Banner Corporation (NASDAQ GSM: BANR) ("Banner"), the parent

company of Banner Bank and Islanders Bank, today reported net

income of $16.9 million, or $0.47 per diluted share, for the first

quarter 2020, compared to $33.7 million, or $0.95 per diluted

share, in the preceding quarter and $33.3 million, or $0.95 per

diluted share, in the first quarter of 2019. Banner's first

quarter earnings reflect the impact of the COVID-19 pandemic

resulting in a substantial reduction in business activity or the

closing of businesses in all the western states Banner operates.

First quarter of 2020 results also include $1.1

million of acquisition-related expenses, compared to $4.4 million

of acquisition-related expenses in the preceding quarter and $2.1

million in the first quarter of 2019.

“We are in unprecedented times - as a health

crisis has quickly evolved to also become an economic crisis,

creating far-reaching impacts to clients and the communities we

serve,” said Mark Grescovich, President and CEO. “In

mid-March we began preparations for the COVID-19 pandemic by

closing branch lobbies, mobilizing personnel to work from home and

providing appropriate IT equipment and services to accommodate

Stay-At-Home Orders. Our lending teams have reached out to

borrowers that have been affected by the economic decline and

offered assistance in various forms including deferred payments and

interest-only payments. We have worked with our customers to

file applications for the Paycheck Protection Program offered

through the Small Business Administration and expect this program

to provide some near-term relief to help small businesses sustain

operations. Meanwhile, we are monitoring the economy closely

and reviewing loan payment deferrals and interest waivers daily and

have elevated our liquidity levels in anticipation of cash needs of

our customers.”

Grescovich concluded, “In anticipation of future

credit losses, we determined it is prudent to increase the

allowance for credit losses through the addition of $21.7 million

in credit loss provisions for the quarter ended March 31, 2020.”

This provision compares to a $4.0 million provision for loan losses

during the previous quarter and a $2.0 million provision for loan

losses in the first quarter a year ago. The allowance for

credit losses - loans was 1.41% of total loans and 299% of

non-performing loans at the end of the first quarter of 2020. The

increased allowance includes provisions taken in anticipation of

changes in risks associated with loan classification assignments

and a deteriorating economy.

At March 31, 2020, Banner Corporation had

$12.78 billion in assets, $9.16 billion in net loans and $10.45

billion in deposits. Banner operates 176 branch offices,

including branches located in eight of the top 20 largest western

Metropolitan Statistical Areas by population.

COVID-19 Pandemic Response

- SBA Paycheck Protection

Program. The U.S. Small Business Administration

(SBA) is providing assistance to small businesses impacted by

COVID-19 through the Paycheck Protection Program (PPP), which is

designed to provide near-term relief to help small businesses

sustain operations. Banner is offering small businesses loans

to clients in its service area through this program. As of

April 16, 2020, the funds allocated to the PPP from the CARES Act

had been fully allocated. Congress recently approved a second round

of funding for the PPP. Banner will continue to process

applications received under the PPP until the available funds have

been fully allocated. Banner is also planning to assist small

businesses with accessing other borrowing options as they become

available, including the Main Street Lending Program and other

government sponsored lending programs, as appropriate.

- Loan

Accommodations. Banner is offering payment and financial

relief programs for borrowers impacted by COVID-19. These programs

include loan payment deferrals for up to 90 days, waived late fees,

and, on a more limited basis, waived interest or allowed

interest-only loan payments and we have temporarily suspended

foreclosure proceedings. Since these loans were performing

loans that were current on their payments prior to COVID-19, these

modifications are not considered to be troubled debt

restructurings.

- Allowance for Credit Losses

- Loans. Banner recorded a provision for credit

losses of $21.7 million for the first quarter of 2020, compared to

a $4.0 million provision in the preceding quarter and a $2.0

million provision in the first quarter a year ago. The

provision for the current quarter reflects expected lifetime credit

losses based upon the conditions and economic outlook that existed

as of March 31, 2020. The probability of further decline in

economic conditions, including higher unemployment rates and lower

gross domestic product, has increased since quarter end and should

it materialize, an additional provision for expected credit losses

will be necessary.

- Branch Operations, IT

Changes and One-Time Expenses. We have taken various steps

to help protect customers and staff by limiting branch activities

to appointment only and use of our drive-up facilities, and by

encouraging the use of our digital and electronic banking channels,

all the while adjusting for evolving State and Federal

guidelines. To further the well-being of staff and customers,

Banner implemented measures to allow employees to work from home to

the extent practicable. To facilitate this approach, Banner

allocated additional computer equipment to staff and enhanced the

Company's network capabilities with several upgrades. These

expenses plus other expenses incurred in response to the COVID-19

pandemic resulted in $239,000 of related costs during the first

quarter of 2020.

- Capital

Management. At March 31, 2020, the tangible

common shareholders' equity to tangible assets ratio was 9.70% and

Banner’s capital was well in excess of all regulatory requirements.

During the current quarter, prior to the COVID-19 pandemic

outbreak, Banner repurchased 624,780 shares of its common

stock. To preserve capital, Banner has discontinued any

additional repurchase of shares until further notice and will

closely monitor capital levels going forward.

First Quarter 2020

Highlights

- Revenues were $138.4 million,

compared to $139.8 million in the preceding quarter, and increased

3% when compared to $134.2 million in the first quarter a year

ago.

- Net interest income, before the

provision for loan losses, was $119.3 million in the first quarter

of 2020, compared to $119.5 million in the preceding quarter and

$116.1 million in the first quarter a year ago.

- Net interest margin was 4.19%,

compared to 4.20% in the preceding quarter and 4.37% in the first

quarter a year ago.

- Mortgage banking revenues increased

63% to $10.2 million, compared to $6.2 million in the preceding

quarter, and increased 198% compared to $3.4 million in the first

quarter a year ago, reflecting strong refinance demand due to

decreasing market interest rates.

- Return on average assets was 0.54%,

compared to 1.07% in the preceding quarter and 1.15% in the first

quarter a year ago.

- Net loans receivable decreased

modestly to $9.16 billion at March 31, 2020, compared to $9.20

billion at December 31, 2019, and increased 7% when compared

to $8.60 billion at March 31, 2019.

- Non-performing assets increased to

$46.1 million, or 0.36% of total assets, at March 31, 2020,

compared to $40.5 million, or 0.32% of total assets in the

preceding quarter, and $22.0 million, or 0.19% of total assets, at

March 31, 2019.

- Provision for credit losses - loans

was $21.7 million, and the allowance for credit losses - loans was

$130.5 million, or 1.41% of total loans receivable, as of

March 31, 2020, compared to $100.6 million, or 1.08% of total

loans receivable as of December 31, 2019.

- Provision for credit losses -

unfunded loan commitments was $1.7 million, and the allowance for

credit losses - unfunded loan commitments was $11.5 million as of

March 31, 2020, compared to $2.7 million as of

December 31, 2019.

- Core deposits increased 4% to $9.28

billion at March 31, 2020, compared to $8.93 billion at

December 31, 2019, and increased 13% compared to $8.21 billion

a year ago. Core deposits represented 89% of total deposits

at March 31, 2020.

- Dividends to shareholders were

$0.41 per share in the quarter ended March 31, 2020.

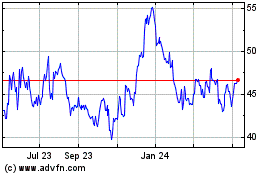

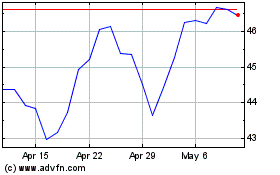

- Common shareholders’ equity per

share increased 2% to $45.63 at March 31, 2020, compared to

$44.59 at the preceding quarter end, and increased 6% from $42.99 a

year ago.

