false

2024

Q1

--12-31

0001850391

0001850391

2024-01-01

2024-03-31

0001850391

2024-03-31

0001850391

2023-12-31

0001850391

cik0001850391:DigitalAssetsBitcoinMember

2024-01-01

2024-03-31

0001850391

cik0001850391:DigitalAssetsBitcoinMember

2024-03-31

0001850391

cik0001850391:DigitalAssetsMember

2024-03-31

0001850391

cik0001850391:OtherAssetsLessLiabilitiesMember

2024-01-01

2024-03-31

0001850391

cik0001850391:OtherAssetsLessLiabilitiesMember

2024-03-31

0001850391

us-gaap:FairValueInputsLevel1Member

2024-03-31

0001850391

us-gaap:FairValueInputsLevel2Member

2024-03-31

0001850391

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001850391

2023-12-01

2023-12-31

0001850391

2024-01-11

2024-03-31

0001850391

cik0001850391:WisdomTreeIncMember

2023-12-31

0001850391

cik0001850391:WisdomTreeIncMember

2024-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

cik0001850391:Integer

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31,

2024

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-03480

WISDOMTREE BITCOIN FUND

(Exact name of registrant as specified in its

charter)

| Delaware |

|

99-6119726 |

|

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

250 West 34th Street, 3rd Floor

New York, New York 10119

|

| (Address of Principal Executive Offices) (Zip Code) |

Registrant’s telephone number, including

area code: (866) 909-9473

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Shares of Beneficial Interest of WisdomTree Bitcoin Fund |

BTCW |

Cboe BZX Exchange, Inc. |

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer |

¨ |

|

Accelerated Filer |

¨ |

| Non-Accelerated Filer |

x |

|

Smaller reporting company |

x |

| |

|

|

Emerging growth company |

x |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of outstanding Shares as of

March 31, 2024: 1,080,000

WISDOM TREE BITCOIN FUND

QUARTER ENDED MARCH 31, 2024

TABLE OF CONTENTS

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

1 |

| PART I. FINANCIAL INFORMATION |

2 |

| ITEM 1. FINANCIAL STATEMENTS |

2 |

| |

Statements of Financial Condition |

2 |

| |

Schedule of Investment |

3 |

| |

Statement of Operations |

4 |

| |

Statement of Changes in Net Assets |

5 |

| |

Statement of Cash Flows |

6 |

| |

Notes to Unaudited Financial Statements |

7 |

| ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

12 |

| ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

16 |

| ITEM 4. CONTROLS AND PROCEDURES |

16 |

| PART II. OTHER INFORMATION |

16 |

| Item 1. Legal Proceedings |

16 |

| Item 1A. Risk Factors |

16 |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds |

16 |

| Item 3. Defaults Upon Senior Securities |

17 |

| Item 4. Mine Safety Disclosures |

17 |

| Item 5. Other Information |

17 |

| Item 6. Exhibits |

17 |

| |

SIGNATURES |

18 |

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report on Form 10-Q contains “forward-looking

statements” (as such term is defined in the Private Securities Litigation Reform Act of 1995) that involve risks and uncertainties

and are subject to change based on various important factors, many of which may be beyond our control. In some cases, you can identify

forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “intend,”

“plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential”

or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in

this quarterly report that address activities, events or developments that will or may occur in the future, including such matters as

movements in the cryptocurrencies markets and indexes that track such movements, the Trust’s operations, the Sponsor’s plans

and references to the Trust’s future success and other similar matters, are forward-looking statements. These statements are only

predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses the Sponsor

has made based on its perception of historical trends, current conditions and expected future developments, as well as other factors appropriate

in the circumstances. Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions,

however, is subject to a number of risks and uncertainties, including the special considerations discussed in this quarterly report and

“Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2023, general economic, market and

business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or regulatory

bodies, and other world economic and political developments. Consequently, all the forward-looking statements made in this quarterly report

are qualified by these cautionary statements, and there can be no assurance that actual results or developments the Sponsor anticipates

will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects

on, the Trust’s operations or the value of its Shares.

Unless otherwise stated or the context otherwise requires, the terms

“we,” “our” and “us” in this quarterly report refer to the Trust.

PART

I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

WisdomTree Bitcoin Fund

Statements of Financial Condition

March 31, 2024 and December 31,

2023

| | |

| | | |

| | |

| | |

March 31, 2024

(unaudited) | | |

December 31,

2023 | |

| ASSETS: | |

| | | |

| | |

| Investment in Bitcoin, at cost | |

$ | 63,518,740 | | |

$ | – | |

| Investment in Bitcoin, at fair value (Note 2) | |

| 80,980,787 | | |

| – | |

| Cash | |

| 3,372 | | |

| 50,000 | |

| Total Assets | |

| 80,984,159 | | |

| 50,000 | |

| LIABILITIES: | |

| | | |

| | |

| Total Liabilities | |

| – | | |

| – | |

| NET ASSETS | |

| 80,984,159 | | |

| 50,000 | |

| | |

| | | |

| | |

| Net Assets consist of: | |

| | | |

| | |

| Capital Stock | |

| 62,520,262 | | |

| 50,000 | |

| Total distributable earnings (loss) | |

| 18,463,897 | | |

| – | |

| NET ASSETS | |

| 80,984,159 | | |

| 50,000 | |

| Outstanding beneficial interest shares of $0.0001 par value (unlimited number of shares authorized) | |

| 1,080,000 | | |

| 1,000 | |

| Net Asset Value Per Share | |

$ | 74.99 | | |

$ | 50.00 | |

See accompanying Notes to Unaudited Financial

Statements which are an integral part of the financial statements.

