Asure Software (NASDAQ: ASUR), a leading provider of workforce

management software, today reiterated that stockholders should not

be deceived by the misleading statements, most recently reflected

in the release issued June 29, 2009, by Red Oak Partners and the

Pinnacle Fund, a group of dissident stockholders who are attempting

to gain control of the Company by means of a hostile proxy contest.

"We are deeply concerned and disappointed that Red Oak Partners,

Pinnacle Fund and its portfolio manager, David Sandberg, are again

perpetuating misperceptions and spreading false allegations about a

company -- in this case Asure Software -- in an attempt to gain

unwarranted support for their effort to take control of the Company

without paying a premium," said Nancy L. Harris, President and

Chief Executive Officer.

"We have in good faith tried numerous times to meet with

Pinnacle/Red Oak and the members of their proposed slate to learn

more about their individual qualifications as potential directors

and managers of your company as well as their plans for improving

Asure's profitability and increasing stockholder value," Harris

said. "The fact that this group has failed to put forth any plan

for taking the company to profitability and increasing stockholder

value should be alarming to all stockholders, especially given

Pinnacle/Red Oak's lack of experience with Asure's business and

with public companies in general and their history of contentious

litigation in connection with their earlier hostile takeover

attempts. We can only conclude that they have no plan other than

the pursuit of a self-serving, short-term agenda that is not in the

best interests of Asure's shareholders."

In this vein, on February 17, 2009, CLST Holdings, Inc.

announced that it had filed a lawsuit in the United States District

Court for the Northern District of Texas against Red Oak Fund,

L.P., Red Oak Partners, LLC, and David Sandberg, alleging the

defendants violated federal securities laws by making recent

purchases of the common stock of CLST. Among other things, CLST

accused the defendants of falsely stating their intention to

abandon a previously announced tender offer for CLST's common stock

while proceeding with an illegal tender offer that did not comply

with applicable securities laws. CLST has also accused the

defendants of failing to make timely disclosure of their stock

purchases in light of their undisclosed tender offer.

"Our current Board of Directors and management team are

diligently committed to long-term value creation with a plan to get

the Company to break-even this year and continue our profitable

growth in the workforce management market," said Harris. "We have

made great headway since the acquisition of iEmployee in the fall

of 2007, and we are in an excellent position to grow that business

so that it generates long-term value for shareholders."

The Company also will send the following letter, dated July 1,

2009, to all stockholders:

Dear Fellow Stockholder:

Red Oak Partners, a New York-based hedge fund with a reputation

for aggressively attacking companies for short-term gains, has

stated its intent through its affiliate, The Pinnacle Fund, to wage

a proxy contest for control of your company by replacing Asure

Software's existing Board of Directors with its own slate of six

directors of questionable background, experience and

qualifications. This unproductive and costly proxy contest comes at

a time when the company can ill afford to be distracted from

continuing to implement its transformational growth strategy.

The Board of Directors strongly urges Asure Software

stockholders not to take any action in response to the dissident

proxy material and not to sign any proxy cards you might receive

from Pinnacle/Red Oak.

We believe Pinnacle/Red Oak is attempting to seize control of

your company without paying for it, a deceptive tactic we have seen

them use in other proxy contests.

Since Pinnacle/Red Oak is using questionable tactics, misleading

comments and unproven assertions, we are writing to ensure you have

all the facts with respect to the following:

Pinnacle/Red Oak's actions show that it is pursuing a

self-serving, short-term agenda that is not in the best interests

of Asure's shareholders.

-- Pinnacle/Red Oak has opportunistically increased its stake in the

company by acquiring shares at a historically low price, with the apparent

intent of gaining control of the Board without paying a premium and at the

expense of long-term value creation for investors. It has provided no

strategic plan that would be superior to the company's ongoing long-term

strategy.

-- We have found Pinnacle/Red Oak to be disingenuous in its

communications with Asure shareholders, publicly stating several times that

it did not desire to have Board representation, and then proceeding with a

proxy contest. They have also rejected your Board's good-faith efforts to

engage them in discussions that could have led to a compromise to avoid

this proxy fight. Frankly, their inconsistent communications with the

company indicate they lack true understanding of the business and our

rapidly evolving markets.

Asure Software has reported solid performance in recent quarters

and completely transformed its business in the past six years.

-- Under the current Board's leadership since 2003, we have successfully

integrated two strategic acquisitions -- NetSimplicity and iEmployee --

that serve high-growth, high-margin markets. We also divested the legacy

businesses that were facing eroding market demand and relevancy. Since we

started this transformation, we have eliminated 93% of expenses from the

company.

-- Despite the recent harsh macroeconomic environment, we have reported

solid financial and operational results in recent quarters and have

outperformed our competitors. For example, iEmployee new customer bookings

grew 59% in the fiscal 2009 third quarter, and we further reduced expenses

by 11%, including a 10% pay cut across the company.

-- In the short term, we expect to get to break-even by the end of our

October quarter by further reducing our operational expenses. In the long

term, we will continue pursuing our vision of being the leading provider of

on-demand workforce management software solutions to small and mid-sized

companies. We expect rapid profitable growth when the economy and our

target markets rebound, with our objective to reach $30 million in revenues

and 10% profit exiting fiscal 2013 (top-line CAGR of approximately 30%).

Your Board has a track record of transparency, strong corporate

governance and listening to all shareholders, not just a chosen few

with self-serving agendas.

