, such as brands’ store operations, customer services and value-added services

in logistics and supply chain management, IT and digital marketing. |

| b> | BZI includes our e-commerce businesses outside of mainland China, including locations such as Hong Kong, Macau, Taiwan, South East

Asia and Europe. |

| (ii) | Brand Management engages in holistic brand management, encompassing strategy and tactic positioning, branding and marketing,

retail and e-commerce operations, supply chain and logistics and technology empowerment to leverage our portfolio of technologies to forge

into longer and deeper relationships with brands. |

| | | |

The table below provides a summary of the Group’s

reportable segment results for the three months ended September 30, 2022 and 2023, with prior periods’ segment information retrospectively

recast to conform to current period presentation:

| | |

For the three months ended September 30, | |

| | |

2022 | | |

2023 | |

| | |

RMB | | |

RMB | |

| Net revenues: | |

| | | |

| | |

| E-Commerce | |

| 1,741,272 | | |

| 1,543,276 | |

| Brand Management | |

| - | | |

| 299,645 | |

| Inter-segment eliminations * | |

| - | | |

| (19,279 | ) |

| Total consolidated net revenues | |

| 1,741,272 | | |

| 1,823,642 | |

| | |

| | | |

| | |

| **Adjusted Operating Profits (Losses): | |

| | | |

| | |

| E-Commerce | |

| 16,913 | | |

| (40,300 | ) |

| Brand Management | |

| - | | |

| (50,091 | ) |

| Total Adjusted Operating Profits | |

| 16,913 | | |

| (90,391 | ) |

| Inter-segment eliminations * | |

| - | | |

| - | |

| Unallocated expenses: | |

| | | |

| | |

| Share-based compensation expenses | |

| (33,829 | ) | |

| (29,415 | ) |

| Amortization of intangible assets resulting from business acquisition | |

| (9,340 | ) | |

| (7,911 | ) |

| Acquisition-related expenses | |

| - | | |

| (7,995 | ) |

| Total other income (expenses) | |

| (126,197 | ) | |

| 4,198 | |

| Loss before income tax | |

| (152,453 | ) | |

| (131,514 | ) |

*The

inter-segment eliminations mainly consist of revenues from services provided by E-Commerce to Brand Management.

**Adjusted Operating

Profits (Losses) represent segment profits (losses), which is income (loss) from operations from each segment without allocating share-based

compensation expenses, acquisition-related expenses and amortization of intangible assets resulting from business acquisition.

Supplemental Information

Baozun Signs Term Sheet to Acquire 51% Equity Interest of Location

Baozun has signed a Key Term Confirmation Letter ("Term Sheet")

with Hangzhou Location Information Technology Co., Ltd. ("Location") and other relevant parties regarding its equity investment

in Location in November 2023. Baozun plans to acquire 51% of Location's equity through capital increase and equity transfer.

Except for the provisions regarding period of

validity, exclusivity, confidentiality, governing law and dispute resolution in the Term Sheet, the terms and conditions of the proposed

transaction agreed in the Term Sheet are not legally binding on any party. If the proposed transaction is completed, the rights and obligations

of all parties shall be governed by the contents of the definitive transaction documents.

Conference Call

The Company will host a conference call to discuss

the earnings at 6:30 a.m. Eastern Time on Wednesday, November 22, 2023 (7:30 p.m. Beijing time on the same day).

Dial-in details for the earnings conference call

are as follows:

| United States: |

1-888-317-6003 |

| Hong Kong: |

800-963-976 |

| Singapore: |

800-120-5863 |

| Mainland China: |

4001-206-115 |

| International: |

1-412-317-6061 |

| Passcode: |

6234438 |

A replay of the conference call may be accessible

through November 29, 2023 by dialing the following numbers:

| United States: |

1-877-344-7529 |

| International: |

1-412-317-0088 |

| Canada: |

855-669-9658 |

| Replay Access Code: |

3958715 |

A live webcast of the conference call will be

available on the Investor Relations section of Baozun’s website at http://ir.baozun.com. An archived webcast will be available

through the same link following the call.

Use of Non-GAAP Financial Measures

The Company also uses certain non-GAAP

financial measures in evaluating its business. For example, the Company uses non-GAAP income (loss) from operations, non-GAAP

operating margin, non-GAAP net income (loss), non-GAAP net margin, non-GAAP net income (loss) attributable to ordinary shareholders

of Baozun and non-GAAP net income (loss) attributable to ordinary shareholders of Baozun per ADS, as

supplemental measures to review and assess its financial and operating performance. The presentation of these non-GAAP financial

measures is not intended to be considered in isolation, or as a substitute for the financial information prepared and presented in

accordance with U.S. GAAP.