WisdomTree Bitcoin Fund

Schedule of Investment (Unaudited)

March 31, 2024

| | |

| | | |

| | |

| Investment | |

Quantity | | |

Value | |

| DIGITAL ASSETS – 100.0% | |

| | | |

| | |

| Bitcoin(a) | |

| 1,147 | | |

$ | 80,980,787 | |

TOTAL INVESTMENT IN BITCOIN (Cost: $63,518,740) | |

| | | |

| 80,980,787 | |

| Other Assets less Liabilities – 0.0% | |

| | | |

| 3,372 | |

| NET ASSETS - 100.0% | |

| | | |

$ | 80,984,159 | |

FAIR VALUATION SUMMARY

The following is a summary of the fair valuations according to the inputs used in valuing the Trust's investments (See Note 2 - Fair Value Measurement):

| | |

| | | |

| | | |

| | | |

| | |

| | |

Quoted

Prices in

Active

Markets (Level 1) | | |

Other

Significant

Observable

Inputs (Level 2) | | |

Significant

Unobservable

Inputs (Level 3) | | |

Total | |

| Assets: | |

| | | |

| | | |

| | | |

| | |

| Investment in Bitcoin | |

| | | |

| | | |

| | | |

| | |

| Digital Assets | |

$ | 80,980,787 | | |

$ | — | | |

$ | — | | |

$ | 80,980,787 | |

| Total Investment in Bitcoin | |

$ | 80,980,787 | | |

$ | — | | |

$ | — | | |

$ | 80,980,787 | |

December 31, 2023*

| * |

As of December 31, 2023, the WisdomTree Bitcoin Fund did not hold

any investments in Bitcoin. |

See accompanying Notes to Unaudited Financial

Statements which are an integral part of the financial statements.

WisdomTree Bitcoin Fund

Statement of Operations (Unaudited)†

| † | |

| |

| | |

For the Period

January 11,

2024‡ through

March 31, 2024 | |

| | |

| |

| INVESTMENT INCOME: | |

| |

| Total investment income | |

$ |

– | |

| | |

| |

| EXPENSES: | |

| | |

| Total expenses | |

| 20,085 | |

| Net expenses | |

| – | |

| Net investment income | |

| – | |

| | |

| | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENT: | |

| | |

| Net realized gain from investment in Bitcoin | |

| 1,001,850 | |

| Net increase in unrealized appreciation on investment in Bitcoin | |

| 17,462,047 | |

| Net realized and unrealized gain on investment in Bitcoin | |

| 18,463,897 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | |

$ | 18,463,897 | |

See accompanying Notes to Unaudited Financial

Statements which are an integral part of the financial statements.

WisdomTree Bitcoin Fund

Statement of Changes in Net Assets (Unaudited)†

| † | |

| | |

| | |

For the Three

Months Ended

March 31, 2024 | |

| INCREASE IN NET ASSETS RESULTING FROM OPERATIONS: | |

| | |

| Net investment income | |

$ | – | |

| Net realized gain on investment in Bitcoin | |

| 1,001,850 | |

| Net increase in unrealized appreciation on investment in Bitcoin | |

| 17,462,047 | |

| Net increase in net assets resulting from operations | |

| 18,463,897 | |

| | |

| | |

| CAPITAL SHARE TRANSACTIONS: | |

| | |

| Net proceeds from sale of shares | |

| 69,901,679 | |

| Cost of shares redeemed | |

| (7,431,417 | ) |

| Net increase in net assets resulting from capital share transactions | |

| 62,470,262 | |

| Net Increase in Net Assets | |

| 80,934,159 | |

| | |

| | |

| NET ASSETS: | |

| | |

| Beginning of period | |

$ | 50,000 | |

| End of period | |

$ | 80,984,159 | |

| | |

| | |

| SHARES CREATED AND REDEEMED: | |

| | |

| Shares outstanding, beginning of period | |

| 1,000 | |

| Shares created | |

| 1,189,000 | |

| Shares redeemed | |

| (110,000 | ) |

| Shares outstanding, end of period | |

| 1,080,000 | |

See accompanying Notes to Unaudited Financial

Statements which are an integral part of the financial statements.

WisdomTree Bitcoin Fund

Statement of Cash Flows (Unaudited)†

| † | |

| | |

| | |

For the Three

Months Ended

March 31, 2024 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | |

| Net increase in net assets resulting from operations | |

$ | 18,463,897 | |

| ADJUSTMENTS TO RECONCILE NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS TO NET CASH PROVIDED BY (USED FOR) OPERATING ACTIVITIES: | |

| | |

| Purchases of investment in Bitcoin | |

| (66,105,117 | ) |

| Proceeds from sales of investment in Bitcoin | |

| 3,588,227 | |

| Net realized gain on investment in Bitcoin | |

| (1,001,850 | ) |

| Net change in unrealized appreciation from investment in Bitcoin | |

| (17,462,047 | ) |

| Net cash used for operating activities | |

| (62,516,890 | ) |

| | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | |

| Net proceeds from the sale of shares | |

| 69,901,679 | |

| Cost of shares redeemed | |

| (7,431,417 | ) |

| Net cash provided by financing activities | |

| 62,470,262 | |

| Net decrease in cash | |

| (46,628 | ) |

| Cash at beginning of period | |

| 50,000 | |

| Cash at end of period | |

$ | 3,372 | |

See accompanying Notes to Unaudited Financial

Statements which are an integral part of the financial statements.

WisdomTree Bitcoin Fund

Notes

to Unaudited Financial Statements

March 31, 2024

1. ORGANIZATION

WisdomTree Bitcoin Fund (the “Trust”)

is a Delaware statutory trust organized on March 8, 2021 under Delaware law pursuant to the Delaware Statutory Trust Act (the “DTSA”)

and Fund Agreement (the “Trust Agreement”). The Trust’s investment objective is to gain exposure to the price of bitcoin,

less expenses and liabilities of the Trust’s operations. The Trust is an exchange-traded fund that issues common shares of beneficial

interest (the “Shares”) that are listed on the Cboe BZX Exchange, Inc. (the “Exchange”) and trade under the ticker

symbol “BTCW.”

WisdomTree Digital Commodity Services, LLC (the

“Sponsor”) serves as sponsor of the Trust. The Sponsor arranged for the creation of the Trust and is responsible for the ongoing

registration of the Shares for public offering in the United States and the listing of Shares on the Exchange. The Sponsor will develop

and administer a marketing plan for the Trust and prepare marketing materials regarding the Shares, in each case in conjunction with Foreside

Fund Services, LLC (the “Marketing Agent”). The Sponsor will select the service providers, negotiate the applicable agreements

and fees and monitors the performance of the Trust.

Delaware Trust Company (the “Trustee”)

acts as the trustee of the Trust for the purpose of creating a Delaware statutory trust in accordance with the DSTA. The Trustee is appointed

to serve as the trustee of the Trust in the State of Delaware for the sole purpose of satisfying the requirement of Section 3807(a) of

the DSTA that the Trust have at least one trustee with a principal place of business in the State of Delaware.

