false

0001334933

0001334933

2023-11-20

2023-11-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

November 20, 2023

Date of Report (Date of earliest event reported)

URANIUM ENERGY CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

001-33706

|

98-0399476

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

500 North Shoreline, Ste. 800,

Corpus Christi, Texas, U.S.A.

|

|

78401

|

|

(U.S. corporate headquarters)

|

|

(Zip Code)

|

|

1830 – 1030 West Georgia Street

Vancouver, British Columbia, Canada

|

|

V6E 2Y3

|

|

(Canadian corporate headquarters)

|

|

(Zip Code)

|

(Address of principal executive offices)

(361) 888-8235

(Registrant’s telephone number, including area code)

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

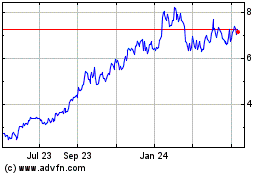

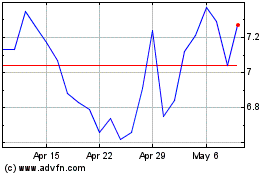

Common Stock

|

UEC

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

__________

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 20, 2023, the Board of Directors (the “Board”) of Uranium Energy Corp. (the “Company”) adopted the Uranium Energy Corp. Policy for the Recovery of Erroneously Awarded Incentive-Based Compensation (the “Clawback Policy”), with an effective date of November 20, 2023, in order to comply with Section 10D of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Rule 10D-1 of the Exchange Act (“Rule 10D-1”) and Section 811 of the NYSE American Company Guide (collectively, the “Final Clawback Rules”). The Board has designated the Compensation Committee of the Board as the administrator of the Clawback Policy.

The Clawback Policy provides for the mandatory recovery of erroneously awarded incentive-based compensation from current and former executive officers as defined in Rule 10D-1 (collectively, the “Covered Officers”) of the Company in the event that the Company is required to prepare an accounting restatement, in accordance with the Final Clawback Rules. The recovery of such compensation applies regardless of whether a Covered Officer engaged in misconduct or otherwise caused or contributed to the requirement of an accounting restatement. Under the Clawback Policy, the Company may recoup from the Covered Officers erroneously awarded incentive-based compensation received within a lookback period of the three completed fiscal years preceding the date on which the Company is required to prepare an accounting restatement.

The foregoing description of the Clawback Policy does not purport to be complete and is qualified in its entirety by reference to the full text of the Clawback Policy, a copy of which is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 8.01 Other Events

On November 20, 2023, the Board of the Company also adopted each of:

| |

(a)

|

A new Cybersecurity Policy for the Company (the “Cybersecurity Policy”);

|

| |

(b)

|

An updated Audit Committee Charter for the Company (the “Audit Committee Charter”);

|

| |

(c)

|

An updated Board Mandate for the Company (the “Board Mandate”); and

|

| |

(d)

|

A new Insider Trading, Reporting and Blackout Policy for the Company (the “Insider Trading, Reporting and Blackout Policy”).

|

The Cybersurity Policy has been adopted as a result of the SEC’s July 26, 2023 adopted and finalized rules (the “Cybersecurity Rules”) to enhance and standardize disclosures regarding cybersecurity risk management, strategy, governance and incident reporting by public companies that are subject to the reporting requirements of the Exchange Act.

Each of the Company’s updated Audit Committee Charter and Board Mandate were revised to include cybersecurity as a specific responsibility.

The new Insider Trading, Reporting and Blackout Policy simply combines and updates certain of the Company’s existing insider trading and related reporting and blackout provisions previously provided for in certain of the Company’s existing corporate governance materials and including, without limitation, the Company’s existing Securities Trading and Reporting Guidelines.

The foregoing descriptions of each of the new Cybersecurity Policy, the updated Audit Committee Charter, the updated Board Mandate and the new Insider Trading, Reporting and Blackout Policy do not purport to be complete and are qualified in their entirety by reference to the full text of the Cybersecurity Policy, the Audit Committee Charter, the Board Mandate and the Insider Trading, Reporting and Blackout Policy, a copy of each of which are filed as Exhibits 99.2 through 99.5 to this Current Report on Form 8-K and are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

Exhibit

|

|

Description

|

|

99.1

|

|

|

|

99.2

|

|

|

|

99.3

|

|

|

|

99.4

|

|

|

|

99.5

|

|

|

|

104

|

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document).

|

__________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

URANIUM ENERGY CORP.

|

|

|

|

|

|

|

|

DATE: November 24, 2023.

|

By:

|

/s/ Pat Obara

|

|

|

|

|

Pat Obara, Secretary and

|

|

|

|

|

Chief Financial Officer

|

|

__________

Exhibit 99.1

URANIUM ENERGY CORP.

(the “Corporation”)

POLICY FOR THE RECOVERY OF ERRONEOUSLY AWARDED

INCENTIVE BASED COMPENSATION

(the “RECOVERY POLICY”)

PART 1

GENERAL PROVISIONS

Purpose

1.1 This Recovery Policy has been adopted by resolution of the Board (as hereinafter defined) of the Corporation in accordance with certain listing standards of the NYSE American stock exchange mandated by Rule 10D-1 (as hereinafter defined), to facilitate reasonably prompt recovery by the Company of the amount of any Incentive-Based Compensation that is deemed to have been erroneously awarded in the event that the Company is required to restate its financial statements due to material non-compliance with any financial reporting requirement under relevant Securities Laws (as hereinafter defined).

Definitions

1.2 In this Recovery Policy, the following terms will have the following meanings:

| |

(a)

|

“Accounting Restatement” means an accounting restatement due to material noncompliance of the Company with any financial reporting requirement under the Securities Laws, including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period;

|

| |

(b)

|

“Board” means the Board of Directors of the Company;

|

| |

(c)

|

“Company” means Uranium Energy Corp.;

|

| |

(d)

|

“Compensation Committee” means the Compensation Committee of the Board;

|

| |

(e)

|

“Effective Date” means the effective date of this Recovery Policy, being the 20th day of November, 2023;

|

| |

(f)

|

“Erroneously Awarded Incentive-Based Compensation” means that portion of any Incentive-Based Compensation that has been paid to an Executive Officer and is recoverable under Section 4.1 of this Recovery Policy, as such Erroneously Awarded Incentive-Based Compensation is determined under this Recovery Policy;

|

| |

(g)

|

“Exchange Act” means the United States Securities Exchange Act of 1934, as amended;

|

| |

(h)

|

“Executive Officer” means any individual deemed to be an “executive officer” of the Company under Rule 10D-1. For the avoidance of doubt, the identification of an executive officer for purposes of this Recovery Policy shall include each executive officer who is or was identified pursuant to Item 401(b) of Regulation S-K or Item 6.A of Form 20-F, as applicable, as well as the principal financial officer and principal accounting officer (or, if there is no principal accounting officer, the controller).