- Tangible common shareholders'

equity per share* increased 3% to $34.23 at March 31, 2020,

compared to $33.33 at the preceding quarter end, and increased 5%

from $32.47 a year ago.

*Tangible common shareholders' equity per share

and the ratio of tangible common equity to tangible assets (both of

which exclude goodwill and other intangible assets, net), and

references to adjusted revenue (which excludes fair value

adjustments and net gain (loss) on the sale of securities from the

total of net interest income before provision for loan losses and

non-interest income) and the adjusted efficiency ratio (which

excludes acquisition-related expenses, COVID-19 expenses,

amortization of core deposit intangibles, real estate owned gain

(loss), Federal Home Loan Bank (FHLB) prepayment penalties and

state/municipal taxes from non-interest expense divided by adjusted

revenue) represent non-GAAP (Generally Accepted Accounting

Principles) financial measures. Management has presented

these non-GAAP financial measures in this earnings release because

it believes that they provide useful and comparative information to

assess trends in Banner's core operations reflected in the current

quarter's results and facilitate the comparison of our performance

with the performance of our peers. Where applicable,

comparable earnings information using GAAP financial measures is

also presented. See also Non-GAAP Financial Measures

reconciliation tables on the last two pages of this press

release.

Significant Recent Initiatives and

Events

On November 1, 2019, Banner completed the

acquisition of AltaPacific Bancorp (“AltaPacific”) and its

wholly-owned subsidiary, AltaPacific Bank, of Santa Rosa,

California. At closing AltaPacific Bank had six branch

locations, including one in Northern California and five in

Southern California. Pursuant to the previously announced

terms, AltaPacific shareholders received 0.2712 shares of Banner

common stock in exchange for each share of AltaPacific common

stock, plus cash in lieu of any fractional shares and cash to

buyout AltaPacific stock options for a total consideration paid of

$87.6 million.

The AltaPacific merger was accounted for using

the acquisition method of accounting. Accordingly, the assets

(including identifiable intangible assets) and the liabilities of

AltaPacific were measured at their respective estimated fair values

as of the merger date. The excess of the purchase price over

the fair value of the net assets acquired was attributed to

goodwill. The fair value on the merger date represents

management's best estimates based on available information and

facts and circumstances in existence on the merger date. The

acquisition accounting is subject to adjustment within a

measurement period of one year from the acquisition date. The

acquisition provided $425.7 million of assets, $332.4 million of

loans, and $313.4 million of deposits to Banner. During the

first quarter of 2020, Banner completed the integration of

AltaPacific systems into Banner's core systems and closure of

overlapping branches.

Adoption of New Accounting

Standard

In June 2016, Financial Accounting Standards

Board issued Accounting Standard Update No. 2016-13, Measurement of

Credit Losses on Financial Instruments (ASU 2016-13). GAAP

prior to ASU 2016-13 required an “incurred loss” methodology for

recognizing credit losses that delays recognition until it is

probable a loss has been incurred. The main objective of ASU

2016-13 is to provide financial statement users with more

decision-useful information about the expected credit losses on

financial instruments and other commitments to extend credit held

by a reporting entity at each reporting date. ASU 2016-13

became effective for Banner on January 1, 2020. The adoption

of ASU No. 2016-13 resulted in a $7.8 million increase to its

allowance for credit losses - loans and a $7.0 million increase to

its allowance for credit losses - unfunded loan commitments.

The combined increases were recorded net of tax as an $11.2 million

reduction to retained earnings as of the adoption date.

Income Statement Review

Net interest income, before the provision for

credit losses, was $119.3 million in the first quarter of 2020,

compared to $119.5 million in the preceding quarter and $116.1

million in the first quarter a year ago.

Banner's net interest margin was 4.19% for the

first quarter of 2020, a one basis-point decrease compared to 4.20%

in the preceding quarter and an 18 basis-point decrease compared to

4.37% in the first quarter a year ago. Grescovich added, "The

net interest margin remained steady during the quarter as improved

securities yields combined with a decline in funding cost helped

offset the decline in loan yields. The 150 basis-point

decrease in the fed funds target rate did not occur until late in

the quarter in March 2020, and the full effect of the lower

interest rate environment had not yet been realized at quarter

end. Banner expects to see further margin compression during

the second quarter." Acquisition accounting adjustments added

ten basis points to the net interest margin in the current quarter

compared to eight basis points in the preceding quarter and seven

basis points in the first quarter a year ago. The total

purchase discount for acquired loans was $22.2 million at

March 31, 2020, compared to $25.0 million at December 31,

2019, and $24.2 million at March 31, 2019.

Average interest-earning asset yields decreased

six basis points to 4.63% in the first quarter compared to 4.69%

for the preceding quarter and decreased 26 basis points compared to

4.89% in the first quarter a year ago. Average loan yields

decreased ten basis points to 5.03% compared to 5.13% in the

preceding quarter and decreased 28 basis points compared to 5.31%

in the first quarter a year ago. Loan discount accretion

added 12 basis points to loan yields in the first quarter of 2020,

compared to 11 basis points in the preceding quarter and nine basis

points in the first quarter a year ago. Deposit costs were

0.35% in the first quarter of 2020, a five basis-point decrease

compared to the preceding quarter and a two basis-point decrease

compared to the first quarter a year ago. The decrease in

deposit costs during the current quarter compared to the preceding

quarter are the result of recent decreases in market interest

rates; however, changes in the average rate paid on

interest-bearing deposits tend to lag changes in market interest

rates. The total cost of funds was 0.46% during the first

quarter of 2020, a six basis-point decrease compared to the

preceding quarter and a ten basis-point decrease compared to the

first quarter a year ago.

Banner recorded a $21.7 million provision for

credit losses in the current quarter, compared to $4.0 million in

the prior quarter and $2.0 million in the same quarter a year ago

as calculated under the prior incurred loss methodology. The

provision for the current quarter reflects expected lifetime credit

losses based upon the conditions that existed as of March 31, 2020

and the potential effects from forecasted deterioration of economic

metrics due to the COVID-19 pandemic based on the outlook as of

March 31, 2020.

Total non-interest income was $19.2 million in

the first quarter of 2020, compared to $20.3 million in the fourth

quarter of 2019 and $18.1 million in the first quarter a year

ago. Deposit fees and other service charges were $9.8 million

in the first quarter of 2020, compared to $9.6 million in the

preceding quarter and $12.6 million in the first quarter a year

ago. The decrease in deposit fees and other service charges

from the first quarter a year ago is primarily a result of Banner

becoming subject to the Durbin Amendment on July 1, 2019, which

reduced interchange fee income by approximately $7 million during

the second half of 2019. Mortgage banking revenues, including

gains on one- to four-family and multifamily loan sales and loan

servicing fees, increased to $10.2 million in the first quarter,

compared to $6.2 million in the preceding quarter and $3.4 million

in the first quarter of 2019. The higher mortgage banking

revenue quarter-over-quarter primarily reflects an increase in the

gain on sale spread on one- to four-family held for sale

loans. The increases compared to the first quarter of 2019

were primarily due to increased production of one- to four-family

held-for-sale loans primarily due to increased refinance

activity. Home purchase activity accounted for 54% of one- to

four-family mortgage loan originations in the first quarter of

2020, compared to 56% in the prior quarter and 80% in the first

quarter of 2019.

