UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 30, 2015

UR-ENERGY INC.

(Exact name of registrant as specified

in its charter)

| Canada |

001- 33905 |

Not applicable |

|

(State or other jurisdiction of

incorporation or organization) |

(Commission File Number) |

(I.R.S.

Employer Identification Number) |

| 10758 W Centennial Road, Suite 200 |

|

| Littleton, Colorado |

80127 |

| (Address of principal executive offices) |

(Zip code) |

Registrant’s

telephone number, including area code: (720) 981-4588

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On October 30, 2015, Ur-Energy Inc. issued

a press release announcing its financial results for the third quarter, ended September 30, 2015.

A copy of the press release is attached

hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in

this Current Report on Form 8-K, including the information set forth in Exhibit 99.1, is being furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise

subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing by the company under

the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

On November 3, 2015,

Ur-Energy held a teleconference and webcast to discuss its third quarter results and provide an operational update, as was previously

announced.

A copy of the presentation

slides from the teleconference and webcast is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The information in

this Current Report on Form 8-K, including the information set forth in Exhibit 99.1, is being furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise

subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing by the company under

the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

| |

Exhibit |

|

| |

No. |

Description |

| |

99.1 |

Press release of Ur-Energy Inc., dated October 30, 2015, reporting financial results for the third quarter, ended September 30, 2015.* |

| |

|

|

| |

99.2 |

Ur-Energy Third Quarter 2015 Teleconference and Webcast Presentation* |

*These

Exhibits are intended to be furnished to, not filed with, the SEC pursuant to General Instruction B.2 of Form 8-K.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: November 3,

2015

| |

Ur-Energy Inc. |

| |

|

|

| |

|

|

| |

By: |

/s/ Penne A. Goplerud |

| |

Name: |

Penne A. Goplerud |

| |

Title: |

Corporate Secretary and General Counsel |

EXHIBIT INDEX

| |

Exhibit |

|

|

| |

No. |

|

Description |

| |

99.1 |

|

Press release of Ur-Energy Inc., dated October 30, 2015, reporting financial results for the third quarter, ended September 30, 2015.* |

| |

|

|

|

| |

99.2 |

|

Ur-Energy Third Quarter 2015 Teleconference and Webcast Presentation* |

*These

Exhibits are intended to be furnished to, not filed with, the SEC pursuant to General Instruction B.2 of Form 8-K.

Exhibit 99.1

Ur-Energy Releases 2015 Q3 Results; Webcast

November 3, 2015

Littleton, Colorado (PR Newswire

– October 30, 2015) Ur-Energy Inc. (NYSE MKT:URG, TSX:URE) (the “Company” or “Ur-Energy”)

has filed the Company’s Form 10-Q for the quarter ended September 30, 2015, with the U.S. Securities and Exchange Commission

at www.sec.gov/edgar.shtml and with Canadian securities authorities on SEDAR at www.sedar.com.

Lost Creek Uranium Production and Sales

During the three months ended September

30, 2015, 172,282 pounds of U3O8 were captured within the Lost Creek plant, 176,850 pounds were packaged

in drums and 184,380 pounds of drummed inventory were shipped to the conversion facility, where 150,000 pounds were sold to customers

at an average price of $56.39. Sales revenues for the quarter of $8.5 million included one term-contract sale of 100,000 pounds

at $66.71 and one 50,000 pound spot sale at $35.75.

This brings our U3O8

production totals for the nine months ended September 30, 2015 to 571,830 pounds captured, 537,765 pounds drummed and 535,557 pounds

shipped. Through September 30, 2015, we sold a total of 700,000 pounds of U3O8 for $34.1 million, which includes

500,000 pounds from Lost Creek produced U3O8 and 200,000 pounds from externally purchased U3O8.

Our average cash cost per pound sold for the quarter was $15.19, which represents a decrease of $0.96, or 5.9%, from the previous

quarter. Our year-to-date average cost per pound sold is now $16.66 for the nine months ended September 30, 2015. These cash cost

per pound figures exclude ad valorem and severance taxes, which were $2.59 and $3.29 for the three and nine months ended September

30, 2015, respectively.

Jeff Klenda, Executive Director of Ur-Energy,

said, “Lost Creek has proven to be a truly exceptional property and, by improving our efficiencies, our operational team

continues to deliver outstanding industry leading performance.”