|

| |

(i)

|

“Financial Reporting Measures” means any measures that are determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements, and any measures derived wholly or in part from such measures whether or not the measure is presented within the financial statements or included in a filing with the SEC. For greater certainty, stock price and TSR are included in the definition of Financial Reporting Measures;

|

| |

(j)

|

“Incentive-Based Compensation” means any compensation that is granted, earned or vested based wholly or in part upon the attainment of a Financial Reporting Measure;

|

| |

(k)

|

“NYSE American” means the NYSE American LLC;

|

| |

(l)

|

“Received” means, in the context of Incentive-Based Compensation, the actual or deemed receipt in the Company’s fiscal period during which the Financial Reporting Measure specified in the Incentive-Based Compensation is attained, even if the payment or grant of the Incentive-Based Compensation occurs after the end of that period;

|

| |

(m)

|

“Recovery Period” has the meaning set forth in Section 4.4;

|

| |

(n)

|

“Recovery Policy” means this policy for the recovery of erroneously awarded executive compensation;

|

| |

(o)

|

“Rule 10D-1” means Rule 10D-1 adopted by the SEC under the Exchange Act;

|

| |

(p)

|

“SEC” means the United States Securities and Exchange Commission;

|

| |

(q)

|

“SEC Final Release” means the final release no. 34-96159 of the SEC entitled “Listing Standards of Recovery of Erroneously Awarded Compensation” in respect of the adoption of Rule 10D-1 pursuant to the requirements of Section 10D of the Exchange Act;

|

| |

(r)

|

“Securities Laws” means the Exchange Act and the U.S. Securities Act;

|

| |

(s)

|

“TSR” means total shareholder return; and

|

| |

(t)

|

“U.S. Securities Act” means the United States Securities Act of 1933, as amended;

|

PART 2

ADMINISTRATION

Administration

2.1 This Recovery Policy will be administered by the Compensation Committee which will be empowered to, with consideration of applicable Securities Laws,

| |

(a)

|

interpret and administer this Recovery Policy;

|

| |

(b)

|

make determinations as to whether any Incentive-Based Compensation that has been Received by the current and former Executive Officers of the Company constitutes Erroneously Awarded Incentive-Based Compensation in the event of an Accounting Restatement;

|

| |

(c)

|

take action to enforce on behalf of the Company any recovery of any Erroneously Awarded Incentive-Based Compensation pursuant to the provisions of this Recovery Policy;

|

| |

(d)

|

make any other determinations that the Compensation Committee deems necessary or desirable to give effect to the objectives of this Recovery Policy; and

|

| |

(e)

|

periodically review legislative developments that may have an impact on this Recovery Policy, and report to the Board any recommendations.

|

Interpretations

2.2 This Recovery Policy is intended to be a “Recovery Policy” for the purposes of Section 811 of the NYSE American Company Guide and will be interpreted by the Compensation Committee consistent with the SEC’s interpretation of Rule 10D-1, including the guidance of the SEC set forth in the SEC Final Release and any other applicable law, regulation, rule or interpretation of the SEC or NYSE American promulgated or issued in connection therewith. This Recovery Policy is in addition to the requirements of Section 304 of the Sarbanes-Oxley Act of 2002 that are applicable to the Company’s chief executive officer and chief financial officer.

Compliance

2.3 The Compensation Committee may require that any employment agreement, offer letter, compensation plan, equity award agreement, or any other agreement entered into on or after the Effective Date require an Executive Officer to agree to abide by the terms of this Recovery Policy. Further, the Compensation Committee may require each Executive Officer to acknowledge this Recovery Policy through execution of the form of acknowledgement attached hereto as Appendix A (or such other form as approved from time-to-time by the Compensation Committee).

PART 3

SCOPE AND INTERPRETATION OF THIS RECOVERY POLICY

Effective Period

3.1 This Recovery Policy will be applied to all Incentive Based Compensation that is Received by an Executive Officer on or after the Effective Date.

Scope of Executive Officers Subject to Recovery Policy

3.2 The Compensation Committee will determine from time-to-time the individuals that are deemed to be subject to the Recovery Policy by virtue of being considered an Executive Officer of the Company under Rule 10D-1.

Scope of Accounting Restatements Subject to Recovery Policy

3.3 The Accounting Restatements that will trigger the obligation to recover Erroneously Awarded Incentive-Based Compensation will include any restatement of any of the financial statements of the Company filed with the SEC under the Exchange Act to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period. For clarity, Accounting Restatements include for the purposes of this Recovery Policy both:

| |

(a)

|

big “R” restatements, being restatements to correct an error material to previously issued financial statements, and

|

| |

(b)

|

little “r” restatements, being restatements to correct errors that were not material to those previously issued financial statements, but would result in a material misstatement if (i) the errors were left uncorrected in the current report or (ii) the error correction was recognized in the current period.

|

Determination of When Incentive-Based Compensation is Received

3.4 Incentive-Based Compensation will be deemed Received in the fiscal period during which the Financial Reporting Measure specified in the Incentive-Based Compensation award was attained, even if the payment or grant occurs after the end of that period.

PART 4

RECOVERY OF ERRONEOUSLY AWARDED INCENTIVE-BASED COMPENSATION

Recovery

4.1 In that event that the Company is required to prepare an Accounting Restatement, the Company will reasonably promptly take action to recover the amount of any Erroneously Awarded Incentive-Based Compensation that has been Received by each applicable Executive Officer:

| |

(a)

|

after beginning services as an Executive Officer;

|

| |

(b)

|

who served as Executive Officer at any time during the performance period for that Incentive-Based Compensation;

|

| |

(c)

|

while the Company has a class of securities listed on NYSE American (or another national securities exchange in the United States); and

|

| |

(d)

|

during the three completed fiscal years immediately preceding the date on which the Company was required to prepare the Accounting Statement, as this three year period is determined under Section 4.4 below.

|

4.2 Recovery will be required on a “no fault” basis, without regard to whether an Executive Officer engaged in any misconduct or whether the Executive Officer was responsible for the erroneous financial statements that led to the Accounting Restatement.

Trigger for Recovery of Erroneously Award Compensation

4.3 The date on which the Company is deemed to be required to prepare an Accounting Statement for the purposes of determining the Recovery Period under Section 4.1 will be the earlier to occur of:

| |

(a)

|

the date that the Board or a committee of the Board concludes, or reasonably should have concluded that the Company, is required to prepare an Accounting Restatement, or

|

| |

(b)

|

the date that a court, regulator or other legally authorized body directs the Company to prepare an Accounting Restatement.

|

Determination of Recovery Period

4.4 The recovery period for the determination of Erroneously Awarded Incentive-Based Compensation (the “Recovery Period”) will determined as the three completed fiscal years immediately preceding the date that the Company is required to prepare an Accounting Restatement, as that date is determined under Section 4.3. In the event of a change in the financial year of the Company, the Recovery Period will also include any transition period that results from a change in the Company’s fiscal year within or immediately following those three completed fiscal years, provided that a transition period between the last day of the Company’s previous fiscal year end and the first day of its new fiscal year that comprises a period of nine to 12 months would be deemed a completed fiscal year.