Banner’s first quarter 2020 results included a

$4.6 million net loss for fair value adjustments as a result of

changes in the valuation of financial instruments carried at fair

value, principally comprised of certain investment securities held

for trading as a result of widening market spreads during the

quarter, and a $78,000 net gain on the sale of securities. In

the preceding quarter, results included a $36,000 net loss for fair

value adjustments and a $62,000 net gain on the sale of

securities. In the first quarter a year ago, results included

an $11,000 net gain for fair value adjustments and a $1,000 net

gain on the sale of securities.

Total revenue decreased nominally to $138.4

million for the first quarter of 2020, compared to $139.8 million

in the preceding quarter, and increased 3% compared to $134.2

million in the first quarter a year ago. Adjusted revenue*

(the total of net interest income before provision for credit

losses and total non-interest income excluding the net gain and

loss on the sale of securities and the net change in valuation of

financial instruments) was $142.9 million in the first quarter of

2020, compared to $139.7 million in the preceding quarter and

$134.2 million in the first quarter of 2019.

Banner’s total non-interest expense was $95.2

million in the first quarter of 2020, compared to $93.7 million in

the preceding quarter and $90.0 million in the first quarter of

2019. The increase in non-interest expense during the first

quarter of 2020 reflects the first full quarter expenses associated

with the operations acquired from AltaPacific, as well as lower

deferred loan costs primarily related to lower loan

originations. Acquisition-related expenses were $1.1 million

for the first quarter of 2020, compared to $4.4 million for the

preceding quarter and $2.1 million in the first quarter of

2019. The current quarter includes a $1.7 million provision

for credit losses - unfunded loan commitments compared to no

provision for the prior quarter or the year ago quarter.

Banner’s efficiency ratio was 68.76% for the current quarter,

compared to 67.03% in the preceding quarter and 67.06% in the year

ago quarter. Banner’s adjusted efficiency ratio* was 63.47%

for the current quarter, compared to 61.19% in the preceding

quarter and 63.32% in the year ago quarter.

For the first quarter of 2020, Banner had $4.6

million in state and federal income tax expense for an effective

tax rate of 21.4%, reflecting the benefits from tax exempt

income. Banner’s statutory income tax rate is 23.5%,

representing a blend of the statutory federal income tax rate of

21.0% and apportioned effects of the state income tax rates.

Balance Sheet Review

Total assets increased 1% to $12.78 billion at

March 31, 2020, compared to $12.60 billion at

December 31, 2019, and increased 9% when compared to $11.74

billion at March 31, 2019. The total of securities and

interest-bearing deposits held at other banks was $2.15 billion at

March 31, 2020, compared to $1.89 billion at both

December 31, 2019 and March 31, 2019. The increase

during the current quarter was primarily the result of security

purchases made towards the end of the quarter as balance sheet

liquidity increased and market spreads widened. The average

effective duration of Banner's securities portfolio was

approximately 2.9 years at March 31, 2020, compared to 3.0 years at

March 31, 2019.

Net loans receivable decreased modestly to $9.16

billion at March 31, 2020, compared to $9.20 billion at

December 31, 2019, and increased 7% when compared to $8.60

billion at March 31, 2019. The year-over-year increase

in net loans included $332.4 million of portfolio loans acquired in

the AltaPacific acquisition during the preceding quarter.

Commercial real estate and multifamily real estate loans increased

slightly to $4.02 billion at March 31, 2020, compared to $4.01

billion at December 31, 2019, and increased 11% compared to

$3.63 billion a year ago. Commercial business loans increased

1% to $2.17 billion at March 31, 2020, compared to $2.14

billion at December 31, 2019, and increased 12% compared to

$1.94 billion a year ago. Agricultural business loans

decreased to $330.3 million at March 31, 2020, compared to

$337.3 million three months earlier and $339.5 million a year

ago. Total construction, land and land development loans were

$1.22 billion at March 31, 2020, a small decrease from $1.23

billion at December 31, 2019, and a 6% increase compared to

$1.15 billion a year earlier. Consumer loans decreased to

$661.8 million at March 31, 2020, compared to $664.3 million

at December 31, 2019, and $693.3 million a year ago. One- to

four-family loans decreased to $881.4 million at March 31,

2020, compared to $925.5 million at December 31, 2019, and

$942.5 million a year ago.

Loans held for sale were $182.4 million at

March 31, 2020, compared to $210.4 million at

December 31, 2019, and $45.9 million at March 31,

2019. The volume of one- to four- family residential mortgage

loans sold was $204.0 million in the current quarter, compared to

$268.1 million in the preceding quarter and $107.2 million in the

first quarter a year ago. During the first quarter of 2020,

Banner sold $119.7 million in multifamily loans compared to $103.4

million in the preceding quarter and $149.9 million in the first

quarter a year ago.

Total deposits increased 4% to $10.45 billion at

March 31, 2020, compared to $10.05 billion at

December 31, 2019, and increased 11% when compared to $9.38

billion a year ago. The year-over-year increase in deposits

included $313.4 million in deposits acquired in the AltaPacific

acquisition during the preceding quarter.

Non-interest-bearing account balances increased 4% to $4.11 billion

at March 31, 2020, compared to $3.95 billion at

December 31, 2019, and increased 12% compared to $3.68 billion

a year ago. Core deposits (non-interest-bearing and

interest-bearing transaction and savings accounts) increased 4%

from the prior quarter and increased 13% compared to a year ago and

represented 89% of total deposits at March 31, 2020.

Certificates of deposit increased 4% to $1.17 billion at

March 31, 2020, compared to $1.12 billion at December 31,

2019, and increased slightly compared to $1.16 billion a year

earlier. The increase in certificates of deposit during the

first quarter of 2020 primarily reflects the increase in brokered

deposits to $251.0 million at March 31, 2020, compared to

$202.9 million at December 31, 2019 and $239.4 million a year

ago. FHLB borrowings totaled $247.0 million at March 31,

2020, compared to $450.0 million at December 31, 2019, and

$418.0 million a year earlier.

At March 31, 2020, total common

shareholders' equity was $1.60 billion, or 12.53% of assets,

compared to $1.59 billion or 12.65% of assets at December 31,

2019, and $1.51 billion or 12.87% of assets a year ago. At

March 31, 2020, tangible common shareholders' equity*, which

excludes goodwill and other intangible assets, net, was $1.20

billion, or 9.70% of tangible assets*, compared to $1.19 billion,

or 9.77% of tangible assets, at December 31, 2019, and $1.14

billion, or 10.04% of tangible assets, a year ago. Banner's

tangible book value per share* increased to $34.23 at

March 31, 2020, compared to $32.47 per share a year ago.

Banner and its subsidiary banks continue to

maintain capital levels in excess of the requirements to be

categorized as “well-capitalized.” At March 31,

2020, Banner's common equity Tier 1 capital ratio was 10.52%, its

Tier 1 leverage capital to average assets ratio was 10.45%, and its

total capital to risk-weighted assets ratio was 12.98%.

Credit Quality

The allowance for credit losses - loans was

$130.5 million at March 31, 2020, or 1.41% of total loans

receivable outstanding and 299% of non-performing loans, compared

to $100.6 million at December 31, 2019, or 1.08% of total

loans receivable outstanding and 254% of non-performing loans, and

$97.3 million at March 31, 2019, or 1.12% of total loans

receivable outstanding and 504% of non-performing loans. In

addition to the allowance for credit losses - loans, Banner

maintains an allowance for credit losses - unfunded loan

commitments which was $11.5 million at March 31, 2020, compared to

$2.7 million at December 31, 2019 and $2.6 million at March 31,

2019. Net loan recoveries totaled $404,000 in the first

quarter, compared to net loan charge-offs of $1.2 million in both

the preceding quarter and in the first quarter a year ago.

Banner recorded a $21.7 million provision for credit losses in the

current quarter, compared to $4.0 million in the prior quarter and

$2.0 million in the year ago quarter primarily due to forecasted

credit losses related to the COVID-19 pandemic.