The Company defines non-GAAP income (loss) from

operations as income (loss) from operations excluding the impact of share-based compensation expenses, amortization of intangible assets

resulting from business acquisition and acquisition-related expenses. The Company defines non-GAAP operating margin as non-GAAP income

(loss) from operations as a percentage of total net revenues. The Company defines non-GAAP net income (loss) as net income (loss) excluding

the impact of share-based compensation expenses, amortization of intangible assets resulting from business acquisition, acquisition-related

expenses, impairment of goodwill and investments, loss on variance from expected contingent acquisition payment, cancellation fees of

repurchased ADSs and returned ADSs, fair value loss on derivative liabilities, loss on disposal of subsidiaries and investment in equity

investee, and unrealized investment loss. The Company defines non-GAAP net margin as non-GAAP net income (loss) as a percentage of total

net revenues. The Company defines non-GAAP net income (loss) attributable to ordinary shareholders of Baozun as net income (loss)

attributable to ordinary shareholders of Baozun excluding the impact of share-based compensation expenses, amortization of intangible

assets resulting from business acquisition, acquisition-related expenses, impairment of goodwill and investments, loss on variance from

expected contingent acquisition payment, cancellation fees of repurchased ADSs and returned ADSs, fair value loss on derivative liabilities,

loss on disposal of subsidiaries and investment in equity investee, and unrealized investment loss. The Company defines non-GAAP net income

(loss) attributable to ordinary shareholders of Baozun per ADS as non-GAAP net income (loss) attributable to ordinary shareholders

of Baozun divided by weighted average number of shares used in calculating net income (loss) per ordinary share multiplied by

three.

The Company presents the non-GAAP financial measures

because they are used by the Company’s management to evaluate the Company’s financial and operating performance and formulate

business plans. Non-GAAP income (loss) from operations, non-GAAP net income (loss), non-GAAP net income (loss) attributable to ordinary

shareholders of Baozun and Non-GAAP net income (loss) attributable to ordinary shareholders of Baozun per ADS reflect

the Company’s ongoing business operations in a manner that allows more meaningful period-to-period comparisons. The Company believes

that the use of the non-GAAP financial measures facilitates investors to understand and evaluate the Company’s current operating

performance and future prospects in the same manner as management does, if they so choose. The Company also believes that the non-GAAP

financial measures provide useful information to both management and investors by excluding certain expenses, gain/loss and other items

that are not expected to result in future cash payments or that are non-recurring in nature or may not be indicative of the Company’s

core operating results and business outlook.

The non-GAAP financial measures are not defined

under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations

as analytical tools. One of the key limitations of using non-GAAP income (loss) from operations, non-GAAP net income (loss), non-GAAP

net income (loss) attributable to ordinary shareholders of Baozun, and non-GAAP net income (loss) attributable to ordinary shareholders

of Baozun per ADS is that they do not reflect all items of income and expense that affect the Company’s operations.

Further, the non-GAAP measures may differ from

the non-GAAP measures used by other companies, including peer companies, potentially limiting the comparability of their financial results

to the Company’s. In light of the foregoing limitations, the non-GAAP income (loss) from operations, non-GAAP operating margin,

non-GAAP net income (loss), non-GAAP net margin, non-GAAP net income (loss) attributable to ordinary shareholders of Baozun and

non-GAAP net income (loss) attributable to ordinary shareholders of Baozun per ADS for the period should not be considered in

isolation from or as an alternative to income (loss) from operations, operating margin, net income (loss), net margin, net income (loss)

attributable to ordinary shareholders of Baozun and net income (loss) attributable to ordinary shareholders of Baozun per

ADS, or other financial measures prepared in accordance with U.S. GAAP.

The Company compensates for these limitations

by reconciling the non-GAAP financial measures to the nearest U.S. GAAP performance measures, which should be considered when

evaluating the Company’s performance. The company encourages you to review the company’s financial information in its entirety

and not rely on a single financial measure. For reconciliations of these non-GAAP financial measures to the most directly comparable GAAP

financial measures, please see the section of the accompanying tables titled, “Reconciliations of GAAP and Non-GAAP Results.”

