Ameristar Casinos Reports Record 2004 Fourth Quarter and Annual

Financial Results; Third Consecutive Year of Growth in All Key

Performance Measures LAS VEGAS, Feb. 3 /PRNewswire-FirstCall/ --

Ameristar Casinos, Inc. (NASDAQ:ASCA) today announced 2004 fourth

quarter and annual financial results, which set records for

consolidated net revenues, operating income, EBITDA, net income and

earnings per share. Financial Highlights * Fourth quarter

consolidated net revenues of $214.7 million, representing an

increase of $17.6 million, or 8.9%, over the fourth quarter of

2003. Consolidated net revenues of $854.7 million for the year

ended December 31, 2004, an increase of $72.7 million, or 9.3%,

from 2003. * Fourth quarter consolidated operating income of $37.9

million, an increase of $6.6 million, or 20.9%, from the prior-year

fourth quarter. Consolidated operating income of $159.5 million for

2004, an increase of $19.5 million, or 14.0%, from 2003. * Fourth

quarter consolidated EBITDA (a non-GAAP financial measure which is

defined and reconciled with operating income below) of $57.1

million, representing an increase of $8.8 million, or 18.3%, over

the fourth quarter of 2003. Consolidated EBITDA of $232.7 million

for the year ended December 31, 2004, an increase of $29.2 million,

or 14.3%, from 2003. Our December 21, 2004 acquisition of Mountain

High Casino in Black Hawk, Colorado contributed $1.0 million to

EBITDA for the quarter and year ended December 31, 2004. * Fourth

quarter consolidated net income of $14.5 million, up $4.9 million,

or 51.4%, from the fourth quarter of 2003. Consolidated net income

of $62.0 million for the year ended December 31, 2004, an increase

of $14.4 million, or 30.2%, from 2003. * Fourth quarter diluted

earnings per share of $0.52, compared to $0.35 for the fourth

quarter of 2003. Diluted earnings per share were $2.23 for the year

ended December 31, 2004, representing an increase of 26.7% from

2003. Analysts' latest consensus estimates for the fourth quarter

and full year 2004, as reported by Thomson First Call, were $0.45

and $2.18, respectively. Our previously issued earnings guidance

for the fourth quarter of 2004 indicated a range of $0.41 to $0.45

per share. The Mountain High Casino acquisition had a favorable

impact of $0.02 on diluted earnings per share for the fourth

quarter and year ended December 31, 2004. * On November 15, 2004,

our Board of Directors declared a quarterly cash dividend of $0.125

per share, which was paid on December 15, 2004 to our shareholders

of record as of November 30, 2004. * Late in the fourth quarter of

2004, we borrowed $115.0 million to fund the Mountain High

acquisition, and during the quarter we prepaid $20.0 million of

long-term debt under our senior credit facilities. In 2004, we

prepaid a total of $65.0 million in debt associated with our senior

credit facilities. We improved our total debt leverage ratio (as

defined in our senior credit agreement) from 3.49:1 at December 31,

2003 to 3.29:1 at December 31, 2004. * We continued to be the

leader in market share in our Kansas City, Council Bluffs,

Vicksburg and Jackpot markets during the fourth quarter of 2004. We

were the market share leader in all of our markets for the year

ended December 31, 2004. Craig H. Neilsen, Chairman and CEO,

stated: "The 2004 year was the most prosperous in the Company's

history, as our reported financial results clearly demonstrate. In

2004, we continued to improve upon the financial successes of prior

years by further increasing revenues, profitability and cash flows.

Our performance in 2004 extends our trend of growth in all key

performance indicators -- net revenues, operating income, EBITDA,

net income and earnings per share -- for a third consecutive year.

Our success is largely the result of our dedicated and talented

team and continuing successful implementation of the four key

strategies of our business model: 1) creating the best facility in

each of our markets; 2) further building the Ameristar brand; 3)

leading our markets in slot technology; and 4) our hands-on

management approach at the property and corporate levels."