Prior to December 31, 2023, the Trust had no

operations other than matters relating to its organization and registration under Securities Act of 1933, as amended (the “1933 Act”). WisdomTree, Inc., the parent of the

Sponsor, purchased (i)

$50,000 in Shares at a price per Share of $50 on December 22, 2023, and (ii) $2,450,000 in Shares at a price per Share of $50 on

January 8, 2024, for a total of $2,500,000, resulting in total ownership of 50,000 Shares. Proceeds from the

issuance of these shares were held in cash as presented on the Trust’s Statement of Financial Condition. Effective January 10,

2024, the Trust’s registration statement relating to the continuous public offering of its Shares was declared effective by

the U.S. Securities and Exchange Commission (the “SEC”) and the Trust commenced trading on the Exchange on January 11,

2024.

In the ordinary course of operation, the Trust

will sell or redeem its Shares, in blocks of 5,000 Shares (a “Basket”) based on the quantity of bitcoin attributable to each

Share of the Trust (net of accrued but unpaid expenses and liabilities). For a subscription of Shares, the subscription shall be in the

amount of cash needed to purchase the amount of bitcoin represented by the Basket being created, in each case as calculated by State Street

Bank and Trust Company, the Trust’s administrator (the “Trust Administrator” or the “Cash Custodian”). For

a redemption of Shares, the Sponsor shall arrange for the bitcoin represented by the Basket to be sold and the cash proceeds distributed.

Financial firms that are authorized to purchase or redeem Shares with the Trust (known as “Authorized Participants”) will

deliver cash to the Trust’s account with the Cash Custodian in exchange for Shares when they purchase Shares and will receive cash

(from the Cash Custodian), when they redeem Shares with the Trust. Shares initially comprising the same Basket but offered by the Authorized

Participants to the public at different times may have different offering prices, which depend on various factors, including the supply

and demand for Shares, the value of the Trust’s assets, and market conditions at the time of a transaction.

In the normal course of business, the Trust may

enter into contracts that contain a variety of representations or that provide indemnification for certain liabilities. The Trust’s

maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have

not yet occurred. However, the Trust has not had prior claims or losses pursuant to these contracts and believes such exposure to be remote.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary

of significant accounting policies consistently followed by the Trust in the preparation of its financial statements. The financial statements

have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”) and

in the opinion of management reflect all adjustments, consisting of only normal recurring adjustments, necessary for a fair presentation

of the financial statements. The Trust is an investment company for GAAP purposes and follows the specialized accounting and reporting

guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC” or “Codification”)

Topic 946, Financial Services—Investment Companies. Rules and interpretive releases of the SEC under authority of federal laws are

also sources of authoritative GAAP for SEC registrants.

Indemnifications

— The Trust Agreement provides that the Sponsor and its shareholders, members, directors, officers, employees, affiliates and subsidiaries

(each a “Sponsor Indemnified Party”) will be indemnified by the Trust and held harmless against any loss, liability or expense

incurred under the Trust Agreement without fraud, bad faith, or willful misconduct on the part of such Sponsor Indemnified Party arising

out of or in connection with the performance of its obligations hereunder or any actions taken in accordance with the provisions of the

Trust Agreement. The Trust’s maximum exposure under these arrangements cannot be known; however, the Trust expects any risk of loss

to be remote.

Use of Estimates

— The preparation of financial statements in conformity with GAAP, requires management to make certain estimates and assumptions

that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of increases and decreases in the net assets from operations during the reporting period. Actual results

could differ from those estimates.

Investment Valuation

— The Trust’s investment in bitcoin is recorded on the financial statements at fair value in accordance with FASB ASC Topic 820, “Fair

Value Measurements and Disclosures” (“ASC 820”). Fair value is defined as the price that would be received to sell an

asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. A fair value measurement

assumes that the transaction to sell the asset or transfer the liability takes place either in the principal market for the asset or liability

or, in the absence of a principal market, in the most advantageous market for the asset for liability. ASC 820 defines “principal

market” as the market with the greatest volume and level of activity for the asset or liability. The determination of the principal

market (and, as a result, the market participants in the principal market) is made from the perspective of the reporting entity. ASC 820

defines “most advantageous market” as the market that maximizes the amount that would be eived to sell the asset or minimizes

the amount that would be paid to transfer the liability, after taking into account transaction costs and transportation costs. Based on

the foregoing, the Trust has determined its principal market for GAAP reporting for its bitcoin investment to be the cryptocurrency exchange

platform operated by Coinbase, Inc. and utilizes an exchange-traded price from that principal market as of 11:59:59 p.m. Eastern Standard

Time on the financial statement measurement date.

ASC

820 has established a three-tier hierarchy of inputs to be used when determining fair value measurements for disclosure purposes. Inputs

refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk

— for example, the risk inherent in a particular valuation technique used to measure fair value (such as a pricing model) and/or

the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs reflect the assumptions

market participants would use in pricing the asset or liability. Observable inputs are based on market data obtained from sources independent

of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants

would use in pricing the asset or liability. Unobservable inputs are based on the best information available in the circumstances. The

three-tier hierarchy of inputs is summarized in the three broad levels listed below:

Level 1 –

quoted prices in active markets for identical securities

Level 2 –

other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 –

significant unobservable inputs (including the Trust’s assumptions in determining the fair value of investments)

The inputs

or methodology used for valuation are not necessarily an indication of the risk associated with investing in those investments.

The summary of fair valuations

according to the inputs used in valuing the Trust’s assets as of the measurement date is included in a “Fair Valuation Summary”

supplementary table in the Schedule of Investment.

For the three

months ended March 31, 2024 and the period ended December 31, 2023, there were no significant transfers into or out of Level 3 of the fair value hierarchy.

Income Taxes —

The Trust is classified as a “grantor trust” for United States federal income tax purposes. As a result, the Trust itself

will not be subject to United States federal income tax. Instead, the Trust’s income and expenses will “flow through”

to the shareholders. Consequently, each sale of bitcoin by the Trust would constitute a taxable event to shareholders.