Safe Harbor Statements

This announcement contains forward-looking statements.

These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995.

These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates,” “confident,”

“potential,” “continues,” “ongoing,” “targets,” “guidance,” “going forward,”

“looking forward,” “outlook” or other similar expressions. Statements that are not historical facts, including

but not limited to statements about Baozun’s beliefs and expectations, are forward-looking statements. Forward-looking statements

involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in

any forward-looking statement, including but not limited to Baozun’s filings with the United States Securities and Exchange Commission

and its announcements, notices or other documents published on the website of The Stock Exchange of Hong Kong Limited. All information

provided in this announcement is as of the date hereof and is based on assumptions that Baozun believes to be reasonable as of this date,

and Baozun undertakes no obligation to update such information, except as required under applicable law.

About Baozun Inc.

Founded in 2007, Baozun Inc. is a leader in brand

e-commerce service, brand management, and digital commerce service. It serves more than 400 brands from various industries and sectors

around the world, including East and Southeast Asia, Europe and North America.

Baozun Inc. comprises three major business lines

- Baozun e-Commerce (BEC), Baozun Brand Management (BBM) and Baozun International (BZI) and is committed to accelerating high-quality

and sustainable growth. Driven by the principle that “Technology Empowers the Future Success”, Baozun’s business lines

are devoted to empowering their clients’ business and navigating their new phase of development.

For more information, please visit http://ir.baozun.com.

For investor and media inquiries, please contact:

Baozun Inc.

Ms. Wendy Sun

Email: ir@baozun.com

Baozun Inc.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

| | |

As of | |

| | |

December 31, 2022 | | |

September 30, 2023 | | |

September 30, 2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| ASSETS | |

| | |

| | |

| |

| Current assets | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 2,144,020 | | |

| 2,157,961 | | |

| 295,773 | |

| Restricted cash | |

| 101,704 | | |

| 54,068 | | |

| 7,411 | |

| Short-term investments | |

| 895,425 | | |

| 718,655 | | |

| 98,500 | |

| Accounts receivable, net | |

| 2,292,678 | | |

| 1,664,731 | | |

| 228,170 | |

| Inventories | |

| 942,997 | | |

| 1,130,888 | | |

| 155,001 | |

| Advances to suppliers | |

| 372,612 | | |

| 411,863 | | |

| 56,451 | |

| Prepayments and other current assets | |

| 554,415 | | |

| 592,472 | | |

| 81,207 | |

| Amounts due from related parties | |

| 93,270 | | |

| 71,726 | | |

| 9,831 | |

| Total current assets | |

| 7,397,121 | | |

| 6,802,364 | | |

| 932,344 | |

| | |

| | | |

| | | |

| | |

| Non-current assets | |

| | | |

| | | |

| | |

| Investments in equity investees | |

| 269,693 | | |

| 299,383 | | |

| 41,034 | |

| Property and equipment, net | |

| 694,446 | | |

| 854,152 | | |

| 117,071 | |

| Intangible assets, net | |

| 310,724 | | |

| 307,791 | | |

| 42,186 | |

| Land use right, net | |

| 39,490 | | |

| 38,721 | | |

| 5,307 | |

| Operating lease right-of-use assets | |

| 847,047 | | |

| 1,087,413 | | |

| 149,042 | |

| Goodwill | |

| 336,326 | | |

| 346,914 | | |

| 47,549 | |

| Other non-current assets | |

| 65,114 | | |

| 57,732 | | |

| 7,913 | |

| Deferred tax assets | |

| 162,509 | | |

| 205,204 | | |

| 28,126 | |

| Total non-current assets | |

| 2,725,349 | | |

| 3,197,310 | | |

| 438,228 | |

| | |

| | | |

| | | |

| | |

| Total assets | |

| 10,122,470 | | |

| 9,999,674 | | |

| 1,370,572 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Short-term loan | |

