UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 13, 2015

UR-ENERGY INC.

(Exact name of registrant as specified in

its charter)

|

Canada |

001- 33905 |

Not applicable |

(State

or other jurisdiction of

incorporation or organization) |

(Commission

File Number) |

(I.R.S.

Employer

Identification Number) |

| 10758 W Centennial Road, Suite 200 |

|

| Littleton, Colorado |

80127 |

| (Address of principal executive offices) |

(Zip code) |

Registrant’s

telephone number, including area code: (720) 981-4588

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On April 13, 2015,

Ur-Energy Inc. issued a press release providing an operational update for the quarter ended March 31, 2015.

A copy of the press

release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in

this Current Report on Form 8-K, including the information set forth in Exhibit 99.1, is being furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise

subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing by the company under

the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

No. |

|

Description |

| 99.1 |

|

Press release of Ur-Energy Inc., dated April 13, 2015, providing an operational update for the quarter ended March 31, 2015.* |

| | *This Exhibit is intended to be furnished to, not filed with, the SEC pursuant to General Instruction B.2 of Form 8-K. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: April 14, 2015

| |

Ur-Energy Inc. |

|

| |

|

|

|

| |

By: |

/s/ Penne A. Goplerud |

|

| |

|

|

|

| |

|

Name: |

Penne A. Goplerud |

|

| |

|

Title: |

Corporate Secretary and General Counsel |

EXHIBIT INDEX

Exhibit

No. |

|

Description |

| 99.1 |

|

Press release of Ur-Energy Inc., dated April 13, 2015, providing an operational update for the quarter ended March 31, 2015.* |

| | *This Exhibit is intended to be furnished to, not filed with, the SEC pursuant to General Instruction

B.2 of Form 8-K. |

Exhibit 99.1

Ur-Energy Provides 2015 Q1 Operational

Results

Littleton, Colorado (PR Newswire

– April 13, 2015) Ur-Energy Inc. (NYSE MKT:URG, TSX:URE) (the “Company” or “Ur-Energy”) provides

the following report of operational results for first quarter 2015.

Highlights

| Lost Creek Operations |

| |

Units |

2015 Q1 |

|

2014 Q4 |

| |

|

|

|

|

| U3O8 Captured |

(‘000 lbs) |

192.3 |

|

149.6 |

| U3O8 Dried & Drummed |

(‘000 lbs) |

177.1 |

|

117.2 |

| U3O8 Sold |

(‘000 lbs) |

146.0 |

|

100.0 |

| |

|

|

|

|

| Average Flow Rate |

(gpm) |

1,681 |

|

1,145 |

| U3O8 Head Grade |

(mg/l) |

110 |

|

123 |

Lost Creek Uranium Production and Sales

For a sixth straight quarter, the Company’s

Lost Creek Project made sales to meet its contractual commitments. This included product sales of 146,000 pounds U3O8,

which were sold at an average price of $50.55 per pound. Quarterly product sales revenues totaled $7.4 million.

Although production rates at the Project

were slowed slightly during the latter part of the quarter while maintenance was conducted on several process circuits, captured

pounds increased 29% over the previous quarter. Production flow increased by 47% quarter-over-quarter by sourcing from nine header

houses in the first mine unit. Header houses 8 and 9 were brought on line during the first quarter. A tenth header house in the

first mine unit is under construction. Plant head grades continue to be significantly higher than projected. For the quarter, 192,280

pounds of U3O8 were captured within the Lost Creek plant. 177,057 pounds U3O8 were

packaged in drums and 171,505 pounds U3O8 of drummed inventory were shipped out of the Lost Creek processing

plant.

Pending Exploration Results and Additional

Operational Highlights

During the quarter, the exploration team

initiated an exploration drill program south of the production area for which results are currently being analyzed. Thus far, the

program has included 91 holes, of which 34 holes encountered uranium intercepts with either strong mineralization or what

the Company characterizes within its technical reports specific to the property as “ore-quality” mineralization (namely,

GT ≥ 0.30, grade ≥ 0.020% eU3O8). We anticipate completing the 150-hole program during third quarter.

In addition to the plant maintenance and

refinements which were completed during the period, Lost Creek water management practices continue to improve: the third deep disposal

well and the reverse osmosis circuits became operational during the period.

Continuing Guidance for 2015

The Q2 2015 production target

for Lost Creek is 210,000 pounds U3O8 dried and drummed. The production rate may be adjusted based on continuing

operational refinements, and indicators in the market, including uranium spot market pricing and other factors.

About Ur-Energy

Ur-Energy is a uranium mining company

operating the Lost Creek in-situ recovery uranium facility in south-central Wyoming. The Lost Creek processing facility

has a two million pounds per year nameplate design capacity. Shirley Basin, our newest project, is one of the Pathfinder Mines

assets we acquired in 2013. Baseline studies necessary for permitting and licensing of the project are currently being advanced.

Ur-Energy is engaged in uranium mining, recovery and processing activities, including the acquisition, exploration, development

and operation of uranium mineral properties in the United States. Shares of Ur-Energy trade on the NYSE MKT under the symbol “URG”

and on the Toronto Stock Exchange under the symbol “URE.” Ur-Energy’s corporate office is located in Littleton,

Colorado; its registered office is in Ottawa, Ontario. Ur-Energy’s website is www.ur-energy.com.

FOR FURTHER INFORMATION, PLEASE CONTACT

| Rich Boberg, Senior Director IR/PR |

Jeffrey Klenda, Executive Director, Acting CEO |

| 866-981-4588 |

866-981-4588 |

| Rich.Boberg@ur-energy.com |

Jeff.Klenda@ur-energy.com |

NI 43-101 Review

of Technical Information

John K. Cooper,

Ur-Energy Project Geologist, P.Geo., SME Registered Member and Qualified Person as defined by National Instrument 43-101, reviewed

and approved the technical information contained in this release.

Cautionary Note Regarding Forward-Looking

Information

This release may contain “forward-looking

statements” within the meaning of applicable securities laws regarding events or conditions that may occur in the future

(e.g., results of continued commissioning, maintenance and operational activities at the Lost Creek facility, including

water management practices; ability to meet production targets for second quarter) and are based on current expectations that,

while considered reasonable by management at this time, inherently involve a number of significant business, economic and competitive

risks, uncertainties and contingencies. Factors that could cause actual results to differ materially from any forward-looking

statements include, but are not limited to, capital and other costs varying significantly from estimates; failure to establish

estimated resources and reserves; the grade and recovery of ore which is mined varying from estimates; production rates, methods

and amounts varying from estimates; delays in obtaining or failures to obtain required governmental, environmental or other project

approvals; inflation; fluctuations in commodity prices; delays in development and other factors described in the public filings

made by the Company at www.sedar.com and www.sec.gov. Readers should not place undue reliance on forward-looking

statements. The forward-looking statements contained herein are based on the beliefs, expectations and opinions of management

as of the date hereof and Ur-Energy disclaims any intent or obligation to update them or revise them to reflect any change in

circumstances or in management’s beliefs, expectations or opinions that occur in the future.

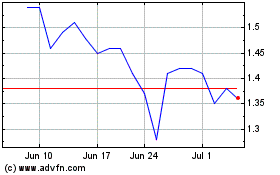

Ur Energy (AMEX:URG)

Historical Stock Chart

From Oct 2024 to Nov 2024

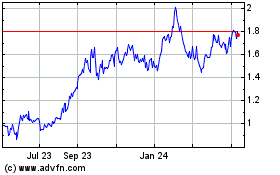

Ur Energy (AMEX:URG)

Historical Stock Chart

From Nov 2023 to Nov 2024