SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13E-3

TRANSACTION STATEMENT UNDER SECTION 13(e) OF THE

SECURITIES EXCHANGE ACT OF 1934 AND

RULE 13e-3 THEREUNDER

Rule 13e-3 Transaction Statement Under Section 13(e)

of the Securities Exchange Act of 1934

SUPERIOR

DRILLING PRODUCTS, INC.

(Name of the Issuer)

Superior

Drilling Products, Inc.

Drilling Tools International Corporation

DTI Merger Sub I, Inc.

DTI Merger Sub II, LLC

G. Troy Meier

Annette

Meier

Meier Family Holding Company, LLC

Meier Management Company, LLC

(Names of Persons Filing Statement)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

868153107

(CUSIP Number

of Class of Security)

|

|

|

|

|

R. Wayne Prejean

President and Chief Executive Officer

Drilling Tools International Corporation

3701 Briarpark Drive, Suite 150

Houston, Texas 77042

(832)

742-8500 |

|

|

|

Troy Meier

Chief Executive Officer

Superior Drilling Products, Inc.

1583 South 1700 East

Vernal, Utah 84078

(435) 789-0594 |

| (Name, Address, and Telephone Numbers of Person Authorized to Receive Notices and Communications on Behalf of

the Persons Filing Statement) With copies

to: |

Michael J. Blankenship

Winston & Strawn LLP

800 Capitol Street, Suite 2400

Houston, Texas 77002

(713) 651-2678 |

|

Kevin Poli

Porter Hedges LLP 100

Main Street, 36th Floor Houston, TX 77002

(713) 226-6682 |

|

Randolph Ewing

Ewing & Jones, PLLC

6363 Woodway, Suite 100

Houston, Texas 77057

(713) 590-9610 |

This statement is filed in connection with (check the appropriate box):

|

|

|

|

|

| a. |

|

☒ |

|

The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

|

|

|

| b. |

|

☒ |

|

The filing of a registration statement under the Securities Act of 1933. |

|

|

|

| c. |

|

☐ |

|

A tender offer. |

|

|

|

| d. |

|

☐ |

|

None of the above. |

Check the following box if the soliciting materials or information statement referred to in checking box (a) are

preliminary copies: ☐

Check the following box if the filing is a final amendment reporting the results of the transaction: ☐

Neither the SEC nor any state securities regulatory agency has approved or disapproved the Merger, passed upon the merits or fairness of the Merger or

passed upon the adequacy or accuracy of the disclosure in this document. Any representation to the contrary is a criminal offense.

INTRODUCTION

This Rule 13e-3 Transaction Statement on Schedule 13E-3 (this

“Transaction Statement”), together with the exhibits hereto, is being filed with the U.S. Securities and Exchange Commission (the “SEC”) pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), by: (i) Superior Drilling Products, Inc., a Utah corporation (“SDPI”), and the issuer of the common stock, par value $0.001 per share (the “SDPI Common Stock”), that is subject to the Rule 13e-3 transaction; (ii) Drilling Tools International Corporation, a Delaware corporation (“DTI”), (iii) DTI Merger Sub I, Inc., a Delaware corporation (“Merger Sub I”), (iv) DTI Merger Sub

II, LLC, a Delaware limited liability company (“Merger Sub II”), (v) G. Troy Meier, (vi) Annette Meier, (vii) Meier Family Holdings Company, LLC and (viii) Meier Management Company, LLC (collectively, the “Filing Persons”).

This Transaction Statement relates to the Agreement and Plan of Merger, dated March 6, 2024 (as it may be amended from time to time, the

“Merger Agreement”), by and among SDPI, DTI, Merger Sub I, and Merger Sub II, pursuant to which (i) Merger Sub I, a direct and wholly owned subsidiary of DTI, will merge with and into SDPI with SDPI surviving as a wholly owned

subsidiary of DTI (the “First Merger,” and such surviving corporation, the “Surviving Corporation”) and (ii) following the effective time of the First Merger (the “First Effective Time”), the Surviving Corporation

will merge with and into DTI Merger Sub II, a direct and wholly owned subsidiary of DTI, with Merger Sub II surviving as a wholly owned subsidiary of DTI (the “Second Merger,” and together with the First Merger, the “Merger”).

