Xilinx Increases Dividend - Analyst Blog

March 14 2012 - 2:21PM

Zacks

Xilinx, Inc. (XLNX) recently announced that the

company’s Board of Directors increased the quarterly cash dividend

to $0.22 per share from $0.19 per share.

The dividend will be paid on June 6, 2012 to all stockholders of

record at the close of business on May 16, 2012.

The company is making continuous efforts to return excess cash

to shareholders through dividends and share repurchases. Cash flow

continues to be strong for Xilinx. During the December quarter, the

company generated operating cash flow of $181 million before

spending $19 million in capital expenditures. In the past four

quarters, Xilinx generated a record cash flow of $863 million from

operating activities.

Xilinx is maintaining its tradition of increasing dividend every

year. In 2011, Xilinx paid dividends of $169.1 million amounting to

$0.64 per share. In 2010, Xilinx paid dividends of $165.6 million

to stockholders amounting to $0.60 per share.

In addition, Xilinx repurchased 17.8 million shares using

$468.9 million in fiscal 2011. In fiscal 2010, Xilinx

repurchased 6.2 million shares for $150.0 million.

Meanwhile, Xilinx posted a net income of $127.0 million or $0.47

per share in the third quarter of fiscal 2012 compared to a net

income of $126.3 million or $0.47 per diluted share in the second

quarter of fiscal 2012 and a net income of $152.3 million or $0.58

per share in the year-ago quarter. The reported earnings beat the

Zacks Consensus Estimate of $0.37 per share.

Earnings estimates for fiscal 2012 and the fourth quarter have

increased significantly thereafter in the last sixty days.

Xilinx reported sales of $511.1 million were down 10% year over

year and 8% sequentially, better than management’s revised guidance

range of $510.8 million to $538.5 million.

Xilinx stated that it expects strong growth from 28-nanometer

and 40-nanometer product families in the March quarter.

Consequently, Xilinx expects sales to be up 2% to up 6%

sequentially. Sales from Europe are expected to increase, sales

from Asia-Pacific expected to decrease and sales from North America

and Japan to be approximately flat.

We continue to be sceptical as prime rival Altera

Corporation (ALTR) recently narrowed its guidance for the

March quarter citing a more pronounced and broader than anticipated

inventory adjustment related weakness leading to a more significant

decline.

Nevertheless, we continue to maintain a Neutral recommendation

on Xilinx. In the short-run, we have a Zacks #2 Rank, which

translates into a short-term rating of Buy.

ALTERA CORP (ALTR): Free Stock Analysis Report

XILINX INC (XLNX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

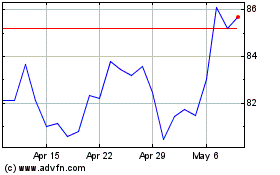

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From May 2024 to Jun 2024

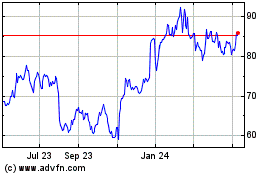

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Jun 2023 to Jun 2024