| 1,016,071 | | |

| 976,310 | | |

| 133,814 | |

| Accounts payable | |

| 474,732 | | |

| 536,228 | | |

| 73,496 | |

| Notes payable | |

| 487,837 | | |

| 320,000 | | |

| 43,860 | |

| Income tax payables | |

| 46,828 | | |

| 20,779 | | |

| 2,848 | |

| Accrued expenses and other current liabilities | |

| 1,025,540 | | |

| 1,036,029 | | |

| 142,004 | |

| Derivative liabilities | |

| 364,758 | | |

| - | | |

| - | |

| Amounts due to related parties | |

| 30,434 | | |

| 28,876 | | |

| 3,958 | |

| Current operating lease liabilities | |

| 235,445 | | |

| 299,541 | | |

| 41,056 | |

| Total current liabilities | |

| 3,681,645 | | |

| 3,217,763 | | |

| 441,036 | |

| | |

| | | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Deferred tax liabilities | |

| 28,082 | | |

| 26,682 | | |

| 3,657 | |

| Long-term operating lease liabilities | |

| 673,955 | | |

| 851,382 | | |

| 116,692 | |

| Other non-current liabilities | |

| 62,450 | | |

| 57,644 | | |

| 7,901 | |

| Total non-current liabilities | |

| 764,487 | | |

| 935,708 | | |

| 128,250 | |

| | |

| | | |

| | | |

| | |

| Total liabilities | |

| 4,446,132 | | |

| 4,153,471 | | |

| 569,286 | |

Baozun Inc.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except for share and per share data)

| | |

As of | |

| | |

December 31, 2022 | | |

September 30, 2023 | | |

September 30, 2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Redeemable non-controlling interests | |

| 1,438,082 | | |

| 1,560,795 | | |

| 213,924 | |

| | |

| | | |

| | | |

| | |

| Baozun Inc. shareholders’ equity: | |

| | | |

| | | |

| | |

| Class A ordinary shares (US$0.0001 par value; 470,000,000 shares authorized, 163,100,873 and 165,629,464 shares issued and outstanding as of December 31, 2022 and September 30, 2023, respectively) | |

| 116 | | |

| 93 | | |

| 13 | |

| Class B ordinary shares (US$0.0001 par value; 30,000,000 shares authorized, 13,300,738 shares issued and outstanding as of December 31, 2022 and September 30, 2023, respectively) | |

| 8 | | |

| 8 | | |

| 1 | |

| Additional paid-in capital | |

| 5,129,103 | | |

| 4,544,489 | | |

| 622,874 | |

| Treasury shares | |

| (832,578 | ) | |

| - | | |

| - | |

| Accumulated deficit | |

| (228,165 | ) | |

| (458,173 | ) | |

| (62,800 | ) |

| Accumulated other comprehensive income | |

| 15,678 | | |

| 56,034 | | |

| 7,680 | |

| | |

| | | |

| | | |

| | |

| Total Baozun Inc. shareholders' equity | |

| 4,084,162 | | |

| 4,142,451 | | |

| 567,768 | |

| | |

| | | |

| | | |

| | |

| Non-controlling interests | |

| 154,094 | | |

| 142,957 | | |

| 19,594 | |

| | |

| | | |

| | | |

| | |

| Total Shareholders’ equity | |

| 4,238,256 | | |

| 4,285,408 | | |

| 587,362 | |

| | |

| | | |

| | | |

| | |

| Total liabilities, redeemable non-controlling interests and Shareholders’ equity | |

| 10,122,470 | | |

| 9,999,674 | | |

| 1,370,572 | |

Baozun Inc.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF COMPREHENSIVE INCOME

(In thousands, except for share and per share

data and per ADS data)