Non-performing loans were $43.7 million at March 31, 2020,

compared to $39.6 million at December 31, 2019, and $19.3

million a year ago. The increase in non-performing loans

year-over-year was largely due to one commercial banking

relationship totaling $14.7 million moving to nonaccrual during the

prior quarter. Real estate owned and other repossessed assets

were $2.4 million at March 31, 2020, compared to $936,000 at

December 31, 2019, and $2.7 million a year ago.

In accordance with acquisition accounting, loans

acquired from acquisitions were recorded at their estimated fair

value, which resulted in a net discount to the loans’ contractual

amounts, a portion of which reflects a discount for possible credit

losses. Credit discounts are included in the determination of

fair value, and as a result, no allowance for credit losses is

recorded for acquired loans at the acquisition date. At

March 31, 2020, the total purchase discount for acquired loans

was $22.2 million.

Banner's total non-performing assets were $46.1

million, or 0.36% of total assets, at March 31, 2020, compared

to $40.5 million, or 0.32% of total assets, at December 31,

2019, and $22.0 million, or 0.19% of total assets, a year ago.

Conference Call

Banner will host a conference call on Tuesday,

April 28, 2020, at 8:00 a.m. PDT, to discuss its first quarter

results. To listen to the call on-line, go to

www.bannerbank.com. Investment professionals are invited to

dial (866) 235-9915 to participate in the call. A replay will

be available for one week at (877) 344-7529 using access code

10140349, or at www.bannerbank.com.

About the Company

Banner Corporation is a $12.78 billion bank

holding company operating two commercial banks in four Western

states through a network of branches offering a full range of

deposit services and business, commercial real estate,

construction, residential, agricultural and consumer loans.

Visit Banner Bank on the Web at www.bannerbank.com.

Forward-Looking Statements

When used in this press release and in other

documents filed with or furnished to the Securities and Exchange

Commission (the “SEC”), in press releases or other public

stockholder communications, or in oral statements made with the

approval of an authorized executive officer, the words or phrases

"may," “believe,” “will,” “will likely result,” “are expected to,”

“will continue,” “is anticipated,” “estimate,” “project,” “plans,”

"potential," or similar expressions are intended to identify

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. You are cautioned

not to place undue reliance on any forward-looking statements,

which speak only as of the date such statements are made and based

only on information then actually known to Banner. Banner

does not undertake and specifically disclaims any obligation to

revise any forward-looking statements to reflect the occurrence of

anticipated or unanticipated events or circumstances after the date

of such statements. These statements may relate to future

financial performance, strategic plans or objectives, revenues or

earnings projections, or other financial information. By

their nature, these statements are subject to numerous

uncertainties that could cause actual results to differ materially

from those anticipated in the statements and could negatively

affect Banner's operating and stock price performance.

Important factors that could cause actual

results to differ materially from the results anticipated or

projected include, but are not limited to, the following: (1)

the effect of the COVID-19 pandemic, including on Banner’s

credit quality and business operations, as well as its impact on

general economic and financial market conditions and other

uncertainties resulting from the COVID-19 pandemic, such as the

extent and duration of the impact on public health, the U.S. and

global economies, and consumer and corporate customers, including

economic activity, employment levels and market liquidity;

(2) the credit risks of lending activities, including changes in

the level and direction of loan delinquencies and write-offs and

changes in estimates of the adequacy of the allowance for credit

losses, which could necessitate additional provisions for credit

losses, resulting both from loans originated and loans acquired

from other financial institutions; (3) results of examinations by

regulatory authorities, including the possibility that any such

regulatory authority may, among other things, require increases in

the allowance for credit losses or writing down of assets or impose

restrictions or penalties with respect to Banner's activities; (5)

competitive pressures among depository institutions; (6) interest

rate movements and their impact on customer behavior and net

interest margin; (6) the impact of repricing and competitors'

pricing initiatives on loan and deposit products; (7) fluctuations

in real estate values; (8) the ability to adapt successfully to

technological changes to meet customers' needs and developments in

the market place; (9) the ability to access cost-effective funding;

(10) changes in financial markets; (11) changes in economic

conditions in general and in Washington, Idaho, Oregon and

California in particular; (12) the costs, effects and outcomes of

litigation; (13) legislation or regulatory changes, including but

not limited to the impact of the Dodd-Frank Act and regulations

adopted thereunder, changes in regulatory capital requirements

pursuant to the implementation of the Basel III capital standards,

other governmental initiatives affecting the financial services

industry and changes in federal and/or state tax laws or

interpretations thereof by taxing authorities; (14) changes in

accounting principles, policies or guidelines; (15) future

acquisitions by Banner of other depository institutions or lines of

business; (16) future goodwill impairment due to changes in

Banner's business, changes in market conditions, including as a

result of the COVID-19 pandemic or other factors; and (17) other

economic, competitive, governmental, regulatory, and technological

factors affecting our operations, pricing, products and services;

and other risks detailed from time to time in our filings with the

Securities and Exchange Commission including our Quarterly Reports

on Form 10-Q and our Annual Reports on Form 10-K.

