- Maintains Stable Profit Margins and Market Positions at

Historical Properties for Full Year 2007 LAS VEGAS, Feb. 20

/PRNewswire-FirstCall/ -- Ameristar Casinos, Inc. (NASDAQ:ASCA)

today announced financial results for the fourth quarter and year

ended December 31, 2007. "Ameristar retained its strong positions

in all locations in 2007," said John Boushy, Chief Executive

Officer and President. "We maintained stable profit margins and

market positions on a same-store basis for the year due to the high

quality of our assets and the broad array of amenities at our

properties. This is indicative of the strong appeal of the

Ameristar brand and our ongoing commitment to drive profitable

growth." "Although slowing market growth, severe weather and

construction-related disruption negatively impacted our fourth

quarter performance, Ameristar demonstrated substantial resilience

in the face of this confluence of factors," Mr. Boushy said. Net

revenues for the fourth quarter were $302.8 million compared to

$244.0 million in last year's fourth quarter. Included in 2007

results were net revenues of $64.4 million from the Company's East

Chicago property, which was acquired on September 18, 2007. Fourth

quarter 2007 adjusted EBITDA was $66.8 million, similar to the

$66.6 million in adjusted EBITDA for the 2006 fourth quarter.

Adjusted EBITDA for the 2007 fourth quarter represents EBITDA of

$59.3 million, excluding: -- pre-opening expenses of $2.1 million

related to the St. Charles hotel and other new amenities; --

integration and transition costs of $974,000 related to the East

Chicago property acquisition; and -- an impairment loss of $4.5

million related to a previously-planned hotel project. Adjusted

EBITDA for the 2006 fourth quarter represents EBITDA of $66.1

million, excluding: -- an impairment loss of $581,000 related to a

previously-planned hotel project. More information on non-GAAP

financial measures, EBITDA and Adjusted EBITDA can be found under

the caption "Use of Non-GAAP Financial Measures" on page 15 of this

release. Operating income for the fourth quarter of 2007 was $34.5

million compared to $42.0 million in the same 2006 period. Fourth

quarter operating income was negatively affected by the $4.5

million impairment charge and the $3 million of pre-opening and

acquisition-related expenses cited above, as well as an increase of

$1.8 million in stock-based compensation expense. Net income for

the fourth quarter was $8.2 million, or $0.14 per share on a

diluted basis, which included $4.9 million, or $0.08 per share,

representing the after-tax impact of the impairment loss and

pre-opening and acquisition-related expenses. Fourth quarter 2007

net income benefited by $1.9 million, or $0.03 per diluted share,

from the favorable outcome of a state income tax matter. In last

year's fourth quarter, the Company reported net income of $17.8

million, or $0.31 per diluted share, which included $378,000, or

$0.01 per share, representing the after-tax impact of the

impairment loss. Net revenues for full year 2007 were $1.1 billion

and included $73.6 million in net revenues from the

recently-acquired East Chicago property. For 2006, the Company

reported net revenues of $1.0 billion. Adjusted EBITDA for 2007

reached $277.9 million, up 3.8% from 2006 adjusted EBITDA of $267.7

million. Adjusted EBITDA for 2007 represents EBITDA of $268.5

million, excluding: -- pre-opening expenses of $2.8 million related

to the St. Charles hotel and other new amenities; -- integration

and transition costs of $2.1 million related to acquisition of the

East Chicago property; and -- the impairment loss of $4.5 million

related to the previously-planned hotel project. Adjusted EBITDA

for 2006 represents EBITDA of $265.4 million, excluding: --

rebranding costs of $1.7 million related to the Black Hawk

property; and -- the impairment loss of $581,000 related to the

previously-planned hotel project. Operating income for the year was

$173.7 million, an increase of 1.3% from the $171.5 million

reported in 2006. Net income was $69.4 million, or $1.19 per

diluted share, compared to $59.6 million, or $1.04 per diluted

share reported for 2006. Net income for 2007 included $6.7 million,

or $0.11 per diluted share, representing the after-tax impact of

the impairment loss, pre-opening expenses and acquisition-related

integration and transition costs cited above, as well as the net

negative impact of an adjustment to state income tax expense. In

2006, net income included a $17.1 million, or $0.30 per diluted