Eleven of the 13 originally-planned header

houses in Mine Unit 1 (MU1) are now in operation and surface construction of the remaining two houses is in progress. We anticipate

bringing HH 12 online early in November. All the originally planned wells have been installed and await only surface hookup following

completion of the remaining two header houses. Development of the already-permitted Mine Unit 2 (MU2) is also underway.

The exploration team has completed the

150-hole drill program, which was conducted to characterize three previously identified mineralized sand horizons. The program

was conducted in two phases. The first phase, consisting of 91 holes, was completed immediately south and adjacent to the production

area during the first quarter. Results from that phase of the program were previously announced and incorporated into the June

17, 2015 Technical Report on the Lost Creek Property. The remaining 59 holes were drilled as a part of the second phase and results

from that phase, as well as results from the development drilling in MU2, will be incorporated into a updated preliminary economic

assessment for the property.

Inventory, production and sales figures

for the Lost Creek Project are presented in the following tables.

| Inventory and Production | |

Unit | | |

2015 Q3 | | |

2015 Q2 | | |

2015 Q1 | | |

2014 Q4 | | |

2015 YTD | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Pounds captured | |

| lb | | |

| 172,282 | | |

| 207,268 | | |

| 192,280 | | |

| 149,564 | | |

| 571,830 | |

| Ad valorem and severance tax | |

| $000 | | |

$ | 674 | | |

$ | 310 | | |

$ | 150 | | |

$ | 1,163 | | |

$ | 1,134 | |

| Wellfield cash cost (1) | |

| $000 | | |

$ | 990 | | |

$ | 830 | | |

$ | 1,080 | | |

$ | 881 | | |

$ | 2,900 | |

| Wellfield non-cash cost (1)(2) | |

| $000 | | |

$ | 1,087 | | |

$ | 1,333 | | |

$ | 1,335 | | |

$ | 1,350 | | |

$ | 3,755 | |

| Ad valorem and severance tax per pound captured | |

| $/lb | | |

$ | 3.91 | | |

$ | 1.50 | | |

$ | 0.78 | | |

$ | 7.78 | | |

$ | 1.98 | |

| Cash cost per pound captured | |

| $/lb | | |

$ | 5.75 | | |

$ | 4.00 | | |

$ | 5.62 | | |

$ | 5.89 | | |

$ | 5.07 | |

| Non-cash cost per pound captured | |

| $/lb | | |

$ | 6.31 | | |

$ | 6.43 | | |

$ | 6.94 | | |

$ | 9.03 | | |

$ | 6.57 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Pounds drummed | |

| lb | | |

| 176,850 | | |

| 183,858 | | |

| 177,057 | | |

| 117,160 | | |

| 537,765 | |

| Plant cash cost (3) | |

| $000 | | |

$ | 1,824 | | |

$ | 1,983 | | |

$ | 1,718 | | |

$ | 1,553 | | |

$ | 5,525 | |

| Plant non-cash cost (2)(3) | |

| $000 | | |

$ | 498 | | |

$ | 498 | | |

$ | 497 | | |

$ | 507 | | |

$ | 1,493 | |

| Cash cost per pound drummed | |

| $/lb | | |

$ | 10.31 | | |

$ | 10.79 | | |

$ | 9.70 | | |

$ | 13.26 | | |

$ | 10.27 | |

| Non-cash cost per pound drummed | |

| $/lb | | |

$ | 2.82 | | |

$ | 2.71 | | |

$ | 2.81 | | |

$ | 4.33 | | |

$ | 2.78 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Pounds shipped to conversion facility | |

| lb | | |

| 184,380 | | |

| 179,672 | | |

| 171,505 | | |

| 102,071 | | |

| 535,557 | |

| Distribution cash cost (4) | |

| $000 | | |

$ | 80 | | |

$ | 141 | | |

$ | 145 | | |

$ | 112 | | |

$ | 366 | |

| Cash cost per pound shipped | |

| $/lb | | |

$ | 0.43 | | |

$ | 0.78 | | |

$ | 0.85 | | |

$ | 1.10 | | |

$ | 0.68 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Pounds purchased | |

| lb | | |

| - | | |

| 200,000 | | |

| - | | |

| - | | |

| 200,000 | |

| Purchase costs | |

| $000 | | |

$ | - | | |

$ | 7,878 | | |

$ | - | | |

$ | - | | |

$ | 7,878 | |

| Cash cost per pound purchased | |

| $/lb | | |

$ | - | | |

$ | 39.39 | | |

$ | - | | |

$ | - | | |

$ | 39.39 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Notes:

| 1 | Wellfield costs include all wellfield operating costs plus amortization of the related mineral