|

CONTACT: |

MARK J. GRESCOVICH, |

|

|

PRESIDENT & CEO |

|

|

PETER J. CONNER,

CFO |

|

|

(509) 527-3636 |

| RESULTS OF

OPERATIONS |

|

Quarters Ended |

| (in thousands except shares and

per share data) |

|

Mar 31, 2020 |

|

Dec 31, 2019 |

|

Mar 31, 2019 |

| |

|

|

|

|

|

|

| INTEREST

INCOME: |

|

|

|

|

|

|

|

Loans receivable |

|

$ |

118,926 |

|

|

$ |

120,915 |

|

|

$ |

115,455 |

|

|

Mortgage-backed securities |

|

9,137 |

|

|

8,924 |

|

|

10,507 |

|

|

Securities and cash equivalents |

|

3,602 |

|

|

3,570 |

|

|

4,034 |

|

| |

|

131,665 |

|

|

133,409 |

|

|

129,996 |

|

| INTEREST

EXPENSE: |

|

|

|

|

|

|

|

Deposits |

|

8,750 |

|

|

9,950 |

|

|

8,643 |

|

|

Federal Home Loan Bank advances |

|

2,064 |

|

|

2,281 |

|

|

3,476 |

|

|

Other borrowings |

|

116 |

|

|

121 |

|

|

60 |

|

|

Junior subordinated debentures |

|

1,477 |

|

|

1,566 |

|

|

1,713 |

|

| |

|

12,407 |

|

|

13,918 |

|

|

13,892 |

|

|

Net interest income before provision for credit losses |

|

119,258 |

|

|

119,491 |

|

|

116,104 |

|

| PROVISION FOR CREDIT

LOSSES |

|

21,748 |

|

|

4,000 |

|

|

2,000 |

|

|

Net interest income |

|

97,510 |

|

|

115,491 |

|

|

114,104 |

|

| NON-INTEREST

INCOME: |

|

|

|

|

|

|

|

Deposit fees and other service charges |

|

9,803 |

|

|

9,637 |

|

|

12,618 |

|

|

Mortgage banking operations |

|

10,191 |

|

|

6,248 |

|

|

3,415 |

|

|

Bank-owned life insurance |

|

1,050 |

|

|

1,170 |

|

|

1,276 |

|

|

Miscellaneous |

|

2,639 |

|

|

3,201 |

|

|

804 |

|

| |

|

23,683 |

|

|

20,256 |

|

|

18,113 |

|

|

Net gain on sale of securities |

|

78 |

|

|

62 |

|

|

1 |

|

|

Net change in valuation of financial instruments carried at fair

value |

|

(4,596 |

) |

|

(36 |

) |

|

11 |

|

|

Total non-interest income |

|

19,165 |

|

|

20,282 |

|

|

18,125 |

|

| NON-INTEREST

EXPENSE: |

|

|

|

|

|

|

|

Salary and employee benefits |

|

59,908 |

|

|

57,050 |

|

|

54,640 |

|

|

Less capitalized loan origination costs |

|

(5,806 |

) |

|

(8,797 |

) |

|

(4,849 |

) |

|

Occupancy and equipment |

|

13,107 |

|

|

13,377 |

|

|

13,766 |

|

|

Information / computer data services |

|

5,810 |

|

|

6,202 |

|

|

5,326 |

|

|

Payment and card processing services |

|

4,240 |

|

|

4,638 |

|

|

3,984 |

|

|

Professional and legal expenses |

|

1,919 |

|

|

2,262 |

|

|

2,434 |

|

|

Advertising and marketing |

|

1,827 |

|

|

2,021 |

|

|

1,529 |

|

|

Deposit insurance expense |

|

1,635 |

|

|

1,608 |

|

|

1,418 |

|

|

State/municipal business and use taxes |

|

984 |

|

|

917 |

|

|

945 |

|

|

Real estate operations |

|

100 |

|

|

40 |

|

|

(123 |

) |

|

Amortization of core deposit intangibles |

|

2,001 |

|

|

2,061 |

|

|

2,052 |

|

|

Provision for credit losses - unfunded loan commitments |

|

1,722 |

|

|

— |

|

|

— |

|

|

Miscellaneous |

|

6,357 |

|

|

7,892 |

|

|

6,744 |

|

|

|

|

93,804 |

|

|

89,271 |

|

|

87,866 |

|

|

COVID-19 expenses |

|

239 |

|

|

— |

|

|

— |

|

|

Acquisition-related expenses |

|

1,142 |

|

|

4,419 |

|

|

2,148 |

|

|

Total non-interest expense |

|

95,185 |

|

|

93,690 |

|

|

90,014 |

|

|

Income before provision for income taxes |

|

21,490 |

|

|

42,083 |

|

|

42,215 |

|

| PROVISION

FOR INCOME TAXES |

|

4,608 |

|

|

8,428 |

|

|

8,869 |

|

| NET

INCOME |

|

$ |

16,882 |

|

|

$ |

33,655 |

|

|

$ |

33,346 |

|

| Earnings per share available

to common shareholders: |

|

|

|

|

|

|

|

Basic |

|

$ |

0.48 |

|

|

$ |

0.96 |

|

|

$ |

0.95 |

|

|

Diluted |

|

$ |

0.47 |

|

|

$ |

0.95 |

|

|

$ |

0.95 |

|

| Cumulative dividends declared

per common share |

|

$ |

0.41 |

|

|

$ |

1.41 |

|

|

$ |

0.41 |

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

Basic |

|

35,463,541 |

|

|

35,188,399 |

|

|

35,050,376 |

|

|

Diluted |

|

35,640,463 |

|

|

35,316,736 |

|

|

35,172,056 |

|

| (Decrease) increase in common

shares outstanding |

|

(649,117 |

) |

|

1,578,219 |

|

|

(30,026 |

) |

|

FINANCIAL CONDITION |

|

|

|

|

|

|

|

Percentage Change |

| (in thousands except shares and

per share data) |

|

Mar 31, 2020 |

|

Dec 31, 2019 |

|

Mar 31, 2019 |

|

Prior Qtr |

|

Prior Yr Qtr |

| |

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

$ |

211,013 |

|

|

$ |

234,359 |

|

|

$ |

218,458 |

|

|

(10.0 |

)% |

|

(3.4 |

)% |

| Interest-bearing deposits |

|

83,988 |

|

|

73,376 |

|

|

43,080 |

|

|

14.5 |

% |

|

95.0 |

% |

|

Total cash and cash equivalents |

|

295,001 |

|

|

307,735 |

|

|

261,538 |

|

|

(4.1 |

)% |

|

12.8 |

% |

| Securities - trading |

|

21,040 |

|

|

25,636 |

|

|

25,838 |

|

|

(17.9 |

)% |

|

(18.6 |

)% |

| Securities - available for

sale |

|

1,608,224 |

|

|

1,551,557 |

|

|

1,603,804 |

|

|

3.7 |

% |

|

0.3 |

% |

| Securities - held to

maturity |

|

437,846 |

|

|

236,094 |

|

|

218,993 |

|

|

85.5 |

% |

|

99.9 |

% |

|

Total securities |

|

2,067,110 |

|

|

1,813,287 |

|

|

1,848,635 |

|

|

14.0 |

% |

|

11.8 |

% |

| Federal Home Loan Bank

stock |

|

20,247 |

|

|

28,342 |

|

|

27,063 |

|

|

(28.6 |

)% |

|

(25.2 |

)% |

| Loans held for sale |

|

182,428 |

|

|

210,447 |

|

|

45,865 |

|

|

(13.3 |

)% |

|

297.7 |

% |

| Loans receivable |

|

9,285,744 |

|

|

9,305,357 |

|

|

8,692,657 |

|

|

(0.2 |

)% |

|

6.8 |

% |

| Allowance for credit losses -

loans |

|

(130,488 |

) |

|

(100,559 |

) |

|

(97,308 |

) |

|

29.8 |

% |

|

34.1 |

% |

|

Net loans receivable |

|

9,155,256 |

|

|

9,204,798 |

|

|

8,595,349 |

|

|

(0.5 |

)% |

|

6.5 |

% |

| Accrued interest

receivable |

|

40,732 |

|

|

37,962 |

|

|

41,220 |

|

|

7.3 |

% |

|

(1.2 |

)% |

| Real estate owned held for

sale, net |

|

2,402 |

|

|

814 |

|

|

2,611 |

|

|

195.1 |

% |

|

(8.0 |

)% |

| Property and equipment,

net |

|

175,235 |

|

|

178,008 |

|

|

171,057 |

|

|

(1.6 |

)% |

|

2.4 |

% |

| Goodwill |

|

373,121 |

|

|

373,121 |

|

|

339,154 |

|

|

— |

% |

|

10.0 |

% |

| Other intangibles, net |

|

27,157 |

|

|

29,158 |

|

|

30,647 |

|

|

(6.9 |

)% |

|

(11.4 |

)% |

| Bank-owned life insurance |

|

193,140 |

|

|

192,088 |

|

|

178,202 |

|

|

0.5 |

% |

|

8.4 |

% |

| Other assets |

|

249,121 |

|

|

228,271 |

|

|

198,944 |

|

|

9.1 |

% |

|

25.2 |

% |

|

Total assets |

|

$ |

12,780,950 |

|

|

$ |

12,604,031 |

|

|

$ |

11,740,285 |

|

|

1.4 |

% |

|

8.9 |

% |

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

|

|

Non-interest-bearing |

|

$ |

4,107,262 |

|

|

$ |

3,945,000 |

|

|

$ |

3,676,984 |

|

|

4.1 |

% |

|

11.7 |

% |

|

Interest-bearing transaction and savings accounts |

|

5,175,969 |

|

|

4,983,238 |

|

|

4,535,969 |

|

|

3.9 |

% |

|

14.1 |

% |

|

Interest-bearing certificates |

|

1,166,306 |

|

|

1,120,403 |

|

|

1,163,276 |

|

|

4.1 |

% |

|

0.3 |

% |

|

Total deposits |

|

10,449,537 |

|

|

10,048,641 |

|

|

9,376,229 |

|

|

4.0 |

% |

|

11.4 |

% |

| Advances from Federal Home

Loan Bank |

|

247,000 |

|

|

450,000 |

|

|

418,000 |

|

|

(45.1 |

)% |

|

(40.9 |

)% |

| Customer repurchase agreements

and other borrowings |

|

128,764 |

|

|

118,474 |

|

|

121,719 |

|

|

8.7 |

% |

|

5.8 |

% |

| Junior subordinated debentures

at fair value |

|

99,795 |

|

|

119,304 |

|

|

113,917 |

|

|

(16.4 |

)% |

|

(12.4 |

)% |

| Accrued expenses and other

liabilities |

|

208,753 |

|

|

227,889 |

|

|

158,669 |

|

|

(8.4 |

)% |

|

31.6 |

% |

| Deferred compensation |

|

45,401 |

|

|

45,689 |

|

|

40,560 |

|

|

(0.6 |

)% |

|

11.9 |

% |

|

Total liabilities |

|

11,179,250 |

|

|

11,009,997 |

|

|

10,229,094 |

|

|

1.5 |

% |

|

9.3 |

% |

| SHAREHOLDERS'