Scope of Incentive Based Compensation Subject to Recovery

4.5 Recovery will be made against each current and former Executive Officer who has Received Incentive-Based Compensation during the three year Recovery Period to the extent that such Incentive-Based Compensation is determined to be Erroneously Awarded Incentive-Based Compensation. Recovery of Incentive-Based Compensation received while an individual was serving in a non-executive capacity prior to becoming an Executive Officer is not subject to this Recovery Policy and recovery will not be required. An award of incentive-based compensation granted to an individual before the individual becomes an Executive Officer will be subject to this Recovery Policy, so long as the Incentive-Based Compensation was received by the individual at any time during the performance period after beginning service as an Executive Officer.

Determination of Amount of Erroneously Awarded Compensation

4.6 The amount of any Erroneously Awarded Incentive-Based Compensation to be recovered under Section 4.1 will be determined as follows for each applicable Executive Officer:

| |

(a)

|

the amount of Incentive-Based Compensation that has been Received by the Executive Officer during the Recovery Period to which this Recovery Policy applies, less

|

| |

(b)

|

the amount of the Incentive-Based Compensation that would have been received in respect of the Recovery Period had the Incentive-Based Compensation been determined based on the restated amount.

|

4.7 Erroneously Awarded Incentive-Based Compensation will include any Incentive-Based Compensation that was based on stock price or TSR to the extent that the Incentive-Based Compensation was inaccurate as a result of the Accounting Restatement. For Incentive-Based Compensation based on stock price or TSR, where the amount of Erroneously Awarded Incentive-Based Compensation is not subject to mathematical recalculation directly from the information in the Accounting Restatement:

| |

(a)

|

the amount must be based on a reasonable estimate of the effect of the Accounting Restatement on the stock price or TSR upon which the Incentive-Based Compensation was received, and

|

| |

(b)

|

the amount of the Incentive-Based Compensation that would have been received in respect of the Recovery Period had the Incentive-Based Compensation been determined based on the restated amount.

|

4.8 The Compensation Committee shall promptly notify each Executive Officer with a written notice containing the amount of any Erroneously Awarded Compensation and a demand for repayment or return of such compensation.

4.9 The amount of any Erroneously Awarded Incentive-Based Compensation will be computed without regard to any taxes paid by the Executive Officer.

4.10 To the extent that the Executive Officer has already reimbursed the Company for any Erroneously Awarded Compensation Received under any duplicative recovery obligations established by the Company or applicable law, including Section 304 of the Sarbanes-Oxley Act of 2002, it shall be appropriate for any such reimbursed amount to be credited to the amount of Erroneously Awarded Compensation that is subject to recovery under this Recovery Policy.

4.11 Notwithstanding anything in this Recovery Policy, in no event will the Company be required to award any Executive Officer an additional payment or other compensation if the Accounting Restatement would have resulted in the grant, payment or vesting of Incentive-Based Compensation that is greater than the Incentive-Based Compensation actually received by the affected Executive Officer. The recovery of Erroneously Awarded Incentive-Based Compensation is not dependent on if or when the restatement is filed.

PART 5

REPORTING

Reporting of Erroneously Award Compensation

5.1 In the event of an Accounting Restatement pursuant to which the Compensation Committee has considered whether recovery of any Erroneously Awarded Incentive-Based Compensation is required, the Compensation Committee will prepare a report to management of the Company detailing the information required to be reported by the Company with respect to such Accounting Restatement on the Form 10-K or other form of annual report to be filed by the Company under the Exchange Act for the fiscal year in which the Accounting Restatement occurred and in any other filing required to be made by the Company under Securities Laws.

Documentation

5.2 The Compensation Committee will maintain documentation as to the determination of the amount of any Erroneously Awarded Incentive-Based Compensation, including any reasonable estimates made during the calculation process, and any efforts undertaken to recover Erroneously Awarded Incentive-Based Compensation. The Company will provide this information to NYSE American upon its request.

Documentation

5.3 Without limiting the above, the Company will comply will all disclosure, documentation and records requirements relating to this Recovery Policy under Section 10D of the Exchange Act, the NYSE American Company Guide and the filings required to be made by the Company under the Exchange Act.

PART 6

ENFORCEMENT OF RECOVERY

Requirement to Recover

6.1 Upon a determination by the Compensation Committee that the Company is obligated to recover Erroneously Awarded Incentive-Based Compensation under Section 4.1, the Company will take steps to recover such Erroneously Awarded Incentive-Based Compensation other than in circumstances where each of (a) and (b) below apply:

| |

(a)

|

one of the following circumstances exists:

|

| |

(i)

|

the direct expense paid to a third party to assist in enforcing this Recovery Policy would exceed the amount to be recovered, provided that before concluding that it would be impracticable to recover any amount of Erroneously Awarded Incentive-Based Compensation based on expense of enforcement, the Company has made a reasonable attempt to recover such Erroneously Awarded Incentive-Based Compensation and documented such reasonable attempt(s) to recover (which documentation will be provided to NYSE American at the request of NYSE American); or

|

| |

(ii)

|

recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly available to employees of the registrant, to fail to meet the requirements of 26 U.S.C. 401(a)(13) or 26 U.S.C. 411(a) and regulations thereunder; and

|

| |

(b)

|

the Compensation Committee, or a majority of the independent directors of the Board, has made a determination that recovery would be impracticable.

|

Deferred Payment Plans

6.2 The Compensation Committee may consider the establishment of a deferred payment where recovery is required from an Executive Officer and where the deferred payment plan allows the Executive Officer to repay the Erroneously Awarded Incentive-Based Compensation as soon as possible without unreasonable economic hardship to the Executive Officer, depending on the facts and circumstances; provided that any such deferred payment plan shall be narrowly tailored to the Erroneously Awarded Incentive-Based Compensation being recovered so as not to constitute a personal loan to the Executive Officer that is prohibited by Section 13(k) of the Exchange Act.

Recovery of Costs

6.3 If an Executive Officer fails to repay all Erroneously Awarded Incentive-Based Compensation when due, the Company will take all actions reasonable and appropriate to recover the Erroneously Awarded Incentive-Based Compensation from the Executive Officer, and in that case the Executive Officer will be required to reimburse the Company for all reasonable expenses incurred in recovering the Erroneously Awarded Incentive-Based Compensation from the Executive Officer.

Other Legal Remedies

6.4 Any right of recovery under this Recovery Policy is in addition to, and not in lieu of, any other remedies or rights of recovery that may be available to the Company under applicable law, regulation or rule, or under the terms of any similar policy or agreement in any employment agreement, offer letter, compensation plan, equity award agreement, or similar agreement and any other legal remedies available to the Company.

6.5 This Recovery Policy does not preclude the Company from taking any other action to enforce an Executive Officer’s obligations to the Company or limit any other remedies that the Company may have available to it and any other actions that the Company may take, including termination of employment, institution of civil proceedings, or reporting of any misconduct to appropriate government authorities.

PART 7

PROHIBITION ON INDEMNIFICATION

Prohibition on Indemnification

7.1 The Company shall not be permitted to indemnify or insure any Executive Officer against (i) the loss of any Erroneously Awarded Compensation that is repaid, returned or recovered pursuant to the terms of this Policy, or (ii) any claims relating to the Company’s enforcement of its rights under this Recovery Policy. Further, the Company shall not enter into any agreement that exempts any Incentive-based Compensation that is granted, paid or awarded to an Executive Officer from the application of this Recovery Policy or that waives the Company’s right to recovery of any Erroneously Awarded Compensation, and this Recovery Policy shall supersede any such agreement (whether entered into before, on or after the Effective Date of this Recovery Policy).