property acquisition costs and depreciation of the related asset retirement obligation costs. Wellfield construction and development

costs, which include wellfield drilling, header houses, pipelines, power lines, roads, fences and disposal wells, are treated as

development expense and are not included in wellfield operating costs. |

| 2 | Non-cash costs include depreciation of plant equipment, capitalized ARO costs and amortization

of the investment in the mineral property acquisition costs. The expenses are calculated on a straight line basis so the expense

is constant for each quarter. The cost per pound from these costs will therefore vary based on production levels only. |

| 3 | Plant costs include all plant operating costs, site overhead costs and depreciation of the related

plant construction and asset retirement obligation costs. |

| 4 | Distribution costs include all shipping costs and costs charged by the conversion facility for

weighing, sampling, assaying and storing the U3O8 prior to sale. |

| Sales and cost of sales | |

Unit | | |

2015 Q3 | | |

2015 Q2 | | |

2015 Q1 | | |

2014 Q4 | | |

2015 YTD | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Pounds sold | |

| lb | | |

| 150,000 | | |

| 404,000 | | |

| 146,000 | | |

| 100,000 | | |

| 700,000 | |

| U3O8 sales | |

| $000 | | |

$ | 8,459 | | |

$ | 18,213 | | |

$ | 7,380 | | |

$ | 6,603 | | |

$ | 34,052 | |

| Average long-term contract price | |

| $/lb | | |

$ | 66.71 | | |

$ | 46.88 | | |

$ | 50.55 | | |

$ | 66.03 | | |

$ | 51.22 | |

| Average spot price (1) | |

| $/lb | | |

$ | 35.75 | | |

$ | 36.50 | | |

$ | - | | |

$ | - | | |

$ | 36.19 | |

| Average price per pound sold | |

| $/lb | | |

$ | 56.39 | | |

$ | 45.08 | | |

$ | 50.55 | | |

$ | 66.03 | | |

$ | 48.65 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| U3O8 cost of sales (2) | |

| $000 | | |

$ | 4,180 | | |

$ | 13,791 | | |

$ | 5,390 | | |

$ | 3,700 | | |

$ | 23,361 | |

| Ad valorem and severance tax cost per pound sold | |

| $/lb | | |

$ | 2.59 | | |

$ | 2.78 | | |

$ | 4.73 | | |

$ | 3.18 | | |

$ | 3.29 | |

| Cash cost per pound sold | |

| $/lb | | |

$ | 15.19 | | |

$ | 16.15 | | |

$ | 18.86 | | |

$ | 20.32 | | |

$ | 16.66 | |

| Non-cash cost per pound sold | |

| $/lb | | |

$ | 10.09 | | |

$ | 10.05 | | |

$ | 13.32 | | |

$ | 13.47 | | |

$ | 11.02 | |

| Cost per pound sold - produced | |

| $/lb | | |

$ | 27.87 | | |

$ | 28.98 | | |

$ | 36.91 | | |

$ | 36.97 | | |

$ | 30.97 | |

| Cost per pound sold - purchased | |

| $/lb | | |

$ | - | | |

$ | 39.39 | | |

$ | - | | |

$ | - | | |

$ | 39.39 | |

| Average cost per pound sold | |

| $/lb | | |

$ | 27.87 | | |

$ | 34.14 | | |

$ | 36.91 | | |

$ | 36.97 | | |

$ | 33.37 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| U3O8 gross profit | |

| $000 | | |

$ | 4,279 | | |

$ | 4,422 | | |

$ | 1,990 | | |

$ | 2,903 | | |

$ | 10,691 | |

| Gross profit per pound sold | |

| $/lb | | |

$ | 28.52 | | |

$ | 10.94 | | |

$ | 13.63 | | |

$ | 29.03 | | |

$ | 15.28 | |

| Gross profit margin | |

| % | | |

| 50.6 | % | |

| 24.3 | % | |

| 27.0 | % | |

| 44.0 | % | |

| 31.4 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ending Inventory Balances | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Pounds | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| In-process inventory | |

| lb | | |

| 71,860 | | |

| 79,036 | | |

| 79,284 | | |

| 65,233 | | |

| | |

| Plant inventory | |

| lb | | |

| 22,455 | | |

| 30,006 | | |

| 25,819 | | |

| 15,188 | | |

| | |

| Conversion facility inventory | |

| lb | | |

| 102,782 | | |

| 66,314 | | |

| 82,021 | | |

| 56,259 | | |

| | |

| Total inventory | |

| lb | | |

| 197,097 | | |

| 175,356 | | |

| 187,124 | | |

| 136,680 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total cost | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| In-process inventory | |

