Asure Software, Inc. (NASDAQ: ASUR), a leading provider of

workforce management software, today announced financial results

for the fiscal second quarter 2010, ended December 31, 2009. The

Fiscal second quarter is a short period consisting of the two

months of November and December, 2009. As of January 1, 2010, Asure

switched to calendar year reporting and its next fiscal quarter

will close on March 31, 2010.

Q2 Highlights:

-- Revenue growth of $0.2M, 14%, over November/December 2008; or $0.3M,

20%, excluding the divested Visual Asset Manager (VAM) product revenue

in November/December 2008. Revenue Growth was driven by hardware sales

in both product lines, $0.2M, as well as growth in NetSimplicity's SaaS

offering.

-- EBITDA of $0.3M

-- EBITDA is defined as operating income (earnings) before interest

expense, income taxes, depreciation & amortization

-- Operating Income of $49K; or $0.02 per share, compared to a loss of

($0.9M) ($0.29) per share (split-adjusted), in November & December

2008; and previously published quarterly losses of ($1.5M)

($0.48)/share (split-adjusted), and ($5.3M) ($1.69)/share

(split-adjusted), in fiscal Q1'10 and fiscal Q4'09 respectively.

Operating income is comprised of the following components:

-- Austin HQ excess lease impact, ($105K)

-- Net onetime items, $264K

-- Core business lines margin, ($110K)

-- Operating Expenses were reduced by 49%, or ($1.1M) compared to

November/December 2008 largely due to both headcount & rate per head

efficiencies ($0.3M), the net effect of one-time items, (0.3M), as well

as other cost reductions. One-time items were driven by the

renegotiation of certain outstanding payables deemed excessive by

current management.

Pat Goepel, Asure's Chief Executive Officer, remarked: "After

two recent difficult quarters, and almost 2 and a half years of

unprofitable results, we are beginning to make progress on turning

this business around. I am pleased with the results of the short

period of fiscal Q2'10 and confirm that our upcoming calendar Q1,

2010 outlook is expected to be on target with our previous

estimates. We are targeting positive EBITDA and potentially

breakeven operating income, excluding the negative impact of the

Austin headquarters lease arrangement."

Asure's newly appointed Chief Financial Officer, David Scoglio,

added: "We have substantially reduced overhead and are carefully

investing in areas that will support our revenue plan in the coming

first quarter of the calendar year 2010. These investments will

include strategic augmentation of our sales force and enhancements

to our products' features and functionality. This strategy, a keen

focus on maintaining current levels of fixed expenses and our

momentum of 72% repetitive revenue from the current period should

propel us forward to achieving our profitability goals of this

calendar year 2010, in spite of a projected $1M in full year excess

lease expense ($1.5M cash). Also notable, as we attain

profitability, we have significant Net Operating Losses carry

forwards at our disposal for up to 20 years, which we hope to

utilize to create shareholder value."

Pat Goepel continued, "In the short period of November &

December 2009, Asure incurred $0.1M of expenses associated with its

Austin lease. As discussed previously, Asure is actively pursuing

options to improve this arrangement, which would only help provide

transparency into the increasingly successful core businesses of

Asure Software, Inc. Asure's Board of Directors and management team

are committed to growing this business by 20% year over year and

achieving levels of 20% EBITDA by calendar year end 2010."

Conference Call Details

Asure Software, Inc. has scheduled a conference call for

Wednesday, February 10, 2010 at 11:00 a.m. ET (10:00 a.m. CT) to

discuss its most recent financial results and outlook.

Participating in the call will be Pat Goepel, Chief Executive

Officer. To take part, please dial 800-299-7089 ten minutes before

the conference call begins, ask for the Asure Software event and

use passcode 16877542. International callers should dial

617-801-9714 and reference the same passcode, 16877542.

Investors, analysts, media and the general public will also have

the opportunity to listen to the conference call in listen-only

mode via the Internet by visiting the investor relations page of

Asure's web site at www.asuresoftware.com. To monitor the live

call, please visit the web site at least 15 minutes early to

register, download and install any necessary audio software. For

those who cannot listen to the live broadcast, an archived replay

will be available shortly after the call on the investor relations

page of the Company's web site at www.asuresoftware.com

About Asure Software, Inc.

Headquartered in Austin, Texas, Asure Software empowers small to

mid-size organizations and divisions of large enterprises to

operate more efficiently, increase worker productivity and reduce

costs through a comprehensive suite of on-demand workforce

management software and services. Asure's market-leading suite

includes products that optimize workforce time and attendance

tracking, benefits enrollment and tracking, pay stubs and W2

documentation, and room scheduling and resource management. With

additional offices in Warwick, Rhode Island, Vancouver, British

Columbia, and Mumbai, India, Asure serves 3,500 customers around

the world. For more information, please visit

www.asuresoftware.com.