Financial Results Net Revenues Consolidated net revenues for the

fourth quarter of 2004 were $214.7 million, an increase of 8.9%

compared to the fourth quarter of 2003. All of our properties

improved in net revenues, with increases of 9.6% at Ameristar

Kansas City, 8.4% at Ameristar Vicksburg, 7.4% at Ameristar St.

Charles, 7.0% at Ameristar Council Bluffs and 5.0% at the Jackpot

Properties. Mountain High Casino contributed $2.0 million in net

revenues during the 11 days that we owned the property in 2004. For

the quarter, Ameristar Vicksburg and Ameristar Kansas City improved

their market leadership positions (based on gross gaming revenues)

to 45.0% and 36.1%, respectively, with increases of 1.6 and 0.5

percentage points, respectively, over the prior-year fourth

quarter. Ameristar Council Bluffs maintained its market share

leadership position with 39.7% of the market despite a 0.4

percentage point decrease from the last quarter of 2003. The

reported market share for Ameristar St. Charles was 31.3%, which

represented a 0.7 percentage point decline compared to the fourth

quarter of 2003. Led by a $20.3 million (12.2%) increase in slot

revenues, consolidated casino revenues for the fourth quarter of

2004 increased $21.1 million, or 10.9%, from the fourth quarter of

2003. We believe that the growth in slot revenues has been driven

by our continued implementation of coinless slot technology at our

Ameristar-branded properties, which are now nearly 100% coinless.

In addition, we believe our continued leadership in the

introduction of new-generation, lower-denomination slot machines at

our Ameristar-branded properties has contributed to the improvement

in slot revenues, due to the popularity of this segment of the slot

market. We further believe casino revenues increased in part as a

result of our continued successful implementation of our targeted

marketing programs, which is evidenced by a 16.5% increase in rated

play at our Ameristar-branded properties when compared to the

fourth quarter of 2003, and in part as a result of a relative

absence of adverse weather, which had negatively impacted the

prior-year fourth quarter. Promotional allowances (which are

deducted in arriving at net revenues) increased $4.5 million, or

13.1%, in the fourth quarter of 2004 compared to the 2003 fourth

quarter, in part due to the increase in rated play. For the full

year, we had record net revenues of $854.7 million, an increase of

$72.7 million, or 9.3%, over 2003. All our properties improved

their net revenues over the prior year, with increases of $22.3

million (8.7%) at Ameristar St. Charles, $19.6 million (9.1%) at

Ameristar Kansas City, $15.1 million (9.6%) at Ameristar Council

Bluffs, $12.4 million (13.0%) at Ameristar Vicksburg and $1.3

million (2.3%) at the Jackpot Properties. For the year ended

December 31, 2004, promotional allowances increased $37.2 million,

or 29.0%, over the prior year due in part to the rated play

increase. For the year ended December 31, 2004, all our properties

improved their market share over the prior year, including

increases by Ameristar Vicksburg of 5.0 percentage points to 45.4%,

Ameristar Council Bluffs of 1.7 percentage points to 40.9%,

Ameristar Kansas City of 0.7 percentage point to 35.1% and

Ameristar St. Charles of 0.8 percentage point to 32.0%. Casino

revenues for the year ended December 31, 2004 increased $96.5

million, or 12.7%, from 2003, including increases in slot revenues

and table games revenues of 14.0% and 4.6%, respectively. The

increased gaming revenues in 2004 are mostly attributable to the

improvement in our slot product, as described above. Non-gaming

revenues increased $13.4 million, or 8.9%, in 2004 compared to the

prior year. The increase in non-gaming revenues was primarily due

to a full year of operations of the new dining and entertainment

venues at Ameristar Kansas City, which were completed in September

2003. Operating Income and EBITDA In the fourth quarter of 2004,

consolidated operating income increased $6.6 million, or 20.9%, to

$37.9 million. Consolidated operating income margin improved 1.8

percentage points from the prior-year fourth quarter, to 17.7%,

driven by increases at Ameristar Vicksburg, Ameristar Kansas City

and the Jackpot Properties of 4.9, 2.2, and 9.8 percentage points,

respectively, when compared to the same period in 2003.