-- Your Board has done its prudent due diligence in reviewing all

possible strategic alternatives for long-term value creation, and has acted

independently according to best practices of corporate governance, with the

assistance of outside advisors. The Board and management team continue to

work toward aggressively reducing expenses, growing revenue and

profitability, and creating shareholder value.

-- In June 2009, the Board implemented a seamless management transition

plan by appointing former Chief Operating Officer Nancy L. Harris to

President and Chief Executive Officer, and naming her to fill the vacancy

of a director who had stepped down. Ms. Harris brings exceptional

leadership skills and experience to the position, along with a forward-

looking vision focused on increasing shareholder value by growing revenues

through innovative software and service solutions, optimizing our

distinctive brands, and continuing to reduce costs and improve operational

efficiency. This appointment effectively separates the positions of

Chairman and CEO, with former Chairman and CEO Richard N. Snyder continuing

as Executive Chairman. Ms. Harris has been integral to the company's

progress during the past eight years, as she led the integration and growth

of our two acquired software businesses -- NetSimplicity and iEmployee.

Based on our knowledge of the dissident slate, the Pinnacle/Red

Oak nominees appear to be either conflicted, lack an understanding

of the company's business or have questionable backgrounds.

The dissident's slate includes:

-- David Sandberg, managing member and founder of Red Oak, whose minimal

public company board experience consists of his recent appointments to the

boards of SMTC and EDCI.

-- Adrian Pertierra, senior analyst at Red Oak, with no known public

company, operational or director experience.

-- Bob Graham and Pat Goepel, both former board members of iEmployee

prior to its acquisition by Asure.

It is doubtful that the limited and conflicted perspectives of

these individuals in combination with the two other dissident

nominees -- Cornelius Ferris and Jeffrey Vogel -- would be

sufficient to make up an effective Board. For example, we have no

knowledge that any of these dissident nominees is qualified to

chair an audit committee, or has firsthand knowledge of securities

law and Sarbanes-Oxley requirements. Moreover, earlier this year,

CLST Holdings sued Red Oak Partners, its affiliates and David

Sandberg over alleged violations of securities laws.

Our Board-recommended slate of directors provides seasoned

public company and relevant tech industry experience and has upheld

the highest levels of corporate governance standards while

successfully guiding the company through its transformation.

In addition to Ms. Harris, our director nominees are:

-- Chairman Richard N. Snyder, who has more than 30 years of direct

experience in all aspects of the computer industry. Mr. Snyder was

responsible for launching and managing the inkjet printing business and

creating the Deskjet brand for Hewlett Packard, where he served for 28

years. He also held senior management positions at Dell and Compaq, and

founded a consulting firm for high-technology businesses. He sits on the

Board of Directors of Symmetricom (SYMM), where he has served on the Audit

and Compensation committees.

-- James H. Wells, a consultant for Internet start-up companies; former

senior vice president of marketing and business development for Dazel, a

Hewlett Packard enterprise software company; and founding officer of the

Internet streaming company RealNetworks, Inc.

-- Lou Mazzucchelli, a partner with venture capital firm Ridgewood

Capital which focuses on the information technology industry; former

investment banker and digital media technology analyst for Gerard Klauer

Mattison; and founder of Cadre Technologies, a pioneering computer-aided

software engineering tools company.

-- Richard J. Agnich, an advisor to technology start-ups; trustee of

Austin College and chair of the Entrepreneurs Foundation of North Texas;

and former Senior Vice President, General Counsel and Secretary at Texas

Instruments.

-- Ray R. Miles, a corporate strategic consultant for Rajko Associates;

former President of Communications Services with EDS, Inc.; and former

manager of software strategy at Texas Instruments.

Your independent Board and management team are focused solely on

delivering steadily increasing financial and operational

performance and will remain responsible to all investors while

continuing to aggressively evaluate growth strategies and

value-creating opportunities.

Your Board of Directors unanimously recommends that an

affirmative vote be cast "for" each of our director nominees and

"for" each of the other proposals listed on the white proxy card.

The Board urges you not to sign or return any proxy card sent to

you by Pinnacle/Red Oak.

Sincerely,

Nancy L. Harris

President, Chief Executive Officer and Director

About Asure Software

Headquartered in Austin, Texas, Asure Software (NASDAQ: ASUR) (a

d/b/a of Forgent Networks, Inc.), empowers small to mid-size

organizations and divisions of large enterprises to operate more

efficiently, increase worker productivity and reduce costs through

a comprehensive suite of on-demand workforce management software

and services. Asure's market-leading suite includes products that

optimize workforce time and attendance tracking, benefits

enrollment and tracking, pay stubs and W2 documentation, expense

management, and meeting and event management. With additional

offices in Warwick, Rhode Island; Vancouver, British Columbia; and

Mumbai, India; Asure serves 3,500 customers around the world. For

more information, please visit www.asuresoftware.com.

"Safe Harbor" Statement under the Private Securities Litigation

Reform Act of 1995:

Statements in this press release regarding Asure's business

which are not historical facts are "forward-looking statements"

that involve risks and uncertainties. Such risks and uncertainties,

which include those associated with continued listing of the

Company's securities on the NASDAQ Capital Market, could cause

actual results to differ from those contained in the

forward-looking statements.

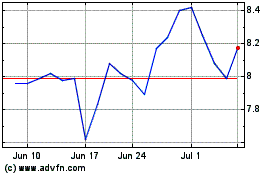

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From May 2024 to Jun 2024

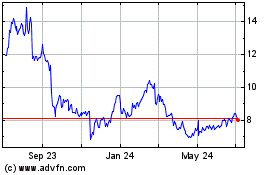

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From Jun 2023 to Jun 2024