Filed Pursuant to Rule 424(b)(4)

Registration Nos. 333-250074 and 333-251088

2,150,000 Shares of common stock

We are offering 2,150,000 shares of common stock, par value $0.001 per share (the “common stock”) at a public offering price of $7.00 per share.

The representative of the underwriters has the option to purchase up to 322,500 additional shares of common stock solely to cover over-allotments, if any, at the price to the public less the underwriting discounts and commissions. The over-allotment option may be used to purchase shares of common stock as determined by the representative, but such purchases cannot exceed an aggregate of 15% of the number of shares of common stock sold in the primary offering. The over-allotment option is exercisable for 30 days from the date of this prospectus.

Our common stock is listed on The Nasdaq Capital Market under the symbol “ACHV.” The closing price of our common stock on December 2, 2020, as reported by The Nasdaq Capital Market, was $7.59 per share.

Investing in our securities involves a high degree of risk. Before making any investment in these securities, you should consider carefully the risks and uncertainties in the section entitled “Risk Factors” beginning on page 8 of this prospectus.

|

|

|

Per Share

|

|

Total

|

|

|

Public offering price

|

|

$

|

7.00

|

|

$

|

15,050,000

|

|

|

Underwriting discount(1)

|

|

$

|

0.42

|

|

$

|

903,000

|

|

|

Proceeds, before expenses, to Achieve Life Sciences, Inc.

|

|

$

|

6.58

|

|

$

|

14,147,000

|

|

|

|

(1)

|

See “Underwriting” for a description of the compensation payable to the underwriter.

|

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. The securities are not being offered in any jurisdiction where the offer is not permitted.

Sole Bookrunner

Lake Street

Co-Manager

Maxim Group

The date of this prospectus is December 2, 2020

TABLE OF CONTENTS

We have not, and the underwriters and their affiliates have not, authorized anyone to provide you with any information or to make any representation not contained or incorporated by reference in this prospectus or any related free writing prospectus. We do not, and the underwriters and their affiliates do not, take any responsibility for, and can provide no assurance as to the reliability of, any information that others may provide to you. This prospectus is not an offer to sell or an offer to buy common stock in any jurisdiction where offers and sales are not permitted. The information in this prospectus is accurate only as of its date, regardless of the time of delivery of this prospectus or any sale of common stock. You should also read and consider the information in the documents to which we have referred you under the caption “Where You Can Find More Information” in the prospectus.

Neither we nor the underwriters have done anything that would permit a public offering of the common stock or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus outside of the United States.

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by, and should be read together with, the more detailed information and financial statements and related notes thereto appearing elsewhere in this prospectus. Before you decide to invest in our common stock, you should read the entire prospectus carefully, including the risk factors and the financial statements and related notes included in this prospectus. Unless the context requires otherwise, in this prospectus the terms “Achieve,” the “Company,” “we,” “us” and “our” refer to Achieve Life Sciences, Inc., together with its subsidiaries, taken as a whole. This prospectus includes trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included in this prospectus are the property of their respective owners.

Company Overview

We are a late clinical-stage pharmaceutical company committed to the global (excluding Central & Eastern Europe plus other territories) development and commercialization of cytisinicline for smoking cessation and nicotine addiction. Our primary focus is to address the global smoking and nicotine addiction epidemic, which is a leading cause of preventable death and is responsible for more than eight million deaths annually worldwide. We may expand our focus to address other methods of nicotine addiction such as e-cigarettes/vaping.

Cytisinicline is an established smoking cessation treatment that has been approved and marketed in Central and Eastern Europe by Sopharma AD for over 20 years under the brand name Tabex™. It is estimated that over 20 million people have used cytisinicline to help treat nicotine addiction, including over 2,000 patients in three investigator-conducted, Phase 3 clinical trials in Europe and New Zealand. Data from the first two studies were published in the New England Journal of Medicine in September 2011 and December 2014. Results from the third study were recently submitted for publication.

Cytisinicline is a naturally occurring, plant-based alkaloid. Cytisinicline is structurally similar to nicotine and has a well-defined, dual-acting mechanism of action that is both agonistic and antagonistic. It is believed to aid in smoking cessation and the treatment of nicotine addiction by interacting with nicotine receptors in the brain by reducing the severity of nicotine withdrawal symptoms through agonistic binding to nicotine receptors and by reducing the reward and satisfaction associated with nicotine through antagonistic properties.

We initiated our Phase 3 ORCA-2 trial in October 2020, which is the first of our two pivotal studies we believe will be required by FDA for US marketing approval. ORCA-2 will randomize 750 U.S. smokers to one of three study arms to determine the efficacy and safety of cytisinicline administered for either 6 or 12 weeks, compared to placebo. The primary endpoint is biochemically verified continuous abstinence during the last 4 weeks of treatment in the 6 and 12-week cytisinicline treatment arms compared to placebo. Each treatment arm will be compared independently to the placebo arm and the trial will be determined to be successful if either or both of the cytisinicline treatment arms show a statistical benefit compared to placebo. Based upon patient enrollment rates in our previous studies, we believe the trial can achieve full enrollment within the first quarter of 2021 with data read out by the end of 2021.

Summary of Risk Factors

Investing in our securities involves substantial risk, and our business is subject to numerous risks and uncertainties. You should carefully consider all of the information set forth in this prospectus and, in particular, the information under the heading “Risk Factors,” prior to making an investment in our securities. Some of these risks include:

|

|

•

|

Substantial doubt exists as to our ability to continue as a going concern. Our ability to continue as a going concern is uncertain and dependent on our success at raising additional capital sufficient to meet our obligations on a timely basis. If we fail to obtain additional financing when needed, we may be unable to complete the development, regulatory approval and commercialization of our product candidate.

|

|

|

•

|

We have incurred losses since inception, have a limited operating history on which to assess our business and anticipate that we will continue to incur losses for the foreseeable future.

|

|

|

•

|

We have never generated any revenue from product sales and may never be profitable.

|

|

|

•

|

We are dependent upon a single company for the manufacture and supply of cytisinicline.

|

|

|

•

|

Cytisinicline is currently our sole product candidate and there is no guarantee that we will be able to successfully develop and commercialize cytisinicline.

|

|

|

•

|

Results of earlier clinical trials of cytisinicline are not necessarily predictive of future results, and any advances of cytisinicline in clinical trials may not have favorable results or receive regulatory approval.