Consolidated EBITDA increased 18.3% to $57.1 million compared to

the fourth quarter of 2003. Additionally, consolidated EBITDA

margin in the fourth quarter of 2004 increased from 24.5% to 26.6%,

with improvements at Ameristar Vicksburg, Ameristar Kansas City,

Ameristar St. Charles and the Jackpot Properties of 5.7, 2.2, 0.3

and 10.2 percentage points, respectively, from the prior-year

fourth quarter. The growth in operating income, EBITDA and the

related margins at these properties was principally driven by the

increase in revenues noted above and the continued implementation

of cost containment initiatives. Operating income and EBITDA at

Ameristar St. Charles increased $1.0 million and $1.8 million,

respectively, in the fourth quarter of 2004, while the change in

the related margins was nominal. The margins were impacted by a

more competitive market environment that has resulted in increased

marketing and promotional costs. Ameristar Council Bluffs increased

fourth quarter operating income by $0.4 million and fourth quarter

EBITDA by $0.9 million when compared to the prior-year period. The

improvements in operating income and EBITDA occurred despite a 2.0%

increase in the Iowa tax rate on gaming revenues of riverboat

casinos, which became effective July 1, 2004. Operating income

margin decreased 0.9 percentage point to 28.7% and EBITDA margin

declined 0.3 percentage point to 35.8% due to higher health benefit

costs, a sales and use tax assessment and the aforementioned gaming

tax increase. Mountain High Casino contributed $0.9 million to

consolidated operating income and $1.0 million to EBITDA for the

11-day period from the acquisition date through December 31, 2004.

Corporate expense increased $1.1 million in the fourth quarter of

2004 compared to the same quarter of 2003. The increase was

primarily the result of higher costs, including employee

compensation, employee benefits and professional fees and related

costs, associated with our expanded development activities.

Depreciation and amortization expense increased to $19.2 million in

the fourth quarter of 2004 from $16.9 million in the fourth quarter

of 2003, primarily due to the increase in our depreciable assets

resulting from the completion of enhancement and renovation

projects at Ameristar Kansas City in September 2003 and Ameristar

Vicksburg in December 2003, the continued implementation of

coinless slot technology and the introduction of lower-denomination

slot machines at our Ameristar-branded properties. For the full

year 2004, operating income and EBITDA reached record levels of

$159.5 million and $232.7 million, respectively. Corporate expense

increased $4.1 million, or 11.1%, compared to 2003. This increase

resulted primarily from the continued growth of the company and

increased development activities. Development-related costs totaled

$4.3 million for the year ended December 31, 2004, a $2.3 million

increase over 2003. We expect this trend to continue through 2005

as we seek growth through development opportunities in the United

Kingdom, Pennsylvania and elsewhere and through acquisition

opportunities. Net Income and Diluted Earnings Per Share For the

fourth quarter of 2004, net income increased 51.4% to $14.5

million, from $9.5 million for the fourth quarter of 2003. Diluted

earnings per share were $0.52 in the quarter ended December 31,

2004, compared to $0.35 in the corresponding prior-year quarter.