| $000 | | |

$ | 1,121 | | |

$ | 1,219 | | |

$ | 1,368 | | |

$ | 2,084 | | |

| | |

| Plant inventory | |

| $000 | | |

$ | 712 | | |

$ | 850 | | |

$ | 761 | | |

$ | 882 | | |

| | |

| Conversion facility inventory | |

| $000 | | |

$ | 3,025 | | |

$ | 1,815 | | |

$ | 2,573 | | |

$ | 2,202 | | |

| | |

| Total inventory | |

| $000 | | |

$ | 4,858 | | |

$ | 3,884 | | |

$ | 4,702 | | |

$ | 5,168 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost per pound | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| In-process inventory | |

| $/lb | | |

$ | 15.60 | | |

$ | 15.42 | | |

$ | 17.25 | | |

$ | 31.95 | | |

| | |

| Plant inventory | |

| $/lb | | |

$ | 31.71 | | |

$ | 28.33 | | |

$ | 29.47 | | |

$ | 58.07 | | |

| | |

| Conversion facility inventory | |

| $/lb | | |

$ | 29.43 | | |

$ | 27.37 | | |

$ | 31.37 | | |

$ | 39.14 | | |

| | |

Notes:

| 1 | There were no spot sales in either 2015 Q1 or 2014. |

| 2 | Cost of sales include all production costs (notes 1, 2, 3 and 4 in the previous Inventory and Production

table) adjusted for changes in inventory values. |

Total Cost Per Pound Sold

Reconciliation | |

Unit | | |

2015 Q3 | | |

2015 Q2 | | |

2015 Q1 | | |

2014 Q4 | | |

2015 YTD | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Ad valorem & severance taxes | |

| $000 | | |

$ | 674 | | |

$ | 310 | | |

$ | 150 | | |

$ | 1,163 | | |

$ | 1,134 | |

| Wellfield costs | |

| $000 | | |

$ | 2,077 | | |

$ | 2,163 | | |

$ | 2,415 | | |

$ | 2,230 | | |

$ | 6,655 | |

| Plant and site costs | |

| $000 | | |

$ | 2,322 | | |

$ | 2,481 | | |

$ | 2,215 | | |

$ | 2,060 | | |

$ | 7,018 | |

| Distribution costs | |

| $000 | | |

$ | 80 | | |

$ | 141 | | |

$ | 145 | | |

$ | 112 | | |

$ | 366 | |

| Inventory change | |

| $000 | | |

$ | (973 | ) | |

$ | 818 | | |

$ | 465 | | |

$ | (1,868 | ) | |

$ | 310 | |

| Cost of sales - produced | |

| $000 | | |

$ | 4,180 | | |

$ | 5,913 | | |

$ | 5,390 | | |

$ | 3,697 | | |

$ | 15,483 | |

| Cost of sales - purchased | |

| $000 | | |

$ | — | | |

$ | 7,878 | | |

$ | — | | |

$ | — | | |

$ | 7,878 | |

| Total cost of sales | |

| $000 | | |

$ | 4,180 | | |

$ | 13,791 | | |

$ | 5,390 | | |

$ | 3,697 | | |

$ | 23,361 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Pounds sold produced | |

| lb | | |

| 150,000 | | |

| 204,000 | | |

| 146,000 | | |

| 100,000 | | |

| 500,000 | |

| Pounds sold purchased | |

| lb | | |

| — | | |

| 200,000 | | |

| — | | |

| — | | |

| 200,000 | |

| Total pounds sold | |

| lb | | |

| 150,000 | | |

| 404,000 | | |

| 146,000 | | |

| 100,000 | | |

| 700,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average cost per pound sold - produced (1) | |

| $/lb. | | |

$ | 27.87 | | |

$ | 28.98 | | |

$ | 36.91 | | |

$ | 36.97 | | |

$ | 30.97 | |

| Average cost per pound sold - purchased | |

| $/lb. | | |

$ | - | | |

$ | 39.39 | | |

$ | - | | |

$ | - | | |

$ | 39.39 | |

| Total average cost per pound sold | |

| $/lb. | | |

$ | 27.87 | | |

$ | 34.14 | | |

$ | 36.91 | | |

$ | 36.97 | | |

$ | 33.37 | |

| 1 | The cost per pound sold reflects both cash and non-cash costs, which are combined as cost of sales

in the statement of operations included in this filing. The cash and non-cash cost components are identified in the above inventory,

production and sales table. |

The cost of sales includes ad valorem and

severance taxes related to the extraction of uranium, all costs of wellfield, plant and site operations including the related depreciation

and amortization of capitalized assets, reclamation and mineral property costs, plus product distribution costs. These costs are

also used to value inventory and the resulting inventoried cost per pound is compared to the estimated sales prices based on the

contracts or spot sales anticipated for the distribution of the product. Any costs in excess of the calculated market value are

charged to cost of sales.