3. EXPENSES, ORGANIZATION AND OFFERING COSTS

The Trust pays the Sponsor a fee (the “Sponsor

Fee”) in accordance with the Trust agreement and as set forth in the Prospectus. The Sponsor

Fee is per annum of the Trust’s daily net asset value. The Sponsor Fee will accrue daily and be payable monthly in

U.S. dollars. The Trust’s only ordinary recurring expense is expected to be the Sponsor Fee. In

exchange for the Sponsor’s Fee, the Sponsor has agreed to assume the marketing and the following administrative expenses of the

Trust: the fees of the Trustee, the Trust Administrator, Fund Accountant, Transfer Agent, the Marketing Agent,

the Cash Custodians’ Fee, Exchange listing fees, SEC registration fees, printing and mailing costs, tax reporting fees, audit fees,

license fees and ordinary legal fees and expenses. The Sponsor will also pay the costs of the Trust’s organization and the initial

sale of the Shares. There is no cap on the amount of these Sponsor paid expenses.

For a six-month period

that commenced on January 11, 2024, the

For the period ended March 31, 2024, the Sponsor waived $ of its fee. Prior to January 11, 2024 and for the period ended December

31, 2023, the Trust did not incur a Sponsor fee.

The Trust may incur certain non-recurring expenses

that are not assumed by the Sponsor, including but not limited to, taxes and governmental charges, any applicable brokerage commissions,

financing charges or fees, Bitcoin network fees and similar transaction fees, expenses and costs of any extraordinary services performed

by the Sponsor (or any other service provider) on behalf of the Trust to protect the Trust or the interests of Shareholders (including,

for example, in connection with any fork of the Bitcoin Blockchain), any indemnification of the Cash Custodian, Bitcoin Custodian, Trust

Administrator or other agents, service providers or counterparties of the Trust and extraordinary legal fees and expenses, including any

legal fees and expenses incurred in connection with litigation, regulatory enforcement or investigation matters.

Because the Trust does not have any income, it

will need to sell bitcoin to cover the Sponsor’s Fee and expenses not assumed by the Sponsor, if any. The Trust may also be subject

to other liabilities (for example, as a result of litigation) that have also not been assumed by the Sponsor. The only source of funds

to cover those liabilities will be sales of bitcoin held by the Trust. Even if there are no expenses other than those assumed by the Sponsor,

and there are no other liabilities of the Trust, the Trust will still need to sell bitcoin to pay the Sponsor’s Fee. The result

of these sales is a decrease in the amount of bitcoin represented by each Share.

To cover the Sponsor’s Fee and expenses

not assumed by the Sponsor, the Sponsor or its delegate will cause the Trust (or its delegate) to convert bitcoin into U.S. dollars at

the price available through the Prime Execution Agent. The number of bitcoins represented by a Share will decline each time the Trust

pays the Sponsor Fee or any Trust expenses not assumed by the Sponsor by transferring or selling bitcoins. The Trust is responsible for

paying any costs associated with the transfer of bitcoin to the Sponsor or the sale of bitcoin. However, under the terms of each Authorized

Participant Agreement, the Authorized Participants will be responsible for any brokerage or transaction costs associated with the sale

or transfer of Bitcoin incurred in connection with the fulfillment of a creation or redemption order.

4. RELATED PARTIES

As of December 31, 2023, WisdomTree, Inc. owned

1,000 shares or 100% of the outstanding Shares of the Trust. As of March 31, 2024, WisdomTree, Inc. owned 50,000 shares or approximately

5% of the outstanding Shares of the Trust.

5. CREATIONS AND REDEMPTION OF SHARES

The Sponsor has the power and authority, without

action or approval by the shareholders, to cause the Trust to issue Shares from time to time as it deems necessary or desirable, but only

in one or more baskets (“Baskets”) of 5,000 shares based on the quantity of bitcoin attributable to each Share of the Trust.

The number of Shares authorized is unlimited. From time to time, the Sponsor may cause the Trust to divide or combine the Shares into

a greater or lesser number without thereby changing the proportionate beneficial interests in the Trust, or in any way affecting the rights,

of the shareholders, without action or approval by the shareholders. The ownership of Shares are recorded on the books of the Trust or

a transfer or similar agent for the Trust. No certificates certifying the ownership of Shares are issued except as the Sponsor may otherwise

determine from time to time. The Sponsor may make such rules as it considers appropriate for the issuance of share certificates, transfer

of Shares and similar matters. The record books of the Trust as kept by the Trust, or any transfer or similar agent, as the case may be,

are conclusive as to the identity of the shareholders and as to the number of Shares held from time to time by each.

“Authorized Participants” are the

only persons that may place orders to create and redeem Baskets. Each Authorized Participant must (i) be a registered broker-dealer or

other securities market participant, such as a bank or other financial institution that is not required to register as a broker-dealer

to engage in securities transactions, and (ii) be a participant in The Depository Trust Company, and (iii) have entered into an Authorized

Participant Agreement.

The total deposit of cash required to create each

Basket includes the cash equivalent of an amount of bitcoin that is in the same proportion to the total assets of the Trust. In order

to calculate the amount of cash necessary for a creation Basket, the Trust administrator multiplies the NAV per share by the number of

Shares in a creation Basket (5,000). Each night, the Sponsor or Trust administrator publish the amount of cash that will be required in

exchange for each creation Basket the next business day.

NAV per Share for purposes of facilitating creations and redemptions

of the Trust is computed each business day using the CME CF Bitcoin Reference Rate – New York Variant (the “Reference Rate”)

as of 4:00 p.m. Eastern Time to value the Trust’s investment in bitcoin. The methodology of the Reference Rate used to value bitcoin

for purposes of calculating NAV per Share may not be deemed consistent with GAAP.

Creation and redemption transactions of Shares of the Trust are shown

in the Statement of Changes in Net Assets.

