Current Report Filing (8-k)

August 08 2022 - 6:05AM

Edgar (US Regulatory)

false

0001334933

0001334933

2022-08-05

2022-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

August 5, 2022

Date of Report (Date of earliest event reported)

URANIUM ENERGY CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

001-33706

|

98-0399476

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

1030 West Georgia Street, Suite 1830

Vancouver, British Columbia

|

|

V6E 2Y3

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(604) 682-9775

Registrant’s telephone number, including area code

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock

|

UEC

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01

|

Regulation FD Disclosure

|

On August 5, 2022, Uranium Energy Corp. (the “Company” or “UEC”) issued a news release announcing that, further to its news release of July 28, 2022, it has advised UEX Corporation (“UEX”) that it is submitting a superior offer to the acquisition proposal made by Denison Mines Corp. (“Denison”) on July 28, 2022 (the “Denison Proposal”) for all of the issued and outstanding shares of UEX (“UEX Shares”).

Under the terms of UEC’s revised offer (the “Revised UEC Offer”), each holder of UEX Shares will now receive 0.0890 of one common share of UEC (a “UEC Share”) for each UEX Share held, implying consideration of approximately C$0.49 per UEX Share based on the closing price of UEX Shares and UEC Shares on the Toronto Stock Exchange and the NYSE American Exchange, respectively, and the spot exchange rate as of August 5, 2022. The Revised UEC Offer also increases the break fee by 7%, which is an increase proportional to the percentage increase in the offered exchange ratio under the Revised UEC Offer.

Amir Adnani, President and CEO, stated: “After careful analysis and consideration, we firmly believe the Revised UEC Offer represents a value-creating opportunity for UEC and UEX shareholders. We remain disciplined with respect to pursuing accretive growth and the Revised UEC Offer strikes a balance of a modest increase in the exchange ratio while doubling UEC’s uranium resources1 at only a 14.2% dilution to our outstanding shares. This transaction highlights UEC’s sector leading strategy as the fastest growing, pure play, 100% unhedged uranium company and will create the largest, diversified North American focused uranium company. Finally, a true testament to the win-win industrial logic of the transaction is the overwhelming positive support for our deal, as evidenced with over 38% of eligible UEX securities tendered with over 93.7% voted in favor, and the positive share price performance for UEC. With an offer that is superior to the Denison Proposal in all respects, we look forward to completing this transaction following the UEX shareholder vote next week.”

If the board of directors of UEX (the “UEX Board”) accepts the Revised UEC Offer, UEC expects that the special meeting of UEX securityholders to approve UEC’s acquisition of the UEX Shares based on the Revised UEC Offer will continue to be held as currently scheduled on Tuesday August 9, 2022, with an anticipated closing date (subject to court approval and the satisfaction or waiver of closing conditions customary for a transaction of this nature) by mid-August.

The Revised UEC Offer is superior to the Denison Proposal in all respects:

| |

●

|

Superior Financial Consideration. The Revised UEC Offer values UEX at C$0.49 per UEX Share, a 7% improvement over the original exchange ratio and higher financial consideration than the Denison Proposal based on closing prices of the shares and the spot exchange rate as at August 5, 2022. The Revised UEC Offer reflects a premium of 72% over the unaffected UEX Share price on June 10, 2022 (being the last trading day prior to the announcement of UEC’s proposed acquisition of UEX).

|

1 Subject to the completion of technical report summaries by UEC following closing of the proposed acquisition of UEX.

| |

●

|

Stronger Deal Certainty. As part of its Revised UEC Offer submission to the UEX Board, UEC has provided UEX with a simple amending agreement to the original arrangement agreement dated June 13, 2022, as amended June 23, 2022, among UEX, UEC and UEC 2022 Acquisition Corp. (the “Arrangement Agreement”) to reflect the Revised UEC Offer. By its own admission, Denison has characterized its proposal as “non-binding” and “remains subject to the entering into of a definitive agreement”2. Upon acceptance of the Revised UEC Offer by UEX, UEC will be firmly bound to complete the Revised UEC Offer as soon as practicable.

