Ameristar Amends Credit Facilities to Reduce Pricing

March 02 2004 - 10:59AM

PR Newswire (US)

Ameristar Amends Credit Facilities to Reduce Pricing LAS VEGAS,

March 2 /PRNewswire-FirstCall/ -- Ameristar Casinos, Inc. today

announced that it has amended its senior credit facilities,

effective March 1, 2004. The amendment (1) consolidates

therevolving term loan facility, term loan A and term loan B, under

which $33.5 million, $13.7 million and $286.8 million,

respectively, were outstanding immediately prior to the amendment,

into a new term loan B-1; (2) reduces the applicable interest rate

margin on term loan B-1 to 200 basis points over LIBOR, a reduction

of 50 basis points compared to the margin on former term loan B;

and (3) permits Ameristar to pay cash dividends on its common stock

in a total amount not to exceed $25.0 million. The amendment does

not affect the terms of the $75.0 million revolving credit

facility, under which $68.5 million is currently available for

borrowing. Ameristar was not required to pay a fee to its lenders

in connection with the amendment. "We are verypleased that our

lenders have recognized the continued improvement in our operating

results and financial condition and agreed to reprice our senior

credit facilities," said Craig H. Neilsen, President and Chief

Executive Officer. "This amendment significantly reduces our

existing interest cost and affords us the flexibility to pay cash

dividends should we choose to do so." Forward-looking information

This press release contains certain forward-looking information

that generally can be identified by the context of the statement or

the use of forward-looking terminology, such as "believes,"

"estimates," "anticipates," "intends," "expects," "plans," "is

confident that" or words of similar meaning, with reference to

Ameristar or our management. Similarly, statements that describe

our future plans, objectives, strategies, financial results or

position, operational expectations or goals are forward-looking

statements. It is possible that our expectations may not be met due

to various factors, manyof which are beyond our control, and we

therefore cannot give any assurance that such expectations will

prove to be correct. For a discussion of relevant factors, risks

and uncertainties that could materially affect our future results,

attention is directed to "Item 1. Business -- Risk Factors" and

"Item 7. Management's Discussion and Analysis of Financial

Condition and Results of Operations" in our Annual Report on Form

10-K for the year ended December 31, 2002 and "Item 2. Management's

Discussionand Analysis of Financial Condition and Results of

Operations" in our Quarterly Report on Form 10-Q for the quarter

ended September 30, 2003. About Ameristar Ameristar Casinos, Inc.

is a leading Las Vegas-based gaming and entertainment company known

for its premier properties characterized by innovative

architecture, state-of-the-art casino floors, and superior dining,

lodging and entertainment offerings. Ameristar's focus on the total

entertainment experience and the highest quality guest servicehas

earned it the leading market share position in each of the five

markets in which it operates. Founded in 1954 in Jackpot, Nevada,

Ameristar recently marked its 10th anniversary as a public company.

The company has a portfolio of six casinos: Ameristar Kansas City;

Ameristar St. Charles (greater St. Louis); Ameristar Council Bluffs

(Omaha, Nebraska and southwestern Iowa); Ameristar Vicksburg

(Jackson, Mississippi and Monroe, Louisiana); and Cactus Petes and

the Horseshu in Jackpot, Nevada (Idaho and the Pacific Northwest).

Visit Ameristar Casinos' Web site at

http://www.ameristarcasinos.com/ (which shall not be deemed to be

incorporated in or a part of this news release).

http://www.newscom.com/cgi-bin/prnh/20010501/AMERISTARLOGO

http://photoarchive.ap.org/ DATASOURCE: Ameristar Casinos, Inc.

CONTACT: Tom Steinbauer, Senior Vice President of Finance, Chief

Financial Officer of Ameristar Casinos, Inc., +1-702-567-7000 Web

site: http://www.ameristarcasinos.com/

Copyright

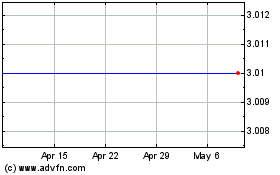

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From May 2024 to Jun 2024

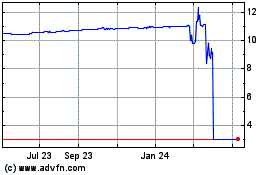

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Jun 2023 to Jun 2024