6. FINANCIAL HIGHLIGHTS1

Selected data for a share of beneficial interest outstanding throughout

the period is presented below:

| Schedule of financial highlights | |

| | |

| | |

For the Three

Months Ended

March 31, 2024

(unaudited) | |

| Net asset value, beginning of period^ | |

$ | 50.00 | |

| Investment operations: | |

| | |

| Net income | |

| — | |

| Net realized and unrealized gain | |

| 24.99 | |

| Total from investment operations | |

| 24.99 | |

| Net asset value, end of period | |

| 74.99 | |

| TOTAL RETURN2 | |

| 49.98 | % |

| RATIOS/SUPPLEMENTAL DATA: | |

| | |

| Net assets, end of period (000’s omitted) | |

$ | 80,984 | |

| Ratios to average net assets of: | |

| | |

| Expenses, net of expense waivers3 | |

| 0.00 | % |

| Expenses, prior to expense waivers3 | |

| 0.25 | % |

| Net investment income3 | |

| 0.00 | % |

7. SUBSEQUENT EVENTS

The Sponsor has evaluated all subsequent transactions and events through

the date on which these financial statements were issued and has determined that no additional items require disclosure in these financial

statements.

| ITEM 2. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

The following discussion and analysis of our

financial condition and results of operations should be read together with, and is qualified in its entirety by reference to, our unaudited

financial statements and related notes included elsewhere in this Quarterly Report on Form 10-Q (this "Quarterly Report”), which

have been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”). The following

discussion may contain forward-looking statements based on assumptions we believe to be reasonable. Our actual results could differ materially

from those discussed in these forward-looking statements. Factors that could cause or contribute to these differences include, but are

not limited to, those discussed below and elsewhere in this Quarterly Report, “Cautionary Note Regarding Forward-Looking Statements,”

and the risks described in the in Item 1A. “Risk Factors” of the Trust’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2023.

Overview

The Trust is an exchange-traded fund that issues

Shares that are traded on the Exchange. The Trust’s investment objective is to gain exposure to the price of bitcoin as represented

by the Reference Rate, less expenses and liabilities of the Trust’s operations. In seeking to achieve its investment objective,

the Trust holds bitcoin and values its Shares daily based on the Reference Rate, which is based on an aggregation of executed trade flow

of major bitcoin platforms.

Prior to January 8, 2024, the Trust had no operations

other than a sale to WisdomTree, Inc., the parent of the Sponsor, of 1,000 shares at $50 per share for total proceeds of $50,000. On January

8, 2024, WisdomTree, Inc. purchased an additional 49,000 shares at $50 per share for total proceeds of $2,450,000. Total proceeds to the

Trust from these initial sales of the shares were $2,500,000. On January 11, 2024, the Shares commenced trading on Cboe BZX Exchange,

Inc. under the ticker symbol “BTCW”.

The following discussion and analysis was prepared

to supplement information contained in the accompanying financial statements and is intended to explain certain items regarding the Trust’s

financial condition as of March 31, 2024, and its results of operations for the period ended March 31, 2024. It should be read

in conjunction with the unaudited financial statements and related notes thereto contained in this Quarterly Report.

Critical Accounting Policies and Estimates

Fair Value Determination

The Trust’s

investment in bitcoin is recorded on the financial statements at fair value in accordance with FASB ASC Topic 820, “Fair Value

Measurements and Disclosures” (“ASC 820”). Fair value is defined as the price that would be received to sell an

asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. A fair value

measurement assumes that the transaction to sell the asset or transfer the liability takes place either in the principal market for

the asset or liability or, in the absence of a principal market, in the most advantageous market for the asset for liability. ASC

820 defines “principal market” as the market with the greatest volume and level of activity for the asset or liability.

The determination of the principal market (and, as a result, the market participants in the principal market) is made from the

perspective of the reporting entity. ASC 820 defines “most advantageous market” as the market that maximizes the amount

that would be received to sell the asset or minimizes the amount that would be paid to transfer the liability, after taking into

account transaction costs and transportation costs. Based on the foregoing, the Trust has determined its principal market for GAAP

reporting for its bitcoin investment to be the cryptocurrency exchange platform operated by Coinbase, Inc. and utilizes an

exchange-traded price from that principal market as of 11:59:59 p.m. Eastern Time on the financial statement measurement date. The

Sponsor will perform other procedures (consistent with GAAP) to value an investment in bitcoin when a market quote is not

available.

Results of Operations

Prior to January 8, 2024, the Trust had no operations

other than a sale to WisdomTree, Inc., the parent of the Sponsor, of 1,000 shares at $50 per share for total proceeds of $50,000.

On January 8, 2024, (i) WisdomTree, Inc. purchased

an additional 49,000 shares at $50 per share for total proceeds of $2,450,000. Total proceeds to the Trust from these initial sales of

the shares were $2,500,000 and (ii) the Trust purchased 53.115 bitcoin with the proceeds of the initial sale of shares using the Prime

Execution Agent.

On January 10, 2024, the Trust’s registration

statement on Form S-1/A (File No. 333-254134) was declared effective pursuant to which the Trust registered the offering of an unlimited

number of Shares. The Trust’s Shares began trading on the Cboe BZX Exchange, Inc. on January 11, 2024 and since that date through

March 31, 2024 (excluding any redemptions), the Trust sold 1,140,000 Shares for aggregate proceeds of $67,395,856. The Trust seeks to

use substantially all of the proceeds of the offering of Shares to make investments in bitcoin in a manner consistent with the Trust’s

investment objective.

There is no performance history for the Trust

prior to the beginning of trading on January 11, 2024. On January 10, 2024, the SEC approved the listing and trading of a number of spot

bitcoin exchange-traded funds (the “ETFs”), including the Trust. The ETFs have improved the liquidity of the bitcoin trading

market which we believe have contributed to the increase in the market price of bitcoin for the three months ended March 31, 2024.

Selected Financial

Highlights for the period January 11, 2024 through March 31, 2024

| |

|

For

the Period January 11, 2024†

through March 31, 2024 |

|

| Net realized and unrealized gain on

investment in Bitcoin |

|

$ |

18,463,897 |

|

| Net increase in net assets resulting from operations |

|

$ |

18,463,897 |

|

| Net assets |

|

$ |

80,984,159 |

|

† The commencement of operations date is considered to be the date the WisdomTree Bitcoin Fund began

trading in the secondary market, which is January 11, 2024.

Net realized and

unrealized gain on investment in bitcoin for the three months ended March 31, 2024 was $18,463,897 which

includes a net change in unrealized appreciation on investment in bitcoin of $17,462,047. Net realized and unrealized gain

on investment in bitcoin for the period was driven by bitcoin price appreciation from $46,411.68 per bitcoin as

of January 10, 2024 (the end of day price prior to the commencement of operations) to $70,596.99 per bitcoin as

of March 31, 2024. Net increase in net assets resulting from operations was $18,463,897 for the three

months ended March 31, 2024, which consisted of the net realized and unrealized gain on investment in bitcoin. Net assets

increased to $80,984,159 at March 31, 2024, and total return (based on NAV per Share) for the period was 49.98%. The

increase in net assets resulted from the aforementioned bitcoin price appreciation and by $62,470,262 of net increase resulting from

capital share transactions.