Continuing Guidance for 2015

Our production plan for 4Q2015 is to maintain

an average production rate of approximately 60,000 to 70,000 pounds per month, and to produce between 750,000 and 850,000 pounds

of U3O8 for the year. Current projections indicate meeting this target at the low end of the range. Any excess

production that is not sold into existing contracts will be used to build inventory, which may be utilized to complete discretionary

spot sales transactions on an as-needed basis if market conditions warrant.

We ended the quarter with 125,237

pounds of dried and drummed U3O8 in ending inventory. Of those, 102,782 pounds were held at the conversion

facility at a total cost per pound of $29.43, which consisted of ad valorem and severance taxes ($2.99), cash costs ($16.50) and

non-cash costs ($9.94). This represents an increase of $2.06 per pound, or 7.5%, from the previous quarter. The increase was primarily

the result of capturing and drumming fewer pounds during the quarter as compared to the previous quarter, combined with higher

ad valorem and severance taxes as more fully described in our 2015 Third Quarter Form 10-Q.

Production rates in the fourth

quarter are improving. Through October 28, we have captured 63,440 pounds and drummed 64,192 pounds of U3O8.

The average flow rate through October 28 was 2,393 gallons per minute and the U3O8 head grade was 83.7 milligrams

per liter.

As at October 29, 2015, our unrestricted

cash position was $3.0 million.

Our 2015 Third Quarter Form

10-Q may be accessed on the Company’s website at www.ur-energy.com.

November 3, 2015 Webcast

The Ur-Energy management team will provide

a review of the 2015 third quarter operations and sales, and guidance via a webcast on November 3, 2015. A Q&A session will

follow the presentation. Those wishing to participate by phone can do so by calling:

US Number 1-877-226-2859

Canada Number 1-855-669-9657

International Number 1-412-542-4134

Ask to be joined into the Ur-Energy

call.

The call is being webcast by PR Newswire.

The webcast can be accessed 10 minutes prior to the call. Pre-registration and participation access is available by clicking here

or by copying the following URL into your web browser:

https://www.webcaster4.com/Webcast/Page/1186/11126

If you are unable to join the call, a

link will be available following the webcast on the Company’s website www.ur-energy.com.

About Ur-Energy

Ur-Energy is a uranium mining company

operating the Lost Creek in-situ recovery uranium facility in south-central Wyoming. The Lost Creek processing facility

has a two million pounds per year nameplate design capacity. Shirley Basin, our newest project, is one of the Pathfinder Mines

assets we acquired in 2013. Baseline studies necessary for permitting and licensing of the project are currently being advanced.

Ur-Energy is engaged in uranium mining, recovery and processing activities, including the acquisition, exploration, development

and operation of uranium mineral properties in the United States. Shares of Ur-Energy trade on the NYSE MKT under the symbol “URG”

and on the Toronto Stock Exchange under the symbol “URE.” Ur-Energy’s corporate office is located in Littleton,

Colorado; its registered office is in Ottawa, Ontario. Ur-Energy’s website is www.ur-energy.com.

FOR FURTHER INFORMATION, PLEASE CONTACT

| Rich Boberg, Senior Director IR/PR |

Jeff Klenda, Chairman |

| 866-981-4588 |

866-981-4588 |

| rich.boberg@ur-energy.com |

jeff.klenda@ur-energy.com

|

Cautionary Note Regarding Forward-Looking

Information

This release may contain “forward-looking

statements” within the meaning of applicable securities laws regarding events or conditions that may occur in the future

(e.g., results of production and ability to maintain production in steady state at Lost Creek; ability to meet production

targets, continue to lower cost per pound, and to timely deliver into existing contractual obligations; the results of 2015 drilling

at Lost Creek; ability to deliver into spot sales if the market conditions warrant) and are based on current expectations that,

while considered reasonable by management at this time, inherently involve a number of significant business, economic and competitive

risks, uncertainties and contingencies. Factors that could cause actual results to differ materially from any forward-looking statements

include, but are not limited to, capital and other costs varying significantly from estimates; failure to establish estimated resources

and reserves; the grade and recovery of ore which is mined varying from estimates; production rates, methods and amounts varying

from estimates; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; inflation;

changes in exchange rates; fluctuations in commodity prices; delays in development and other factors described in the public filings

made by the Company at www.sedar.com and www.sec.gov. Readers should not place undue reliance on forward-looking statements. The

forward-looking statements contained herein are based on the beliefs, expectations and opinions of management as of the date hereof

and Ur-Energy disclaims any intent or obligation to update them or revise them to reflect any change in circumstances or in management’s

beliefs, expectations or opinions that occur in the future.

