Current Report Filing (8-k)

December 19 2022 - 4:31PM

Edgar (US Regulatory)

false

0001334933

0001334933

2022-12-19

2022-12-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

December 19, 2022

Date of Report (Date of earliest event reported)

URANIUM ENERGY CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

001-33706

|

98-0399476

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer Identification

No.)

|

|

500 North Shoreline, Ste. 800

Corpus Christi, Texas

|

|

78401

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(361) 888-8235

Registrant’s telephone number, including area code

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock

|

UEC

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

__________

|

Item 7.01

|

Regulation FD Disclosure

|

On December 19, 2022, Uranium Energy Corp. (the “Company” or “UEC”) issued a news release announcing, in accordance with NYSE American requirements, the filing of the Company’s quarterly report on Form 10-Q for the quarter ended October 31, 2022 with the U.S. Securities and Exchange Commission (the “SEC”). This Form 10-Q filing, which includes the Company’s interim condensed consolidated financial statements, related notes thereto and management’s discussion and analysis, is available for viewing on the SEC’s website at http://www.sec.gov/edgar.shtml or on the Company's website at www.uraniumenergy.com.

Completed two accretive acquisitions, realized profit from Physical Portfolio, and strengthened balance sheet:

| |

●

|

Industry leading growth with two accretive acquisitions of UEX Corporation (“UEX”) and Rio Tinto’s world-class, development-stage Roughrider Project.

|

| |

●

|

Acquired UEX for $192.7 million primarily in UEC stock which is expected to double total resources in all categories in the world-class, politically stable and uranium mining friendly jurisdiction of Canada, leading to the creation of the largest diversified North American focused uranium company.

|

| |

●

|

Welcomed Rio Tinto as a new shareholder with the acquisition of the Roughrider Project for total consideration of $146.2 million comprised of $82.1 million cash and $64.1 million in UEC stock.

|

| |

●

|

Expanded physical uranium purchases to date and contracted deliveries to 5.8 million pounds of North American warehoused uranium (“Physical Portfolio”), resulting in an average cost of ~$38 per pound with various delivery dates through December 2025.

|

| |

●

|

Generated revenues of $57.2 million from spot market sales of 1,150,000 pounds at a weighted average price of $49.75 per pound, realized gross profit of $13.8 million for the quarter ended Oct 31, 2022.

|

| |

●

|

No debt and $110.5 million of cash and liquid assets, comprised of $52.9 million in cash and physical uranium including 866,000 pounds of inventory, and $57.6 million in equity holdings as of December 16, 2022.

|

Amir Adnani, CEO and President stated: “This most recent quarter validates UEC's growth strategy and our strengths and unique abilities as a pure-play, 100% unhedged uranium supplier. Supported by our strong balance sheet and Physical Portfolio we are advancing a two-pronged approach, combining best in-class: 1) U.S. in-situ recovery (“ISR”) production anchored by two processing plants; and 2) Canadian high-grade conventional development pipeline. The Company’s North American warehoused Physical Portfolio is enabling opportunistic and profitable spot market sales and will be a reliable long-term source of supply.”

Acquisition Highlights

The UEX and Roughrider assets are primarily situated in the eastern Athabasca Basin of Saskatchewan, Canada. Highlights of the acquisitions include the following:

| |

●

|

Unlocking Value and Immediate Synergies: Roughrider with the recently acquired UEX projects located in the eastern Athabasca Basin, positions UEC with a critical mass of resources to enhance future production plans. Near to the development-stage Roughrider Project include UEC’s Raven-Horseshoe, Hidden Bay and Christie Lake Projects.

|

| |

●

|

Scaling up in Canada's High-Grade Athabasca Basin: After Cameco and Orano, UEC now controls the largest diversified resource base, hosted in multiple assets, in Canada’s Athabasca Basin.

|

| |

●

|

Infrastructure, Nearby Operations and Long-Standing Uranium History: There are over 20 uranium deposits, four current and historically producing mines, and two uranium mills within a 100 km distance from Roughrider, providing excellent infrastructure for future development, including all-weather roads, an all-weather airstrip within seven kms and robust electrical grid access, primarily generated from renewable hydroelectric power sources.(1)

|

| |

●

|

World-class Roughrider Project in a Premier Uranium Mining Jurisdiction: Development-stage Roughrider Project has a non-current, historic resource of 58 million pounds at an average grade of 4.73% U3O8 situated in the eastern Athabasca Basin of Canada, where 10% of global uranium production was sourced in 2021. (2)(3)

|

|

1.

|

Cameco Corporation 2021 ESG Report, SaskPower System Map accessible at https://www.saskpower.com

|

|

2.

|

Subject to the completion of S-K 1300 technical report summary.

|

|

3.

|

World Nuclear Association – World Uranium Mining Production and Largest Producing Uranium Mines in 2021.

|

The technical information in this news release has been reviewed by Christopher Hamel, P. Geo, Vice President Exploration Canada, for the Company, being a Qualified Person under Item 1302 of Regulation S-K.

A copy of the news release is attached as Exhibit 99.1 hereto.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

(a)

|

Financial Statements of Business Acquired

|

Not applicable.

|

(b)

|

Pro forma Financial Information

|

Not applicable.

|

(c)

|

Shell Company Transaction

|

Not applicable.

|

Exhibit

|

|

Description

|

| |

|

|

|

99.1

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document).

|

__________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

DATE: December 19, 2022.

|

URANIUM ENERGY CORP.

|

| |

|

| |

|

| |

By: |

/s/ Pat Obara

Pat Obara, Secretary and

Chief Financial Officer

|

__________

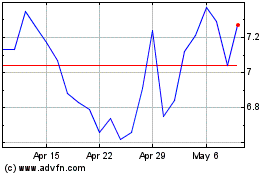

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Jun 2024 to Jul 2024

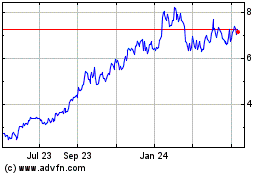

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Jul 2023 to Jul 2024