EQUITY |

|

|

|

|

|

|

|

|

|

|

| Common stock |

|

1,343,699 |

|

|

1,373,940 |

|

|

1,338,386 |

|

|

(2.2 |

)% |

|

0.4 |

% |

| Retained earnings |

|

177,922 |

|

|

186,838 |

|

|

152,911 |

|

|

(4.8 |

)% |

|

16.4 |

% |

| Other components of

shareholders' equity |

|

80,079 |

|

|

33,256 |

|

|

19,894 |

|

|

140.8 |

% |

|

nm |

|

|

Total shareholders' equity |

|

1,601,700 |

|

|

1,594,034 |

|

|

1,511,191 |

|

|

0.5 |

% |

|

6.0 |

% |

|

Total liabilities and shareholders' equity |

|

$ |

12,780,950 |

|

|

$ |

12,604,031 |

|

|

$ |

11,740,285 |

|

|

1.4 |

% |

|

8.9 |

% |

| Common Shares

Issued: |

|

|

|

|

|

|

|

|

|

|

| Shares outstanding at end of

period |

|

35,102,459 |

|

|

35,751,576 |

|

|

35,152,746 |

|

|

|

|

|

| Common shareholders' equity

per share (1) |

|

$ |

45.63 |

|

|

$ |

44.59 |

|

|

$ |

42.99 |

|

|

|

|

|

| Common shareholders' tangible

equity per share (1) (2) |

|

$ |

34.23 |

|

|

$ |

33.33 |

|

|

$ |

32.47 |

|

|

|

|

|

| Common shareholders' tangible

equity to tangible assets (2) |

|

9.70 |

% |

|

9.77 |

% |

|

10.04 |

% |

|

|

|

|

| Consolidated Tier 1 leverage

capital ratio |

|

10.45 |

% |

|

10.71 |

% |

|

10.73 |

% |

|

|

|

|

|

(1 |

) |

Calculation is based on number of

common shares outstanding at the end of the period rather than

weighted average shares outstanding. |

|

(2 |

) |

Common shareholders' tangible

equity excludes goodwill and other intangible assets. Tangible

assets exclude goodwill and other intangible assets. These

ratios represent non-GAAP financial measures. See also

Non-GAAP Financial Measures reconciliation tables on the final two

pages of the press release tables. |

| ADDITIONAL FINANCIAL

INFORMATION |

|

|

|

|

|

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Percentage Change |

| LOANS |

|

Mar 31, 2020 |

|

Dec 31, 2019 |

|

Mar 31, 2019 |

|

Prior Qtr |

|

Prior Yr Qtr |

| |

|

|

|

|

|

|

|

|

|

|

| Commercial real estate: |

|

|

|

|

|

|

|

|

|

|

|

Owner-occupied |

|

$ |

1,024,089 |

|

|

$ |

980,021 |

|

|

$ |

869,634 |

|

|

4.5 |

% |

|

17.8 |

% |

|

Investment properties |

|

2,007,537 |

|

|

2,024,988 |

|

|

1,838,328 |

|

|

(0.9 |

)% |

|

9.2 |

% |

|

Small balance CRE |

|

591,783 |

|

|

613,484 |

|

|

619,646 |

|

|

(3.5 |

)% |

|

(4.5 |

)% |

| Multifamily real estate |

|

400,206 |

|

|

388,388 |

|

|

300,684 |

|

|

3.0 |

% |

|

33.1 |

% |

| Construction, land and land

development: |

|

|

|

|

|

|

|

|

|

|

|

Commercial construction |

|

205,476 |

|

|

210,668 |

|

|

181,888 |

|

|

(2.5 |

)% |

|

13.0 |

% |

|

Multifamily construction |

|

250,410 |

|

|

233,610 |

|

|

183,203 |

|

|

7.2 |

% |

|

36.7 |

% |

|

One- to four-family construction |

|

534,956 |

|

|

544,308 |

|

|

514,410 |

|

|

(1.7 |

)% |

|

4.0 |

% |

|

Land and land development |

|

232,506 |

|

|

245,530 |

|

|

271,038 |

|

|

(5.3 |

)% |

|

(14.2 |

)% |

| Commercial business: |

|

|

|

|

|

|

|

|

|

|

|

Commercial business |

|

1,357,817 |

|

|

1,364,650 |

|

|

1,199,930 |

|

|

(0.5 |

)% |

|

13.2 |

% |

|

Small business scored |

|

807,539 |

|

|

772,657 |

|

|

738,665 |

|

|

4.5 |

% |

|

9.3 |

% |

| Agricultural business,

including secured by farmland |

|

330,257 |

|

|

337,271 |

|

|

339,472 |

|

|

(2.1 |

)% |

|

(2.7 |

)% |

| One- to four-family

residential |

|

881,387 |

|

|

925,531 |

|

|

942,477 |

|

|

(4.8 |

)% |

|

(6.5 |

)% |

| Consumer: |

|

|

|

|

|

|

|

|

|

|

|

Consumer—home equity revolving lines of credit |

|

521,618 |

|

|

519,336 |

|

|

532,600 |

|

|

0.4 |

% |

|

(2.1 |

)% |

|

Consumer—other |

|

140,163 |

|

|

144,915 |

|

|

160,682 |

|

|

(3.3 |

)% |

|

(12.8 |

)% |

|

Total loans receivable |

|

$ |

9,285,744 |

|

|

$ |

9,305,357 |

|

|

$ |

8,692,657 |

|

|

(0.2 |

)% |

|

6.8 |

% |

| Restructured loans performing

under their restructured terms |

|

$ |

6,423 |

|

|

$ |

6,466 |

|

|

$ |

13,036 |

|

|

|

|

|

| Loans 30 - 89 days past due

and on accrual |

|

$ |

39,974 |

|

|

$ |

20,178 |

|

|

$ |

28,972 |

|

|

|

|

|

| Total delinquent loans

(including loans on non-accrual), net |

|

$ |

61,101 |

|

|

$ |

38,322 |

|

|

$ |

46,616 |

|

|

|

|

|

| Total delinquent

loans / Total loans receivable |

|

0.66 |

% |

|

0.41 |

% |

|

0.54 |

% |

|

|

|

|

| LOANS BY GEOGRAPHIC

LOCATION |

|

|

|

|

|

|

|

|

|

Percentage Change |

| |

|

Mar 31, 2020 |

|

Dec 31, 2019 |

|

Mar 31, 2019 |

|

Prior Qtr |

|

Prior Yr Qtr |

| |

|

Amount |

|

Percentage |

|

Amount |

|

Amount |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Washington |

|

$ |

4,350,273 |

|

|

46.7 |

% |

|

$ |

4,364,764 |

|

|

$ |

4,329,759 |

|

|

(0.3 |

)% |

|

0.5 |

% |

| California |

|

2,140,895 |

|

|

23.1 |

% |

|

2,129,789 |

|

|

1,581,654 |

|

|

0.5 |

% |

|

35.4 |

% |

| Oregon |

|

1,664,652 |

|

|

17.9 |

% |

|

1,650,704 |

|

|

1,639,427 |

|

|

0.8 |

% |

|

1.5 |

% |

| Idaho |

|

524,663 |

|

|

5.7 |

% |

|

530,016 |

|

|

524,705 |

|

|

(1.0 |

)% |

|

— |

% |

| Utah |

|

52,747 |

|

|

0.6 |

% |

|

60,958 |

|

|

59,940 |

|

|

(13.5 |

)% |

|

(12.0 |

)% |

| Other |

|

552,514 |

|

|

6.0 |

% |

|

569,126 |

|

|

557,172 |

|

|

(2.9 |

)% |

|

(0.8 |

)% |

| Total loans receivable |

|

$ |

9,285,744 |

|

|

100.0 |

% |

|

$ |

9,305,357 |

|

|

$ |

8,692,657 |

|

|

(0.2 |

)% |

|

6.8 |

% |

ADDITIONAL FINANCIAL INFORMATION(dollars in

thousands)

The following table shows loan originations (excluding loans

held for sale) activity for the quarters ending March 31,

2020, December 31, 2019, and March 31, 2019.