Insurance

7.2 The Company will not purchase or pay or reimburse any Executive Officer for any insurance policy to cover losses incurred by any Executive Officer under this Recovery Policy.

Other Recovery Rights

7.3 This Recovery Policy shall be binding and enforceable against all Executive Officers and, to the extent required by applicable law or guidance from the SEC or NYSE American, their beneficiaries, heirs, executors, administrators or other legal representatives. The Compensation Committee intends that this Policy will be applied to the fullest extent required by applicable law. Any employment agreement, equity award agreement, compensatory plan or any other agreement or arrangement with an Executive Officer shall be deemed to include, as a condition to the grant of any benefit thereunder, an agreement by the Executive Officer to abide by the terms of this Recovery Policy. Any right of recovery under this Recovery Policy is in addition to, and not in lieu of, any other remedies or rights of recovery that may be available to the Company under applicable law, regulation or rule or pursuant to the terms of any policy of the Company or any provision in any employment agreement, equity award agreement, compensatory plan, agreement or other arrangement.

PART 8

AUTHORITY OF THE COMPENSATION COMMITTEE

Engagement of Professional Advisors

8.1 In addition to any authority provided under its charter, the Compensation Committee will have the authority to engage and retain independent legal counsel, independent accounting advisors and any outside professional advisor that it determines necessary to carry out its duties, at the expense of the Company, without the Board’s approval and at any time, and has the authority to determine any such advisor’s fees and other retention terms.

Oversight

8.2 In the event that the Company is required to recover any Erroneously Awarded Incentive-Based Compensation under this Recovery Policy, such recovery efforts will be undertaken with the supervision of the office of the Vice-President, General Counsel under oversight of the Compensation Committee, provided that Compensation Committee will directly supervise such efforts in the event of that the Vice-President, General Counsel is an Executive Officer who is subject to recovery.

Review

8.3 The Compensation Committee will periodically review legislative developments, regulatory initiatives, and similar matters relating to Securities Laws that may have an impact on this Recovery Policy, and report to the Board any recommendations it may have concerning the Recovery Policy.

__________

Appendix A

ATTESTATION AND ACKNOWLEDGEMENT OF POLICY FOR THE RECOVERY OF ERRONEOUSLY AWARDED INCENTIVE-BASED COMPENSATION

By my signature below, I acknowledge and agree that:

| |

●

|

I have received and read the attached Policy for the Recovery of Erroneously Awarded Incentive-Based Compensation (this “Recovery Policy”); and

|

| |

●

|

I hereby agree to abide by all of the terms of this Recovery Policy both during and after my employment with the Company, including, without limitation, by promptly repaying or returning any Erroneously Awarded Incentive-Based Compensation to the Company as determined in accordance with this Recovery Policy.

|

__________

Exhibit 99.2

URANIUM ENERGY CORP.

(the “Corporation”)

CYBERSECURITY POLICY

Purpose

The Board of Directors of the Corporation has adopted this Cybersecurity Policy (or the “Policy” as the context provides for) with a purpose of serving as a standard for setting, reviewing and implementing the Corporation’s cybersecurity goals, objectives and targets.

The “Corporation” includes Uranium Energy Corp. and all of its subsidiaries. All vendors, suppliers and partners working with the Corporation are expected to comply with the principles found in this Policy as they relate to the Corporation and its businesses, and are encouraged to adopt similar policies within their own businesses.

This Policy should be read in conjunction with the other Corporation policies set forth below which are available on the Corporation’s website at www.uraniumenergy.com.

The information that exists within the information technology (“IT”) network and infrastructure (the “Cyberspace”) is a valuable asset of the Corporation and, therefore, benefits from protection and preservation thereof. Effective information security management is necessary for the secured sharing and protection of information within the Corporation’s Cyberspace.

This Policy serves as a framework that all employees, directors and officers shall abide by to ensure that risks to the confidentiality, integrity or availability of the Corporation’s assets within the Cyberspace are managed in accordance with the agreed upon cybersecurity approach. In guiding the Corporation’s ongoing operation, maintenance and effective management of its cybersecurity initiatives, this Policy will detail the roles and responsibilities of key personnel, provide guidance on the initiatives necessary to meet the objectives of this Policy.

Applicability

This Policy applies to all directors, officers, employees and contractors of the Corporation and any parent, holding companies and subsidiaries regardless of the terms of their contract (collectively, “you”), who use the Corporation’s technological devices. References in this Policy to “we”, “us” or “our” shall be interpreted as referring to the Corporation unless the context suggests otherwise.

Policy Statement

The Corporation recognizes the importance of effective information security management and strives to maintain the confidentiality, integrity and availability of information in the Cyberspace. In aspiring to prevent, detect and respond to unauthorized and malicious attacks in the Cyberspace, the Corporation will identify, prioritize and manage dedicated efforts towards both protection of information and the minimization of risks of unauthorized and malicious access to information in the Cyberspace.

The Board of Directors of the Corporation (the “Board of Directors”) aims to lead the Corporation in a direction that minimizes the risk of unauthorized and malicious use, disclosure, potential theft, alteration or damaging effects of the Corporation’s operations while concurrently enabling the sharing of information in Cyberspace. The Board of Director is committed to ensuring that risks to the confidentiality, integrity or availability of Corporation-owned information assets are managed and appropriately by implementing an information security risk management approach. In furthering the Corporation’s mission to protect information within Cyberspace as a valuable asset, the Corporation is committed to its information security program aimed at securing the information asset of the organisation. In addition, the Corporation strives to ensure continued protection and maintenance of a secure environment for users of its Cyberspace information by aligning its information security approach. This includes reserving a right to monitor and audit network and system usage at any time for compliance reasons pursuant to this Policy. The Corporation views all reports of breaches hereunder seriously and will abide by rigorous investigation processes in the event of a breach.

Roles and Responsibilities

Committee Oversight

The Audit Committee of the Corporation (the “Audit Committee”) will oversee this policy and will be responsible for the implementation of the Corporation’s oversight, programs, procedures, and policies related to cybersecurity, cybersecurity risks, information security, and data privacy.

Management shall report to the Audit Committee on the Corporation’s and its subsidiaries’ strategy, risks, metrics and operations relating to cybersecurity and information security matters, including significant cybersecurity and information security-related projects and initiatives and related progress, the integration and alignment of such strategy with the Corporation’s overall business and strategy, and trends that may affect such strategy or operations.

Management Oversight

Team leads from various departments of the Corporation have been identified under this Policy to report to the Corporation’s Chief Financial Officer (the “CFO”) and oversee the Strategy (as defined herein) of the Corporation. While these named leaders will oversee the Strategy pursuant to this Policy, cybersecurity is the responsibility of all business stakeholders and requires the cooperation and compliance of all personnel.