Exhibit 99.2

NYSE MKT: URG • TSX: URE Ur - Energy Third Quarter 2015 Teleconference and Webcast

NYSE MKT: URG • TSX: URE This presentation contains “forward - looking statements,” within the meaning of applicable securities laws, regarding events or conditions that may occur in the future . Such statements include without limitation the Company’s ability to maintain steady state and improve production rates, associated costs and timing to make product deliveries ; the technical and economic viability of Lost Creek (including the production and cost projections contained in the preliminary economic analysis of the Lost Creek Property) ; whether higher - than - expected headgrades will continue to be realized throughout Lost Creek ; the ability to complete additional favorable uranium sales agreements and ability to reduce exposure to volatile market ; the potential of exploration targets throughout the Lost Creek Property (including the continuing ability to expand resources) ; completion of (and timing for) regulatory approvals and other development at Shirley Basin ; whether additional financing may become necessary . These statements are based on current expectations that, while considered reasonable by management at this time, inherently involve a number of significant business, economic and competitive risks, uncertainties and contingencies . Numerous factors could cause actual events to differ materially from those in the forward - looking statements . Factors that could cause such differences, without limiting the generality of the following, include : risks inherent in exploration activities ; volatility and sensitivity to market prices for uranium ; volatility and sensitivity to capital market fluctuations ; the impact of exploration competition ; the ability to raise funds through private or public equity financings ; imprecision in resource and reserve estimates ; environmental and safety risks including increased regulatory burdens ; unexpected geological or hydrological conditions ; a possible deterioration in political support for nuclear energy ; changes in government regulations and policies, including trade laws and policies ; demand for nuclear power ; weather and other natural phenomena ; delays in obtaining or failures to obtain required governmental, environmental or other project approvals ; and other exploration, development, operating, financial market and regulatory risks . Although Ur - Energy Inc . believes that the assumptions inherent in the forward - looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this presentation . Ur - Energy Inc . disclaims any intention or obligation to update or revise any forward - looking statement, whether as a result of new information, future events or otherwise . Cautionary Note Regarding Projections : Similarly, t his presentation also may contain projections relating to an extended future period and, accordingly, the estimates and assumptions underlying the projections are inherently highly uncertain, based on events that have not taken place, and are subject to significant economic, financial, regulatory, competitive and other uncertainties and contingencies beyond the control of Ur - Energy Inc . Further, given the nature of the Company's business and industry that is subject to a number of significant risk factors, there can be no assurance that the projections can be or will be realized . It is probable that the actual results and outcomes will differ, possibly materially, from those projected . The attention of investors is drawn to the Risk Factors set out in the Company's Annual Report on Form 10 - K, filed March 2 , 2015 , which is filed with the U . S . Securities and Exchange Commission on EDGAR (http : //www . sec . gov/edgar . shtml) and the regulatory authorities in Canada on SEDAR (www . sedar . com) . Cautionary Note to U . S . Investors Concerning Estimates of Measured, Indicated or Inferred Resources : the information presented uses the terms "measured", "indicated" and "inferred" mineral resources . United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize these terms . United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves . United States investors are also cautioned not to assume that all or any part of an inferred mineral resource exists, or is economically or legally minable . John Cooper, Ur - Energy Senior Geologist, P . Geo . , SME Registered Member and Qualified Person as defined by National Instrument 43 - 101 , reviewed and approved the technical information contained in this presentation . 2

NYSE MKT: URG • TSX: URE 3 See Disclaimer re Forward - looking Statements and Projections (slide 2) ▪ Lost Creek ISR – our 100% Owned Uranium Production Facility – Initiated Production 3Q 2013 • Produced 1,000,000 th pound of U 3 0 8 2Q 2015 • State of the art flagship project • Results demonstrate that Lost Creek is a reliable, low cost production center – “steady state” production ▪ Resource Growth – First 2015 Update • MU1 gross increase of 2.31 million lbs measured resource • Resources from exploration drilling: 100,000lbs Measured &Indicated; 300,000lbs Inferred ▪ Pathfinder - Shirley Basin, our Next Development • PEA Completed in January 2015 • Applications for permits anticipated 4Q 2015 ▪ Realizing better sales prices through long - term sales agreements