Net Asset Value

The Trust’s NAV per Share is calculated

by:

|

• |

taking the Trust’s total assets including, but not limited to, the market value of bitcoin, carrying

amount of cash or other assets; |

|

• |

subtracting any liabilities; and |

|

• |

dividing that total by the total number of outstanding Shares. |

The methodology of the Reference Rate used to

value bitcoin for purposes of calculating NAV per Share may not be deemed consistent with GAAP. To the extent the methodology used to

calculate the Reference Rate is deemed not to be consistent with GAAP, the Trust will utilize an alternative GAAP-consistent pricing source

for purposes of the Trust’s periodic financial statements, as further discussed below.

The Trust Administrator calculates the NAV of

the Trust once each Exchange trading day. The NAV for a normal trading day will be released after 4:00 p.m. EST. Trading during the core

trading session on the Exchange typically closes at 4:00 p.m. EST. However, NAVs are not officially struck until later in the day (often

by 5:30 p.m. EST and almost always by 8:00 p.m. EST).

The Sponsor believes that the Reference Rate is

reflective of a reasonable valuation of the average spot price of bitcoin. However, in the event the Reference Rate is not available or

is determined by the Sponsor to not be reliable, the Sponsor will “fair value” the Trust’s bitcoin holdings. The Sponsor

does not anticipate that the need to “fair value” bitcoin will be a common occurrence. The Sponsor reserves the right to replace

the Reference Rate with another valuation methodology which it believes will accurately track the price of bitcoin. If the Sponsor makes

the decision to materially change the valuation methodology or replace either the Reference Rate or the Benchmark Administrator, the Sponsor

will notify Shareholders via a posting on the Trust’s website, prospectus supplement, post-effective amendment, through a current

report on Form 8-K or in the Trust’s annual or quarterly reports.

The Sponsor publishes the NAV, NAV per Share and

the Trust’s bitcoin holdings at www.wisdomtree.com/investments after their determination and availability. Reference Rate data and

the description of the Reference Rate are based on information made publicly available by the Benchmark Administrator on its website at

https://www.cfbenchmarks.com.

As of March 28, 2024, the Trust had a net closing

balance of 1,147.085551 bitcoins with a value of $81,169,632 based on the Reference Rate Price of $70,761.62, which is calculated pursuant to non-GAAP methodology. As

of March 31, 2024, the total market value of the Trust’s bitcoin was $80,980,787, based on the price of a bitcoin in the principal

market of $70,596.99. For the three months ended March 31, 2024, the Trust determined that Coinbase was its principal market.

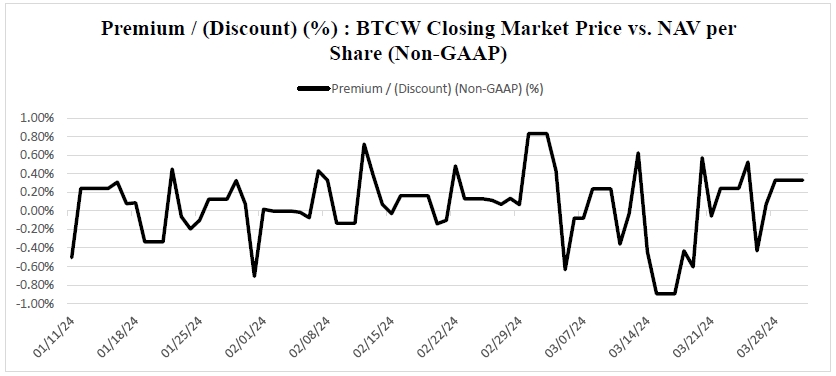

The following chart illustrates the movement in

the Market Price per Share and the Trust’s NAV per Share from January 11, 2024, the date the Trust was listed on the Exchange, to

March 31, 2024.

The table below illustrates the high and low price of Bitcoin as represented by the Reference Rate and the principal market during the

period ended March 31, 2024.

| |

|

|

High |

|

|

Low |

|

|

End of Period |

|

| Period |

|

|

Reference

Rate Price |

|

|

Principal

Market

Price |

|

|

Date |

|

|

Reference

Rate Price |

|

|

Principal

Market

Price |

|

|

Date |

|

|

Reference

Rate

Price‡ |

|

|

Principal

Market

Price |

|

| For the period ended March 31, 2024† |

|

|

$ |

73,127.23 |

|

|

$ |

73,308.46 |

|

|

|

3/13/24 |

|

|

$ |

39,238.43 |

|

|

$ |

39,631.41 |

|

|

|

1/23/24 |

|

|

$ |

70,761.62 |

|

|

$ |

70,596.99 |

|

|

† |

For the period January 8, 2024 (initial purchase date of Bitcoin investment) through March 31, 2024. |

|

‡ |

The Reference Rate Price shown is as of the last business day during the period. |

Liquidity and Capital Resources

The Trust is not aware of any trends, demands,

conditions or events that are reasonably likely to result in material changes to its liquidity needs.

The Trust

will pay the Sponsor a unified fee of 0.25% per annum of the Trust’s average daily NAV (the “Sponsor Fee”) as compensation

for services performed under the Trust Agreement. The Trust’s only ordinary recurring expense is the Sponsor Fee. For the 6-month

period commencing on January 11, 2024, the day the Trust’s Shares are initially listed on the Exchange,

the Sponsor will waive the entire Sponsor Fee on the first $1 billion of Trust assets.

Except for

periods during which all or a portion of the Sponsor Fee is being waived, the Sponsor Fee will accrue and be payable in U.S. dollars.

The Trust’s only ordinary recurring expense is expected to be the Sponsor Fee. In exchange for the Sponsor’s Fee, the Sponsor

has agreed to assume the marketing and the following administrative expenses of the Trust: the fees of the Trustee, the Trust Administrator,

Fund Accountant, Transfer Agent, the Marketing Agent, the Cash Custodians’ Fee, Exchange

listing fees, SEC registration fees, printing and mailing costs, tax reporting fees, audit fees, license fees and ordinary legal fees

and expenses. The Sponsor will also pay the costs of the Trust’s organization and the initial sale of the Shares. There is no cap

on the amount of these Sponsor paid expenses.