Diluted earnings per share in the 2004 quarter benefited by $0.02

as a result of the acquisition of the Black Hawk property. Interest

expense for the 2004 fourth quarter was $14.0 million, down $2.0

million from the fourth quarter of 2003. The decline was due to a

decrease in our average long-term debt level for the quarter as we

prepaid senior debt, the termination of our interest rate swap

agreement on March 31, 2004, and lower interest rates on our senior

credit facilities year-over-year. We incurred $0.3 million in

non-operating losses on early retirement of debt in the fourth

quarters of both 2004 and 2003. Net income for the full year 2004

increased to $62.0 million from $47.6 million in 2003, and diluted

earnings per share improved to $2.23 from $1.76. Interest expense

for 2004 decreased to $57.0 million from $64.3 million in 2003 for

the reasons noted above. Our effective income tax rate for the

quarter ended December 31, 2004 decreased to 36.9% from 37.7% for

the quarter ended December 31, 2003, due primarily to a decrease in

our effective state income tax rate. Our effective income tax rate

for the year ended December 31, 2004 was 38.6%, compared to 37.0%

for the prior year. The federal statutory rate was 35.0% in each

year. The difference from the statutory rate was due to the effects

of certain expenses we incurred that are not deductible for federal

income tax purposes and certain tax credits. Liquidity and Capital

Resources Our financial position remains strong, with approximately

$86.5 million of cash and cash equivalents and $68.9 million of

available borrowing capacity under our senior credit facilities as

of December 31, 2004. During the fourth quarter of 2004, we

increased our long-term debt by approximately $96.6 million, due

primarily to the borrowing of $115.0 million under our senior

credit facilities in order to fund the acquisition of the Black

Hawk property. Partially offsetting our borrowings, we made

prepayments totaling $20.0 million of principal under our senior

credit facilities in the fourth quarter of 2004. At December 31,

2004, our total debt was $766.3 million, representing an increase

of $49.4 million from December 31, 2003. Capital expenditures for

the 2004 fourth quarter and full year totaled $26.8 million and

$89.6 million, respectively, and included the continued acquisition

of coinless slot machines, the implementation of information

technology solutions to enhance our operating capabilities and

capital projects at all of our properties. In 2005, we expect to

incur approximately $200.0 million in capital expenditures. We

anticipate spending approximately $50.0 million on maintenance

capital expenditures (including the acquisition of slot machines)

and approximately $150.0 million on internal expansion projects.

Actual 2005 capital expenditures will depend on the start date of

certain projects and the progress of construction through year-end.

Our planned internal expansion projects include: 1) the

reconfiguration and expansion of the gaming area, additional

covered parking, an upgrade of the food and beverage outlets and

construction of a 300-room AAA Four Diamond-quality hotel at our

newly acquired property in Black Hawk, Colorado; 2) the renovation

of hotel rooms at our Council Bluffs and Kansas City properties,

which began in the fourth quarter of 2004; 3) the expansion of our

gaming space at Ameristar Council Bluffs and Ameristar Vicksburg to

accommodate increases of 300 and 200 slot machines, respectively,

and the addition of a poker room at both properties; and 4) the

construction of a 300-room, all-suite hotel, 20,000 square feet of

meeting facilities, a new 1,300-seat entertainment pavilion and an

additional parking garage at Ameristar St. Charles. We anticipate

the benefit associated with these internal growth projects will

primarily be realized commencing in 2006 and 2007. Outlook Based on

our preliminary results of operations to date in 2005 and our

outlook for the remainder of the quarter, we currently estimate

operating income of $42 million to $44 million, EBITDA of $62

million to $64 million (given anticipated depreciation expense of

$20 million), interest expense of $15 million and diluted earnings

per share of $0.58 to $0.63 for the first quarter of 2005. For the

year ending December 31, 2005, we currently estimate operating

income of $171 million to $179 million, EBITDA of $254 million to

$262 million (given anticipated depreciation expense of $83

million), interest expense of $62 million and diluted earnings per

share of $2.34 to $2.51. These estimates take into account

construction disruption at most of our properties associated with

the projects described above as we position them for future growth.

Financial Accounting Standards Board Statement No. 123(R),

Share-Based Payment, will become effective in the quarter ending

September 30, 2005. Statement 123(R) requires the recognition of

compensation expense in an amount equal to the fair value of

share-based payments (e.g., stock options and restricted stock)

granted to employees. Our estimates of operating income, EBITDA and

diluted earnings per share for the full year 2005 do not give

effect to the impact of this new standard, as we are unable to

reasonably estimate the impact at this time. Gaming regulatory

authorities in Colorado, Iowa, Mississippi and Missouri currently

publish, on a monthly basis, gross gaming revenue, market share and

other financial information with respect to the gaming facilities,

including Ameristar's, that operate within their respective

jurisdictions. Because various factors in addition to our gross

gaming revenue (including changes in operating costs, promotional

allowances and other expenses) influence our operating income,

EBITDA and diluted earnings per share, such reported information,

as it relates to Ameristar, may not be indicative of the results of

our operations for such periods or for future periods. Conference

Call We will hold a conference call to discuss our fourth quarter

results and guidance for the first quarter and full year 2005 at

5:00 p.m. Eastern Time on February 3, 2005. The call can be

accessed live by calling (800) 967-7185. It can be replayed until

February 9, 2005 at 12:00 a.m. Eastern Time by calling (888)

