Outlook Remains Positive SAN JOSE, Calif., Nov. 21

/PRNewswire-FirstCall/ -- Agile Software Corporation (NASDAQ:AGIL),

a leading provider of product lifecycle management (PLM) solutions,

today announced results for the second quarter of fiscal 2006,

which ended October 31, 2005. Total revenues for the quarter were

$31.5 million, compared to $28.2 million for the second quarter of

fiscal 2005. License revenues for the second quarter of fiscal 2006

were $10.1 million, compared to $11.2 million for the second

quarter of fiscal 2005. Net loss for the second quarter of fiscal

2006, on a generally accepted accounting principles (GAAP) basis,

was $4.0 million, or ($0.07) per share, compared to a net loss of

$92,000, or ($0.00) per share, for the second quarter of fiscal

2005. Non-GAAP net loss for the second quarter of fiscal 2006,

which excludes amortization of intangibles and stock compensation,

was $1.6 million, or ($0.03) per share, compared to a non-GAAP net

income of $672,000, or $0.01 per share, for the second quarter of

fiscal 2005. Reconciliation between our net income (loss) on a GAAP

and non-GAAP basis is provided in a table immediately following the

non-GAAP Condensed Consolidated Statements of Operations below.

Management Commentary "Revenues were up year-over-year, but down

sequentially," said Bryan Stolle, Agile chief executive officer.

"While PLM remains the hottest segment within enterprise software

sector, the demand picture in the overall enterprise software

sector is still difficult, creating challenges in delivering

predictable results. Overall, we are optimistic about the PLM

segment, but we are experiencing somewhat inconsistent results due

to unpredictable customer capital spending patterns." "We remain

optimistic about the long-term prospects for our business and for

PLM, though we are disappointed in the Q2 results," said Jay

Fulcher, president and COO. "Agile continues to win in the market,

and Agile customers continue to broaden their deployment of our

solutions. In the second half of our fiscal year we will be focused

on driving more predictable revenues and improved bottom line

performance while continuing to deliver value to our customers."

Customer Wins and Expansions Organizations that purchased new or

additional licenses of Agile's PLM solutions include: Advanced

Medical Optics, Alps, Alcatel, Analogic, Arthrocare, Braun,

Chunghwa, Cisco, Eastman Kodak, Flextronics, Harris, Hill-Rom,

Hitachi, IBM, Intier, Intuitive Surgical, Inventech, Lockheed

Martin, Matsushita, Metaldyne, Panasonic, Philip Morris

International, Philips, SanDisk, Sanmina SCI, Siemens, Tellabs,

Texas Instruments, Thyssen Krupp and Welch Allyn. Awards and

Recognition Agile is very proud that Agile customers Arthrocare

Corporation and Lucent Technologies were honored with Start

Magazine's Technology and Business Awards for clearly demonstrating

their commitment and understanding of how PLM helps them

effectively improve and enhance their companies and their bottom

lines. During the quarter, Agile was also recognized by leading

industry analyst Gartner as a visionary in the PLM market. The

Gartner Magic Quadrant profiles companies that will have the

greatest impact on the PLM market, and positions each vendor based

on Gartner's view of how evaluated companies will serve users and

perform during a two year period. Agile earned high marks for its

ability to deliver value to discrete manufacturing industries, and

earned the highest ratings of any PLM vendor in the high tech and

life sciences industries. Agile was also noted as a top vendor in

the automotive and consumer packaged goods industries. Last but not

least, Agile was named to Software Magazine's 23rd Annual Software

500, a list of the world's foremost software and services

providers. The Software 500 is a revenue-based ranking of the

world's largest software and services suppliers targeting

enterprise IT organizations. Conference Call Details Agile will

discuss its second quarter results and management's forward looking

guidance on a conference call today beginning at 2:00 p.m. Pacific

Time. A Web cast of the conference will be available on Agile's Web

site at http://www.agile.com/ under the 'Investor Relations'

section. You may access replays of the Web cast for ninety days

after the call at http://www.agile.com/investors . Financial and

statistical information to be discussed in the call will be

available on the company's Web site immediately prior to

commencement of the call. Additional investor information can be

accessed at http://www.agile.com/ or by calling Agile's Investor

Relations at 408-284-4011. About Agile Software Corporation Agile

Software Corporation helps companies drive profits, accelerate

innovation, reduce costs, and ensure regulatory compliance

throughout the product lifecycle. With a broad suite of enterprise

class PLM solutions, time-to-value focused implementations, and a

unique Guaranteed Business ResultsSM program, Agile helps companies

get the most from their products. Alcatel, Boeing, Dell Inc.,

Flextronics International, Hitachi, Leapfrog, Lockheed Martin,

Magna Steyr, Siemens, QUALCOMM and ZF are among the over 10,000

customers in the automotive, aerospace and defense, consumer

products, electronics, high tech, industrial products, and life

sciences industries that have licensed Agile solutions. For more

information, call 408-284-4000 or visit http://www.agile.com/.