| | |

For the three months ended September 30, | |

| | |

2022 | | |

2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Net revenues | |

| | | |

| | | |

| | |

| Product sales(1) | |

| 497,098 | | |

| 707,855 | | |

| 97,020 | |

| Services | |

| 1,244,174 | | |

| 1,115,787 | | |

| 152,931 | |

| Total net revenues | |

| 1,741,272 | | |

| 1,823,642 | | |

| 249,951 | |

| | |

| | | |

| | | |

| | |

| Operating expenses (2) | |

| | | |

| | | |

| | |

| Cost of products | |

| (414,776 | ) | |

| (491,160 | ) | |

| (67,319 | ) |

| Fulfillment(3) | |

| (575,875 | ) | |

| (512,997 | ) | |

| (70,312 | ) |

| Sales and marketing (3) | |

| (602,438 | ) | |

| (637,488 | ) | |

| (87,375 | ) |

| Technology and content(3) | |

| (98,301 | ) | |

| (120,382 | ) | |

| (16,500 | ) |

| General and administrative(3) | |

| (97,684 | ) | |

| (214,487 | ) | |

| (29,398 | ) |

| Other operating income, net | |

| 21,546 | | |

| 17,160 | | |

| 2,352 | |

| Total operating expenses | |

| (1,767,528 | ) | |

| (1,959,354 | ) | |

| (268,552 | ) |

| Loss from operations | |

| (26,256 | ) | |

| (135,712 | ) | |

| (18,601 | ) |

| Other income (expenses) | |

| | | |

| | | |

| | |

| Interest income | |

| 8,485 | | |

| 24,466 | | |

| 3,352 | |

| Interest expense | |

| (9,724 | ) | |

| (11,190 | ) | |

| (1,534 | ) |

| Unrealized investment loss | |

| (8,219 | ) | |

| (7,805 | ) | |

| (1,070 | ) |

| Impairment loss of investments | |

| (8,400 | ) | |

| - | | |

| - | |

| Loss on disposal of subsidiaries and investment in equity investee | |

| (99,521 | ) | |

| - | | |

| - | |

| Exchange loss | |

| (8,818 | ) | |

| (1,273 | ) | |

| (174 | ) |

| Loss before income tax | |

| (152,453 | ) | |

| (131,514 | ) | |

| (18,027 | ) |

| Income tax expense (4) | |

| (4,259 | ) | |

| (1,946 | ) | |

| (267 | ) |

| Share of income (loss) in equity method investment, net of tax of nil | |

| (269 | ) | |

| 3,861 | | |

| 529 | |

| Net loss | |

| (156,981 | ) | |

| (129,599 | ) | |

| (17,765 | ) |

| Net (income) loss attributable to noncontrolling interests | |

| (2,382 | ) | |

| 7,900 | | |

| 1,083 | |

| Net income attributable to redeemable noncontrolling interests | |

| (9,495 | ) | |

| (4,734 | ) | |

| (649 | ) |

| Net loss attributable to ordinary shareholders of Baozun Inc. | |

| (168,858 | ) | |

| (126,433 | ) | |

| (17,331 | ) |

| | |

| | | |

| | | |

| | |

| Net loss per share attributable to ordinary shareholders of Baozun Inc.: | |

| | | |

| | | |

| | |

| Basic | |

| (0.96 | ) | |

| (0.71 | ) | |

| (0.10 | ) |

| Diluted | |

| (0.96 | ) | |

| (0.71 | ) | |

| (0.10 | ) |

| Net loss per ADS attributable to ordinary shareholders of Baozun Inc.: | |

| | | |

| | | |

| | |

| Basic | |

| (2.88 | ) | |

| (2.12 | ) | |

| (0.29 | ) |

| Diluted | |

| (2.88 | ) | |

| (2.12 | ) | |

| (0.29 | ) |

| Weighted average shares used in calculating net loss per ordinary share | |

| | | |

| | | |

| | |

| Basic | |

| 176,164,018 | | |

| 178,755,231 | | |

| 178,755,231 | |

| Diluted | |

| 176,164,018 | | |

| 178,755,231 | | |

| 178,755,231 | |

| | |

| | | |

| | | |

| | |

| Net loss | |

| (156,981 | ) | |

| (129,599 | ) | |

| (17,765 | ) |

| Other comprehensive income, net of tax of nil: | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| 83,606 | | |

| 8,630 | | |

| 1,183 | |

| Comprehensive loss | |

| (73,375 | ) | |

| (120,969 | ) | |

| (16,582 | ) |

| (1) | Including product sales from E-Commerce and Brand Management of RMB411.6 million and RMB296.3 million for the three months period

ended September 30, 2023, respectively, compared with product sales from e-Commerce of RMB497.1 million for the three months period ended

September 30, 2022. |

| (2) | Share-based compensation expenses are allocated in operating expenses items as follows: |

| | |

For the three months ended September 30, | |

| | |

2022 | | |

2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Fulfillment | |

| 2,820 | | |

| 1,846 | | |

| 253 | |

| Sales and marketing | |

| 14,643 | | |

| 10,394 | | |

| 1,425 | |

| Technology and content | |

| 5,233 | | |

| 3,448 | | |

| 473 | |

| General and administrative | |

| 11,133 | | |

| 13,727 | | |

| 1,881 | |

| | |

| 33,829 | | |

| 29,415 | | |

| 4,032 | |

(3) Including amortization of intangible assets resulting from business

acquisition, which amounted to RMB9.3 million and RMB7.9 million for the three months period ended September 30, 2022 and 2023, respectively.