Employee Responsibility

All employees shall exercise professional judgement in using computing devices and network resources connected to the Cyberspace. All information, physical and intellectual properties stored on electric and computing devices or existing within the Cyberspace remain the sole property of the Corporation. Therefore, employees must neither access nor share confidential and proprietary information prior to receiving consent from management or the Corporation’s directors and officers.

Employees are strictly prohibited from performing any act that would be in contrary to this Policy, including but not limited to:

| |

●

|

accessing data, a server or an account for any purpose other than conducting the Corporation’s business in ordinary course;

|

| |

●

|

copying or distributing copyrighted material or intellectual property without prior consent;

|

| |

●

|

installing any copyrighted software without obtain approval from the Corporation’s third party IT group;

|

| |

●

|

sharing passwords with other individuals or allowing others access to your accounts;

|

| |

●

|

exporting software, technical information, encryption software or technologies prior to obtaining consent from either management or the Corporation’s third party IT group; and

|

| |

●

|

making fraudulent offers of products, items or services from any account that represents the Corporation.

|

All potential threats or loss of any Corporation device that may store confidential information must be promptly reported to the CFO.

Management Responsibilities

First and foremost, the Corporation’s management team shall facilitate an environment whereby managing cybersecurity risk is accepted as the personal responsibility of each member of the Corporation. Management will undertake the following roles and responsibilities as appropriate and as operationally feasible:

| |

o

|

Data Protection (VPN); and

|

| |

o

|

Privileged Access Management.

|

| |

●

|

Security Subject Matter Expert:

|

| |

o

|

Mobile Device Management;

|

| |

o

|

Incident Response Program;

|

| |

o

|

Disaster Recovery Program; and

|

| |

o

|

Patch & Vulnerability Management.

|

| |

o

|

IS Governance, Policies and Standards;

|

| |

o

|

Cybersecurity Risk Management;

|

| |

o

|

Deficiencies and Deviation Management; and

|

| |

o

|

Strategic Metrics and Reporting.

|

| |

o

|

Coordinating Audit/Regulatory Exercises;

|

| |

o

|

Public Disclosure and Securities Filings;

|

| |

o

|

Information Security Compliance; and

|

| |

o

|

Awareness and Training Program;

|

| |

o

|

Knowledge and Talent Management; and

|

| |

o

|

Identity Theft Red Flags

|

| |

o

|

Funds Transfer Safeguarding

|

| |

o

|

Physical Security Improvements.

|

Management will ensure that employees are provided with adequate resources and trainings to fully understand the guidelines and expectations for cybersecurity. Members of the management team may be asked by the CFO to assist with IT security investigations in the event of a breach of this Policy. If any member of management is unaware of the best course of action in dealing with an IT-related matter, the manager shall immediately contact the Corporation’s third party IT representative. Upon becoming aware of a potential violation of this Policy or a breach of cybersecurity, the member of management must immediately document the violation and request the individual surrender possession of any devices that may have suffered a security breach.

Disclosure

Disclosure of cybersecurity and information security related matters, including material cybersecurity incidents, risk factors, risk management, governance, strategy, and other disclosures shall be provided in accordance with applicable laws and regulation. The Audit Committee shall also review the Corporation’s cybersecurity-related disclosures in its Form 10-K Annual Report.

Regulatory Developments

The Audit Committee shall monitor, on an ongoing basis, the implementation and effectiveness of this Policy and shall, annually or otherwise when applicable, assess:

| |

●

|

key legislative and regulatory developments that could materially impact the Corporation’s cybersecurity and digital technology strategy, operations or risk exposure;

|

| |

●

|

engagement with government agencies, industry peers, and other critical infrastructure sectors on cybersecurity and related resiliency;

|

| |

●

|

industry trends, benchmarking and best practices relating to cybersecurity and digital technology; and

|

| |

●

|

any relevant cybersecurity and digital technology metrics.

|

Reports to the Board of Directors

The Audit Committee shall report regularly to the Board of Directors concerning its matters covered under this Policy and advising the Board of Directors of any developments that the Committee believes should have Board of Directors’ consideration. The Audit Committee shall also annually review and assess the adequacy of this Policy and recommend any proposed changes to the Board of Directors for approval.

Restrictions and Limitations

Individuals who are subject to this Policy are not limited to the restricted use of specific devices. This Policy is all encompassing and incorporates all future and personal devices that may be used to store IT and confidential information of the Corporation, including intellectual property.

Enforcement

Failure to comply with this Policy or support this Policy and the mandates herein may compromise the Corporation’s information assets and cause irreparable harm to the organisation, its people, clients and digital and physical assets. For further clarity, violations of this Policy may include, but are not limited to, the conscious release of data or confidential information to unauthorized parties, conscious downloads of software or hardware that jeopardizes the security of the Corporation, and openly sharing passwords with any individual. Violations or breaches of this Policy or the associated schedules, standards or guidelines may result in suspension, discipline up to and including termination, in addition to administrative sanctions or legal actions.

__________

Exhibit 99.3

URANIUM ENERGY CORP.

(the “Corporation”)

AUDIT COMMITTEE CHARTER

The purpose of the Audit Committee shall be to assist the Board of Directors of the Corporation (the “Board of Directors) in fulfilling its oversight responsibilities with respect to (1) the integrity of the financial statements of the Corporation, (2) the independent auditor’s qualifications and independence, (3) the performance of the Corporation’s internal financial controls and audit function and the performance of the independent auditors and (4) the compliance by the Corporation with legal and regulatory requirements.

|

1.

|

For so long as the Corporation is a Small Business Issuer (as defined in Regulation S-B adopted by the Securities and Exchange Commission (the “SEC”)), the Audit Committee shall consist of no fewer than two directors as determined by the Board.

|

|

2.

|

All of the members of the Audit Committee shall meet the applicable independence and experience requirements of the law, including Sarbanes-Oxley, rules promulgated by the SEC, and rules promulgated by the NYSE American (the “NYSE”), except to the extent that the NYSE rules permit a director who is not independent pursuant to such rules to be a member of the Audit Committee.

|

|

3.

|

The members and Chairperson of the Audit Committee shall be appointed and may be removed by the Board.

|

|

4.

|

Each member of the Audit Committee shall in the judgment of the Board have the ability to read and understand the Corporation’s basic financial statements.

|

|

5.

|

One of the members of the Audit Committee shall be a “financial expert” pursuant to the requirements of the SEC and “financially sophisticated” pursuant to the requirements of the NYSE.

|

|

6.

|

No director who serves on the audit committee of more than three public corporations other than the Corporation shall be eligible to serve as a member of the Audit Committee.

|

The Audit Committee shall have authority to engage independent counsel and other advisers as it deems necessary to carry out its duties. The Audit Committee shall also have authority to obtain advice and assistance from any officer or employee of the Corporation.

The Corporation shall provide appropriate funding, as determined by the Audit Committee, for payment of (i) compensation to the Corporation’s independent public accountants as well as any other accounting firm engaged to perform audit, review or attest services for the Corporation, (ii) any independent counsel or other adviser retained by the Audit Committee and (iii) ordinary administrative expenses of the Audit Committee that are necessary or appropriate in carrying out its duties. The Audit Committee shall promptly report to the Board of Directors its engagement of any advisor, including the scope and terms of such engagement.

