Euro Weakens As German Inflation Eases More Than Expected

November 29 2023 - 8:14AM

RTTF2

The euro fell against its major counterparts in the New York

session on Wednesday, as German inflation eased in November to the

lowest level in nearly two-and-a-half years.

Data from Destatis showed that the consumer price index

registered an annual increase of 3.2 percent in November, following

a 3.8 percent rise in October.

This was the lowest rate since June 2021, when inflation stood

at 2.4 percent and was also weaker than economists' forecast of 3.5

percent.

On a monthly basis, consumer prices dropped 0.4 percent versus

an expected fall of 0.2 percent.

Eurozone inflation data is due tomorrow, with economists

expecting a further drop in the headline and core measures of

inflation.

The euro declined to an 8-day low of 161.52 against the yen,

3-week low of 0.9597 against the franc and a 1-1/2-month low of

0.8642 against the pound, off its early highs of 162.25, 0.9653 and

0.8662, respectively. The euro is seen finding support around

156.00 against the yen, 0.94 against the franc and 0.84 against the

pound.

The euro fell to 1.0960 against the greenback, reversing from an

early 3-1/2-month high of 1.1017. The currency is likely to locate

support around the 1.05 level.

In contrast, the euro was higher against the loonie, at 1.4924.

On the upside, 1.52 is likely seen as its next resistance

level.

The euro recovered to 1.7860 against the kiwi, from an early

1-1/2-month low of 1.7735. If the currency rises further, it may

locate resistance around the 1.82 level.

The euro held steady against the aussie, after touching a 2-day

high of 1.6604 in the European session. This may be compared to a

fresh 3-week low of 1.6497 seen in the Asian session.

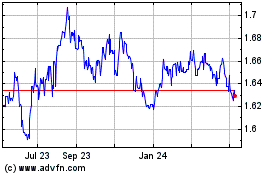

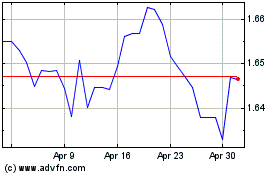

Euro vs AUD (FX:EURAUD)

Forex Chart

From Oct 2024 to Nov 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Nov 2023 to Nov 2024