The Sponsor may, at its sole discretion and from

time to time, waive all or a portion of the Sponsor Fee for stated periods of time. The Sponsor is under no obligation to waive any portion

of its fees and any such waiver shall create no obligation to waive any such fees during any period not covered by the waiver.

The Trust may incur certain non-recurring expenses

that are not assumed by the Sponsor, including but not limited to, taxes and governmental charges, any applicable brokerage commissions,

financing charges or fees, Bitcoin network fees and similar transaction fees, expenses and costs of any extraordinary services performed

by the Sponsor (or any other service provider) on behalf of the Trust to protect the Trust or the interests of Shareholders (including,

for example, in connection with any fork of the Bitcoin Blockchain), any indemnification of the Cash Custodian, Bitcoin Custodian, Trust

Administrator or other agents, service providers or counterparties of the Trust and extraordinary legal fees and expenses, including any

legal fees and expenses incurred in connection with litigation, regulatory enforcement or investigation matters.

Because the Trust does not have any income, it

will need to sell bitcoin to cover the Sponsor’s Fee and expenses not assumed by the Sponsor, if any. The Trust may also be subject

to other liabilities (for example, as a result of litigation) that have also not been assumed by the Sponsor. The only source of funds

to cover those liabilities will be sales of bitcoin held by the Trust. Even if there are no expenses other than those assumed by the Sponsor,

and there are no other liabilities of the Trust, the Trust will still need to sell bitcoin to pay the Sponsors Fee. The result of these

sales is a decrease in the amount of bitcoin represented by each Share.

To cover the Sponsor’s Fee and expenses

not assumed by the Sponsor, the Sponsor or its delegate will cause the Trust (or its delegate) to convert bitcoin into U.S. dollars at

the price available through the Prime Execution Agent. The number of bitcoins represented by a Share will decline each time the Trust

pays the Sponsor Fee or any Trust expenses not assumed by the Sponsor by transferring or selling bitcoins. The Trust is responsible for

paying any costs associated with the transfer of bitcoin to the Sponsor or the sale of bitcoin. However, under the terms of each Authorized

Participant Agreement, the Authorized Participants will be responsible for any brokerage or transaction costs associated with the sale

or transfer of Bitcoin incurred in connection with the fulfillment of a creation or redemption order.

We have not entered into any off-balance sheet

arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition,

revenues or expenses, results of operations, liquidity, capital expenditures or capital resources and would be considered material to

Shareholders.

| ITEM 3. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK. |

Not applicable.

| ITEM 4. |

CONTROLS AND PROCEDURES. |

Conclusion Regarding the Effectiveness of Disclosure

Controls and Procedures

The Trust maintains disclosure controls and procedures

that are designed to ensure that information required to be disclosed in its 1934 Act reports is recorded, processed, summarized and reported

within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to the

Principal Executive Officer and Principal Financial Officer of the Sponsor to allow timely decisions regarding required disclosure.

Under the supervision and with the participation

of the Principal Executive Officer and the Principal Financial Officer of the Sponsor, the Sponsor conducted an evaluation of the Trust’s

disclosure controls and procedures, as defined under 1934 Act Rule 13a-15(e). Based on this evaluation, the Principal Executive Officer

and the Principal Financial Officer of the Sponsor concluded that, as of March 31, 2024, the Trust’s disclosure controls and procedures

were effective.

Changes in Internal Control Over Financial

Reporting

There was no change in the Trust’s internal

controls over financial reporting that occurred during the Trust’s most recently completed fiscal quarter ended March 31, 2024 that

has materially affected, or is reasonably likely to materially affect, these internal controls.

PART II. OTHER INFORMATION

Item 1.

Legal Proceedings.

Not applicable.

Item 1A. Risk

Factors.

There are no material changes from risk factors

as previously disclosed in the Trust’s Annual Report on Form 10-K for the period ended December 31, 2023, filed March 29, 2024.

Item 2.

Unregistered Sales of Equity Securities and Use of Proceeds.

WisdomTree, Inc., the parent of the Sponsor, purchased:

(i) 1,000 Shares at a price per Share of $50 on December 22, 2023 for proceeds of $50,000, and (ii) 49,000 Shares at a price per Share

of $50 on January 8, 2024 for proceeds of $2,450,000, for a total of $2,500,000, resulting in total ownership of 50,000 Shares. The issuance

of such Shares was effected in reliance upon an exemption from registration provided by Section 4(a)(2) of the 1933 Act.

Although the Trust does not purchase Shares directly

from its shareholders, in connection with the redemption of Baskets, the Trust redeemed 110,000 Shares (22 Baskets) during the quarter

ended March 31, 2024 as set forth in the table below:

| Period |

|

|

Total Number

of Shares

Redeemed |

|

|

Average price

of Bitcoin

Per Share |

|

| January 11, 2024 – January 31, 2024 |

|

|

None |

|

|

N/A |

|

| February 1, 2024 – February 29, 2024 |

|

|

|

60,000 |

|

|

$ |

64.11 |

|

| March 1, 2024 – March 31, 2024 |

|

|

|

50,000 |

|

|

$ |

71.73 |

|

| Total |

|

|

|

110,000 |

|

|

$ |

67.57 |

|

Item 3. Defaults Upon Senior

Securities.

None.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Other Information.

None.

Item 6. Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

WisdomTree Bitcoin Fund |

| |

|

| |

|

|

|

| |

|

|

|

| Dated: May 14, 2024 |

|

By: |

/S/Jeremy Schwartz |

| |

|

Name: |

Jeremy Schwartz |

| |

|

Title: |

Chief Executive Officer (Principal Executive Officer)* |

| |

|

|

|

| |

|

|

|

| Dated: May 14, 2024 |

|

By: |

/S/David Castano |

| |

|

Name: |

David Castano |

| |

|

Title: |

Chief Financial Officer and Treasurer (Principal Financial Officer and Principal Accounting Officer)* |

*The registrant is a trust and the persons are signing in their capacities

as officers of WisdomTree Digital Commodity Services, LLC, the Sponsor of the registrant.