The Audit Committee shall:

|

1.

|

Meet as often as it determines, but not less frequently than as required by the SEC, the NYSE or other applicable rule or regulation.

|

|

2.

|

Be directly responsible for the appointment, compensation, retention and oversight of the work of the Corporation’s independent public accountants and the independent public accountants shall report directly to the Audit Committee.

|

|

3.

|

Ensure receipt of an annual formal written statement from the Corporation’s independent public accountants delineating all relationships between the independent public accountants and the Corporation and discuss with the independent public accountants any such relationships that may impact the objectivity and independence of the independent public accountants; and take appropriate action to oversee the independence of the independent public accountants.

|

|

4.

|

Assure the regular rotation of the lead audit partner and the concurring partner every five years (with a five year time-out period after rotation), and the regular rotation of other audit partners engaged in the Annual Audit every seven years (with a two year time-out period after rotation), or as otherwise required by law or the rules of the NYSE.

|

|

5.

|

Be responsible for the pre-approval of all audit services and permissible non-audit services to be provided to the Corporation by the independent public accountants, subject to any exceptions provided in the Securities Exchange Act of 1934, as amended, and the rules of the SEC promulgated thereunder.

|

|

6.

|

Review external and internal audit reports of the Corporation.

|

|

7.

|

Consult with the independent public accountants, senior management, the internal auditing staff of the Corporation and such other advisers as the Audit Committee may deem necessary regarding their evaluation of the adequacy of the Corporation’s “internal controls over financial reporting” and “disclosure controls and procedures” (as such terms are defined by the SEC), and make specific recommendations to the Board of Directors in connection therewith.

|

|

8.

|

Review recommendations made by the independent public accountants and the internal auditing staff of the Corporation, report to the Board of Directors with respect thereto and with respect to external and internal audit reports of the Corporation, and take any necessary actions in connection therewith.

|

|

9.

|

Obtain and review annually, prior to the filing of the Corporation’s Annual Report on Form 10-K or Form 10-KSB, a report from the independent public accountants describing (a) all critical accounting policies and practices used or to be used in the annual audit of the Corporation’s year-end financial statements (the “Annual Audit”), (b) all alternative treatments within generally accepted accounting principles for policies and practices related to material items that have been discussed with management, including ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent public accountants, and (c) other material written communications between the independent public accountants and management, such as any management letter or schedule of unadjusted differences, and discuss with the independent public accountants any material issues raised in such report.

|

|

10.

|

Review and discuss with the independent public accountants and management the Corporation’s annual audited financial statements (including the MD&A) and recommend to the Board of Directors the inclusion of the Corporation’s audited financial statements in its Form 10-K or Form 10-KSB.

|

|

11.

|

Review and discuss with the independent public accountants and management the Corporation’s quarterly unaudited financial statements prior to the publication of the Corporation’s earnings release and prior to the inclusion of such financial statements (including the MD&A) in the Corporation’s Form 10-Q or Form 10-QSB.

|

|

12.

|

Prior to the filing of each Form 10-Q or Form 10-QSB and the Form 10-K or Form 10-KSB, be available to discuss with the independent public accountants the matters required to be discussed by Statement on Auditing Standards No. 61 and other matters that should be communicated to the Audit Committee under the professional standards of the American Institute of Certified Public Accountants.

|

|

13.

|

Review the Corporation’s cybersecurity and other information technology-related risks, programs, controls, policies and procedures, including the Corporation’s plans to mitigate cybersecurity risks and to respond to data breaches.

|

|

14.

|

Be responsible for the review and oversight of all related-party transactions, as such term is defined by the rules of the NYSE.

|

|

15.

|

Establish procedures for (i) the receipt, retention and treatment of complaints received by the Corporation regarding accounting, internal accounting controls, or auditing matters and (ii) the confidential, anonymous submission by employees of the Corporation of concerns regarding questionable accounting or auditing matters, and review periodically with management these procedures and, if appropriate, any significant complaints received, to the extent required by the Act, the rules of the SEC or the NYSE.

|

|

16.

|

Prepare a report to shareholders as required by the SEC and the NYSE.

|

|

17.

|

Review legal and regulatory matters that may have a material impact on the financial statements.

|

|

18.

|

Review periodically the Corporation’s Code of Ethics and the Corporation’s program to monitor compliance therewith.

|

|

19.

|

Set clear hiring policies for employees or former employees of the independent public accountants.

|

|

20.

|

Review and reassess the adequacy of this Charter on an annual basis in accordance with applicable SEC and NYSE audit committee requirements.

|

|

21.

|

Review and evaluate at least annually its own performance and effectiveness.

|

|

22.

|

Oversee the Corporation’s process for identifying and managing enterprise risk.

|

|

23.

|

Perform such other duties as the Board of Directors shall from time to time assign to the Audit Committee.

|

|

VI.

|

INVESTIGATIONS AND STUDIES

|

The Audit Committee may conduct or authorize investigations into or studies of matters within the Audit Committee’s scope of responsibilities as described above, and shall have the authority to retain, at the expense of the Corporation, independent counsel or other consultants necessary to assist in any such investigation or study.

While the Audit Committee has the functions set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Corporation’s financial statements are complete and accurate or are in accordance with generally accepted accounting principles. The Corporation’s management is principally responsible for Corporation accounting policies, the preparation of the financial statements and ensuring that the financial statements are prepared in accordance with generally accepted accounting principles. The Corporation’s independent public accountants are responsible for auditing the Corporation’s financial statements.

__________

Exhibit 99.4

URANIUM ENERGY CORP.

(the “Corporation”)

BOARD MANDATE

Mandate

The Board of Directors of the Corporation (or the “Board”) is responsible for the stewardship of the Corporation. The Board supervises the management of the business and affairs of the Corporation, with a goal of enhancing long-term shareholder value.

Specifically, the Board is charged with responsibility for:

| |

(a)

|

to the extent feasible, satisfying itself as to the integrity of the chief executive officer and other executive officers and that the chief executive officer and other executive officers create a culture of integrity throughout the Corporation;

|

| |

(b)

|

adopting a strategic planning process and approving, on at least an annual basis, a strategic plan which takes into account, among other things, the opportunities and risks of the business;

|

| |

(c)

|

the identification of the principal risks of the Corporation’s business, and ensuring the implementation of appropriate systems to manage these risks;

|

| |

(d)

|

succession planning (including appointing, training and monitoring senior management);

|

| |

(e)

|

adopting a communication policy for the Corporation;

|

| |

(f)

|

the Corporation’s internal control and management information systems; and

|

| |

(g)

|

developing the Corporation’s approach to corporate governance, including developing a set of corporate governance principles and guidelines that are specifically applicable to the Corporation.

|

Membership

The Board of Directors is elected by the shareholders of the Corporation to hold office for the ensuing year or until their successors are elected or appointed.

The Board may from time to time designate one of the members of the Board to be the Chair of the Board. The Chair of the Board should be an independent director. Where the Chair of the Board is not an independent director, the independent directors must designate one of their number to act as Lead Director.

