Xilinx Cuts Sales Guidance - Analyst Blog

September 20 2011 - 9:07AM

Zacks

Xilinx, Inc.(XLNX) has revised its guidance for

the September quarter. Xilinx now expects sales to be down 7–10%

compared to the previous guidance of sales to be up 1% to down 3%

sequentially.

The weaker-than-expected sales growth during the quarter was

driven primarily by the can be traced back to Communications and

Industrial and other categories.

The new guidance implies sales between $553 million and $572

million compared to the sales guidance between $621.7 million and

$597.0 million guided previously.

Earlier, rival chipmaker Altera Corp. (ALTR)

downgraded its sale guidance for the third quarter of 2011 due to

weaker demand in several verticals markets including Telecom and

Wireless (particularly outside Asia).

Xilinx continues to expect gross margin of around 63%, which is

lower than the second quarter, primarily due to the

faster-than-anticipated ramp of Virtex-6 and Spartan-6.

Operating expenses are now projected to come at around $208

million, including approximately $2 million of amortization of

acquisition-related intangibles and approximately $4

million in restructuring charges. This is lower than the

previous estimate of $218 million primarily due to lower variable

expense and the timing of development expense, including labor, and

lower-than-anticipated restructuring charges.

Earlier, Xilinx had posted net income of $154.4 million or $0.56

per diluted share in the first quarter of fiscal 2012, down 4%

sequentially and 3% year over year. However, the result beat

the Zacks Consensus Estimate of $0.53 per share. Sales of $615.5

million were up 5% sequentially and 3% year over year, and above

management’s guided range of $587.9–$611.4 million.

The current Zacks Consensus Estimate is $2.11, down by almost

$0.05 in the last thirty 30 days. We expect some downward revisions

in the consensus earnings estimate to incorporate the downgrade in

guidance provided by the company’s downgraded guidance.

As of now, we maintain a Neutral recommendation on the stock,

which Our Neutral recommendation is supported by a Zacks #3 Rank,

which that translates into a short-term rating of Hold.

ALTERA CORP (ALTR): Free Stock Analysis Report

XILINX INC (XLNX): Free Stock Analysis Report

Zacks Investment Research

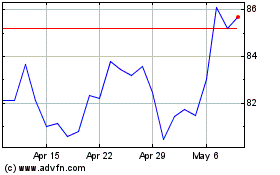

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From May 2024 to Jun 2024

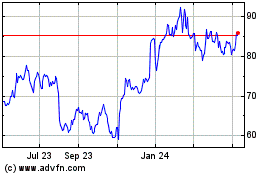

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Jun 2023 to Jun 2024