NYSE MKT: URG • TSX: URE 4 Share Capital & Cash Position As of 9/30/15 Shares Outstanding 130.19M Stock Options & RSUs 9.45M Warrants 8.32M Fully Diluted 147.96M Market Cap (11/02/15) US$72.58M Cash (10/29/15) US$3.0M Share Price (11/02/15) US$0.56 52 Week Range US$.53 - $1.08 Avg. Daily Volume ~231,000 (3 - mo URG & URE 11/02/15) Member of S&P/TSX SmallCap Index Geographical Distribution as of 6/30/15 United States ~65% Canada ~19% Other ~16% NYSE MKT: URG TSX: URE

NYSE MKT: URG • TSX: URE ▪ Multiple long - term contracts spanning 2013 - 2021 timeframe, post Fukushima ▪ ~2.8M lbs committed 2016 – 2020 (avg. price $49.60/lb) ▪ De - risking by securing future revenue stream in an uncertain market • 2015 : 630,000 lbs U 3 O 8 at avg. price of $50.10/lb - $31.56M gross revenues • 2016 : 662,000 lbs U 3 O 8 at avg. price of $47.61/lb - $31.52M gross revenues • Spot sales supplementing 5 ▪ Exclusive representation by Jim Cornell of NuCore Energy, LLC in negotiations of off - take purchase agreements See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE MKT: URG • TSX: URE 6

NYSE MKT: URG • TSX: URE 7 Drilling Status ▪ MU1 - 100% of original planned wells installed ▪ MU2 - Production well installation ongoing in first 3 header houses ▪ Exploration – Completed 150 hole program Mine Unit 1 Interior of Header House Mine Unit Construction Status ▪ MU1 Surface Construction ▪ HH 1 through 11 complete and operating ▪ HH 12 under construction ▪ Pipeline and Road complete ▪ Surface and Downhole construction near completion • MU2 Infrastructure Construction – underway in Q4 2015 Drill Mapping

NYSE MKT: URG • TSX: URE 8 2014 Q4 2015 Q1 2015 Q2 2015 Q3 YTD Through October 28, 2015 Captured Lbs. 150k 192k 207k 172k 635k Drummed Lbs. 117k 177k 184k 177k 602k Shipped Lbs. 102k 172k 180k 184k 609k HHs Operating 7 9 10 11 11 Avg. Grade 123 ppm 110 ppm 108 ppm 86 ppm 100 ppm U 3 O 8 Production ▪ All plant systems functional with maintenance occurring as necessary. ▪ RO is idle until flow rates are elevated or restoration is initiated. ▪ Waste Water ▪ All 3 disposal wells are available and utilized as necessary. ▪ Storage ponds utilized as necessary for waste water storage Lost Creek Plant

NYSE MKT: URG • TSX: URE 9 2013 2014 2015 Q1 2015 Q2 2015 Q3 190K lbs captured 596K lbs captured 192K lbs captured 207K lbs captured 172K lbs captured 131K lbs drummed 548K lbs drummed 177K lbs drummed 184k lbs drummed 177k lbs drummed $21.98/lb cash cost * $19.73/lb cash cost * $18.86/lb cash cost * $16.15/lb cash cost * $15.19/lb cash cost * U 3 O 8 Production 2013 2014 2015 Q1 2015 Q2 2015 Q3 $5.7 million $26.5 million $7.4 million $18.2 million $8.5 million 90K lbs at $62.92/lb sold 518K lbs at $51.22/lb sold 146K lbs at $50.55/lb sold 404k lbs at $45.08/lb sold 150k lbs at $56.39/lb sold Revenues from Operations $16.66 – YTD average cash cost/lb sold before severance and ad valorem taxes for the nine months ended September 30, 2015. * Excludes severance and ad valorem taxes, which for 2014 averaged $2.48 per pound and for the 9 months ended September 30, 2015 averaged $3.29 per pound