share, after-tax impact of a loss on early retirement of debt and

$1.5 million, or $0.03 per diluted share, related to rebranding

costs and the impairment loss. In 2007, the Company repurchased

376,400 shares of common stock in the open market at an average

price of $25.65 per share for a total cost of $9.7 million. Since

August 2006, the Company has repurchased 787,236 shares at an

average price of $22.43 per share for an aggregate cost of $17.7

million. Approximately 2.0 million shares remain available for

repurchase under the currently authorized repurchase program. 2007

Property Highlights -- Ameristar Black Hawk remained a strong

performer in 2007, reporting EBITDA growth of 49.6% for the year

and 23.6% for the fourth quarter and increasing its market share in

both periods. This property has reported excellent results since

its rebranding as "Ameristar" in April 2006 and demonstrates the

Company's successful strategy to generate profitable growth through

its high quality product, superior guest service and proven

marketing techniques. -- Ameristar Kansas City posted increased

profitability for the year despite softer market conditions in the

fourth quarter. EBITDA increased 3.7% on a year-over-year basis,

overcoming a significant increase in the number of bad weather days

during the fourth quarter and the major expansion of a competitor's

property in the second quarter. -- Ameristar St. Charles continued

to be a strong market competitor. Net revenues remained stable on a

year-over-year basis and EBITDA, excluding pre-opening expenses,

declined by a modest 1% in 2007 despite the significant

construction-related disruptions and delays, the impact of bad

weather during the fourth quarter and increased competition in the

market that occurred in the second half of the year. -- Ameristar

Council Bluffs increased its sequential market share in the fourth

quarter without incremental promotional spending. Net revenues for

2007 were slightly below 2006 levels, primarily due to the opening

of a competitor's property in the first quarter of 2006. EBITDA

declined 2% for the year principally due to softer market

conditions throughout most of the year and inclement weather during

the fourth quarter. -- The Jackpot properties recorded 6.6% net

revenue growth for the year and a 9.2% increase in EBITDA,

reflecting the strength of Ameristar's position in this market. --

Ameristar Vicksburg's net revenue performance was affected by the

re-opening of Gulf Coast casinos that were previously closed as a

result of Hurricane Katrina and, during the second half of the

year, by significant construction-related disruptions at the

property and general economic weakness in the region. Net revenues

were down 3.5% for the year and EBITDA declined 5.2% from 2006

levels. -- East Chicago, which the Company acquired late in the

third quarter, experienced a 13.5% decline in fourth quarter gross

gaming revenues during this transition period. This was slightly

greater than the market decline. Year-to-date EBITDA was $8.8

million, including $1.2 million in integration costs. Outlook Based

upon current economic forecasts and initial revenue trends in the

Company's markets, management expects that the first half of 2008

will be a period of difficult same-store, year-over-year

comparisons. "Within what is projected to be a challenging economic

environment," Mr. Boushy said, "we believe that Ameristar will

continue to benefit from the broad appeal of our properties, our

disciplined operating and marketing strategies, and the expansions

that we are bringing on-line in 2008 and beyond." Within a period

of slower than historical market growth, management expects to

maintain Ameristar's market share positions and industry-leading

margins on a same-store basis. "In 2007, the Company made

significant investments in the expansion and enhancement of our

properties," Mr. Boushy noted. "As we complete our St. Charles and

Vicksburg projects and rebrand our East Chicago property, Ameristar

will be well-positioned to drive market growth, increase market

share and post improving operating profitability during 2008." For

the full year 2008, the Company currently expects: -- depreciation

to range from $110 million to $115 million -- interest expense to

be between $77 million and $82 million -- the combined state and

federal income tax rate to be in the range of 42 percent to 43

percent -- capital spending of $275 million to $300 million --

capitalized interest of $12 million to $15 million -- non-cash

stock-based compensation expense of $12 million to $13 million.