|

|

|

•

|

Clinical trials, including our Phase 3 ORCA-2 trial, are costly, time consuming and inherently risky, and we may fail to demonstrate safety and efficacy to the satisfaction of applicable regulatory authorities.

|

|

|

•

|

The development of our product candidate is dependent upon securing sufficient quantities of cytisinicline from the Laburnum anagyroides plant, which grows outside of the United States in a limited number of locations.

|

|

|

•

|

If we do not obtain the necessary regulatory approvals in the United States and/or other countries, we will not be able to sell cytisinicline.

|

|

|

•

|

It is difficult to evaluate our current business, predict our future prospects and forecast our financial performance and growth.

|

|

|

•

|

The outbreak of the novel strain of coronavirus, SARS-CoV-2, which causes COVID-19, could adversely impact our business, including our non-clinical and clinical development activities, patient recruitment timelines and cash runway.

|

|

|

•

|

We expect to continue to rely on third parties to manufacture cytisinicline for use in clinical trials, and we intend to exclusively rely on Sopharma to produce and process cytisinicline, if approved. Our commercialization of cytisinicline could be stopped, delayed or made less profitable if Sopharma fails to obtain approval of government regulators, fails to provide us with sufficient quantities of product, or fails to do so at acceptable quality levels or prices.

|

|

|

•

|

Sopharma may breach its supply agreement with us and sell cytisinicline into our territories or permit third parties to export cytisinicline into our territories and negatively affect our commercialization efforts of our products in our territories.

|

|

|

•

|

We face substantial competition and our competitors may discover, develop or commercialize products faster or more successfully than us.

|

|

|

•

|

We may not be successful in obtaining or maintaining necessary rights to cytisinicline, product compounds and processes for our development pipeline through acquisitions and in-licenses.

|

4

Business Organization

We were incorporated in California in October 1991 and subsequently reorganized as a Delaware corporation in March 1995. Our principal executive offices are located at 1040 West Georgia Street, Suite 1030, Vancouver, B.C. V6E 4H1, and our telephone number is (604) 210-2217.

In August 2017, our company, then named OncoGenex Pharmaceuticals, Inc., completed its merger, or the Arrangement, with Achieve, as contemplated by the Merger Agreement between the companies. We then changed our name to Achieve Life Sciences, Inc. As a result of the Arrangement, Achieve became our wholly owned subsidiary. Achieve was formed in 2015 as a Delaware corporation. Extab Corporation, a Delaware corporation, which was formed in 2009, is also our wholly-owned subsidiary. Achieve Pharma UK Limited, a United Kingdom company, which was formed in 2009, is our indirectly owned subsidiary. As used in this prospectus, the term “OncoGenex” refers to our business prior to August 1, 2017.

5

The Offering

|

Common stock offered

|

2,150,000 shares.

|

|

|

|

|

Public offering price

|

$7.00

|

|

|

|

|

Option to purchase additional shares

|

We have granted the representative of the underwriters an option, exercisable for 30 days after the date of this prospectus, to purchase up to an additional 322,500 shares from us.

|

|

|

|

|

Representative’s warrant

|

The registration statement of which this prospectus is a part also registers a warrant (the “Representative’s Warrant”) to purchase 50,000 shares of common stock to be issued to the representative, as a portion of the underwriting compensation payable in connection with this offering, as well as the shares of common stock issuable upon the exercise of the Representative’s Warrant. The Representative’s Warrant will be exercisable at any time, and from time to time, in whole or in part, commencing 180 days following the effective date of the registration statement of which this prospectus is a part, with an exercise price of $8.75 (125% of the public offering price of the shares sold in this offering) and a term of five years.

|

|

|

|

|

Common stock to be outstanding after this offering

|

5,766,414 shares (or 6,088,914shares if the representative exercises the underwriter’s option to purchase additional shares in full).

|

|

|

|

|

Use of proceeds

|

We estimate that the net proceeds of this offering, after deducting estimated underwriting discounts and commissions and estimated offering expenses, will be approximately $13.8 million (or approximately $16.0 million if the underwriter exercises its option to purchase additional shares in full), based on an offering price of $7.00 per share. We intend to use the net proceeds from this offering to fund our Phase 3 ORCA-2 trial, clinical research and development, as well as for working capital and general corporate purposes. We may also use a portion of the net proceeds for the acquisition of, or investment in, technologies, intellectual property or businesses that complement our business, although we have no present commitments or agreements to this effect. See “Use of Proceeds.”

|

|

|

|

|

Risk factors

|

Investing in our common stock involves significant risks. You should read the “Risk Factors” section of this prospectus and in the documents incorporated by reference in this prospectus, including the risk factors described under the section entitled “Risk Factors” contained in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, for a discussion of factors to consider before deciding to purchase shares of our common stock.

|

|

|

|

|

Nasdaq Capital Market Symbol

|

“ACHV”

|

6

The number of shares of our common stock to be outstanding after this offering is based on 3,616,414 shares of common stock outstanding as of September 30, 2020 and excludes the following:

|

|

•

|

129,470 shares of common stock issuable upon the exercise of options outstanding as of September 30, 2020, with a weighted average exercise price of $78.18 per share;

|

|

|

•

|

231 shares of common stock subject to restricted stock units outstanding as of September 30, 2020;

|

|

|

•

|

1,267,418 shares of common stock issuable upon the exercise of warrants outstanding as of September 30, 2020, with a weighted average exercise price of $18.60 per share;

|

|

|

•

|

99,459 shares of common stock reserved for future issuance under our equity incentive plans as of September 30, 2020; and

|

|

|

•

|

50,000 shares of common stock underlying the warrant to be issued to the representative in connection with this offering.

|

Except as otherwise indicated all information in this prospectus assumes no exercise of outstanding options or warrants, including the warrant to be issued to the representative in connection with this offering, no vesting of restricted stock units, and no exercise of the underwriter’s option to purchase additional shares of common stock.

7

RISK FACTORS

Investing in our securities involves a high degree of risk. Before deciding to invest in our securities, you should consider carefully the risks and uncertainties described below and under Item 1A.“Risk Factors” in our Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission, or SEC, on November 12, 2020, which is incorporated by reference in this prospectus, together with all of the other information contained in this prospectus and documents incorporated by reference herein, and in any free writing prospectus that we have authorized for use in connection with this offering. If any of the matters discussed in the following risk factors were to occur, our business, financial condition, results of operations, cash flows or prospects could be materially adversely affected, the market price of our common stock could decline and you could lose all or part of your investment in our securities. Additional risks and uncertainties not presently known or which we consider immaterial as of the date hereof may also have an adverse effect on our business.