|

| |

●

|

Quicker Path to Completion. UEX securityholders are scheduled to vote on UEC’s proposed acquisition of the UEX Shares based on the Revised UEC Offer on Tuesday August 9, 2022, with closing of the transaction (subject to court approval and the satisfaction or waiver of closing conditions customary for a transaction of this nature) anticipated within days of the UEX securityholder vote. UEC understands that more than 38% of eligible UEX securities have already tendered, as of this press release, with an overwhelming 93.7% voting in favour of the UEC transaction.

|

| |

●

|

Denison Proposal is Financially Inferior, Uncertain and Remains Subject to the Negotiation of a Definitive Agreement. The Denison Proposal remains subject to, among other things, the negotiation of a definitive agreement, the preparation of an information circular providing disclosure on the proposed transaction, court and regulatory approvals, and the calling of a new securityholders meeting to approve the transaction. As such, a closing of any deal with Denison is likely to take UEX shareholders well into Q4 2022.

|

| |

●

|

Larger Trading Liquidity. UEC benefits from a strong institutional and retail following which has resulted in trading liquidity that is more than 50%3 greater than that of Denison. UEX shareholders, upon exchange of their UEX Shares for UEC Shares based on the Revised UEC Offer, will have a deeper pool to value and trade their securities.

|

| |

●

|

UEC Maintains its Strong Balance Sheet With Over $180 million of Cash and Liquid Assets, with No Debt.

|

| |

●

|

The Opportunity to Create the Largest Diversified North American Focused Uranium Company. UEX shareholders have an opportunity to be part of UEC’s fully permitted, production-ready assets in the U.S., which is the largest market in the world for uranium demand. UEC offers superior scale, as exhibited by its larger capital markets presence, and a path for immediate re-rating potential following a rapid timeline to closing of the transaction.

|

1 Denison press release dated July 29, 2022.

2 Based on average daily traded volume over the last 12 months.

It is the view of UEC, based on advice provided by its financial and legal advisors, that the superior proposal notice delivered by UEX to UEC on July 28, 2022 was deficient in several respects. These deficiencies have been communicated to UEX over the past few days, and have not, in our view, been rectified. While we have elected to increase the consideration offered in our proposed transaction, in making the Revised UEC Offer we advised UEX we were reserving all rights to require UEX to comply with the right to match provisions in the Arrangement Agreement, including, among other things, that the right to match period has not yet commenced.

The Revised UEC Offer expires at 7:00 p.m. (Vancouver time) on the date of this press release, coinciding with the termination of the right to match period under the Arrangement Agreement. Upon a determination by the UEX Board that the Revised UEC Offer is at least equivalent to the Denison Proposal, UEX is required to enter into an amending agreement to the Arrangement Agreement to reflect the Revised UEC Offer.

A copy of the news release is attached as Exhibit 99.1 hereto.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

(a)

|

Financial Statements of Business Acquired

|

Not applicable.

|

(b)

|

Pro forma Financial Information

|

Not applicable.

|

(c)

|

Shell Company Transaction

|

Not applicable.

|

Exhibit

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

URANIUM ENERGY CORP.

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE: August 5, 2022.

|

By:

|

/s/ Pat Obara

|

|

|

|

|

Pat Obara, Secretary and

|

|

|

|

|

Chief Financial Officer

|

|

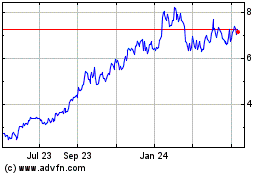

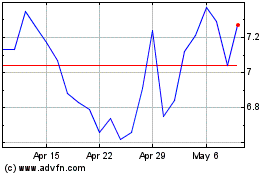

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Uranium Energy (AMEX:UEC)

Historical Stock Chart

From Jul 2023 to Jul 2024