Board Committees

To assist it in exercising its responsibilities, the Board hereby establishes two standing committees of the Board: an “Audit Committee” and a “Compensation and Corporate Governance Committee”. The Audit Committee and the Compensation and Corporate Governance Committee shall be composed of a majority of “independent” directors (as such term is defined and delineated in each of CSA National Instrument 52-110 – Audit Committees (“NI 52-110”) and in Section 803(2) of the Amex Company Guide and Rule 10A-3 of the United States Securities and Exchange Act of 1934, as amended (collectively, “Rule 10A-3”). The Board may establish other standing committees, from time to time.

Each committee shall have a written charter. At a minimum, each charter shall clearly establish the committee’s purpose, responsibilities, member qualifications, member appointment and removal, structure and operations (including any authority to delegate to individual members and subcommittees), and manner of reporting to the Board. Each charter shall be reviewed by the Board (or a committee thereof) on at least an annual basis.

The Board is responsible for appointing directors to each of its committees, in accordance with the written charter for each committee.

Expectations of Directors

The Board expects that each director will, among other things:

| |

(a)

|

act honestly, in good faith and in the best interests of the Corporation;

|

| |

(b)

|

exercise the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances;

|

| |

(c)

|

commit the time and energy necessary to properly carry out his or her duties;

|

| |

(d)

|

attend all Board and committee meetings, as applicable; and

|

| |

(e)

|

review in advance all meeting materials and otherwise adequately prepare for all Board and committee meetings, as applicable.

|

Meetings and Participation

The Board shall meet at least once per quarter, or more frequently as circumstances dictate. The Chair of the Board, the “Lead Director” or any two directors may call a meeting of the Board.

Meeting agendas will be prepared and provided in advance to directors, along with appropriate briefing materials. The agenda will be set by the Chair of the Board in consultation with the Lead Director (if any) and based on input from other directors of the Board and senior management.

No business may be transacted by the Board except at a meeting at which a quorum of the Board is present. A quorum for meetings of the Board is a majority of its directors. The Board may invite such officers, directors and employees of the Corporation as it may see fit from time to time to attend meetings of the Board and assist in the discussion of the Board.

The non-management directors shall meet from time to time without any member of management being present (including any director who is a member of management).

The Board shall keep minutes of its meetings in which shall be recorded all action taken by it, which minutes shall be subsequently presented to the Board for review and approval.

Duties, Powers, and Responsibilities

|

1.

|

Supervising Management of the Corporation

|

The Board is responsible for:

| |

(a)

|

designating the offices of the Corporation, appointing such officers, specifying their duties and delegating to them the power to manage the day-to-day business and affairs of the Corporation;

|

| |

(b)

|

reviewing the officers’ performance and effectiveness; and

|

| |

(c)

|

acting in a supervisory role, such that any duties and powers not delegated to the officers of the Corporation remain with the Board and its committees.

|

The Board is responsible for adopting a strategic planning process for the Corporation. Such process shall include:

| |

(a)

|

the Board overseeing the Corporation’s strategic direction and major policy decisions generally;

|

| |

(b)

|

the Board devoting at least a day-long meeting to strategic planning annually; and

|

| |

(c)

|

the Board discussing strategies and their implementation regularly at the Board meetings.

|

On at least an annual basis, the Board shall approve the Corporation’s strategic plan or an update to the Corporation’s long term strategic plan, which shall take into account, among other things, the opportunities and risks of the Corporation’s business. The Board shall review and approve the corporate financial goals, operating plans and actions of the Company, including significant capital allocations, expenditures and transactions that exceed thresholds set by the Board.

The Board is responsible for identifying the principal risks of the Corporation’s businesses and ensuring that those risks are effectively managed, including appropriate crisis preparedness, business continuity, information system controls, cybersecurity and disaster recovery plans, as well as environmental, social and governance (ESG) matters). Among other things, the Board shall review the Corporation’s risk management policies and procedures. The Board may delegate to the Audit Committee responsibility for reviewing the Corporation’s internal controls and risk management policies and procedures related to the finance and accounting aspects of the business.

The Board shall ensure that systems are in place to identify principal risks to the Corporation and its businesses and that appropriate procedures are in place to manage those risks and to address and comply with applicable regulatory, corporate, securities and other compliance matters. Specifically, the Board shall ensure that procedures are in place to comply with the law, the Corporation’s Articles and By-laws, the Corporation’s Code of Business Conduct and Ethics, all exemption orders issued in respect of the Corporation by applicable securities regulatory authorities and all other significant Corporation policies and procedures.

The Board is responsible for overseeing succession planning matters for officers and senior management, including the appointment, training and monitoring of such persons, and to assist them with certain of those responsibilities, the Board has established the Compensation and Corporate Governance Committee.

The Board is also responsible for:

| |

(a)

|

generally ensuring depth in senior management;

|

| |

(b)

|

reviewing candidates for senior management positions;

|

| |

(c)

|

considering annually the organizational structure of the Corporation; and

|

| |

(d)

|

considering annually other succession planning matters.

|

The Board is responsible for adopting a communications policy that ensures that the Corporation communicates effectively with its shareholders, other stakeholders, and the public in general. The Corporate Disclosure Policy shall:

| |

(a)

|

contain measures for the Corporation to comply with its continuous and timely disclosure requirements and to avoid selective disclosure;

|

| |

(b)

|

address how the Corporation interacts with analysts, investors, other key stakeholders and the public; and

|

| |

(c)

|

address who reviews and approves major Corporation announcements.

|

The Corporation shall maintain an investor relations group contact with the responsibility of maintaining communications with the investing public in accordance with the Corporate Disclosure Policy. The Audit Committee shall review the Corporate Disclosure Policy at least annually.

The Board is responsible for ensuring the integrity of the Corporation’s internal control and management information systems. The Board may delegate its responsibilities relating to the Corporation’s internal control and management information systems to the Audit Committee.

The Board is responsible for developing the Corporation’s approach to corporate governance, including developing a set of corporate governance principles and guidelines that are specifically applicable to the Corporation. The Board shall monitor and evaluate the effectiveness of the system of corporate governance at the Corporation, including the information requirements for the Board, the frequency and content of meetings and the need for any special meetings, communication processes between the Board and management, the charters of the Board and its committees and policies governing size and compensation of the Board. To assist them with certain of these responsibilities, the Board has established the Compensation and Corporate Governance Committee.

|

8.

|

Measures for Receiving Feedback from Security Holders

|

The Board shall establish procedures to ensure that the Corporation, through management, provides timely information to current and potential security holders and responds to their inquiries. The purpose of these procedures will be to ensure that every security holder inquiry receives a prompt response from an appropriate spokesperson in accordance with the Corporation’s Corporate Disclosure Policy. The Board (or a committee thereof) shall ensure that designated persons under the Corporate Disclosure Policy are available to meet regularly with financial analysts and institutional investors.