Expansion Projects St. Charles. In late December 2007, Ameristar

opened two high-quality amenities to complement its St. Charles

facility. HOME, a 17,500 square-foot nightclub, was launched on

December 27th with a five-day celebration that attracted sellout

crowds. Lixx, the trendy new circle bar located on the gaming

floor, features high energy music provided by a state-of-the-art

audio system. At the end of January 2008, the Company opened the

first 100 guest suites at the luxurious Ameristar St. Charles

hotel. The hotel currently has 159 suites in operation. Over each

of the next several months, 80 to 100 suites should be added. It is

expected that all 400 guest suites, as well as the

7,000-square-foot spa and indoor-outdoor pool, will be fully

operational by May. In addition, the renovation and modernization

of Ameristar Boulevard, the five-lane access road to Ameristar St.

Charles, was completed in December 2007 and provides a greatly

improved approach to the property. New lighting and additional

landscaping to enhance the entrance and arrival experience are

currently being installed. East Chicago. The Company's East Chicago

property, which represents an important market for future growth,

is undergoing a number of improvements that are designed to

positively impact performance. Upgrades to the casino and

enhancements to the dining experiences are ongoing in an effort to

bring the property closer to the Ameristar standard. The Company is

also fine-tuning its marketing and promotional activities in order

to most effectively reach its target customers. Ameristar remains

on budget for the upgrades and related expenses to be incurred in

connection with the rebranding of the property. The Company

continues to expect to launch the Ameristar brand in the

Chicagoland market no later than the third quarter of 2008.

Jackpot. In order to reinforce its AAA Four Diamond rating, the

hotel at Cactus Petes is undergoing renovation. The project is

expected to be complete by Memorial Day at a cost of approximately

$16 million. Vicksburg. Ameristar Vicksburg is undergoing a major

expansion program at a cost of approximately $100 million. Work is

progressing on the 1,000-space garage and expanded gaming facility

with completion targeted for the end of June 2008. Renovation of

the hotel was completed in December 2007 on schedule and slightly

below budget. Black Hawk. Excavation and rock removal at the site

of the new Ameristar Black Hawk hotel has been completed. Work on

the 536-room hotel tower is continuing, and the planned opening for

the hotel remains in the second half of 2009. The cost of the hotel

is expected to be approximately $235 million to $240 million,

representing an increase of $15 million to $20 million over the

previous budget. The revised cost estimate is attributable to

increases in material costs and the unforeseen site conditions,

which necessitated the relocation of incoming utilities. Council

Bluffs. The Company continues to evaluate design alternatives for

its planned expansion project at Council Bluffs. The current plan

calls for doubling the casino floor by adding approximately 60,000

square feet to the facility with a budget of approximately $100

million and a scheduled completion date in the second half of 2009.

Conference Call Information Ameristar will hold a conference call

to discuss our fourth quarter and year-end results on Wednesday,

February 20, 2008 at 5 p.m. Eastern Time. The call can be accessed

live by dialing (888) 694-4728 and using the conference ID number,

which is 32007885. Conference call participants are requested to

dial in to the call at least five minutes early to ensure a prompt

start. Interested parties wanting to listen to the conference call

and view corresponding informative slides on the Internet may do so

live at our web site -- http://www.ameristar.com/ -- in "About

Ameristar/Investor Relations" under the "Quarterly Results

Conference Calls" section. The conference call will be recorded and

can be replayed from February 20, 2008 at 8:00 p.m. Eastern Time

until February 27, 2008 at 3:00 a.m. Eastern Time. To listen to the

replay, call (800) 642-1687. Forward-Looking Information This

document contains certain forward-looking information that

generally can be identified by the context of the statement or the

use of forward-looking terminology, such as "believes,"

"estimates," "anticipates," "intends," "expects," "plans," "is

confident that" or words of similar meaning, with reference to

Ameristar or our management. Similarly, statements that describe

our future plans, objectives, strategies, financial results or

position, operational expectations or goals are forward-looking

statements. It is possible that our expectations may not be met due

to various factors, many of which are beyond our control, and we

therefore cannot give any assurance that such expectations will

prove to be correct. For a discussion of relevant factors, risks

and uncertainties that could materially affect our future results,

attention is directed to "Item 1A. Risk Factors" and "Item 7.