203-1112 and using the access code number 2428596. Forward-Looking

Information This press release contains certain forward-looking

information that generally can be identified by the context of the

statement or the use of forward-looking terminology, such as

"believes," "estimates," "anticipates," "intends," "expects,"

"plans," "is confident that" or words of similar meaning, with

reference to Ameristar or our management. Similarly, statements

that describe our future plans, objectives, strategies, financial

results or position, operational expectations or goals are

forward-looking statements. It is possible that our expectations

may not be met due to various factors, many of which are beyond our

control, and we therefore cannot give any assurance that such

expectations will prove to be correct. For a discussion of relevant

factors, risks and uncertainties that could materially affect our

future results, attention is directed to "Item 1. Business - Risk

Factors" and "Item 7. Management's Discussion and Analysis of

Financial Condition and Results of Operations" in our Annual Report

on Form 10-K for the year ended December 31, 2003 and "Item 2.

Management's Discussion and Analysis of Financial Condition and

Results of Operations" in our Quarterly Report on Form 10-Q for the

quarter ended September 30, 2004. About Ameristar Ameristar

Casinos, Inc. is a leading Las Vegas-based gaming and entertainment

company known for its premier properties characterized by

innovative architecture, state-of-the-art casino floors and

superior dining, lodging and entertainment offerings. Ameristar's

focus on the total entertainment experience and the highest quality

guest service has earned it a leading market share position in each

of the markets in which it operates. Founded in 1954 in Jackpot,

Nevada, Ameristar has been a public company since November 1993.

The company has a portfolio of seven casinos in six markets:

Ameristar St. Charles (greater St. Louis); Ameristar Kansas City;

Ameristar Council Bluffs (Omaha, Nebraska and southwestern Iowa);

Ameristar Vicksburg (Jackson, Mississippi and Monroe, Louisiana);

Mountain High Casino in Black Hawk, Colorado (Denver metropolitan

area); and Cactus Petes and the Horseshu in Jackpot, Nevada (Idaho

and the Pacific Northwest). Visit Ameristar Casinos' Web site at

http://www.ameristar.com/ (which shall not be deemed to be

incorporated in or a part of this news release). AMERISTAR CASINOS,

INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Amounts in Thousands, Except Per Share Data) (Unaudited) Three

Months Year Ended December 31, Ended December 31, 2004 2003 2004

2003 REVENUES: Casino $214,685 $193,624 $856,901 $760,376 Food and

beverage 27,937 26,887 114,010 103,176 Rooms 6,062 6,133 26,082

25,136 Other 5,382 5,286 23,166 21,557 254,066 231,930 1,020,159

910,245 Less: Promotional allowances 39,386 34,837 165,461 128,278

Net revenues 214,680 197,093 854,698 781,967 OPERATING EXPENSES:

Casino 94,193 89,802 379,909 349,845 Food and beverage 16,416

15,987 63,758 59,747 Rooms 1,653 1,631 6,565 6,343 Other 2,951

3,306 13,687 12,522 Selling, general and administrative 42,331

38,076 157,907 149,292 Depreciation and amortization 19,220 16,933

73,236 63,599 Impairment loss -- -- 174 687 Total operating

expenses 176,764 165,735 695,236 642,035 Income from operations

37,916 31,358 159,462 139,932 OTHER INCOME (EXPENSE): Interest

income 88 48 245 330 Interest expense (13,974) (15,917) (57,003)

(64,261) Loss on early retirement of debt (250) (286) (923) (701)

