Pinnacle-Ameristar Under One Roof - Analyst Blog

December 24 2012 - 7:00AM

Zacks

Pinnacle Entertainment

Inc. (PNK) recently inked a definitive acquisition

agreement with Ameristar Casinos Inc. (ASCA) to

buy the latter through an all-cash deal worth $26.50 per share by

third-quarter 2013.

The purchase consideration includes Ameristar Casinos’ total

enterprise value of $2.8 billion including debt of $1.9 billion and

cash on hand of $116 million as of September 30, 2012. The offer

price is at a 45% premium to Ameristar Casinos’ average closing

stock price for the 90 days ended December 20, 2012.

We consider the deal to be strategically positive for both the

parties. For Ameristar, it holds immediate cash value for its

shareholders. The deal will likely benefit this casino gaming

company with the newest and most popular slot machines as its

acquirer also operates in the same vertical.

On the other hand, the acquisition holds significant potential for

Pinnacle Entertainment as well. Ameristar's eight properties are

spread across some of the country’s most compelling geographic

locations like Missouri, Colorado, Mississippi, Indiana, Iowa and

Nevada that makes it a lucrative acquisition target. Hence, the

deal is in sync with Pinnacle Entertainment’s strategy to grow

through geographical diversification.

Ameristar’s assets are expected to be seamlessly integrated with

Pinnacle’s current operational portfolio. The integration will more

than double Pinnacle’s size to 17 operational properties in 13

different geographies. Location-wise, the properties of both the

companies are least likely to overlap.

Pinnacle is confident about deriving significant synergy off the

deal. The acquirer anticipates that this unison will garner scale

advantage of at least $40 million annually, with the amount scaling

up as the integration process moves forward. The acquisition of

Ameristar is expected to be accretive to Pinnacle’s free cash flow

and earnings per share subsequent to the closure of the deal.

Recently,, casino industry operators have been striving hard to

gain market share through sector consolidation. While the step

enhances operational efficiency, it alleviates competitive pressure

as well. In May this year, another casino operator Boyd

Gaming Corporation (BYD) also embarked on a high-budget

acquisition of Peninsula Gaming (worth $1.45 billion). Currently,

Ameristar has a Zacks #3 Rank short-term ‘Hold’ rating.

AMERISTAR CASIN (ASCA): Free Stock Analysis Report

BOYD GAMING CP (BYD): Free Stock Analysis Report

PINNACLE ENTRTN (PNK): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

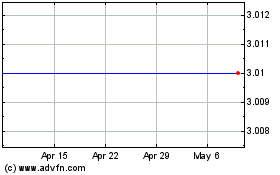

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From May 2024 to Jun 2024

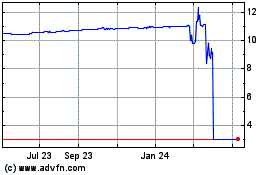

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Jun 2023 to Jun 2024