Management's Discussion and Analysis of Financial Condition and

Results of Operations" in our Annual Report on Form 10-K for the

year ended December 31, 2006 and "Item 1A. Risk Factors" and "Item

2. Management's Discussion and Analysis of Financial Condition and

Results of Operations" in our Quarterly Report on Form 10-Q for the

quarter ended September 30, 2007. On a monthly basis, gaming

regulatory authorities in certain states in which we operate

publish gross gaming revenue and/or certain other financial

information for the gaming facilities that operate within their

respective jurisdictions. Because various factors in addition to

our gross gaming revenue (including operating costs, promotional

allowances and corporate and other expenses) influence our

operating income, EBITDA and diluted earnings per share, such

reported information, as it relates to Ameristar, may not

accurately reflect the results of our operations for such periods

or for future periods. About Ameristar Ameristar Casinos, Inc. is a

leading Las Vegas-based gaming and entertainment company known for

its premier properties characterized by innovative architecture,

state-of-the-art casino floors and superior dining, lodging and

entertainment offerings. Ameristar's focus on the total

entertainment experience and the highest quality guest service has

earned it a leading market share position in each of the markets in

which it operates. Founded in 1954 in Jackpot, Nevada, Ameristar

has been a public company since November 1993. The Company has a

portfolio of eight casinos in seven markets: Ameristar St. Charles

(greater St. Louis); Ameristar Kansas City (Western Missouri);

Ameristar Council Bluffs (Omaha, Nebraska and southwestern Iowa);

Ameristar Vicksburg (Jackson, Mississippi and Monroe, Louisiana);

Ameristar Black Hawk (Denver metropolitan area); Cactus Petes and

The Horseshu in Jackpot, Nevada (Idaho and the Pacific Northwest);

and Resorts East Chicago (Chicagoland area), which was acquired on

September 18, 2007. Visit Ameristar Casinos' web site at

http://www.ameristar.com/ (which shall not be deemed to be

incorporated in or a part of this news release). AMERISTAR CASINOS,

INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Amounts in Thousands, Except Per Share Data) (Unaudited) Three

Months Ended Year Ended December 31, December 31, 2007 (1)(2) 2006

2007 (1)(2) 2006 (3) REVENUES: Casino $306,991 $242,389 $1,083,380

$1,008,311 Food and beverage 37,977 31,768 136,471 131,795 Rooms

8,794 6,608 30,844 27,972 Other 8,371 7,016 30,387 29,082 362,133

287,781 1,281,082 1,197,160 Promotional allowances (59,357)

(43,738) (200,559) (196,862) Net revenues 302,776 244,043 1,080,523

1,000,298 OPERATING EXPENSES: Casino 145,651 105,526 478,504

439,101 Food and beverage 19,145 17,346 70,439 68,744 Rooms 3,506

1,776 9,341 6,780 Other 4,625 3,981 19,157 18,749 Selling, general

and administrative 65,994 48,781 229,801 200,588 Depreciation and

amortization 24,758 24,031 94,810 93,889 Impairment loss on assets

4,592 581 4,758 931 Total operating expenses 268,271 202,022

906,810 828,782 Income from operations 34,505 42,021 173,713

171,516 OTHER INCOME (EXPENSE): Interest income 395 631 2,113 2,746

Interest expense, net (22,828) (12,151) (57,742) (50,291) Loss on

early retirement of debt - - - (26,264) Net (loss) gain on

disposition of assets (103) 570 (1,408) 683 Other (189) - (178) -

INCOME BEFORE INCOME TAX PROVISION 11,780 31,071 116,498 98,390

Income tax provision 3,542 13,238 47,065 38,825 NET INCOME $8,238

$17,833 $69,433 $59,565 EARNINGS PER SHARE: Basic $0.14 $0.32 $1.22

$1.06 Diluted $0.14 $0.31 $1.19 $1.04 CASH DIVIDENDS DECLARED PER

SHARE $0.10 $0.09 $0.41 $0.38 WEIGHTED AVERAGE SHARES OUTSTANDING:

Basic 57,078 56,227 57,052 56,155 Diluted 58,219 57,538 58,322

57,327 (1) The East Chicago property was acquired on September 18,

2007. Accordingly, operating results are included only from the

acquisition date. (2) For the three months and year ended December

31, 2007, the Company reported an impairment loss related to a

discontinued construction project. The impairment loss adversely

impacted net income and diluted earnings per share by $2.9 million

and $0.05, respectively. (3) For the year ended December 31, 2006,

the Company reported a one-time charge related to loss on early

retirement of debt, which negatively impacted net income and

diluted earnings per share by $17.1 million and $0.30,

respectively. AMERISTAR CASINOS, INC. AND SUBSIDIARIES SUMMARY

CONSOLIDATED FINANCIAL DATA (Dollars in Thousands) (Unaudited)

December 31, 2007 December 31, 2006 Balance sheet data Cash and

cash equivalents $98,498 $101,140 Total assets $2,409,548

$1,541,475 Total debt, including current maturities $1,645,952

$883,012 Stockholders' equity $503,126 $434,164 Three Months Ended

Year Ended December 31, December 31, 2007 2006 2007 2006

Consolidated cash flow information Net cash provided by operating

activities $30,882 $31,130 $202,746 $169,538 Net cash used in

investing activities $(85,578) $(71,294) $(954,287) $(237,681) Net

cash provided by financing activities $39,754 $26,556 $748,899

$63,138 Net revenues Ameristar St. Charles $67,502 $68,716 $284,106

$284,841 Ameristar Kansas City 58,662 63,442 249,716 252,991

Ameristar Council Bluffs 43,439 44,476 178,349 181,840 Ameristar

Vicksburg 29,959 32,053 130,498 135,236 Ameristar Black Hawk 22,020

18,676 91,050 76,692 Jackpot Properties 16,765 16,680 73,199 68,698

Net revenues from historical properties 238,347 244,043 1,006,918

1,000,298 East Chicago (1) 64,429 - 73,605 - Consolidated net

revenues $302,776 $244,043 $1,080,523 $1,000,298 Operating income

(loss) Ameristar St. Charles $12,949 $15,005 $64,743 $64,842

Ameristar Kansas City 9,649 11,949 50,092 47,625 Ameristar Council

Bluffs 11,575 13,364 49,692 50,950 Ameristar Vicksburg 7,557 10,809

40,586 43,630 Ameristar Black Hawk 3,331 2,170 17,019 7,555 Jackpot

Properties 2,321 2,662 13,926 12,812 Corporate and other (18,569)

(13,938) (67,705) (55,898) Operating income from historical

properties 28,813 42,021 168,353 171,516 East Chicago (1) 5,692 -

5,360 - Consolidated operating income $34,505 $42,021 $173,713

$171,516 EBITDA Ameristar St. Charles $17,379 $21,833 $87,728

$91,493 Ameristar Kansas City 15,142 17,667 72,596 70,009 Ameristar

Council Bluffs 14,891 16,743 62,901 64,201 Ameristar Vicksburg

10,639 13,832 52,867 55,788 Ameristar Black Hawk 6,446 5,214 28,799

19,251 Jackpot Properties 3,606 3,817 18,799 17,209 Corporate and

other (17,540) (13,054) (63,942) (52,546) EBITDA from historical

properties 50,563 66,052 259,748 265,405 East Chicago (1) 8,700 -

8,775 - Consolidated EBITDA $59,263 $66,052 $268,523 $265,405

AMERISTAR CASINOS, INC. AND SUBSIDIARIES SUMMARY CONSOLIDATED

FINANCIAL DATA - CONTINUED (Dollars in Thousands) (Unaudited) Three

Months Ended Year Ended December 31, December 31, 2007 2006 2007

2006 Operating income margins (2) Ameristar St. Charles 19.2% 21.8%

22.8% 22.8% Ameristar Kansas City 16.4% 18.8% 20.1% 18.8% Ameristar

Council Bluffs 26.6% 30.0% 27.9% 28.0% Ameristar Vicksburg 25.2%

33.7% 31.1% 32.3% Ameristar Black Hawk 15.1% 11.6% 18.7% 9.9%

Jackpot Properties 13.8% 16.0% 19.0% 18.6% Operating income margin

from historical properties 12.1% 17.2% 16.7% 17.1% East Chicago (1)

8.8% - 7.3% - Consolidated operating income margin 11.4% 17.2%

16.1% 17.1% EBITDA margins (3) Ameristar St. Charles 25.7% 31.8%

30.9% 32.1% Ameristar Kansas City 25.8% 27.8% 29.1% 27.7% Ameristar

Council Bluffs 34.3% 37.6% 35.3% 35.3% Ameristar Vicksburg 35.5%

43.2% 40.5% 41.3% Ameristar Black Hawk 29.3% 27.9% 31.6% 25.1%

Jackpot Properties 21.5% 22.9% 25.7% 25.1% EBITDA margin from

historical properties 21.2% 27.1% 25.8% 26.5% East Chicago (1)

13.5% - 11.9% - Consolidated EBITDA margin 19.6% 27.1% 24.9% 26.5%

(1) We acquired the East Chicago property on September 18, 2007,

and operating results for this property are included only for the

three months and year ended December 31, 2007. (2) Operating income

margin is operating income (loss) as a percentage of net revenues.

(3) EBITDA margin is EBITDA as a percentage of net revenues.

RECONCILIATION OF OPERATING INCOME (LOSS) TO EBITDA (Dollars in

Thousands) (Unaudited) The following table sets forth a

reconciliation of operating income (loss), a GAAP financial

measure, to EBITDA, a non-GAAP financial measure. Three Months

Ended Year Ended December 31, December 31, 2007 2006 2007 2006

Ameristar St. Charles: Operating income $12,949 $15,005 $64,743

$64,842 Depreciation and amortization 4,430 6,828 22,985 26,651

EBITDA $17,379 $21,833 $87,728 $91,493 Ameristar Kansas City:

Operating income $9,649 $11,949 $50,092 $47,625 Depreciation and

amortization 5,493 5,718 22,504 22,384 EBITDA $15,142 $17,667

$72,596 $70,009 Ameristar Council Bluffs: Operating income $11,575

$13,364 $49,692 $50,950 Depreciation and amortization 3,316 3,379

13,209 13,251 EBITDA $14,891 $16,743 $62,901 $64,201 Ameristar

Vicksburg: Operating income $7,557 $10,809 $40,586 $43,630

Depreciation and amortization 3,082 3,023 12,281 12,158 EBITDA

$10,639 $13,832 $52,867 $55,788 Ameristar Black Hawk: Operating

income $3,331 $2,170 $17,019 $7,555 Depreciation and amortization

3,115 3,044 11,780 11,696 EBITDA $6,446 $5,214 $28,799 $19,251

Jackpot Properties: Operating income $2,321 $2,662 $13,926 $12,812

Depreciation and amortization 1,285 1,155 4,873 4,397 EBITDA $3,606

$3,817 $18,799 $17,209 East Chicago: Operating income $5,692 $-

$5,360 $- Depreciation and amortization 3,008 - 3,415 - EBITDA

$8,700 $- $8,775 $- Corporate and other: Operating loss $(18,569)

$(13,938) $(67,705) $(55,898) Depreciation and amortization 1,029

884 3,763 3,352 EBITDA $(17,540) $(13,054) $(63,942) $(52,546)

Consolidated: Operating income $34,505 $42,021 $173,713 $171,516

Depreciation and amortization 24,758 24,031 94,810 93,889 EBITDA

$59,263 $66,052 $268,523 $265,405 RECONCILIATION OF EBITDA TO

ADJUSTED EBITDA (Dollars in Thousands) (Unaudited) Three Months

Ended Year Ended December 31, December 31, 2007 2006 2007 2006

EBITDA $59,263 $66,052 $268,523 $265,405 Impairment loss on

discontinued expansion projects 4,456 581 4,456 581 St. Charles

hotel pre-opening expenses 2,080 - 2,840 - East Chicago transition,

rebranding and acquisition costs 974 - 2,087 - Ameristar Black Hawk

rebranding costs - - - 1,675 Adjusted EBITDA $66,773 $66,633

$277,906 $267,661 Use of Non-GAAP Financial Measures Securities and

Exchange Commission Regulation G, "Conditions for Use of Non-GAAP

Financial Measures," prescribes the conditions for use of non-GAAP

financial information in public disclosures. We believe our

presentations of the following non-GAAP financial measures are

important supplemental measures of operating performance to

investors: earnings before interest, taxes, depreciation and

amortization (EBITDA), and Adjusted EBITDA. The following

discussion defines these terms and why we believe they are useful

measures of our performance. EBITDA and Adjusted EBITDA EBITDA is a

commonly used measure of performance in our industry that we

believe, when considered with measures calculated in accordance

with United States generally accepted accounting principles, or

GAAP, gives investors a more complete understanding of operating

results before the impact of investing and financing transactions

and income taxes and facilitates comparisons between us and our

competitors. Management has adjusted EBITDA, when deemed

appropriate, for the evaluation of operating performance because we

believe that the exclusion of certain non-recurring items is

necessary to provide the most accurate measure of our core

operating results and as a means to compare period-to-period

results. We have chosen to provide this information to investors to

enable them to perform more meaningful analysis of past, present

and future operating results and as a means to evaluate the results

of core ongoing operations. We do not reflect such items when

calculating EBITDA; however, we adjust for these items and refer to

this measure as Adjusted EBITDA. We have reported this measure to

our investors and believe the inclusion of Adjusted EBITDA will

provide consistency in our financial reporting. We use Adjusted

EBITDA in this press release because we believe it is useful to

investors in allowing greater transparency related to a significant

measure used by management in its financial and operational

decision-making. Adjusted EBITDA is a significant factor in

management's internal evaluation of total company and individual

property performance and in the evaluation of incentive

compensation related to property management. Management also uses

Adjusted EBITDA as a measure in determining the value of potential

acquisitions and dispositions it may evaluate. Externally, we

believe these measures are used by investors in their assessment of

our operating performance and the valuation of our Company.

Adjusted EBITDA, as used in this press release, reflects EBITDA

adjusted for impairment losses related to discontinued construction

projects, new property acquisition costs, pre-opening expenses and

transition and rebranding costs. In future periods, the adjustments

we make to EBITDA in order to calculate Adjusted EBITDA may be

different than or in addition to those made in this release. The

foregoing tables reconcile Adjusted EBITDA to EBITDA and operating

income, based upon GAAP. Limitations on the Use of Non-GAAP

Measures The use of EBITDA and Adjusted EBITDA has certain

limitations. Our presentation of EBITDA and Adjusted EBITDA may be

different from the presentations used by other companies and

therefore comparability among companies may be limited.

Depreciation expense for various long-term assets, interest

expense, income taxes and other items have been and will be

incurred and are not reflected in the presentation of EBITDA or

Adjusted EBITDA. Each of these items should also be considered in

the overall evaluation of our results. Additionally, EBITDA and

Adjusted EBITDA do not consider capital expenditures and other

investing activities and should not be considered as a measure of

our liquidity. We compensate for these limitations by providing the

relevant disclosure of our depreciation, interest and income tax

expense, capital expenditures and other items both in our

reconciliations to the GAAP financial measures and in our

consolidated financial statements, all of which should be

considered when evaluating our performance. EBITDA and Adjusted

EBITDA should be used in addition to and in conjunction with

results presented in accordance with GAAP. EBITDA and Adjusted

EBITDA should not be considered as an alternative to net income,

operating income or any other operating performance measure

prescribed by GAAP, nor should these measures be relied upon to the

exclusion of GAAP financial measures. EBITDA and Adjusted EBITDA

reflect additional ways of viewing our operations that we believe,

when viewed with our GAAP results and the reconciliations to the

corresponding GAAP financial measures, provide a more complete

understanding of factors and trends affecting our business than

could be obtained absent this disclosure. Management strongly

encourages investors to review our financial information in its

entirety and not to rely on a single financial measure.

http://www.newscom.com/cgi-bin/prnh/20040930/LATH017LOGO

http://photoarchive.ap.org/ DATASOURCE: Ameristar Casinos, Inc.

CONTACT: investors, Tom Steinbauer, Senior Vice President, Chief

Financial Officer, +1-702-567-7000, or media, Karen Lynn, VP of

Communications, +1-702-567-7038, both of Ameristar Casinos, Inc.

Web site: http://www.ameristar.com/

Copyright

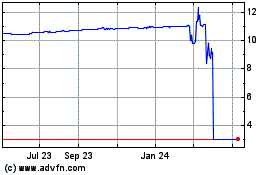

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From May 2024 to Jun 2024

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Jun 2023 to Jun 2024