| LOAN

ORIGINATIONS |

Quarters Ended |

| |

Mar 31, 2020 |

|

Dec 31, 2019 |

|

Mar 31, 2019 |

| Commercial real estate |

$ |

76,359 |

|

|

$ |

165,064 |

|

|

$ |

92,183 |

|

| Multifamily real estate |

10,171 |

|

|

20,034 |

|

|

3,733 |

|

| Construction and land |

369,613 |

|

|

530,195 |

|

|

231,744 |

|

| Commercial business |

199,873 |

|

|

228,050 |

|

|

137,142 |

|

| Agricultural business |

31,261 |

|

|

25,992 |

|

|

30,483 |

|

| One-to four-family

residential |

31,041 |

|

|

30,432 |

|

|

31,186 |

|

| Consumer |

67,357 |

|

|

70,539 |

|

|

62,370 |

|

| Total loan originations

(excluding loans held for sale) |

$ |

785,675 |

|

|

$ |

1,070,306 |

|

|

$ |

588,841 |

|

| ADDITIONAL FINANCIAL

INFORMATION |

|

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

|

| |

|

Quarters Ended |

| CHANGE IN

THE |

|

Mar 31, 2020 |

|

Dec 31, 2019 |

|

Mar 31, 2019 |

| ALLOWANCE FOR CREDIT

LOSSES - LOANS |

|

|

|

|

|

|

| Balance, beginning of

period |

|

$ |

100,559 |

|

|

$ |

97,801 |

|

|

$ |

96,485 |

|

| Beginning balance adjustment

for adoption of ASC 326 |

|

7,812 |

|

|

— |

|

|

— |

|

| Provision for credit losses -

loans |

|

21,713 |

|

|

4,000 |

|

|

2,000 |

|

| Recoveries of loans previously

charged off: |

|

|

|

|

|

|

|

Commercial real estate |

|

167 |

|

|

199 |

|

|

21 |

|

|

Construction and land |

|

— |

|

|

— |

|

|

22 |

|

|

One- to four-family real estate |

|

148 |

|

|

159 |

|

|

43 |

|

|

Commercial business |

|

205 |

|

|

225 |

|

|

23 |

|

|

Agricultural business, including secured by farmland |

|

1,750 |

|

|

10 |

|

|

— |

|

|

Consumer |

|

96 |

|

|

61 |

|

|

110 |

|

| |

|

2,366 |

|

|

654 |

|

|

219 |

|

| Loans charged off: |

|

|

|

|

|

|

|

Commercial real estate |

|

(100 |

) |

|

— |

|

|

(431 |

) |

|

Multifamily real estate |

|

(66 |

) |

|

— |

|

|

— |

|

|

Construction and land |

|

— |

|

|

(45 |

) |

|

— |

|

|

One- to four-family real estate |

|

(64 |

) |

|

— |

|

|

— |

|

|

Commercial business |

|

(1,384 |

) |

|

(1,180 |

) |

|

(590 |

) |

|

Agricultural business, including secured by farmland |

|

— |

|

|

(4 |

) |

|

(4 |

) |

|

Consumer |

|

(348 |

) |

|

(667 |

) |

|

(371 |

) |

| |

|

(1,962 |

) |

|

(1,896 |

) |

|

(1,396 |

) |

|

Net recoveries/(charge-offs) |

|

404 |

|

|

(1,242 |

) |

|

(1,177 |

) |

| Balance, end of period |

|

$ |

130,488 |

|

|

$ |

100,559 |

|

|

$ |

97,308 |

|

| Net recoveries/(charge-offs) /

Average loans receivable |

|

0.004 |

% |

|

(0.013 |

)% |

|

(0.013 |

)% |

| ALLOCATION

OF |

|

|

|

|

|

|

| ALLOWANCE FOR CREDIT

LOSSES - LOANS |

|

Mar 31, 2020 |

|

Dec 31, 2019 |

|

Mar 31, 2019 |

| Specific or allocated credit

loss allowance: |

|

|

|

|

|

|

|

Commercial real estate |

|

$ |

29,339 |

|

|

$ |

30,591 |

|

|

$ |

27,091 |

|

|

Multifamily real estate |

|

2,805 |

|

|

4,754 |

|

|

4,020 |

|

|

Construction and land |

|

34,217 |

|

|

22,994 |

|

|

23,713 |

|

|

One- to four-family real estate |

|

11,884 |

|

|

4,136 |

|

|

4,711 |

|

|

Commercial business |

|

31,648 |

|

|

23,370 |

|

|

18,662 |

|

|

Agricultural business, including secured by farmland |

|

4,513 |

|

|

4,120 |

|

|

3,596 |

|

|

Consumer |

|

16,082 |

|

|

8,202 |

|

|

7,980 |

|

|

Total allocated |

|

130,488 |

|

|

98,167 |

|

|

89,773 |

|

| Unallocated |

|

— |

|

|

2,392 |

|

|

7,535 |

|

|

Total allowance for credit losses - loans |

|

$ |

130,488 |

|

|

$ |

100,559 |

|

|

$ |

97,308 |

|

| Allowance for credit losses -

loans / Total loans receivable |

|

1.41 |

% |

|

1.08 |

% |

|

1.12 |

% |

| Allowance for credit losses -

loans / Non-performing loans |

|

299 |

% |

|

254 |

% |

|

504 |

% |

| |

|

Quarters Ended |

| CHANGE IN

THE |

|

Mar 31, 2020 |

|

Dec 31, 2019 |

|

Mar 31, 2019 |

| ALLOWANCE FOR CREDIT

LOSSES - UNFUNDED LOAN COMMITMENTS |

|

|

|

|

|

|

| Balance, beginning of

period |

|

$ |

2,716 |

|

|

$ |

2,599 |

|

|

$ |

2,599 |

|

| Beginning balance adjustment

for adoption of ASC 326 |

|

7,022 |

|

|

— |

|

|

— |

|

| Provision for credit losses -

unfunded loan commitments |

|

1,722 |

|

|

— |

|

|

— |

|

| Additions through

acquisitions |

|

— |

|

|

117 |

|

|

— |

|

| Balance, end of period |

|

$ |

11,460 |

|

|

$ |

2,716 |

|

|

$ |

2,599 |

|

| ADDITIONAL FINANCIAL

INFORMATION |

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

| |

Mar 31, 2020 |

|

Dec 31, 2019 |

|

Mar 31, 2019 |

| NON-PERFORMING

ASSETS |

|

|

|

|

|

| Loans on non-accrual

status: |

|

|

|

|

|

|

Secured by real estate: |

|

|

|

|

|

|

Commercial |

$ |

8,512 |

|

|

$ |

5,952 |

|

|

$ |

5,734 |

|

|

Multifamily |

— |

|

|

85 |

|

|

— |

|

|

