Semiconductor Stocks Up On Encouraging Comments

January 18 2012 - 3:05PM

Dow Jones News

Semiconductor stocks rallied Wednesday following encouraging

comments in the sector and ahead of earnings from giants such as

Intel Corp. (INTC) and Texas Instruments Inc. (TXN).

Positive commentary from analog chip maker Linear Technology

Corp. (LLTC), manufacturer Taiwan Semiconductor Manufacturing Co.

(TSM, 2330.TW) and semiconductor-equipment maker ASML Holding NV

(AMSL, ASML.AE) stood in contrast to recent guidance cuts from

other companies in the industry. Analysts said the news boosted

hopes that the chip sector may soon rebound following a few

quarters of tepid results.

"While we continue to expect estimate cuts for the group,

investor confidence in shortly reaching an end to the current

inventory correction has likely been boosted," Canaccord Genuity

analyst Bobby Burleson noted.

The news helped to push the Philadelphia SOX Semiconductor Index

to its highest level since July. The index recently rose 4.8% to

403.68. Among the index's biggest gainers Wednesday were Linear,

Altera Corp. (ALTR), Texas Instruments, Micron Technology Inc. (MU)

and STMicroelectronics N.V. (STM).

Semiconductor companies in general have posted softer results in

recent quarters because of weakening demand. Customers, worried

about an economic slowdown, have pared back orders as they work

through their inventory levels, but some observers have been hoping

the market had reached its low point.

The market will gain more clarity when some of the companies

start to report quarterly results. Intel is on tap for its

fourth-quarter results Thursday, followed by Texas Instruments on

Monday. Both Intel and Texas Instruments lowered their guidance for

the current period, with Intel citing the impact that severe

flooding in Thailand has had on the personal-computer industry and

Texas Instruments blaming broad-based lower demand.

On Tuesday, Linear, which makes analog chips that take

real-world signals, such as sound and light, and convert them to

digital signals, said it had reached an inflection point in its

business. It provided better-than-expected guidance for the current

period and said bookings improved in December and January.

Chief Financial Officer Paul Coghlan, speaking during a

conference call Wednesday, said customers remain concerned about

the global macroeconomic environment, but there are indications

business it turning around.

"Customers, although cautious, appear to want to stop reducing

inventory and invest modestly in demand," Coghlan said.

J.P. Morgan analyst Chris Danely noted that Linear was the first

semiconductor company to talk about higher bookings. He said he

expects that strength to spread across the sector in the first half

of the year, with inventory in the channel depleted almost to the

levels of the 2008 to 2009 downturn. Danely added that it is "time

to buy semis aggressively."

Linear shares, down 8.7% over the past 12 months, recently were

up 10% to $33. Its analog rivals were among the biggest gainers,

with Fairchild Semiconductor International Inc. (FCS) up 10% to

$14.34 and Analog Devices Inc. (ADI) ahead 5.6% to $39.13. Both

Texas Instruments and Intersil Corp. (ISIL) grew about 7%.

Meanwhile, Taiwan Semiconductor Manufacturing Co., which makes

chips for U.S. companies such as Qualcomm Inc. (QCOM), Nvidia Corp.

(NVDA) and Texas Instruments, sounded a slightly upbeat note about

its prospects for the first quarter. The company said it expects

revenue to be largely flat compared to the fourth quarter, instead

of lower as is the seasonal norm, as some customers are expected to

replenish their inventories after holding off from doing so for

months due to the dour global economic outlook.

But all wasn't rosy. The company said ongoing lower demand for

computer chips, which resulted in a decline in its fourth-quarter

net profit, has led it to cut planned capital expenditures by 18%

this year. Taiwan Semiconductor Manufacturing shares recently were

up 2.8% to $13.84.

Still, Dutch semiconductor equipment maker ASML Holding which

counts Intel and Samsung Electronics Co. (SSNHY, 005930.SE) among

its customers, said Wednesday that it expects a healthy start to

2012, as its customers invest in chip production to drive faster

and more powerful smartphones and tablet computers.

"It's too early to provide a full-year outlook, but the

prospects for the first six months, based on the expectations of

our clients, are good," Chief Financial Officer Peter Wennink

said.

ASML shares slid 1.2% to $42.07.

-By Shara Tibken, Dow Jones Newswires; 212-416-2189;

shara.tibken@dowjones.com

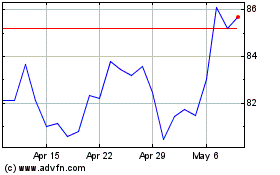

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From May 2024 to Jun 2024

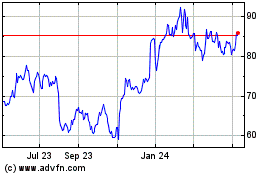

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Jun 2023 to Jun 2024