Risks Related to This Offering

Management will have broad discretion as to the use of proceeds from this offering and we may use the net proceeds in ways with which you may disagree.

We intend to use the net proceeds of this offering to fund our Phase 3 ORCA-2 trial, and clinical research and development, as well as for working capital and general corporate purposes. We may also use a portion of the net proceeds for the acquisition of, or investment in, technologies, intellectual property or businesses that complement our business, although we have no present commitments or agreements to this effect. Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. Accordingly, you will be relying on the judgment of our management on the use of net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. Our failure to apply these funds effectively could have a material adverse effect on our business, delay the development of our product candidates and cause the price of our common stock to decline.

If you purchase our common stock in this offering, you will incur immediate and substantial dilution in the book value of your shares.

You will suffer immediate and substantial dilution in the net tangible book value of our common stock you purchase in this offering. Based on a public offering price of $7.00 per share, purchasers of common stock in this offering will experience immediate dilution of $0.66 per share in net tangible book value of our common stock. In the past, we issued options, warrants and other securities to acquire common stock at prices below the public offering price. To the extent these outstanding securities are ultimately exercised, investors purchasing common stock in this offering will sustain further dilution. See “Dilution” for a more detailed description of the dilution to new investors in the offering.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains or incorporates by reference “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a number of risks and uncertainties. We caution readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statement. These statements are based on current expectations of future events. Such statements include, but are not limited to, statements about future financial and operating results, plans, objectives, expectations and intentions, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management and other statements that are not historical facts. You can find many of these statements by looking for words like “believes,” “expects,” “anticipates,” “estimates,” “may,” “should,” “will,” “could,” “plan,” “intend” or similar expressions in this prospectus or in documents incorporated by reference into this prospectus. We intend that such forward-looking statements be subject to the safe harbors created thereby. Examples of these forward-looking statements include, but are not limited to:

|

|

•

|

our ability to continue as a going concern, our anticipated future capital requirements and the terms of any capital financing agreements;

|

|

|

•

|

progress and preliminary and future results of any clinical trials;

|

|

|

•

|

anticipated regulatory filings, requirements and future clinical trials;

|

|

|

•

|

the effects of COVID-19 on our business and financial results;

|

|

|

•

|

timing and amount of future contractual payments, product revenue and operating expenses; and

|

|

|

•

|

market acceptance of our products and the estimated potential size of these markets.

|

These forward-looking statements are based on the current beliefs and expectations of our management and are subject to significant risks and uncertainties. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results may differ materially from current expectations and projections. Factors that might cause such a difference include the risk factors identified under the caption “Risk Factors” in this prospectus, as well as those identified under Item 1A. “Risk Factors” in our Quarterly Report on Form 10-Q, filed with the SEC on November 12, 2020.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus or, in the case of documents referred to or incorporated by reference, the date of those documents.

All subsequent written or oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events, except as may be required under applicable U.S. securities law. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

9

USE OF PROCEEDS

We estimate that the net proceeds of this offering, after deducting estimated underwriting discounts and commissions and estimated offering expenses, will be approximately $13.8 million, or $16.0 million if the underwriter’s option to purchase additional shares is exercised in full, based on a public offering price of $7.00 per share.

We intend to use net proceeds from this offering to fund our Phase 3 ORCA-2 trial, clinical research and development, as well as for working capital and general corporate purposes. We may also use a portion of the net proceeds for the acquisition of, or investment in, technologies, intellectual property or businesses that complement our business, although we have no present commitments or agreements to this effect.

The amounts and timing of our actual expenditures will depend on numerous factors, including the progress of our clinical trials and other development efforts and other factors described under “Risk Factors” in this prospectus and the documents incorporated by reference herein, as well as the amount of cash used in our operations. As a result, our management will have broad discretion over the uses of the net proceeds, if any, we receive in connection with securities offered pursuant to this prospectus and investors will be relying on the judgment of our management regarding the application of the proceeds.

Pending these uses, we intend to invest the net proceeds in short-term or long-term, investment-grade, interest-bearing securities.

10

MARKET FOR COMMON EQUITY AND DIVIDEND POLICY

Market Information and Holders of Record

Our common stock trades on The Nasdaq Capital Market under the symbol “ACHV.” The last reported sale price for our common stock on December 2, 2020 was $7.59 per share. As of November 24, 2020, we had approximately 22 holders of record of our common stock. The number of record holders was determined from the records of our transfer agent and does not include beneficial owners of common stock whose shares are held in the names of various security brokers, dealers, and registered clearing agencies. A description of the common stock that we are issuing in this offering is set forth under the heading “Description of Securities.”

Dividend Policy

We have never declared or paid any cash dividends on our capital stock. We intend to retain future earnings, if any, to finance the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in any future financing instruments.

11

CAPITALIZATION

The following table sets forth our cash and cash equivalents and our capitalization as of September 30, 2020:

|

|

•

|

on an actual basis; and

|

|

|

•

|

on an as adjusted basis to give effect to the sale of 2,150,000 shares of common stock, based on an offering price of $7.00 per share, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

|

You should read this table together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Quarterly Report on Form 10-Q filed with the SEC on November 12, 2020 and with our consolidated financial statements and the accompanying notes, which are incorporated by reference in this prospectus.

|

|

|

As of September 30, 2020

|

|

|

|

|

Actual

|

|

|

As Adjusted

|

|

|

|

|

(In thousands, except share data)

|

|

|

Cash and cash equivalents

|

|

$

|

22,393

|

|

|

$

|

36,235

|

|

|

Stockholders’ equity (deficit)

|

|

|

|

|

|

|

|

|

|

Preferred Stock, par value $0.001 per share; 5,000,000

shares authorized; no shares issued and outstanding as

of September 30, 2020

|

|

|

—

|

|

|

|

—

|

|

|

Common Stock, par value $0.001 per share; 150,000,000

shares authorized; 3,616,414 shares issued and

outstanding as of September 30, 2020

|

|

|

74

|

|

|

|

76

|

|

|

Additional paid-in capital

|

|

|

81,307

|

|

|

|

95,147

|

|

|

Accumulated deficit

|

|

|

(55,710)

|

|

|

|

(55,710)

|

|

|

Accumulated other comprehensive income

|

|

|

4

|

|

|

|

4

|

|

|

Total stockholders’ equity

|

|

|

25,675

|

|

|

|

39,517

|

|

|

Total capitalization

|

|

|

25,675

|

|

|

|

39,517

|

|

The table above excludes the following:

|

|

•

|

129,470 shares of common stock issuable upon the exercise of options outstanding as of September 30, 2020, with a weighted average exercise price of $78.18 per share;

|

|

|

•

|

231 shares of common stock subject to restricted stock units outstanding as of September 30, 2020;

|

|

|

•

|

1,267,418 shares of common stock issuable upon the exercise of warrants outstanding as of September 30, 2020, with a weighted average exercise price of $18.60 per share;

|

|

|

•

|

99,459 shares of common stock reserved for future issuance under our equity incentive plans as of September 30, 2020; and

|

|

|

•

|

50,000 shares of common stock underlying the warrant to be issued to the representative in connection with this offering.

