3 Casino Stocks to Gamble on - Investment Ideas

June 15 2011 - 8:00PM

Zacks

Willing to roll the dice on gaming stocks? Well, it is not quite

the gamble you may think it is.

2 Sides of the Coin

Essentially there are 2 scenarios that could play out and they

are not mutually exclusive. It is starting to look like a win-win

situation.

1.) If we see more economic optimism moving forward, the

propensity to gamble will rise and lead to more money for gamin

companies. That is pretty straight forward. Will we? That is very

much up for debate right now.

2.) But the other angle here is the struggling state budgets.

There are plenty of opponents to having casinos allowed in

particular areas. But guess what has even more opponents? Raising

taxes.

Here in Chicago, we are riddled with taxes on all levels and

fees for just about everything. As a result, there are talks to

allow casinos in Chicago and other areas in the state. This is not

entirely new, but more people are on board now, seeing it as a way

to bridge budget shortfalls rather than raising taxes. And I am

willing to bet other states will see similar legislation.

The Party is Over

In addition, in recent months the U.S. has come down hard on

internet gambling sites, effectively shutting down that segment of

the gaming industry. Online gambling has been embattled for years,

but the fatal blow may have just been dealt.

While not a huge impact, many professional poker players will

have to turn to live games. And those who have satiated the

gambling itch online will have to hit brick and mortal

locations.

Safe Bets

Ameristar Casinos (ASCA) has several locations across the

U.S. Right now the company does not have any new projects slated,

which would give them a big boost, but even if nothing changes,

they are in pretty good shape.

Estimates spiked after the last quarterly report. The full-year

consensus estimate for 2011 is up 65 cents in the past 3 months, to

$1.72. Next year's forecast popped 92 cents, to $2.06. That puts

growth rates at 135% this year and another 20% next year.

Shares are trading at just 13 times forward estimates, with a

PEG ratio of 0.8 and have a Zacks #1 Rank (Strong Buy).

Melco Crown Entertainment (MPEL) owns gaming and

entertainment resorts, primarily in Macau. Not necessarily a play

on the domestic budget angle but a solid gaming company and a Zacks

#2 Rank (Buy).

Estimates for 2011 are now averaging $0.24 per share, up from

$0.15 before the quarterly report. Next year's Zacks Consensus

Estimate is up 10 cents, to $0.38. In 2010 the company made just

$0.02, so profits should be up 12 times this year and another 58%

next year.

Just looking at the P/E, shares look a bit pricey at over 40

times the 2011 estimate. But factoring in the long-term growth rate

gives you a PEG ratio of just 0.6, which is a bargain. The price to

book is right near 2.1.

Bally Technologies, Inc. (BYI) makes, operates and

distributes gaming machines and technology worldwide. They offer

slot machines and other lottery-style games as well as various

casino management services.

Not sure which casino company to target? This one as exposure to

the industry as a whole. Right now BYI has a Zacks #3 Rank (Hold)

but that could be changing soon. Bally just announced an

enterprise-wide agreement with Caesars on June 14th.

The biggest casino entertainment company in the world will

implement Bally's machines across their casino operations. Other

details were not immediately announced, but could be substantial

given Caesars massive operation.

What are the Odds?

There are plenty of other casino and gaming related companies

out there, these are just a few. But, if you see the industry as

beaten down and undervalued with some upside potential, now may be

a good time to roll the dice.

Bill Wilton is the Aggressive Growth Stock Strategist for

Zacks.com. He is also the Editor in charge of the Zacks Small Cap

Trader service

AMERISTAR CASIN (ASCA): Free Stock Analysis Report

BALLY TECH INC (BYI): Free Stock Analysis Report

MELCO PBL ENTMT (MPEL): Free Stock Analysis Report

Zacks Investment Research

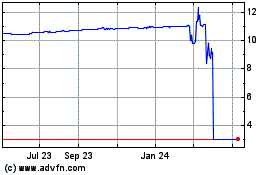

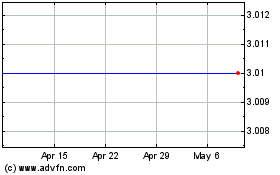

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From May 2024 to Jun 2024

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Jun 2023 to Jun 2024