18

Exhibit 31.1

Certification

I, Jeremy Schwartz, certify that:

| 1. | I have reviewed this quarterly report on Form 10-Q of WisdomTree Bitcoin Fund; |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period

covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this

report; |

| 4. | The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and

procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined

in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision,

to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others

within those entities, particularly during the period in which this report is being prepared; |

| b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under

our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting principles; |

| c) | Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions

about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation;

and |

| d) | Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s

most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected,

or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| 5. | The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control

over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or

persons performing the equivalent functions): |

| a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which

are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information;

and |

| b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s

internal control over financial reporting. |

| |

|

By: |

|

/s/ Jeremy Schwartz |

| |

|

|

|

Jeremy Schwartz* |

| |

|

|

|

|

| |

|

|

|

Chief Executive Officer |

| |

|

|

|

(Principal Executive Officer) |

| |

|

|

|

|

| |

|

|

|

* The registrant is a trust and Jeremy Schwartz

is signing in his capacity as Principal Executive Officer of WisdomTree Digital Commodity Services, LLC, Sponsor of the WisdomTree Bitcoin

Fund |

| |

|

|

|

|

| |

|

|

|

Date: May 14, 2024 |

Exhibit 31.2

Certification

I, David Castano, certify that:

| 1. | I have reviewed this quarterly report on Form 10-Q of WisdomTree Bitcoin Fund; |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period

covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this

report; |

| 4. | The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and

procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined

in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision,

to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others

within those entities, particularly during the period in which this report is being prepared; |

| b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under

our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting principles; |

| c) | Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions

about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such

evaluation; and |

| d) | Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s

most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected,

or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| 5. | The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control

over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors

(or persons performing the equivalent functions): |

| a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which

are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information;

and |

| b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s

internal control over financial reporting. |

| |

|

By: |

|

/s/ David Castano |

| |

|

|

|

David Castano* |

| |

|

|

|

|

| |

|

|

|

Chief Financial Officer

(Principal Financial Officer and

Principal Accounting Officer) |

| |

|

|

|

|

| |

|

|

|

* The registrant is a trust and David Castano is signing in his capacity

as Principal Financial Officer of WisdomTree Digital Commodity Services, LLC, Sponsor of the WisdomTree Bitcoin Fund |

| |

|

|

|

|

| |

|

|

|

Date: May 14, 2024 |

Exhibit 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of WisdomTree

Bitcoin Fund (the “Company”) on Form 10-Q for the period ended March 31, 2024 as filed with the Securities and Exchange

Commission (the “SEC”) on the date hereof (the “Report”), I, Jeremy Schwartz, Chief Executive Officer of WisdomTree

Digital Commodity Services, LLC, Sponsor of the Company, certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002, to my knowledge, that:

| (1) | The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934,

as amended; and |

| (2) | The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations

of the Company. |

This certification is being furnished and not filed,

and shall not be incorporated into any documents for any purpose, under the Securities Exchange Act of 1934, as amended.

A signed original of this written statement required by Section 906 has been provided to the Company and will be retained by the

Company and furnished to the SEC or its staff upon request.

| By: |

|

/s/ Jeremy Schwartz |

|

|

| |

|

Jeremy Schwartz* |

|

|

| |

|

|

|

|

| |

|

Chief Executive Officer

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| |

|

* The registrant is a trust and Jeremy Schwartz is signing in his capacity

as Principal Executive Officer of WisdomTree Digital Commodity Services, LLC, Sponsor of the WisdomTree Bitcoin Fund |

|

|

| |

|

|

|

|

| |

|

May 14, 2024 |

|

|

Exhibit 32.2

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of WisdomTree

Bitcoin Fund (the “Company”) on Form 10-Q for the period ended March 31, 2024 as filed with the Securities and Exchange

Commission (the “SEC”) on the date hereof (the “Report”), I, David Castano, Chief Financial Officer of WisdomTree

Digital Commodity Services, LLC, Sponsor of the Company, certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002, to my knowledge, that:

| (1) | The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934,

as amended; and |

| (2) | The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations

of the Company. |

This certification is being furnished and not filed,

and shall not be incorporated into any documents for any purpose, under the Securities Exchange Act of 1934, as amended.

A signed original of this written statement required by Section 906 has been provided to the Company and will be retained by the

Company and furnished to the SEC or its staff upon request.

| By: |

|

/s/ David Castano |

|

|

| |

|

David Castano* |

|

|

| |

|

|

|

|

| |

|

Chief Financial Officer

(Principal Financial Officer and Principal Accounting Officer) |

|

|

| |

|

|

|

|

| |

|

* The registrant is a trust and David Castano is signing in his capacity

as Principal Financial Officer of WisdomTree Digital Commodity Services, LLC, Sponsor of the WisdomTree Bitcoin Fund |

|

|

| |

|

|

|

|

| |

|

May 14, 2024 |

|

|

v3.24.1.1.u2

Cover

|

3 Months Ended |

|

Mar. 31, 2024

shares

|

|---|

| Cover [Abstract] |

|

| Document Type |

10-Q

|

| Amendment Flag |

false

|

| Document Quarterly Report |

true

|

| Document Transition Report |

false

|

| Document Period End Date |

Mar. 31, 2024

|

| Document Fiscal Period Focus |

Q1

|

| Document Fiscal Year Focus |

2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

1-03480

|

| Entity Registrant Name |

WISDOMTREE BITCOIN FUND

|

| Entity Central Index Key |

0001850391

|

| Entity Tax Identification Number |

99-6119726

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

250 West 34th Street

|

| Entity Address, Address Line Two |

3rd Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10119

|

| City Area Code |

(866)

|

| Local Phone Number |

909-9473

|

| Title of 12(b) Security |

Common Shares of Beneficial Interest of WisdomTree Bitcoin Fund

|

| Trading Symbol |

BTCW

|

| Security Exchange Name |

CboeBZX

|

| Entity Current Reporting Status |

Yes

|

| Entity Interactive Data Current |

Yes

|

| Entity Filer Category |

Non-accelerated Filer

|

| Entity Small Business |

true

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Entity Shell Company |

false

|

| Entity Common Stock, Shares Outstanding |

1,080,000

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an quarterly report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-Q

-Number 240

-Section 308

-Subsection a

| Name: |

dei_DocumentQuarterlyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |