- Amended Statement of Beneficial Ownership (SC 13D/A)

May 18 2009 - 12:32PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 3)*

Forgent Networks, Inc.

(Name of Issuer)

Common Stock, par value $.01 per share

(Title of Class of Securities)

34629U103

(CUSIP Number)

RED OAK PARTNERS, LLC

654 Broadway, Suite 5

New York, NY 10012

Attention: David Sandberg

Telephone: (212) 614-8952

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

May 18, 2009

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is

filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the

following box [X].

Note. Schedules filed in paper format shall include a signed original

and five copies of the schedule, including all exhibits. See Section 240.13d-7

for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person's

initial filing on this form with respect to the subject class of securities,

and for any subsequent amendment containing information which would alter

disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be

deemed to be "filed" for the purpose of Section 18 of the Securities Exchange

Act of 1934 or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the

Notes.)

Page 1 of 9 pages

CUSIP No.: 34629U103

1. NAME OF REPORTING PERSON

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY)

Red Oak Partners, LLC

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) [ ]

(b) [ ]

3 SEC USE ONLY

4 SOURCE OF FUNDS

AF

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) or 2(e) [ ]

6 CITIZENSHIP OR PLACE OF ORGANIZATION

New York

NUMBER OF 7 SOLE VOTING POWER 0

SHARES

BENEFICIALLY 8 SHARED VOTING POWER - 2,285,796

OWNED BY

EACH 9 SOLE DISPOSITIVE POWER 0

REPORTING

PERSON WITH 10 SHARED DISPOSITIVE POWER - 2,285,796

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,285,796

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ]

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.35%**

14 TYPE OF REPORTING PERSON

OO

_________________________________

** Based on 31,111,278 shares of common stock of Forgent Networks, Inc.

outstanding at March 11, 2009, as reported in Forgent Networks, Inc.'s

Quarterly Report on Form 10-Q for the quarter ended January 31, 2009 filed with

the Securities and Exchange Commission on March 13, 2009.

Page 2 of 9 pages

|

CUSIP No.: 34629U103

1. NAME OF REPORTING PERSON

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY)

The Red Oak Fund, LP

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) [ ]

(b) [ ]

3 SEC USE ONLY

4 SOURCE OF FUNDS

WC

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) or 2(e) [ ]

6. CITIZENSHIP OR PLACE OF ORGANIZATION

United States

NUMBER OF 7 SOLE VOTING POWER 0

SHARES

BENEFICIALLY 8 SHARED VOTING POWER - 812,177

OWNED BY

EACH 9 SOLE DISPOSITIVE POWER 0

REPORTING

PERSON WITH 10 SHARED DISPOSITIVE POWER - 812,177

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

812,177

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ]

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.61%**

14 TYPE OF REPORTING PERSON

PN

Page 3 of 9 pages

|

CUSIP No.: 34629U103

1. NAME OF REPORTING PERSON

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY)

Pinnacle Partners, LLC

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) [ ]

(b) [ ]

3 SEC USE ONLY

4 SOURCE OF FUNDS

AF

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) or 2(e) [ ]

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Colorado

NUMBER OF 7 SOLE VOTING POWER 0

SHARES

BENEFICIALLY 8 SHARED VOTING POWER - 946,950

OWNED BY

EACH 9 SOLE DISPOSITIVE POWER 0

REPORTING

PERSON WITH 10 SHARED DISPOSITIVE POWER - 946,950

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

946,950

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ]

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.05%**

14 TYPE OF REPORTING PERSON

OO

Page 4 of 9 pages

|

CUSIP No.: 34629U103

1. NAME OF REPORTING PERSON

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY)

Pinnacle Fund, LLLP

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) [ ]

(b) [ ]

3 SEC USE ONLY

4 SOURCE OF FUNDS

WC

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) or 2(e) [ ]

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Colorado

NUMBER OF 7 SOLE VOTING POWER 0

SHARES

BENEFICIALLY 8 SHARED VOTING POWER - 946,950

OWNED BY

EACH 9 SOLE DISPOSITIVE POWER 0

REPORTING

PERSON WITH 10 SHARED DISPOSITIVE POWER - 946,950

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

946,950

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ]

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.05%**

14 TYPE OF REPORTING PERSON

PN

Page 5 of 9 pages

|

CUSIP No.: 34629U103

1. NAME OF REPORTING PERSON

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY)

Bear Market Opportunity Fund, L.P.