|

12

DILUTION

Our net tangible book value as of September 30, 2020 was approximately $22.7 million, or approximately $6.28 per share of common stock based on 3,616,414 shares outstanding. Net tangible book value per share is determined by dividing our net tangible book value, which consists of tangible assets less total liabilities, by the number of shares of common stock outstanding on that date.

After giving effect to the effect to the sale of 2,150,000 shares of common stock, based on an offering price of $7.00 per share, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, we would have had a net tangible book value as of September 30, 2020 of approximately $36.6 million, or $6.34 per share of common stock. This represents an immediate increase in the net tangible book value of $0.06 per share to our existing stockholders and an immediate dilution in net tangible book value of $0.66 per share to the investor in this offering. The following table illustrates this per share dilution:

|

Public offering price per share of common stock

|

|

|

|

|

|

$ 7.00

|

|

|

|

|

|

|

|

|

|

Net tangible book value per share as of September 30, 2020

|

|

$

|

6.28

|

|

|

|

|

Increase in net tangible book value per share attributable

to the offering

|

|

|

0.06

|

|

|

|

|

As adjusted net tangible book value per share after giving

effect to the offering

|

|

|

|

|

|

6.34

|

|

Dilution in net tangible book value per share to new investor

|

|

|

|

|

|

$0.66

|

The table above excludes:

|

|

•

|

129,470 shares of common stock issuable upon the exercise of options outstanding as of September 30, 2020, with a weighted average exercise price of $78.18 per share;

|

|

|

•

|

231 shares of common stock subject to restricted stock units outstanding as of September 30, 2020;

|

|

|

•

|

1,267,418 shares of common stock issuable upon the exercise of warrants outstanding as of September 30, 2020, with a weighted average exercise price of $18.60 per share;

|

|

|

•

|

99,459 shares of common stock reserved for future issuance under our equity incentive plans as of September 30, 2020; and

|

|

|

•

|

50,000 shares of common stock underlying the warrant to be issued to the representative in connection with this offering.

|

13

SECURITY OWNERSHIP OF BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of September 30, 2020, for:

|

|

(1)

|

each person or group of affiliated persons known by us to be the beneficial owner of more than 5% of our common stock;

|

|

|

(2)

|

each of our named executive officers;

|

|

|

(3)

|

each of our directors; and

|

|

|

(4)

|

all current executive officers and directors as a group.

|

Applicable percentage ownership is based on 3,616,414 shares of common stock outstanding at September 30, 2020. We have determined beneficial ownership in accordance with SEC rules. The information does not necessarily indicate beneficial ownership for any other purpose. Under these rules, the number of shares of common stock deemed outstanding includes shares issuable upon exercise of options or warrants, or the conversion of convertible notes, held by the respective person or group that may be exercised or converted within 60 days after September 30, 2020. For purposes of calculating each person’s or group’s percentage ownership, stock options and warrants exercisable, and notes convertible, within 60 days after September 30, 2020 are included for that person or group, but not the stock options of any other person or group.

Unless otherwise indicated and subject to applicable community property laws, to our knowledge, each stockholder named in the following table possesses sole voting and investment power over the shares listed. Unless otherwise noted below, the address of each person listed in the table is c/o Achieve Life Sciences, Inc., 1040 West Georgia Street, Suite 1030, Vancouver, B.C. V6E 4H1.

|

Name of Beneficial Owner

|

|

Amount and

Nature of

Beneficial Ownership(1)

|

|

|

Percent of

Class(%)(1)

|

|

|

Named Executive Officers and Directors:

|

|

|

|

|

|

|

|

|

|

Richard Stewart(2)

|

|

|

18,826

|

|

|

|

*

|

|

|

Anthony Clarke(3)

|

|

|

8,121

|

|

|

|

*

|

|

|

Scott Cormack(4)

|

|

|

1,235

|

|

|

|

*

|

|

|

Cindy Jacobs(5)

|

|

|

4,037

|

|

|

|

*

|

|

|

John Bencich(6)

|

|

|

4,463

|

|

|

|

*

|

|

|

Martin Mattingly(7)

|

|

|

1,027

|

|

|

|

*

|

|

|

Stewart Parker(8)

|

|

|

1,028

|

|

|

|

*

|

|

|

Donald Joseph(9)

|

|

|

1,032

|

|

|

|

*

|

|

|

Jay Moyes(10)

|

|

|

1,032

|

|

|

|

*

|

|

|

All current officers and directors as a group (9 persons)(11)

|

|

|

40,801

|

|

|

|

1.13

|

|

|

(1)

|

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of common stock subject to options and warrants currently exercisable, or exercisable within 60 days of September 30, 2020, are deemed outstanding for computing the percentage of the person holding such options or warrants but are not deemed outstanding for computing the percentage of any other person.

|

|

(2)

|

Represents 10,626 shares owned directly, 6,959 options exercisable within 60 days of September 30, 2020, 359 owned indirectly through his partner and 882 shares owned indirectly through Ricanto Limited as a principal owner.

|

|

(3)

|

Represents 2,752 shares owned directly, 2,691 options exercisable within 60 days of September 30, 2020, 1,796 shares owned indirectly through his spouse, and 882 shares owned indirectly through Ricanto Limited as a principal owner.

|

14

|

(4)

|

Represents 74 shares owned directly, 1,113 options exercisable within 60 days of September 30, 2020, and 48 shares owned indirectly through his spouse.

|

|

(5)

|

Represents 176 shares owned directly and 3,861 options exercisable or vesting within 60 days of September 30, 2020.

|

|

(6)

|

Represents 141 shares owned directly and 4,322 options exercisable or vesting within 60 days of September 30, 2020.