The Board is responsible for:

| |

(a)

|

developing clear written position descriptions for the Chair of the Board, Lead Director and the Chair of each Board committee;

|

| |

(b)

|

together with the Corporation’s Chief Executive Officer (the “CEO”), developing a clear position description for the CEO, which includes delineating management’s responsibilities; and

|

| |

(c)

|

developing or approving the corporate goals and objectives that the CEO is responsible for meeting.

|

|

10.

|

Orientation and Continuing Education

|

The Board is responsible for:

| |

(a)

|

ensuring that all new directors receive a comprehensive orientation, so that they fully understand:

|

| |

(i)

|

the role of the Board and its committees, as well as the contribution individual directors are expected to make (including, in particular, the commitment of time and energy that the Corporation expects from its directors); and

|

| |

(ii)

|

the nature and operation of the Corporation’s business; and

|

| |

(b)

|

providing continuing education opportunities for all directors, so that they may:

|

| |

(i)

|

maintain or enhance their skills and abilities as directors; and

|

| |

(ii)

|

ensure that their knowledge and understanding of the Corporation’s business remains current.

|

|

11.

|

Code of Business Conduct and Ethics

|

The Board is responsible for adopting a written code of business conduct and ethics (the “Code”), applicable to directors, officers and employees of the Corporation. The Code shall constitute written standards that are reasonably designed to promote integrity and deter wrongdoing and shall address the following issues:

| |

(a)

|

conflicts of interest, including transactions and agreements in respect of which a director or executive officer has a material interest;

|

| |

(b)

|

protection and proper use of corporate assets and opportunities;

|

| |

(c)

|

confidentiality of corporate information;

|

| |

(d)

|

fair dealing with the Corporation’s security holders, customers, suppliers, competitors and employees;

|

| |

(e)

|

compliance with laws, rules and regulations; and

|

| |

(f)

|

reporting of any illegal or unethical behaviour.

|

The Board is responsible for monitoring compliance with the Code. Any waivers from the Code that are granted for the benefit of the Corporation’s directors or executive officers shall be granted by the Board (or a Board committee) only.

|

12.

|

Nomination of Directors

|

The Board is responsible for nominating or appointing individuals as directors, and to assist it with this responsibility the Board has established the Compensation and Corporate Governance Committee.

Prior to nominating or appointing individuals as directors, the Board shall:

| |

(a)

|

consider what competencies and skills the Board, as a whole, should possess;

|

| |

(b)

|

assess what competencies and skills each existing director possesses (including the personality and other qualities of each director);

|

| |

(c)

|

consider the appropriate size of the Board, with a view to facilitating effective decision-making; and

|

| |

(d)

|

consider the advice and input of the Compensation and Corporate Governance Committee.

|

The Board is responsible for overseeing compensation matters (including compensation of officers and other senior management personnel, approving the Corporation’s annual compensation budget and reviewing and approving matters related to the Corporation’s pension plans) and to assist it with these responsibilities, the Board has established the Compensation and Corporate Governance Committee.

More specifically, the Board is responsible for approving:

| |

(a)

|

the CEO’s compensation level, after consideration of the evaluation conducted by and the recommendations of the Compensation and Corporate Governance Committee; and

|

| |

(b)

|

non-CEO officer and director compensation, incentive-compensation plans and equity-based plans, after consideration of the recommendations of the Compensation and Corporate Governance Committee.

|

|

14.

|

Regular Board Assessments

|

The Board is responsible for regularly and at least annually assessing its own effectiveness and contribution, as well as the effectiveness and contribution of each Board committee and each individual director. Such assessments should consider:

| |

(a)

|

in the case of the Board, this mandate;

|

| |

(b)

|

in the case of a Board committee, the committee’s charter; and

|

| |

(c)

|

in the case of an individual director, the applicable position description(s), as well as the competencies and skills each individual director is expected to bring to the Board.

|

The Board is responsible for implementing a system which enables an individual director, the Board or a committee to engage an external advisor at the expense of the Corporation in appropriate circumstances. Unless otherwise provided in a committee charter, the engagement of the external advisor shall be subject to the approval of the Board.

__________

Exhibit 99.5

URANIUM ENERGY CORP.

(the “Corporation”)

INSIDER TRADING, REPORTING AND BLACKOUT POLICY

This Insider Trading, Reporting and Blackout Policy (the “Policy”) should be read in conjunction with each of the Corporation’s current Securities Trading and Reporting Guidelines and Corporate Disclosure Policy.

Purpose

The purpose of this Policy is to further explain certain legal concepts with respect to trading in the securities of the Corporation by certain individuals who are either employed by or in a particular relationship with the Corporation.

It is illegal for any director, officer or employee of the Corporation or any subsidiary of the Corporation to trade in the securities of the Corporation while in the possession of material non-public information concerning the Corporation. It is also illegal for any director, officer or employee of the Corporation to give material non-public information to others who may trade on the basis of that information. In order to comply with applicable securities laws governing (i) trading in Corporation securities while in the possession of material non-public information concerning the Corporation and (ii) tipping or disclosing material non-public information to outsiders, and in order to prevent the appearance of improper trading or tipping, the Corporation has adopted this Policy for all of its directors, officers and employees, members of their families and others living in their households, and investment partnerships and other entities (such as trusts and companies) over which such directors, officers or employees have or share voting or investment control.

It is the personal duty of each of directors, senior officers and other insiders of the Corporation to file insider reports following any trade or other change in holdings of securities of the Corporation (including the exercise of any options) in accordance with securities laws. Directors, officers and employees are also responsible for ensuring compliance by their families and other members of their households and entities over which they exercise voting or investment control. This Policy applies to any and all transactions in the Corporation’s securities, including its common shares and options to purchase common shares, warrants and any other type of securities that the Corporation may issue in the future or derivative instruments in such securities.

Any breach of this Policy is a serious offense which may lead to discipline by appropriate regulatory authorities, including possible fines and imprisonment. Any failure to adhere to the requirements specified herein also constitute grounds for immediate dismissal with cause from the Corporation.

This Policy provides a general explanation of the corporate governance requirements of a public company, like the Corporation, as well as the insider trading rules and insider reporting requirements under applicable securities laws and legislation in Canada and the United States. Each director, officer and employee is expected to review the enclosed materials and agrees to comply with the terms of this Policy. Any questions on this policy should be directed to the Corporation’s Chief Financial Officer.

Overview of Insider Trading Provisions under Securities Laws

Securities laws generally prohibit persons “in a special relationship” with the Corporation from (i) trading in securities with the knowledge of a material fact or change concerning the Corporation which is not generally disclosed, or (ii) informing another, except in the necessary course of business, of a material fact or change concerning the reporting issuer before it is generally disclosed. Securities laws also prohibit a person or company in a “special relationship” with a reporting issuer from purchasing or selling securities of such reporting issuer with knowledge of a material fact or material change with respect to that issuer that has not been generally disclosed.

Persons in a special relationship to the Corporation include (but are not limited to):

| |

(i)

|

members of the Board of Directors of the Corporation (each, a “Director”), officers and employees of the Corporation;

|

| |

(ii)

|

directors and officers of corporations which have a significant investment (more than 10%) in the Corporation securities;

|

| |

(iii)

|

a family member who lives in the same house as a person referred to above; and

|

| |

(iv)

|

any person who learns of a material fact or material change from any person referred to above.

|

A “material fact” is a piece of information which significantly affects or would reasonably be expected to have a significant effect on the market price or value of the Corporation securities.