Other (858) 128 (904) 288 INCOME BEFORE INCOME TAX PROVISION 22,922

15,331 100,877 75,588 Income tax provision 8,464 5,782 38,898

27,968 NET INCOME $14,458 $9,549 $61,979 $47,620 EARNINGS PER

SHARE: Basic $0.53 $0.36 $2.29 $1.80 Diluted $0.52 $0.35 $2.23

$1.76 WEIGHTED AVERAGE SHARES OUTSTANDING: Basic 27,269 26,562

27,057 26,423 Diluted 28,062 27,362 27,826 27,120 AMERISTAR

CASINOS, INC. AND SUBSIDIARIES SUMMARY CONSOLIDATED FINANCIAL DATA

(Dollars in Thousands) (Unaudited) Three Months Year Ended December

31, Ended December 31, 2004 2003 2004 2003 Consolidated cash flow

information Net cash provided by operating activities $52,229

$39,036 $176,505 $151,162 Net cash used in investing activities

(136,051) (22,647) (208,659) (83,379) Net cash provided by/ (used

in) financing activities 94,143 (19,629) 40,457 (80,136) Net

revenues Ameristar St. Charles $69,555 $64,753 $278,887 $256,594

Ameristar Kansas City 60,272 54,987 234,432 214,819 Ameristar

Council Bluffs 42,699 39,920 171,755 156,673 Ameristar Vicksburg

26,151 24,124 107,440 95,048 Jackpot Properties 13,979 13,309

60,160 58,833 Mountain High Casino (1) 2,024 -- 2,024 --

Consolidated net revenues $214,680 $197,093 $854,698 $781,967

Operating income (loss) Ameristar St. Charles $15,978 $14,957

$67,125 $61,257 Ameristar Kansas City 11,316 9,121 44,803 40,351

Ameristar Council Bluffs 12,268 11,834 50,656 45,552 Ameristar

Vicksburg 6,620 4,914 27,592 21,215 Jackpot Properties 1,908 506

8,962 8,022 Mountain High Casino (1) 851 -- 851 -- Corporate and

other (11,025) (9,974) (40,527) (36,465) Consolidated operating

income $37,916 $31,358 $159,462 $139,932 EBITDA (2) Ameristar St.

Charles $22,282 $20,524 $91,108 $84,219 Ameristar Kansas City

16,391 13,732 64,172 54,890 Ameristar Council Bluffs 15,278 14,413

62,161 55,684 Ameristar Vicksburg 9,517 7,399 38,944 30,835 Jackpot

Properties 2,936 1,439 12,824 11,876 Mountain High Casino (1) 998

-- 998 -- Corporate and other (10,266) (9,216) (37,509) (33,973)

Consolidated EBITDA $57,136 $48,291 $232,698 $203,531 Operating

income margins (3) Ameristar St. Charles 23.0% 23.1% 24.1% 23.9%

Ameristar Kansas City 18.8% 16.6% 19.1% 18.8% Ameristar Council

Bluffs 28.7% 29.6% 29.5% 29.1% Ameristar Vicksburg 25.3% 20.4%

25.7% 22.3% Jackpot Properties 13.6% 3.8% 14.9% 13.6% Mountain High

Casino (1) 42.0% -- 42.0% -- Consolidated operating income margin

17.7% 15.9% 18.7% 17.9% AMERISTAR CASINOS, INC. AND SUBSIDIARIES

SUMMARY CONSOLIDATED FINANCIAL DATA - CONTINUED (Dollars in

Thousands) (Unaudited) Three Months Year Ended December 31, Ended

December 31, 2004 2003 2004 2003 EBITDA margins (2) Ameristar St.

Charles 32.0% 31.7% 32.7% 32.8% Ameristar Kansas City 27.2% 25.0%

27.4% 25.6% Ameristar Council Bluffs 35.8% 36.1% 36.2% 35.5%

Ameristar Vicksburg 36.4% 30.7% 36.2% 32.4% Jackpot Properties

21.0% 10.8% 21.3% 20.2% Mountain High Casino (1) 49.3% -- 49.3% --

Consolidated EBITDA margin 26.6% 24.5% 27.2% 26.0% (1) We acquired

Mountain High Casino on December 21, 2004, and operating results

are only included since the acquisition date. (2) EBITDA is

earnings before interest, taxes, depreciation and amortization.