|

|

(7)

|

Represents 4 shares owned directly and 1,023 options exercisable within 60 days of September 30, 2020.

|

|

(8)

|

Represents 5 shares owned directly and 1,023 options exercisable within 60 days of September 30, 2020.

|

|

(9)

|

Represents 1,032 options exercisable within 60 days of September 30, 2020.

|

|

(10)

|

Represents 1,032 options exercisable within 60 days of September 30, 2020.

|

|

(11)

|

Represents for the current officers and directors as a group, 16,863 shares owned directly or indirectly as indicated above, and 23,056 options exercisable or vesting within 60 days of September 30, 2020.

|

15

DESCRIPTION OF CAPITAL STOCK

The following description of our common stock summarizes the material terms and provisions of the common stock that we may issue in connection with this offering. It may not contain all the information that is important to you. For the complete terms of our common stock and preferred stock, please refer to our certificate of incorporation, as amended and restated, and our amended and restated bylaws, which were filed as exhibits to the registration statement of which this prospectus forms a part.

Common Stock

Under our restated certificate of incorporation, as of September 30, 2020, we had authority to issue 150,000,000 shares of our common stock, par value $0.001 per share. As of September 30, 2020, 3,616,414 shares of our common stock were issued and outstanding. All shares of our common stock will, when issued, be duly authorized, fully paid and nonassessable.

Voting Rights. For all matters submitted to a vote of stockholders, each holder of our common stock is entitled to one vote for each share registered in his or her name. Except as may be required by law and in connection with some significant actions, such as mergers, consolidations, or amendments to our certificate of incorporation that affect the rights of stockholders, holders of our common stock vote together as a single class. There is no cumulative voting in the election of our directors, which means that, subject to any rights to elect directors that are granted to the holders of any class or series of preferred stock, a plurality of the votes cast at a meeting of stockholders at which a quorum is present is sufficient to elect a director.

Liquidation. In the event we are liquidated, dissolved or our affairs are wound up, after we pay or make adequate provision for all of our known debts and liabilities, each holder of our common stock will be entitled to share ratably in all assets that remain, subject to any rights that are granted to the holders of any class or series of preferred stock.

Dividends. Subject to preferential dividend rights of any other class or series of stock, the holders of shares of our common stock are entitled to receive dividends, including dividends of our stock, as and when declared by our board of directors, subject to any limitations imposed by law and to the rights of the holders, if any, of our preferred stock. We have never paid cash dividends on our common stock. We do not anticipate paying periodic cash dividends on our common stock for the foreseeable future. Any future determination about the payment of dividends will be made at the discretion of our board of directors and will depend upon our earnings, if any, capital requirements, operating and financial conditions and on such other factors as the board of directors deems relevant.

Other Rights and Restrictions. Subject to the preferential rights of any other class or series of stock, all shares of our common stock have equal dividend, distribution, liquidation and other rights, and have no preference, appraisal or exchange rights, except for any appraisal rights provided by Delaware General Corporation Law (“DGCL”). Furthermore, holders of our common stock have no conversion, sinking fund or redemption rights, or preemptive rights to subscribe for any of our securities. Our certificate of incorporation and our bylaws do not restrict the ability of a holder of our common stock to transfer his or her shares of our common stock.

The rights, powers, preferences and privileges of holders of our common stock are subject to, and may be adversely affected by, the rights of holders of shares of any series of preferred stock which we may designate and issue in the future.

Listing. Our common stock is listed on The Nasdaq Capital Market under the symbol “ACHV.”

Transfer Agent and Registrar. The transfer agent for our common stock is American Stock Transfer & Trust Company, LLC.

16

Preferred Stock

Under our restated certificate of incorporation, we have authority, subject to any limitations prescribed by law and without further stockholder approval, to issue from time to time up to 5,000,000 shares of preferred stock, par value $0.001 per share, in one or more series. As of September 30, 2020, no shares of preferred stock were issued and outstanding.

Pursuant to our restated certificate of incorporation, we are authorized to issue “blank check” preferred stock, which may be issued from time to time in one or more series upon authorization by our board of directors. Our board of directors, without further approval of the stockholders, is authorized to fix the designation, powers, preferences, relative, participating optional or other special rights, and any qualifications, limitations and restrictions applicable to each series of the preferred stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes could, among other things, adversely affect the voting power or rights of the holders of our common stock and, under certain circumstances, make it more difficult for a third party to gain control of us, discourage bids for our common stock at a premium or otherwise adversely affect the market price of the common stock.

Outstanding Warrants

Prior to this offering, as of September 30, 2020 we had outstanding warrants to purchase common stock as follows:

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

Outstanding

|

|

|

Exercise

|

|

|

|

|

|

|

and

|

|

|

price per

|

|

|

|

|

|

|

Exercisable

|

|

|

Share

|

|

|

Expiration Date

|

|

(1) Series A-1 Warrants issued in April 2015 financing

|

|

|

108

|

|

|

|

5,280.00

|

|

|

October 2020

|

|

(2) Warrants issued in September 2017 financing

|

|

|

411

|

|

|

|

699.20

|

|

|

March 2023

|

|

(3) Warrants issued in June 2018 financing

|

|

|

114,100

|

|

|

|

80.00

|

|

|

June 2023

|

|

(4) Warrants issued in October 2018 financing

|

|

|

31,215

|

|

|

|

62.89

|

|

|

October 2023

|

|

(5) Warrants issued in May 2019 financing

|

|

|

60,000

|

|

|

|

90.00

|

|

|

May 2025

|

|

(6) Warrants issued in December 2019 financing

|

|

|

682,871

|

|

|

|

6.60

|

|

|

December 2024

|

|

(7) Warrants issued in April 2020 financing

|

|

|

182,461

|

|

|

|

7.24

|

|

|

April 2025

|

|

(8) Warrants issued in April 2020 financing

|

|

|

28,125

|

|

|

|

7.32

|

|

|

April 2025

|

|

(9) Warrants issued in April 2020 financing

|

|

|

25,270

|

|

|

|

7.59

|

|

|

April 2025

|

|

(10) Pre-Funded Warrants issued in August 2020 financing

|

|

|

142,857

|

|

|

|

0.001

|

|

|

*

|

|

*

|

The pre-funded warrants do not have an expiration date.

|

Certain Effects of Authorized but Unissued Stock

We have shares of common stock and preferred stock available for future issuance without stockholder approval. We may issue these additional shares for a variety of corporate purposes, including future public or private offerings to raise additional capital or to facilitate corporate acquisitions or for payment as a dividend on our capital stock. The existence of unissued and unreserved preferred stock may enable our board of directors to issue shares of preferred stock with terms that could render more difficult or discourage a third-party attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise, thereby protecting the continuity of our management. In addition, if we issue additional preferred stock, the issuance could adversely affect the voting power of holders of common stock and the likelihood that holders of common stock will receive dividend payments or payments upon liquidation.

