Current Report Filing (8-k)

December 28 2021 - 4:17PM

Edgar (US Regulatory)

0000353184false00003531842021-12-282022-01-030000353184us-gaap:CommonStockMember2021-12-282022-01-030000353184airt:CumulativeCapitalSecuritiesMember2021-12-282022-01-03

______________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________________________________________________________________________

FORM 8-K

______________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 28, 2021

______________________________________________________________________________

AIR T, INC.

(Exact Name of Registrant as Specified in Charter)

______________________________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-35476

|

|

52-1206400

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

5930 Balsom Ridge Road

Denver, North Carolina 28037

(Address of Principal Executive Offices, and Zip Code)

________________(828) 464-8741__________________

Registrant’s Telephone Number, Including Area Code

Not applicable___

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

AIRT

|

NASDAQ Global Market

|

|

Alpha Income Preferred Securities (also referred to as 8% Cumulative Capital Securities) (“AIP”)

|

AIRTP

|

NASDAQ Global Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

|

|

|

☐

|

Emerging growth company

|

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Item 7.01 Regulation FD Disclosure

Item 8.01 Other Matters

Employee Retention Credit.

In early January 2022, Air T, Inc. ("the Company") intends to file an application with the Internal Revenue Service for an Employee Retention Credit in an amount approximating $9,000,000. The Employee Retention Credit, originally included in the CARES Act in 2020 and subsequently modified by Congress, is a refundable tax credit against certain employment taxes equal to 50-70% of the qualified wages an eligible employer pays to its employees. The Company’s application will be made with respect to wages paid between the period January 1, 2001 and September 30, 2021. There is no assurance that the Company will qualify for this credit or when, or in what amount, the application will be approved.

Potential Acquisition

The Company is negotiating the purchase, with two principals of the underlying business, of all of the shares of a Northern European company involved in the global aviation data and information business. Details of the expected transaction are not yet complete, but it is anticipated that the purchase price will be approximately 12.5MM Euros, and the Company’s interest in the entity would approximate 70%.

Final definitive documents with respect to the potential transaction have not been completed or executed and once executed would be subject to numerous closing conditions and other terms and conditions customary for transactions of this kind, including further due diligence review. While the parties project signing a definitive agreement in early January 2022 and closing in late January 2022, there is no assurance definitive agreements will be finalized and signed or that a closing will occur.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 28, 2021.

AIR T, INC.

By: /s/ Brian Ochocki

Brian Ochocki, Chief Financial Officer

23135415v3

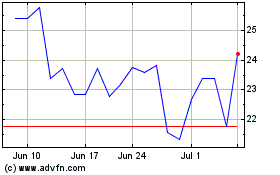

Air T (NASDAQ:AIRT)

Historical Stock Chart

From Oct 2024 to Nov 2024

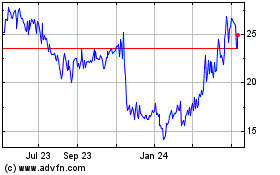

Air T (NASDAQ:AIRT)

Historical Stock Chart

From Nov 2023 to Nov 2024