NYSE MKT: URG • TSX: URE ▪ June 17, 2015 43 - 101 Technical Report increased MU1 resources Net increase to MU1 of 1.3 Mlbs. Measured resource (55% increase) after production accounting. Lowered GT cut - off from 0.30 to 0.20 ▪ 2015 Exploration Program • Phase 1 drilling in Q1 delineated 121,000 lbs. M&I resources and 296,000 lbs. Inf. resources. • Phase 2 drilling was completed in Q3 and additional resources are being evaluated and compiled. ▪ MU2 Development Drilling • Over 200 wells have been piloted in 2015 within MU2. Results of this drilling are anticipated to increase mine unit resources. ▪ Resource Update and Economic Analysis (PEA) expected in Q4 10 See Disclaimer re Forward - looking Statements and Projections (slide 2) Sweetwater County, Wyoming, USA * Technical Report for the Lost Creek Property, Sweetwater County, Wyoming prepared by TREC Inc. – June 17, 2015 (posted on SEDAR) .

NYSE MKT: URG • TSX: URE ▪ Purchase closed in December 2013 ▪ On patented mining claims – we own the ground ▪ NI 43 - 101 Preliminary Economic Assessment published January 27, 2015 ▪ 8.8 million pounds, shallow, high grade roll front deposit ▪ ISR amenable mineralization ▪ Permit applications nearing completion 11 See Disclaimer re Forward - looking Statements and Projections (slide 2) * Preliminary Economic Assessment Shirley Basin Uranium Project, Carbon County, Wyoming prepared by Western Water Consultants, Inc ., d/b/a WWC Engineering – January 27, 2015 (posted on SEDAR).

NYSE MKT: URG • TSX: URE 12 ▪ Cash cost per pound falling quarter - over - quarter (Q1 $18.86, Q2 $16.15, Q3 $15.19) ▪ All - in costs below $30 ▪ Margins improving $2.52 $3.18 $4.73 $2.78 $2.59 $20.77 $20.32 $18.86 $16.15 $15.19 $14.23 $13.47 $13.32 $10.05 $10.09 $31.80 $37.13 $38.36 $36.17 $36.21 $59.96 $66.03 $50.55 $45.08 $56.39 $- $10.00 $20.00 $30.00 $40.00 $50.00 $60.00 $70.00 2014 Q3 2014 Q4 2015 Q1 2015 Q2 2015 Q3 $ per Pound Quarter Price and Cost per Pound Sold by Quarter Ad valorem and severance tax Cash Non-cash Spot rate Average sales price

NYSE MKT: URG • TSX: URE 13 Increasing operational efficiencies (steady state) permits ▪ b uilding inventory; ▪ d iscretionary spot sales; ▪ low cash cost per pound in ending inventory (Q3 $16.50). 66,298 65,233 79,284 79,036 71,860 5,634 15,188 25,819 30,006 22,455 47,506 56,259 82,021 66,314 102,782 $36.35 $39.14 $31.37 $27.37 $30.13 $- $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 $45.00 - 50,000 100,000 150,000 200,000 250,000 2014 Q3 2014 Q4 2015 Q1 2015 Q2 2015 Q3 Cost per Pound Pounds Quarter Ending Inventory by Quarter In-process Plant Conversion Facility Cost per Pound

NYSE MKT: URG • TSX: URE ▪ Continued focus to attain company - wide cost savings ▪ Long - term s ales a greements • Multiple contracts t hrough 2021 • Very selective as to pricing that we will accept ▪ M & A activities ▪ No equity financing ▪ Q4 corporate priorities • Lost Creek: continue at steady - state; greater efficiencies • Complete Lost Creek resource update and PEA • Submit Shirley Basin applications for permits / licenses 14

NYSE MKT: URG • TSX: URE For more information, please contact: Jeff Klenda , Board Chairman & Executive Director Rich Boberg , Senior Director of Investor and Public Relations By Mail: Ur - Energy Corporate Office 10758 W. Centennial Rd., Suite 200 Littleton, CO 80127 USA By Phone: Office 720.981.4588 Toll - Free 866.981.4588 Fax 720.981.5643 By E - mail: jeff.klenda@ur - energy.com rich.boberg@ur - energy.com 15

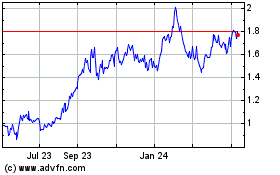

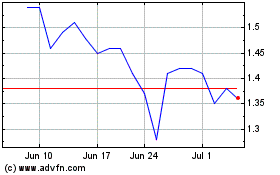

Ur Energy (AMEX:URG)

Historical Stock Chart

From Sep 2024 to Oct 2024

Ur Energy (AMEX:URG)

Historical Stock Chart

From Oct 2023 to Oct 2024