17

Anti-Takeover Effects of Provisions of Our Charter Documents

Our certificate of incorporation and bylaws include a number of provisions that could deter hostile takeovers or delay or prevent changes in control of our company, including the following:

|

|

•

|

only the chairman of the board, the chief executive officer, the president or a majority of our board of directors may call special meetings of stockholders, and the business transacted at special meetings of stockholders is limited to the business stated in the notice of such meetings;

|

|

|

•

|

advance notice procedures for stockholders seeking to bring business before our annual meeting of stockholders or to nominate candidates for election as directors at our annual meeting of stockholders, including certain requirements regarding the form and content of a stockholder’s notice;

|

|

|

•

|

our board of directors may designate the terms of and issue new series of preferred stock;

|

|

|

•

|

unless otherwise required by our bylaws, our certificate of incorporation or by law, our board of directors may amend our bylaws without stockholder approval; and

|

|

|

•

|

only our board of directors may fill vacancies on our board of directors.

|

Anti-Takeover Effects of Provisions of Delaware Law

We are subject to the provisions of Section 203 of the DGCL (“Section 203”). Under Section 203, we would generally be prohibited from engaging in any business combination with any interested stockholder for a period of three years following the time that this stockholder became an interested stockholder unless:

|

|

•

|

prior to this time, our board of directors approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

|

|

|

•

|

upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding shares owned by persons who are directors and also officers, and by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

|

|

|

•

|

at or subsequent to such time, the business combination is approved by our board of directors and authorized at a special or annual stockholders meeting, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder.

|

Under Section 203, a “business combination” includes:

|

|

•

|

any merger or consolidation involving the corporation and the interested stockholder;

|

|

|

•

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

|

|

•

|

any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder, subject to limited exceptions;

|

|

|

•

|

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

|

|

|

•

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

|

In general, Section 203 defines an interested stockholder as an entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation and any entity or person affiliated with or controlling or controlled by such entity or person.

18

Limitation of Liability and Indemnification

Our certificate of incorporation provides that our directors shall not be personally liable to us or our stockholders for monetary damages for any breach of fiduciary duty as a director, except for liability for breach of the director’s duty of loyalty to us or our stockholders, for acts or omissions not in good faith or involving intentional misconduct or a knowing violation of law, for payment of dividends or approval of stock purchases or redemptions that are prohibited by the DGCL, or for any transaction from which the director derived an improper personal benefit. The inclusion of this provision in our certificate of incorporation may reduce the likelihood of derivative litigation against directors and may discourage or deter stockholders or management from bringing a lawsuit against directors for breach of their duty of care.

Under the DGCL, our directors have a fiduciary duty to us that is not eliminated by this provision of the restated certificate of incorporation and, in appropriate circumstances, equitable remedies such as injunctive or other forms of non-monetary relief will remain available. This provision also does not affect our directors’ responsibilities under any other laws, such as federal securities laws or state or federal environmental laws.

Section 145 of the DGCL empowers a corporation to indemnify its directors and officers against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlements actually and reasonably incurred by them in connection with any action, suit or proceeding brought by third parties by reason of the fact that they were or are directors or officers of the corporation, if they acted in good faith, in a manner they reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe that their conduct was unlawful. The DGCL provides further that the indemnification permitted thereunder shall not be deemed exclusive of any other rights to which the directors and officers may be entitled under the corporation’s bylaws, any agreement, a vote of stockholders or otherwise. Our restated certificate of incorporation provides that, to the fullest extent permitted by Section 145 of the DGCL, we shall indemnify any person who is or was a director or officer of us, or is or was serving at our request as a director, officer or trustee of another corporation, partnership, joint venture, trust, employee benefit plan or other enterprise, against the expenses, liabilities or other matters referred to in or covered by Section 145 of the DGCL. Our amended and restated bylaws provide that we will indemnify any person who was or is a party or threatened to be made a party to any proceeding by reason of the fact that such person is or was a director or officer of us or is or was serving at our request as a director, officer or trustee of another corporation, partnership, joint venture, trust, employee benefit plan or other enterprise to the fullest extent permitted by the DGCL.

In addition, our bylaws authorize our board of directors to enter into indemnification contracts with each of our officers and directors. We have entered into indemnification contracts with each of our directors and executive officers. The indemnification contracts provide for the indemnification of directors and officers against all expenses, liability, and loss actually reasonably incurred to the fullest extent permitted by our certificate of incorporation, bylaws, and applicable law.

Section 145 of the DGCL also empowers a corporation to purchase insurance for its officers and directors for such liabilities. We maintain liability insurance for our officers and directors.

19

UNDERWRITING

Lake Street Capital Markets, LLC (“representative”) is acting as sole bookrunner in this offering and Maxim Group LLC is acting as co-manager in this offering. We have entered into an underwriting agreement dated December 2, 2020 with the representative. Subject to the terms and conditions of the underwriting agreement, we have agreed to sell to the underwriters named below, and the underwriters named below have agreed to purchase from us, at the public offering price less the underwriting discounts set forth on the cover page of this prospectus, the number of shares of common stock listed next to its name in the following table:

|

Name

|

|

Number of Shares

|

|

|

Lake Street Capital Markets, LLC

|

|

|

1,827,500

|

|

|

Maxim Group LLC

|

|

|

322,500

|

|

|

Total

|

|

|

2,150,000

|

|

The underwriters have agreed to purchase all of the shares offered by this prospectus (other than those covered by the over-allotment option described below) if any are purchased.

The shares should be ready for delivery on or about December 7, 2020 against payment in immediately available funds. The underwriters are offering the shares subject to various conditions and may reject all or part of any order. The underwriters have advised us that they propose to offer the shares directly to the public at the public offering price that appears on the cover page of this prospectus. In addition, the underwriters may offer some of the shares to other securities dealers at the public offering price less a selling concession not in excess of $0.42 per share. After the shares are released for sale to the public, the underwriters may change the offering price and other selling terms at various times.