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) [ ]

(b) [ ]

3 SEC USE ONLY

4 SOURCE OF FUNDS

WC

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) or 2(e) [ ]

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

NUMBER OF 7 SOLE VOTING POWER 0

SHARES

BENEFICIALLY 8 SHARED VOTING POWER - 526,669

OWNED BY

EACH 9 SOLE DISPOSITIVE POWER 0

REPORTING

PERSON WITH 10 SHARED DISPOSITIVE POWER - 526,669

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

526,669

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ]

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.69%**

14 TYPE OF REPORTING PERSON

PN

Page 6 of 9 pages

|

CUSIP No.: 34629U103

1. NAME OF REPORTING PERSON

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY)

David Sandberg

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) [ ]

(b) [ ]

3 SEC USE ONLY

4 SOURCE OF FUNDS

AF

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) or 2(e) [ ]

6. CITIZENSHIP OR PLACE OF ORGANIZATION

United States

NUMBER OF 7 SOLE VOTING POWER

SHARES

BENEFICIALLY 8 SHARED VOTING POWER - 2,285,796

OWNED BY

EACH 9 SOLE DISPOSITIVE POWER

REPORTING

PERSON WITH 10 SHARED DISPOSITIVE POWER - 2,285,796

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,285,796

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ]

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.35%**

14 TYPE OF REPORTING PERSON

IN

Page 7 of 9 pages

|

ITEM 4. Purpose of Transaction.

Item 4 as previously filed is amended by adding the following

language:

On May 18th, Pinnacle Partners issued a letter, attached as Exhibit A, to Asure

Software's ("ASUR") Board of Directors in response to their May 12th letter

which was filed with the Securities and Exchange Commission ("SEC") on May 14th

and issued via press release on May 15th.

On May 18th, Pinnacle Partners also issued a press release, attached as Exhibit

B. The press release indicated that Pinnacle had filed with the SEC a copy of

its May 18th letter in a 13D filing. It also indicated that on May 13th

Pinnacle filed its preliminary proxy statement in a PREC14A filing in

opposition to the proposed "going private" transactions to be voted on at a

Company special meeting currently scheduled to be held June 2, 2009. In its

letter, Pinnacle asked that Asure's CEO - who during an April meeting had

indicated to several investors his plans to step down in six months - step down

immediately and without severance. Pinnacle also highlighted other measures to

reduce costs which were independent of any go-private efforts and stated that

it believes it is inappropriate that ASUR has not explained that these savings

can occur without going private.

ITEM 7. Material to be Filed as Exhibits.

Item 7 is hereby amended to add the following exhibits:

Exhibit A: Letter to Board of Directors

Exhibit B: Preliminary Proxy Statement

Page 8 of 9 pages

SIGNATURES

After reasonable inquiry and to the best of its knowledge and belief,

each of the undersigned certifies that the information set forth in this

Statement is true, complete and correct.

Dated: May 18, 2009

/s/ David Sandberg

-------------------------

David Sandberg

|

Red Oak Partners LLC

By: /s/ David Sandberg

-------------------------------

David Sandberg, Managing Member

|

Pinnacle Partners, LLP

By: Red Oak Partners LLC, its general partner

By: /s/ David Sandberg

-------------------------------

David Sandberg, Managing Member

|

The Red Oak Fund, L.P.

By: Red Oak Partners LLC, its general partner

By: /s/ David Sandberg

-------------------------------

David Sandberg, Managing Member

|

Pinnacle Fund, LLLP

By: Pinnacle Partners, LLC, its general partner

By: Red Oak Partners LLC, its general partner

By: /s/ David Sandberg

-------------------------------

David Sandberg, Managing Member

|

Bear Market Opportunity Fund, L.P.

By: Red Oak Partners, LLC, its investment advisor

By: /s/ David Sandberg

-------------------------------

David Sandberg, Managing Member

|

Page 9 of 9 pages

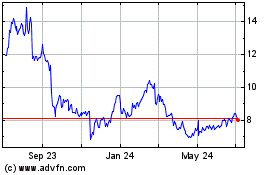

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From May 2024 to Jun 2024

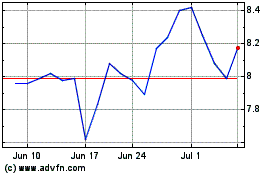

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From Jun 2023 to Jun 2024