For Immediate Release

Chicago, IL – February 10, 2012 – Zacks Equity Research

highlights Hain Celestial Group (HAIN) as the Bull

of the Day and Altera Corp. (ALTR) as the Bear of

the Day. In addition, Zacks Equity Research provides analysis on

PepsiCo (PEP), Sirius XM Radio

(SIRI) and J.P. Morgan (JPM).

Full analysis of all these stocks is available at

http://at.zacks.com/?id=2678.

Here is a synopsis of all five stocks:

Bull of the Day:

A leader in natural food and personal care products with an

array of well-known brands, Hain Celestial Group

(HAIN) offers investors one of the strongest growth profiles in the

industry. The company's strategic investments plus continued

efforts to contain costs, increase productivity, and enhance cash

flows and margins have enabled it to deliver healthy results.

This is quite evident from Hain's second-quarter 2012. The

quarterly earnings of $0.52 per share beat the Zacks Consensus

Estimate of $0.49, and rose 33.3% from the prior-year quarter. The

company's top line also grew an impressive 32.1%.

The company continues to expect total revenue between $1,455

million and $1,480 million, and earnings in the range of $1.63 to

$1.73 per share for fiscal 2012. Buoyed by better-than-expected

results and an optimistic outlook, we continue to maintain our

Outperform recommendation on the stock.

Bear of the Day:

Earnings estimates for Altera Corp. (ALTR) have

declined significantly after a weak guidance for the first quarter

of 2012. The company expects sales to decline 5%-9% sequentially.

As per management, the program timing in the Military section will

account for half of the decline.

The company expects revenues from the wireless segment to move

lower across multiple geographies due to continued inventory

depletion and softening of demand in the second half of 2011.

Altera has a large exposure to the telecommunications industry, in

particular China.

The recent slowdown in China has adversely impacted the

company's business. Therefore, we have downgraded our

recommendation to Underperform from Neutral.

Latest Posts on the Zacks Analyst Blog:

ECB, Greek Austerity, Jobless Claims &

China

In an expected move, the European Central Bank (ECB) left

short-term interest rates unchanged at 1% Thursday morning. It also

appears that Greek politicians have finally come around to

accepting all the demands of the EU/ECB/IMF troika that were a

precondition to a fresh bailout for the country.

The major sticking point in the end was the demand for cuts to

public sector pension benefits that the Greek leaders were

resisting. But the issue appears to have now been decided, though

all the details are not out at this stage.

In other news, China’s January inflation numbers were a tad hotter

than expected. On the home front, we have another positive report

on the labor market front, with weekly Initial Jobless Claims

falling more than expected.

Initial Jobless Claims dropped a better than expected 15K last week

to 358K. The four-week average, which smooths out the week-to-week

fluctuation, dropped by 11K to 366.3K, maintaining its downtrend of

recent weeks. This key data series witnessed some sharp volatility

in recent weeks, but appears to be back on its downtrend.

China’s inflation numbers accelerated a bit in January from the

preceding month, but the increase likely reflected the seasonal

impact of the Chinese New Year that results in a temporary bump in

demand for essentials. The January increase notwithstanding, the

overall trend on the inflation front is favorable, improving the

odds that the central bank will remain in an easing mode through

lower interest rates and reserve requirements.

On the earnings front, PepsiCo (PEP) came ahead of

earnings and revenue expectations, but referred to 2012 as a year

of transition where it will be unable to pass on above-average

costs through price increases. The company is planning to implement

$1.5 billion in additional cost cuts through 2014 and increase its

North American advertising budget. Sirius XM Radio

(SIRI) met earnings expectations, but missed modestly on the

top-line.

In other news, five major banks appear to be close to announcing a

$26 billion settlement on the year-long foreclosure investigation

with the government. These banks include J.P.

Morgan (JPM) and Ally Financial, among others.

Get the full analysis of all these stocks by going to

http://at.zacks.com/?id=2649.

About the Bull and Bear of the Day

Every day, the analysts at Zacks Equity Research select two

stocks that are likely to outperform (Bull) or underperform (Bear)

the markets over the next 3-6 months.

About the Analyst Blog

Updated throughout every trading day, the Analyst Blog provides

analysis from Zacks Equity Research about the latest news and

events impacting stocks and the financial markets.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous analyst coverage is provided for a universe of 1,150

publicly traded stocks. Our analysts are organized by industry

which gives them keen insights to developments that affect company

profits and stock performance. Recommendations and target prices

are six-month time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today by visiting

http://at.zacks.com/?id=7158.

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leonard Zacks. As a PhD from MIT Len

knew he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment

Research is through our free daily email newsletter; Profit from

the Pros. In short, it's your steady flow of Profitable ideas

GUARANTEED to be worth your time! Register for your free

subscription to Profit from the Pros at

http://at.zacks.com/?id=4582.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

ALTERA CORP (ALTR): Free Stock Analysis Report

HAIN CELESTIAL (HAIN): Free Stock Analysis Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

PEPSICO INC (PEP): Free Stock Analysis Report

SIRIUS XM RADIO (SIRI): Free Stock Analysis Report

To read this article on Zacks.com click here.

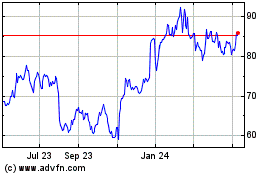

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From May 2024 to Jun 2024

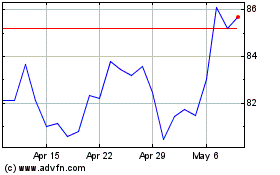

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Jun 2023 to Jun 2024