UNI Price Soars 20% As Uniswap Labs Pushes Back Against SEC’s Wells Notice

May 21 2024 - 10:30PM

NEWSBTC

Uniswap Labs, the creator of one of the largest decentralized

trading platforms, is challenging a potential enforcement action by

the US Securities and Exchange Commission (SEC), arguing that

crypto tokens should not be classified as securities. The New

York-based firm recently refuted the allegation that it operated as

an unregistered exchange and broker-dealer. This response follows

the SEC’s issuance of a Wells Notice to Uniswap Labs, signaling its

intent to recommend legal action against the company. Uniswap

Labs Challenges SEC’s Claims In a 40-page filing submitted to the

SEC, Uniswap Labs outlined numerous reasons why the agency’s

pursuit of legal action should be reconsidered. The SEC’s claims

are primarily based on the assumption that all tokens are

securities, a premise that Uniswap Labs disputes. Related Reading:

Institutional Investors Pour $942 Million Into Bitcoin, Will This

Trigger A Rally To $80,000? Marvin Ammori, Chief Legal Officer of

Uniswap Labs, emphasized that tokens are merely a file format for

value and not inherently securities. He criticized the SEC’s

attempt to redefine the terms “exchange,” “broker,” and “investment

contract” to encompass Uniswap’s operations. This year, the

SEC has taken action against numerous crypto firms through Wells

notices, lawsuits, or settlements. The commission’s scrutiny

has increasingly focused on Ethereum and decentralized finance

players, including Uniswap, ShapeShift, TradeStation, and

Consensys. Additionally, reports suggest that the Ethereum

Foundation is under investigation. Distinction Between Tokens

And Securities Uniswap Labs believes that the SEC’s case against

them is flawed. It fails to recognize the distinction between

tokens as files for value and tokens as securities. If the SEC

proceeds with a lawsuit accusing Uniswap Labs of operating as an

unregistered exchange, it risks facing adverse consequences

regarding its authority over crypto tokens. Uniswap Labs

warned that such litigation could set a precedent undermining the

SEC’s ongoing rulemaking efforts. The company expressed its

willingness to litigate if necessary and expressed confidence in a

favorable outcome, stating: But we’re prepared to fight. Our

lawyers are 2-0 in high-profile SEC cases. Andrew Ceresney, a

former head of enforcement at the SEC, represented Ripple in their

victory over the SEC. Don Verrilli, a former U.S. solicitor

general, has argued more than 50 cases before the U.S. Supreme

Court and represented Grayscale in its successful case against the

SEC. Related Reading: Why Is The Ethereum Price Up 20% Today? SEC

Chairman Gary Gensler has consistently maintained that

decentralized exchanges are not genuinely decentralized and should

fall under the regulator’s purview. Gensler has also argued

that many digital assets qualify as unregistered securities subject

to SEC regulations. Uniswap Labs, in its response, contended that

its governance token, UNI, does not meet the requirements of the

Howey Test, a legal framework used to evaluate investment

contracts. The company also disputed the SEC’s classification

of LP tokens, which are used as securities for liquidity provision

in Uniswap pools. Uniswap Labs asserted that LP tokens are

accounting tools rather than investment instruments. Uniswap’s

native token UNI has seen significant gains of nearly 20% in the

last 24 hours alone, as the market rebounded from a two-month

consolidation period to trade at $9.34. Featured image from

Shutterstock, chart from TradingView.com

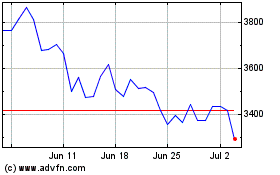

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From May 2024 to Jun 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Jun 2023 to Jun 2024