"Safe Harbor" Statement under the Private Securities Litigation

Reform Act of 1995: Statements in this press release regarding

Asure's business which are not historical facts are

"forward-looking statements" that involve risks and uncertainties.

Such risks and uncertainties, which include those associated with

continued listing of the Company's securities on the NASDAQ Capital

Market, could cause actual results to differ from those contained

in the forward-looking statements.

ASURE SOFTWARE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except per share data)

December 31, JULY 31,

2009 2009

(UNAUDITED)

ASSETS

Current Assets:

Cash and equivalents $ 2,263 $ 4,375

Short-term investments 0 5,339

Accounts receivable, net of allowance for

doubtful accounts of $34 and $20 at December 31,

2009 and July 31, 2009, respectively 1,526 1,207

Inventory 49 3

Prepaid expenses and other current assets 213 143

---------- ----------

Total Current Assets 4,051 11,067

Property and equipment, net 581 672

Intangible assets, net 3,623 3,949

---------- ----------

Total Assets $ 8,255 $ 15,688

========== ==========

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities:

Accounts payable $ 1,039 $ 6,294

Accrued compensation and benefits 79 278

Lease impairment and advance 562 899

Other accrued liabilities 411 541

Deferred revenue 1,744 1,897

---------- ----------

Total Current Liabilities 3,835 9,909

Long-Term Liabilities:

Deferred revenue 134 119

Lease impairment and advance 196 250

Other long-term obligations 212 206

---------- ----------

Total Long-Term Liabilities 542 575

Stockholders' Equity:

Preferred stock, $.01 par value; 1,500 shares

authorized; none issued or outstanding -- --

Common stock, $.01 par value; 6,500 shares

authorized; 3,375 and 3,290 shares issued;

3,162 and 3,112 shares outstanding at

December 31, 2009 and July 31, 2009,

respectively 334 329

Treasury stock at cost, 213 and 179 shares at

December 31, 2009 and July 31, 2009,

respectively (4,907) (4,815)

Additional paid-in capital 270,925 270,738

Accumulated deficit (262,404) (260,947)

Accumulated other comprehensive income (70) (101)

---------- ----------

Total Stockholders' Equity 3,878 5,204

---------- ----------

Total Liabilities and Stockholders'

Equity $ 8,255 $ 15,688

========== ==========

ASURE SOFTWARE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except per share data)

FOR THE FOR THE

TWO MONTHS ENDED FIVE MONTHS ENDED

DECEMBER 31, DECEMBER 31,

2009 2008 2009 2008

---------- ---------- ---------- ----------

(UNAUDITED) (UNAUDITED)

Revenues $ 1,679 $ 1,467 $ 4,000 $ 4,259

Cost of Sales (435) (294) (914) (858)

---------- ---------- ---------- ----------

Gross Margin 1,244 1,173 3,086 3,401

OPERATING EXPENSES:

Selling, general and

administrative 797 1,857 3,537 5,036

Research and development 264 343 676 904

Amortization of

intangible assets 100 99 249 248

---------- ---------- ---------- ----------

Total Operating

Expenses 1,161 2,299 4,462 6,188

INCOME (LOSS) FROM

OPERATIONS 83 (1,126) (1,376) (2,787)

OTHER INCOME AND (EXPENSES):

Interest income 2 25 9 80

Foreign currency

translation (15) (19) (46) 102

Gain on sale of assets 0 250 0 250

Interest expense and

other (8) (17) (20) (27)

---------- ---------- ---------- ----------

Total Other Income (21) (239) (57) 405

INCOME (LOSS) FROM

OPERATIONS, BEFORE INCOME

TAXES 62 (887) (1,433) (2,382)

Provision for income taxes (13) 0 (25) (25)

---------- ---------- ---------- ----------

NET INCOME (LOSS) $ 49 $ (887) $ (1,458) $ (2,407)

========== ========== ========== ==========

BASIC AND DILUTED LOSS

PER SHARE:

Net income (loss) per

share - basic $ 0.02 $ (0.29) $ (0.46) $ (0.77)

Net income (loss) per

share - diluted $ 0.02 $ (0.29) $ (0.46) $ (0.77)

WEIGHTED AVERAGE SHARES

OUTSTANDING:

Basic 3,156 3,111 3,141 3,111

Diluted 3,162 3,111 3,141 3,111

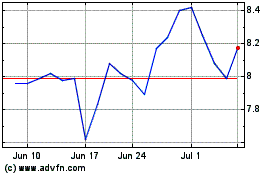

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From May 2024 to Jun 2024

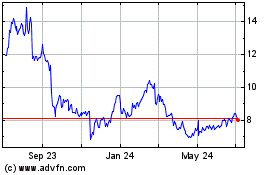

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From Jun 2023 to Jun 2024