(4) Including income tax benefits of RMB1.8 million and RMB1.5 million

related to the reversal of deferred tax liabilities, which was recognized on business acquisition for the three months period ended September

30, 2022 and 2023, respectively.

Baozun Inc.

Reconciliations of GAAP and Non-GAAP Results

(in thousands, except for share and per ADS

data)

| | |

For the three months ended September 30, | |

| | |

2022 | | |

2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Loss from operations | |

| (26,256 | ) | |

| (135,712 | ) | |

| (18,601 | ) |

| Add: Share-based compensation expenses | |

| 33,829 | | |

| 29,415 | | |

| 4,032 | |

| Amortization of intangible assets resulting from business acquisition | |

| 9,340 | | |

| 7,911 | | |

| 1,084 | |

| Acquisition-related expenses | |

| - | | |

| 7,995 | | |

| 1,096 | |

| Non-GAAP income (loss) from operations | |

| 16,913 | | |

| (90,391 | ) | |

| (12,389 | ) |

| | |

| | | |

| | | |

| | |

| Net loss | |

| (156,981 | ) | |

| (129,599 | ) | |

| (17,765 | ) |

| Add: Share-based compensation expenses | |

| 33,829 | | |

| 29,415 | | |

| 4,032 | |

| Amortization of intangible assets resulting from business acquisition | |

| 9,340 | | |

| 7,911 | | |

| 1,084 | |

| Acquisition-related expenses | |

| - | | |

| 7,995 | | |

| 1,096 | |

| Unrealized investment loss | |

| 8,219 | | |

| 7,805 | | |

| 1,070 | |

| Impairment loss of investments | |

| 8,400 | | |

| - | | |

| - | |

| Loss on disposal of subsidiaries and investment in equity investee | |

| 99,521 | | |

| - | | |

| - | |

| Less: Tax effect of amortization of intangible assets resulting

from business acquisition | |

| (1,838 | ) | |

| (1,507 | ) | |

| (207 | ) |

| Non-GAAP net income (loss) | |

| 490 | | |

| (77,980 | ) | |

| (10,690 | ) |

| | |

| | | |

| | | |

| | |

| Net loss attributable to ordinary shareholders of Baozun Inc. | |

| (168,858 | ) | |

| (126,433 | ) | |

| (17,331 | ) |

| Add: Share-based compensation expenses | |

| 33,829 | | |

| 29,415 | | |

| 4,032 | |

| Amortization of intangible assets resulting from business acquisition | |

| 7,139 | | |

| 5,991 | | |

| 821 | |

| Acquisition-related expenses | |

| - | | |

| 7,995 | | |

| 1,096 | |

| Unrealized investment loss | |

| 8,219 | | |

| 7,805 | | |

| 1,070 | |

| Impairment loss of investments | |

| 8,400 | | |

| - | | |

| - | |

| Loss on disposal of subsidiaries and investment in equity investee | |

| 99,521 | | |

| - | | |

| - | |

| Less: Tax effect of amortization of intangible assets resulting

from business acquisition | |

| (1,396 | ) | |

| (1,127 | ) | |

| (155 | ) |

| Non-GAAP net loss attributable to ordinary shareholders of Baozun Inc. | |

| (13,146 | ) | |

| (76,354 | ) | |

| (10,467 | ) |

| | |

| | | |

| | | |

| | |

| Non-GAAP net loss attributable to ordinary shareholders of Baozun Inc. per ADS: | |

| | | |

| | | |

| | |

| Basic | |

| (0.22 | ) | |

| (1.28 | ) | |

| (0.18 | ) |

| Diluted | |

| (0.22 | ) | |

| (1.28 | ) | |

| (0.18 | ) |

| Weighted average shares used in calculating net loss per ordinary share | |

| | | |

| | | |

| | |

| Basic | |

| 176,164,018 | | |

| 178,755,231 | | |

| 178,755,231 | |

| Diluted | |

| 176,164,018 | | |

| 178,755,231 | | |

| 178,755,231 | |

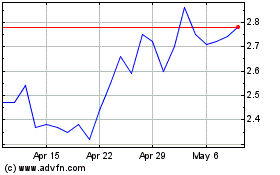

Baozun (NASDAQ:BZUN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Baozun (NASDAQ:BZUN)

Historical Stock Chart

From Nov 2023 to Nov 2024