Over-Allotment Option

We have granted the representative an over-allotment option. This option, which is exercisable for up to 30 days after the date of this prospectus, permits the representative to purchase a maximum of 322,500 additional shares from us to cover over-allotments. If the representative exercises all or part of this option, they will purchase shares covered by the option at the public offering price that appears on the cover page of this prospectus, less the underwriting discount. If this option is exercised in full, the total proceeds to us will be $17.3 million before deduction of underwriting discounts and expenses and other offering expenses. The representative has agreed that, to the extent the over-allotment option is exercised, the underwriters will each purchase a number of additional shares proportionate to the underwriter’s initial amount reflected in the foregoing table.

Discount and Representative’s Warrant

The following table shows the public offering price, underwriting discounts and proceeds, before expenses, to us. The information assumes either no exercise or full exercise by the underwriter of its over-allotment option.

|

|

|

Per Share

|

|

Total Without

Over-

Allotment

Option

|

|

|

Total With

Over-

Allotment

Option

|

|

|

Public offering price

|

|

$

|

7.00

|

|

$

|

15,050,000

|

|

|

$

|

17,307,500

|

|

|

Underwriting discount (6.0%)

|

|

$

|

0.42

|

|

$

|

903,000

|

|

|

$

|

1,038,450

|

|

|

Proceeds, before expense, to us

|

|

$

|

6.58

|

|

$

|

14,147,000

|

|

|

$

|

16,269,050

|

|

We have agreed to issue to the representative a warrant to purchase up to 50,000 shares of common stock with an exercise price of $8.75 per share and a term of five years. We estimate that the total expenses of the offering, excluding underwriting discount, will be approximately $0.2 million and are payable by us. Neither the warrant nor any shares of common stock issuable upon exercise of the warrant may be sold, transferred, assigned, pledged, or hypothecated, or be the subject of any hedging, short sale, derivative, put, or call transaction that would result in the effective economic disposition of the warrant, or any security issuable upon exercise of the warrant, by any person for a period of 180 days immediately following the effective date of the registration statement of which this prospectus forms a part, except as provided in FINRA Rule 5110(g)(2). We have also agreed to pay the underwriters an accountable expense allowance of up to $75,000.

20

Ladenburg Thalmann & Co. Inc. is acting as an independent financial advisor to us in connection with this offering, and will receive an advisory fee for the performance of certain services in such capacity. Ladenburg Thalmann & Co. Inc. will not engage in, nor is it affiliated with any FINRA member that is engaged in, the solicitation or distribution of the offering.

We have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act of 1933, as amended.

Rules of the SEC may limit the ability of the underwriters to bid for or purchase shares before the distribution of the shares is completed. However, the underwriters may engage in the following activities in accordance with the rules:

● Stabilizing transactions — Each underwriter may make bids or purchases for the purpose of pegging, fixing or maintaining the price of the shares, so long as stabilizing bids do not exceed a specified maximum.

● Over-allotments and syndicate covering transactions — Each underwriter may sell more shares of common stock in connection with this offering than the number of shares that it has committed to purchase. This over-allotment creates a short position for such underwriter. This short sales position may involve either “covered” short sales or “naked” short sales. Covered short sales are short sales made in an amount not greater than the underwriter’s over-allotment option to purchase additional shares in this offering described above. The underwriter may close out any covered short position either by exercising its over-allotment option or by purchasing shares in the open market. To determine how it will close the covered short position, the underwriter will consider, among other things, the price of shares available for purchase in the open market, as compared to the price at which it may purchase shares through the over-allotment option. Naked short sales are short sales in excess of the over-allotment option. The underwriter must close out any naked short position by purchasing shares in the open market. A naked short position is more likely to be created if the underwriter is concerned that, in the open market after pricing, there may be downward pressure on the price of the shares that could adversely affect investors who purchase shares in this offering.

● Penalty bids — If an underwriter purchases the shares in the open market in a stabilizing transaction or syndicate covering transaction, it may reclaim a selling concession from the underwriter and selling group members who sold those shares as part of this offering.

● Passive market making — Market makers in the shares who are underwriters or prospective underwriters may make bids for or purchase the shares, subject to limitations, until the time, if ever, at which a stabilizing bid is made.

Similar to other purchase transactions, an underwriter’s purchases to cover the syndicate short sales or to stabilize the market price of our common stock may have the effect of raising or maintaining the market price of our common stock or preventing or mitigating a decline in the market price of our common stock. As a result, the price of our common stock may be higher than the price that might otherwise exist in the open market. The imposition of a penalty bid might also have an effect on the price of our common stock if it discourages resales of the shares.

Neither we nor the underwriters make any representation or prediction as to the effect that the transactions described above may have on the price of our common stock. These transactions may occur on the Nasdaq Capital Market or otherwise. If such transactions are commenced, they may be discontinued without notice at any time.

Electronic Delivery of Preliminary Prospectus: A prospectus in electronic format may be delivered to potential investors by the underwriters participating in this offering. The prospectus in electronic format will be identical to the paper version of such preliminary prospectus. Other than the prospectus in electronic format, the information on any underwriter’s website and any information contained in any other website maintained by an underwriter is not part of the prospectus or the registration statement of which this prospectus forms a part.

Upon completion of this offering, in certain circumstances, we have granted the representative a right of first refusal to act as bookrunner or placement agent in connection with any subsequent public offering of equity securities by us resulting in gross proceeds of $10 million or more. This right of first refusal extends until May 31, 2021. The terms of any such engagement of the representative will be determined by separate agreement.

21

Notice to Non-US Investors

Canada

The securities may be sold in Canada only to purchasers purchasing, or deemed to be purchasing, as principal that are “accredited investors”, as defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are “permitted clients”, as defined in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of the securities must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws. Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if this prospectus (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the purchaser’s province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights or consult with a legal advisor. Pursuant to section 3A.3 of National Instrument 33-105 Underwriting Conflicts (NI 33-105), the underwriter is not required to comply with the disclosure requirements of NI 33-105 regarding underwriter conflicts of interest in connection with this offering.