EBITDA is presented solely as a supplemental disclosure because

management believes that it is a widely used measure of operating

performance in the gaming industry and a principal basis for the

valuation of gaming companies. Our credit agreement also requires

the use of EBITDA as a measure of compliance with our principal

debt covenants. In addition, management uses property-level EBITDA

(EBITDA before corporate expense) as the primary measure of our

operating properties' performance, including the evaluation of

operating personnel. EBITDA margin is EBITDA as a percentage of net

revenues. EBITDA should not be construed as an alternative to

income from operations (as determined in accordance with GAAP) as

an indicator of our operating performance, or as an alternative to

cash flows from operating activities (as determined in accordance

with GAAP) as a measure of liquidity, or as an alternative to any

other measure determined in accordance with GAAP. We have

significant uses of cash flows, including capital expenditures,

interest payments, taxes and debt principal repayments, which are

not reflected in EBITDA. It should also be noted that not all

gaming companies that report EBITDA calculate EBITDA in the same

manner as we do. (3) Operating income margin is operating income as

a percentage of net revenues. RECONCILIATION OF OPERATING INCOME

(LOSS) TO EBITDA (Dollars in Thousands) (Unaudited) The following

table sets forth a reconciliation of operating income (loss), a

GAAP financial measure, to EBITDA, a non-GAAP financial measure.

Three Months Year Ended December 31, Ended December 31, 2004 2003

2004 2003 Ameristar St. Charles: Operating income $15,978 $14,957

$67,125 $61,257 Depreciation and amortization 6,304 5,567 23,983

22,962 EBITDA $22,282 $20,524 $91,108 $84,219 Ameristar Kansas

City: Operating income $11,316 $9,121 $44,803 $40,351 Depreciation

and amortization 5,075 4,611 19,369 14,539 EBITDA $16,391 $13,732

$64,172 $54,890 Ameristar Council Bluffs: Operating income $12,268

$11,834 $50,656 $45,552 Depreciation and amortization 3,010 2,579

11,505 10,132 EBITDA $15,278 $14,413 $62,161 $55,684 Ameristar

Vicksburg: Operating income $6,620 $4,914 $27,592 $21,215

Depreciation and amortization 2,897 2,485 11,352 9,620 EBITDA

$9,517 $7,399 $38,944 $30,835 Jackpot Properties: Operating income

$1,908 $506 $8,962 $8,022 Depreciation and amortization 1,028 933

3,862 3,854 EBITDA $2,936 $1,439 $12,824 $11,876 Mountain High

Casino: Operating income $851 $-- $851 $-- Depreciation and

amortization 147 -- 147 -- EBITDA $998 $-- $998 $-- Corporate and

other: Operating loss $(11,025) $(9,974) $(40,527) $(36,465)

Depreciation and amortization 759 758 3,018 2,492 EBITDA $(10,266)

$(9,216) $(37,509) $(33,973) Consolidated: Operating income $37,916

$31,358 $159,462 $139,932 Depreciation and amortization 19,220

16,933 73,236 63,599 EBITDA $57,136 $48,291 $232,698 $203,531

http://www.newscom.com/cgi-bin/prnh/20040930/LATH017LOGO

http://photoarchive.ap.org/ DATASOURCE: Ameristar Casinos, Inc.

CONTACT: Tom Steinbauer, Senior Vice President of Finance, Chief

Financial Officer of Ameristar Casinos, Inc., +1-702-567-7000 Web

site: http://www.ameristar.com/

Copyright

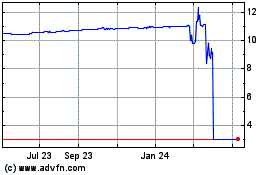

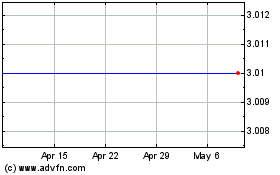

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From May 2024 to Jun 2024

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Jun 2023 to Jun 2024