Construction and land |

1,393 |

|

|

1,905 |

|

|

3,036 |

|

|

One- to four-family |

3,045 |

|

|

3,410 |

|

|

1,538 |

|

|

Commercial business |

25,027 |

|

|

23,015 |

|

|

3,614 |

|

|

Agricultural business, including secured by farmland |

495 |

|

|

661 |

|

|

2,507 |

|

|

Consumer |

1,812 |

|

|

2,473 |

|

|

2,181 |

|

| |

40,284 |

|

|

37,501 |

|

|

18,610 |

|

| Loans more than 90 days

delinquent, still on accrual: |

|

|

|

|

|

|

Secured by real estate: |

|

|

|

|

|

|

Commercial |

24 |

|

|

89 |

|

|

— |

|

|

Construction and land |

1,407 |

|

|

332 |

|

|

— |

|

|

One- to four-family |

1,089 |

|

|

877 |

|

|

640 |

|

|

Commercial business |

77 |

|

|

401 |

|

|

1 |

|

|

Agricultural business, including secured by farmland |

461 |

|

|

— |

|

|

— |

|

|

Consumer |

320 |

|

|

398 |

|

|

42 |

|

| |

3,378 |

|

|

2,097 |

|

|

683 |

|

| Total non-performing

loans |

43,662 |

|

|

39,598 |

|

|

19,293 |

|

| Real estate owned (REO) |

2,402 |

|

|

814 |

|

|

2,611 |

|

| Other repossessed assets |

47 |

|

|

122 |

|

|

50 |

|

|

Total non-performing assets |

$ |

46,111 |

|

|

$ |

40,534 |

|

|

$ |

21,954 |

|

| Total non-performing

assets to total assets |

0.36 |

% |

|

0.32 |

% |

|

0.19 |

% |

| |

Quarters Ended |

| REAL ESTATE

OWNED |

Mar 31, 2020 |

|

Dec 31, 2019 |

|

Mar 31, 2019 |

| Balance, beginning of

period |

$ |

814 |

|

|

$ |

228 |

|

|

$ |

2,611 |

|

|

Additions from loan foreclosures |

1,588 |

|

|

— |

|

|

— |

|

|

Additions from acquisitions |

— |

|

|

650 |

|

|

— |

|

|

Proceeds from dispositions of REO |

— |

|

|

(105 |

) |

|

— |

|

|

Gain on sale of REO |

— |

|

|

41 |

|

|

— |

|

| Balance, end of period |

$ |

2,402 |

|

|

$ |

814 |

|

|

$ |

2,611 |

|

| ADDITIONAL FINANCIAL

INFORMATION |

|

|

|

|

|

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| DEPOSIT

COMPOSITION |

|

|

|

|

|

|

|

Percentage Change |

| |

|

Mar 31, 2020 |

|

Dec 31, 2019 |

|

Mar 31, 2019 |

|

Prior Qtr |

|

Prior Yr Qtr |

| |

|

|

|

|

|

|

|

|

|

|

|

Non-interest-bearing |

|

$ |

4,107,262 |

|

|

$ |

3,945,000 |

|

|

$ |

3,676,984 |

|

|

4.1 |

% |

|

11.7 |

% |

| Interest-bearing checking |

|

1,331,860 |

|

|

1,280,003 |

|

|

1,174,169 |

|

|

4.1 |

% |

|

13.4 |

% |

| Regular savings accounts |

|

1,997,265 |

|

|

1,934,041 |

|

|

1,865,852 |

|

|

3.3 |

% |

|

7.0 |

% |

| Money market accounts |

|

1,846,844 |

|

|

1,769,194 |

|

|

1,495,948 |

|

|

4.4 |

% |

|

23.5 |

% |

|

Total interest-bearing transaction and savings accounts |

|

5,175,969 |

|

|

4,983,238 |

|

|

4,535,969 |

|

|

3.9 |

% |

|

14.1 |

% |

|

Total core deposits |

|

9,283,231 |

|

|

8,928,238 |

|

|

8,212,953 |

|

|

4.0 |

% |

|

13.0 |

% |

| Interest-bearing

certificates |

|

1,166,306 |

|

|

1,120,403 |

|

|

1,163,276 |

|

|

4.1 |

% |

|

0.3 |

% |

|

Total deposits |

|

$ |

10,449,537 |

|

|

$ |

10,048,641 |

|

|

$ |

9,376,229 |

|

|

4.0 |

% |

|

11.4 |

% |

| GEOGRAPHIC

CONCENTRATION OF DEPOSITS |

|

|

|

|

|

|

|

|

|

|

| |

|

Mar 31, 2020 |

|

Dec 31, 2019 |

|

Mar 31, 2019 |

|

Percentage Change |

| |

|

Amount |

|

Percentage |

|

Amount |

|

Amount |

|

Prior Qtr |

|

Prior Yr Qtr |

| Washington |

|

$ |

6,037,864 |

|

|

57.8 |

% |

|

$ |

5,861,809 |

|

|

$ |

5,604,567 |

|

|

3.0 |

% |

|

7.7 |

% |

| Oregon |

|

2,093,738 |

|

|

20.0 |

% |

|

2,006,163 |

|

|

1,906,132 |

|

|

4.4 |

% |

|

9.8 |

% |

| California |

|

1,828,064 |

|

|

17.5 |

% |

|

1,698,289 |

|

|

1,402,213 |

|

|

7.6 |

% |

|

30.4 |

% |

| Idaho |

|

489,871 |

|

|

4.7 |

% |

|

482,380 |

|

|

463,317 |

|

|

1.6 |

% |

|

5.7 |

% |

| Total deposits |

|

$ |

10,449,537 |

|

|

100.0 |

% |

|

$ |

10,048,641 |

|

|

$ |

9,376,229 |

|

|

4.0 |

% |

|

11.4 |

% |

| INCLUDED IN TOTAL

DEPOSITS |

|

Mar 31, 2020 |

|

Dec 31, 2019 |

|

Mar 31, 2019 |

| Public non-interest-bearing

accounts |

|

$ |

115,354 |

|

|

$ |

111,015 |

|

|

$ |

92,122 |

|

| Public interest-bearing

transaction & savings accounts |

|

130,958 |

|

|

133,403 |

|

|

118,033 |

|

| Public interest-bearing

certificates |

|

48,232 |

|

|

35,184 |

|

|

29,572 |

|

|

Total public deposits |

|

$ |

294,544 |

|

|

$ |

279,602 |

|

|

$ |

239,727 |

|

| Total brokered deposits |

|

$ |

250,977 |

|

|

$ |

202,884 |

|

|

$ |

239,444 |

|

| ADDITIONAL FINANCIAL

INFORMATION |

|

|

| (in thousands) |

|

|

| |

|

|

| |

|

|

| ACQUISITION OF

ALTAPACIFIC BANCORP |

|

|

| The following table* provides

the estimated fair value of the assets acquired and liabilities

assumed in the AltaPacific acquisition at November 1, 2019 (in

thousands): |

|

|

| |

November 1, 2019 |

| |

|

|

|

Cash paid |

|

$ |

2,360 |

|