Non-GAAP Financial Measures In addition to reporting our financial

results in accordance with generally accepted accounting

principles, or GAAP, we are also providing with this press release

non-GAAP net income (loss) and non-GAAP net income (loss) per share

information. In preparing our non-GAAP information, we have

excluded where applicable, stock-based compensation (a non-cash

charge), acquisition-related amortization of intangible assets and

acquired in-process research and development (non-cash charges),

acquisition related compensation (a non-recurring charge), and

restructuring and other charges. Because of the non-recurring or

infrequent nature and/or non-cash nature of several of these

charges, we believe that excluding them provides both management

and investors with additional insight into our current operations,

the trends affecting the Company and the Company's marketplace

performance. In particular, management finds it useful to exclude

the non-cash charges in order to more readily correlate the

Company's operating activities with the Company's ability to

generate cash from operations, and excludes the non-recurring and

infrequently incurred cash items as a means of more accurately

predicting liquidity requirements. Accordingly, management uses

these non-GAAP measures, along with the comparable GAAP

information, in evaluating our historical performance and in

planning our future business activities. Please note that our

non-GAAP measures may be different than those used by other

companies. The additional non-GAAP financial information we present

should be considered in conjunction with, and not as a substitute

for, our financial information presented in accordance with GAAP.

Safe Harbor Statement This press release contains "forward-looking

statements" as defined under securities laws, including statements

relating to the Company's expectations regarding the Company's

financial results in future periods. Actual results may differ

materially and adversely from those expressed in any

forward-looking statements. These factors include, but are not

limited to, overall spending patterns for enterprise software in

general and for PLM in particular and other risk factors detailed

in the Company's filings with the Securities and Exchange

Commission. For additional information regarding the risks inherent

in our business, please see "Risk Factors" included in our Annual

Report on Form 10-K for the year ended April 30, 2005, and in our

Quarterly Report on Form 10-Q for the quarter ended July 31, 2005,

as filed with the Securities and Exchange Commission. We undertake

no obligation to revise our forward-looking statements to reflect

events or circumstances after the date hereof as a result of new

information, future events or otherwise. NOTE: Agile and Agile

Software are registered trademarks of Agile Software Corporation.

Agile Software Corporation CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except per share data) (Unaudited) Three

Months Ended Six Months Ended October 31, October 31,

------------------ ------------------ 2005 2004 2005 2004 -------

------- ------- ------- Revenues: License $10,076 $11,206 $23,477

$21,520 Service 21,403 17,011 42,386 33,178 ------- ------- -------

------- Total revenues 31,479 28,217 65,863 54,698 ------- -------

------- ------- Cost of revenues: License 835 1,164 1,607 2,241

Service (1) 10,731 8,013 22,413 15,582 Amortization of intangible

assets 725 177 1,450 355 ------- ------- ------- ------- Total cost

of revenues 12,291 9,354 25,470 18,178 ------- ------- -------

------- Gross profit 19,188 18,863 40,393 36,520 ------- -------

------- ------- Operating expenses: Sales and marketing (1) 12,332

11,122 25,162 21,458 Research and development (1) 8,534 5,515

16,755 10,845 General and administrative (1) 2,868 2,744 6,314

5,477 Amortization of intangible assets 627 390 1,229 1,046

Restructuring charges -- -- -- 2,132 ------- ------- -------

------- Total operating expenses 24,361 19,771 49,460 40,958

------- ------- ------- ------- Loss from operations (5,173) (908)

(9,067) (4,438) Interest and other income, net 1,284 1,078 2,154

1,878 ------- ------- ------- ------- Loss before income taxes

(3,889) 170 (6,913) (2,560) Provision for income taxes 111 262 407

535 ------- ------- ------- ------- Net loss $(4,000) $(92)

$(7,320) $(3,095) ======= ======= ======= ======= Net loss per

share: Basic and diluted $(0.07) $(0.00) $(0.14) $(0.06) =======

======= ======= ======= Weighted average shares 53,757 52,677

53,674 52,560 ======= ======= ======= ======= (1) Effective May 1,

2005, Agile adopted FAS 123(R), "Share-Based Payments," and uses

the modified prospective method to value its share-based payments.

