Forgent Networks (d/b/a Asure Software) Letter to Stockholders

May 27 2009 - 5:00PM

Marketwired

Asure Software (NASDAQ: ASUR)

Open letter to shareholders

You should have received a proxy from Asure Software asking for

your vote regarding taking the company private. To many of you,

this idea may seem alarming because it immediately calls into

question how you will trade this stock in the future once it is no

longer listed on NASDAQ and does not report as a public company. We

understand those concerns because the Board of Directors has

wrestled with those same issues as both fellow shareholders and

concerned members of an independent board that is entrusted with

doing what is best for all of our shareholders.

There has been a significant amount of communication to you that

has been offered by people and groups outside of the company

expressing their opinions and concern regarding the company and the

go private transaction. Much of this information is confused and

misleading. The Board would like you to have the facts because we

know you want to be fully informed when you cast your final vote

regarding this very important issue.

I would like to share some candid thoughts with you regarding

how Asure's Board and Management arrived at the plan to take the

company private and the vision we have for the company going

forward.

Companies become publicly traded when they have the size, growth

and profitability to create an attractive market in their shares.

Asure has none of those qualifications today because it is a "start

over." The current company is attempting to inherit the benefits of

being publicly traded by growing into the shell of a company that

formerly existed but had a much larger infrastructure. We have

approached this assignment in two ways: Cutting cost and growing

revenue. The revenue growth has come from small acquisitions that

were affordable and organic growth in attractive markets. The

inherited cost structure has been grossly out of proportion to the

new software revenue even though the costs have been reduced over

93% since the start. Our goal has been to reach cash flow positive

by spending only what is necessary to grow revenue.

Today, if you look at just the software portion of the business,

it is near break even and growing which indicates that this portion

of the P&L is balanced. The overhead expenses, however, remain

too high which means we burn cash. We have continued to cut

overhead spending but with the slower revenue growth due to the

economic downturn, profitability will be seriously delayed unless

we reduce overhead expenses dramatically.

There are two major components of overhead that offer the relief

we seek: The cost associated with being publicly traded and our

building lease. The building lease is fifteen years with four

remaining and we have explored for years every legal method of

extricating the company without result to date. The cost associated

with being publicly traded is a collection of expenses related to

government compliance, legal and accounting that amount to more

than $1 million a year.

We have chosen to pay for top tier services because the Board

believes that it is in all shareholders' best interest to ensure

the integrity of financial and compliance reporting. However, it is

difficult for a company of our size to afford those public company

expenses. While some would argue that we could remain public and

save expense by cutting the quality of services and take more risk

with compliance, the Board has always placed a premium on the

integrity of financial and compliance reporting and believes that

such risk is not in shareholders' best interest.

Going private would eliminate some cost, such as Sarbanes-Oxley

compliance, completely and would considerably reduce the risk of

switching to lower cost services such as legal and accounting. The

net result would be a savings of about $250,000 per quarter which

would reduce the cash out flow significantly and accelerate the

time to profitability. Revenues are growing quarterly and we expect

to reach break even under these conditions by the end of 2009.

If we are unsuccessful in taking the company private and

reducing these expenses, then the choices would include taking

longer to reach profitability or reducing cost in the core software

business. The choice to remove $250,000 per quarter from operations

could significantly impair the ability to grow revenue and to

remain competitive. Said differently, if we were unsuccessful in

taking the company private, we would be faced with incurring

significant risk or cutting the core business to afford

infrastructure costs that frankly don't contribute to helping the

company achieve its revenue goals.

These are difficult choices that the Board has carefully

considered for more than a year with the help of many outside

professionals. After careful consideration, the best choice seems

clear: Go private, save expenses, keep the business healthy and

reach profitability.

The Board cares about share liquidity -- yours and their own.

They believe that liquidity is already an issue today because the

stock is so thinly traded. If the company is delisted from NASDAQ,

as it currently faces, then not only will liquidity decline further

on the Over the Counter Bulletin Board but be burdened with public

company expenses. While it is possible to delay delisting by

exercising a reverse stock split, history indicates that the move

can be temporary and share prices return to below the minimum bid

price unless accompanied by an event such as profitability.

The Board believes that a profitable, private software company

that is growing in a strong market, such as Work Force Management,

will be an attractive acquisition candidate in a few years that

could provide an attractive return to our shareholders. In the

meantime, we intend for the stock to be traded on the Over the

Counter Market Pink Sheets, which provides significant liquidity to

over five thousand other companies today. In fact, over $123

Billion traded on the Pink Sheets in 2008 which is an 800% increase

in volume since 2001.

These are difficult circumstances that lead to difficult

choices. On the other hand, we have great opportunities ahead if we

execute our business plan. We have a growing software business;

cash without the need to borrow; no debt and an experienced team

that is passionate about being successful.

Please give your full consideration to this proposal and vote

FOR the proposals on your proxy.

Sincerely,

Richard N. Snyder

Chairman and Chief Executive Officer

Asure Software (NASDAQ:ASUR)

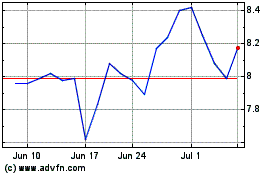

Historical Stock Chart

From May 2024 to Jun 2024

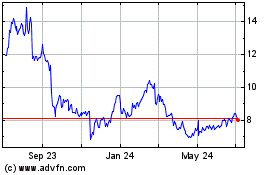

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From Jun 2023 to Jun 2024