Lithia Motors Beats Estimates - Analyst Blog

February 22 2013 - 6:30AM

Zacks

Lithia Motors Inc. (LAD)

posted a 54.2% increase in adjusted earnings per share to 74 cents

in the fourth quarter of 2012 from 48 cents in the corresponding

quarter last year. The quarterly EPS surpassed the Zacks Consensus

Estimate by 7 cents. In absolute terms, profits shot up 52% to

$19.3 million from $12.7 million in the year-ago quarter.

Revenues for the quarter increased 26.2% to $877.4 million from

$695.3 million in the year-ago quarter. The growth in revenues was

driven by better performance across all the segments, with finance

and insurance business and new vehicle sales being the bright

spots. Revenues were ahead of the Zacks Consensus Estimate of

$825.0 million.

Revenues from new vehicle sales improved 32.7% to $506.9 million in

the quarter. New vehicle retail sales increased 31.8% to 14,713

units. However, revenues per vehicle increased marginally by 1% to

$34,451. On a same-store basis, revenues from new vehicle sales

went up 30.8% to $490.0 million.

Revenues from used vehicle retail climbed 22.5% to $208.4 million

in the quarter. Revenues from used vehicle wholesale crept up 2.6%

to $35.8 million. Used vehicle retail sales improved 21.7% to

11,943 units with revenues per vehicle increasing marginally by 1%

to $17,447. Same-store revenues from used vehicle sales went up

20.1% to $200.4 million.

Revenues from service body and parts went up 9.3% to $89.7 million.

Meanwhile, the company’s finance and insurance business witnessed a

30.6% rise in revenues to $29.2 million. Revenues from Fleet and

other shot up 87.4% to $7.5 million.

Gross profit increased 22.6% to $138.4 million from $112.9 million

in the year-ago quarter. Operating income improved 23% to $36.8

million from $29.9 million in the fourth quarter of 2011.

For 2012, Lithia Motors reported adjusted earnings of $2.96 per

share, up 51.8% from $1.95 a year ago. Net income surged 48.8% to

$77.4 million from $52.0 million in 2011. The company’s revenues

for the year increased 26% to $3.3 billion from $2.6 billion in

2011, driven by better performance across all the businesses.

Financial Details

Lithia Motors had cash and cash equivalents of $42.8 million as of

Dec 31, 2012, up from $20.9 million as of Dec 31, 2011. Total debt

was $295.1 million as of Dec 31, 2012 compared with $286.9 million

as of Dec 31, 2011.

The company had an operating cash outflow of $212.5 million in the

full year 2012 compared to a cash outflow of $766.0 thousand in the

corresponding period of 2011.

Outlook

Lithia Motors expects earnings in the range of 69 cents to 71 cents

per share for the first quarter of 2013 and $3.25 to $3.35 for the

full year 2013. The company expects revenues between $3.7 billion

and $3.8 billion for 2013, with an 11.5% increase in new vehicle

same-store sales and a 9% rise in used vehicle same-store sales.

Same-store sales from service body and parts are expected to

improve 5%. The company also expects capital expenditures of $55

million and a tax rate of 39.5% for 2013.

Our Take

Lithia Motors is the ninth largest automotive retailer in U.S. With

87 stores in 11 states, the company provides 27 new vehicle brands

along with all brands of used vehicle. Currently, it retains a

Zacks Rank #2 (Buy).

Besides Lithia, America's Car-Mart Inc. (CRMT),

Asbury Automotive Group, Inc. (ABG) and

Penske Automotive Group, Inc. (PAG) are performing

well in the same industry where it operates. All of them hold a

Zacks Rank #2 (Buy)

ASBURY AUTO GRP (ABG): Free Stock Analysis Report

AMERICAS CAR-MT (CRMT): Free Stock Analysis Report

LITHIA MOTORS (LAD): Free Stock Analysis Report

PENSKE AUTO GRP (PAG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

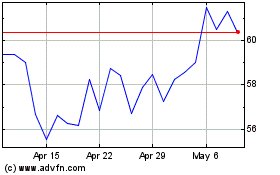

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Jun 2024 to Jul 2024

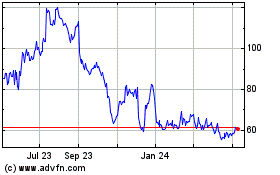

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Jul 2023 to Jul 2024