Accordingly, for the three and six months ended October 31, 2005,

stock compensation was accounted under FAS 123(R) while for the

three and six months ended October 31, 2004, stock compensation was

accounted under APB 25, "Accounting for Stock Issued to Employees."

The amounts in the tables above include stock compensation as

follows: Cost of service revenue $181 $53 $273 $143 Sales and

marketing 478 85 891 244 Research and development 142 8 203 23

General and administrative 206 51 404 123 ------- ------- -------

------- Total stock compensation $1,007 $197 $1,771 $533 =======

======= ======= ======= Agile Software Corporation Non-GAAP

Financial Measures and Reconciliations (In thousands, except per

share data) (Unaudited) Three Months Ended Six Months Ended October

31, October 31, ----------------------- ------------------------

2005 2004 2005 2004 ------- ------- ------- ------- GAAP net loss

to non-GAAP net income (loss) reconciliation: GAAP net loss

$(4,000) $(92) $(7,320) $(3,095) Stock compensation (1) 1,007 197

1,771 533 Amortization of intangible assets 1,352 567 2,679 1,401

Restructuring charges -- -- -- 2,132 ------- ------- -------

------- Non-GAAP net income (loss) $(1,641) $672 $(2,870) $971

======= ======= ======= ======= GAAP basic and diluted to non-GAAP

basic and diluted earnings (loss) per share reconciliation: GAAP

basic and diluted loss per share $(0.07) $(0.00) $(0.14) $(0.06)

Stock compensation (1) 0.02 -- 0.04 0.01 Amortization of intangible

assets 0.02 0.01 0.05 0.03 Restructuring charges -- -- -- 0.04

------- ------- ------- ------- Non-GAAP basic and diluted earnings

(loss) per share $(0.03) $0.01 $(0.05) $0.02 ======= =======

======= ======= Weighted average shares used in calculating

non-GAAP diluted net income per share 53,757 54,300 (2) 53,674

54,219 (2) (1) Effective May 1, 2005, Agile adopted FAS 123(R),

"Share-Based Payments," and uses the modified prospective method to

value its share-based payments. Accordingly, for the three and six

months ended October 31, 2005, stock compensation was accounted

under FAS 123(R) while for the three and six months ended October

31, 2004, stock compensation was accounted under APB 25,

"Accounting for Stock Issued to Employees." (2) Weighted average

shares used in calculating non-GAAP diluted net income per share

for the three and six months ended October 31, 2004 were computed

while giving effect to all dilutive potential common shares, which

were anti-dilutive for the purpose of calculating GAAP diluted net

loss per share. Agile Software Corporation CONDENSED CONSOLIDATED

BALANCE SHEETS (In thousands) (Unaudited) October 31, April 30,

2005 2005 ---------------- ---------------- ASSETS Current assets:

Cash and cash equivalents $96,675 $81,760 Short-term investments

86,023 93,444 Accounts receivable, net 20,472 26,899 Other current

assets 4,241 5,157 ---------------- ---------------- Total current

assets 207,411 207,260 Long-term investments 17,945 23,176 Property

and equipment, net 9,770 10,067 Intangible assets, net 9,756 12,735

Other assets 1,026 1,127 Goodwill 66,716 66,658 ----------------

---------------- Total assets $312,624 $321,023 ================

================ LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities: Accounts payable and other liabilities $24,449 $26,694

Deferred revenue 23,199 25,190 ---------------- ----------------

Total current liabilities 47,648 51,884 Other non-current

liabilities 6,677 8,258 ---------------- ---------------- Total

liabilities 54,325 60,142 Total stockholders' equity 258,299

260,881 ---------------- ---------------- Total liabilities and

stockholders' equity $312,624 $321,023 ================

================ DATASOURCE: Agile Software Corporation CONTACT:

Terri Pruett of Agile Software Corporation, +1-408-284-4048, or Web

site: http://www.agile.com/

Copyright

AgileThought (NASDAQ:AGIL)

Historical Stock Chart

From Jun 2024 to Jul 2024

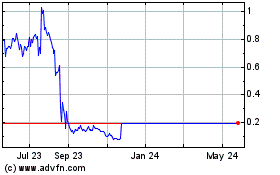

AgileThought (NASDAQ:AGIL)

Historical Stock Chart

From Jul 2023 to Jul 2024