European Economic Area

In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive, each, a Relevant Member State, with effect from and including the date on which the European Union Prospectus Directive, or the EU Prospectus Directive, was implemented in that Relevant Member State, or the Relevant Implementation Date, no offer of securities may be made to the public in that Relevant Member State other than:

1. to any legal entity which is a qualified investor as defined under the EU Prospectus Directive;

2. to fewer than 150 natural or legal persons (other than qualified investors as defined in the EU Prospectus Directive), subject to obtaining the prior consent of the representative; or

3. in any other circumstances falling within Article 3(2) of the EU Prospectus Directive;

provided that no such offer of securities shall require the Company or any underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Directive and each person who initially acquires any securities or to whom any offer is made will be deemed to have represented, acknowledged and agreed to and with the underwriter and the Company that it is a “qualified investor” within the meaning of the law in that Relevant Member State implementing Article 2(1)(e) of the Prospectus Directive.

In the case of any securities being offered to a financial intermediary as that term is used in Article 3(2) of the Prospectus Directive, each such financial intermediary will be deemed to have represented, acknowledged and agreed that the securities acquired by it in the offer have not been acquired on a non-discretionary basis on behalf of, nor have they been acquired with a view to their offer or resale to, persons in circumstances which may give rise to an offer of any securities to the public other than their offer or resale in a Relevant Member State to qualified investors as so defined or in circumstances in which the prior consent of the representative has been obtained to each such proposed offer or resale.

For the purposes of this provision, the expression an “offer of securities to the public” in relation to any securities in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the securities to be offered so as to enable an investor to decide to purchase or subscribe for the securities, as the same may be varied in that Member State by any measure implementing the EU Prospectus Directive in that Member State. The expression “EU Prospectus Directive” means Directive 2003/71/EC (and any amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State) and includes any relevant implementing measure in each Relevant Member State, and the expression “2010 PD Amending Directive” means Directive 2010/73/EU.

22

United Kingdom

In the United Kingdom, this document is being distributed only to, and is directed only at, and any offer subsequently made may only be directed at persons who are “qualified investors” (as defined in the Prospectus Directive) (i) who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended, or the Order, and/or (ii) who are high net worth companies (or persons to whom it may otherwise be lawfully communicated) falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”) or otherwise in circumstances which have not resulted and will not result in an offer to the public of the securities in the United Kingdom.

Any person in the United Kingdom that is not a relevant person should not act or rely on the information included in this document or use it as basis for taking any action. In the United Kingdom, any investment or investment activity that this document relates to may be made or taken exclusively by relevant persons.

23

LEGAL MATTERS

Certain legal matters relating to the issuance of the securities offered by this prospectus will be passed upon for us by Fenwick & West LLP, Seattle, Washington. Certain legal matters in connection with this offering will be passed upon for the underwriters by Pryor Cashman LLP, New York, New York.

EXPERTS

The financial statements incorporated in this prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2019 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement on Form S-1 with the SEC covering the common stock we are offering by this prospectus. This prospectus does not include all of the information contained in the registration statement. You should refer to the registration statement and its exhibits for additional information. Whenever we make reference in this prospectus to any of our contracts, agreements or other documents, the references are not necessarily complete and you should refer to the exhibits filed as part of the registration statement for copies of the actual contract, agreement or other document.

We file annual, quarterly and other periodic reports, proxy statements and other information with the SEC. You can read our SEC filings, including this registration statement, over the Internet at the SEC’s website at www.sec.gov.

Our Internet address is www.achievelifesciences.com. There we make available free of charge, on or through the investor relations section of our website, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act of 1934, as amended (the “Exchange Act”) as soon as reasonably practicable after we electronically file such material with the SEC. The information found on our website is not part of this prospectus and investors should not rely on any such information in deciding whether to invest.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We have elected to incorporate the following documents into this prospectus, together with all exhibits filed therewith or incorporated therein by reference, to the extent not otherwise amended or superseded by the contents of this prospectus:

|

|

•

|

our Annual Report on Form 10-K for the year ended December 31, 2019, as filed with the SEC on March 13, 2020;

|

|

|

•

|

our Quarterly Reports on Form 10-Q for the quarter ended March 31, 2020, as filed with the SEC on May 14, 2020; June 30, 2020, as filed with the SEC on August 6, 2020; and September 30, 2020, as filed with the SEC on November 12, 2020;

|

|

|

•

|

our Current Reports on Form 8-K filed with the SEC on January 24, 2020, April 30, 2020; May 14, 2020 (solely with respect to Item 5.07); June 29, 2020; July 30, 2020; August 4, 2020; August 20, 2020; September 30, 2020; and October 21, 2020;

|

|

|

•

|

our Definitive Proxy Statement on Schedule 14A filed with the SEC on April 2, 2020; and

|

|

|

•

|

the description of our common stock contained in our registration statement on Form 8-A filed with the SEC on September 27, 1995 under Section 12 of the Exchange Act, including any amendment or report filed for the purpose of updating such description.

|

24

In addition, we incorporate by reference in this prospectus any future filings we make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act (excluding any information furnished and not filed with the SEC) after the date on which the registration statement that includes this prospectus was initially filed with the SEC (including all such documents we may file with the SEC after the date of the initial registration statement) until all offerings under this prospectus are terminated.

Any statement contained in a document incorporated by reference herein shall be deemed to be modified or superseded for all purposes to the extent that a statement contained in this prospectus or in any other subsequently filed document which is also incorporated or deemed to be incorporated by reference, modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus. You may request a copy of these filings (other than an exhibit to a filing unless that exhibit is specifically incorporated by reference into that filing) at no cost by writing, telephoning or e-mailing us at the following address, telephone number or e-mail address:

Achieve Life Sciences, Inc.

1040 West Georgia Street, Suite 1030

Vancouver, BC V6E 4H1

Tel: (604) 210-2217

Attn: Sandra Thomson

Copies of these filings are also available through the “Investors” section of our website at www.achievelifesciences.com. For other ways to obtain a copy of these filings, please refer to “Prospectus Summary—Available Information.”

25

2,150,000 Shares of Common Stock

PROSPECTUS

Sole Bookrunner

Lake Street

Co-Manager

Maxim Group

December 2, 2020

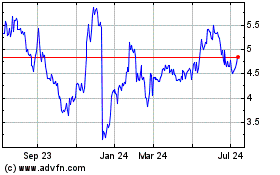

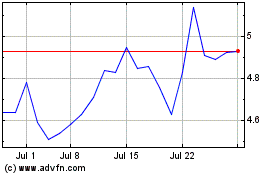

Achieve Life Sciences (NASDAQ:ACHV)

Historical Stock Chart

From Aug 2024 to Sep 2024

Achieve Life Sciences (NASDAQ:ACHV)

Historical Stock Chart

From Sep 2023 to Sep 2024