Under the terms of the Merger Agreement, at the First Effective Time, each share of SDPI Common Stock issued and outstanding immediately

prior to the First Effective Time will be converted into the right to receive, without interest, at the election of the holder thereof, and subject to the proration provisions of the Merger Agreement,: (a) for each share of SDPI Common Stock

with respect to which an election to receive cash has been made and not revoked or lost (each, a “Cash Election Share”), $1.00 in cash (the “Cash Election Consideration”); (b) for each share of SDPI Common Stock with respect to

which an election to receive stock has been made and not revoked or lost (each, a “Stock Election Share”), 0.313 validly issued, fully paid, and non-assessable shares of common stock, par value

$0.0001 per share (the “DTI Common Stock”), of DTI (the “Stock Election Consideration,” and together with the Cash Election Consideration, the “Merger Consideration”); and (c) for each share of SDPI Common Stock

with respect to which no election to receive the Cash Election Consideration or the Stock Election Consideration (each, a “No Election Share”), the Cash Election Consideration or the Stock Election consideration, as provided in the

proration mechanics described below.

If the product obtained by multiplying the aggregate number of Stock Election Shares and 0.313 (the

“Stock Election Multiplier,” and such product, the “Aggregate Stock Elections”) exceeds 4,845,240 (the “Maximum Share Amount”), (i) all Cash Election Shares and No Election Shares will be exchanged for the Cash Election

Consideration and (ii) a portion of the Stock Election Shares of each holder thereof will be exchanged for the Stock Election Consideration, with such portion being equal to the product obtained by multiplying the number of such holder’s

Stock Election Shares by a fraction, the numerator of which is the Maximum Share Amount and the denominator of which is the Aggregate Stock Elections, with the remaining portion of such holder’s Stock Election Shares being exchanged for the

Cash Election Consideration.

If the Aggregate Stock Elections is less than 4,112,752 shares (the “Minimum Share Amount,” and

the difference between the Minimum Share Amount, the “Shortfall Amount”), then (i) first, if the Shortfall Amount is smaller than or equal to the number of No Election Shares multiplied by 0.313 (the “No Election Share

Amount”), then (A) the Cash Election Shares will receive cash as they have chosen and will not be affected by the adjustment and (B) the No Election Shares held by shareholders will be exchanged for the Stock Consideration equal to

the product of (1) the number of No Election Shares of such holders and (2) a fraction, the numerator of which is the Shortfall Amount and the denominator of which is the No Election Share Amount, with the remaining portion of such

holder’s No Election Shares receiving the Cash Consideration and (ii) second, if the Shortfall Amount exceeds the No Election Share Amount, then (A) all No Election Shares will be exchanged for Stock Election Consideration and

(B) the Cash Election Shares held by shareholders will be exchanged for the Stock Election Consideration, with such portion being equal to the product of (x) the number of Cash Election Shares of such holder and (y) a fraction, the

numerator of which is the amount by which the Shortfall Amount exceeds the No Election Share Amount, and the denominator of which is the product of the aggregate number of Cash Election Shares and the Stock Election Multiplier, with the remaining

portion of such holder’s Cash Election Shares receiving the Cash Consideration, and (iii) if the Aggregate Stock Elections is (x) equal to the Maximum Share Amount, (y) less than the Maximum Share Amount but greater than the

Minimum Share Amount, or (z) equal to the Minimum Share Amount, then (1) all Cash Election Shares and No Election Shares will be exchanged for the Cash Election Consideration and (2) all Stock Election Shares will be exchanged for the

Stock Election Consideration.

1

The Merger will become effective, with respect to the First Merger, upon the filing and

acceptance of articles of merger (the “First Certificate of Merger”) with the Utah Department of Commerce, Division of Corporations and Commercial Code (the “Utah Division of Corporations”) and immediately thereafter, with

respect to the Second Merger, a certificate of merger or articles of merger, as applicable, with the Secretary of State of the State of Delaware (the “Delaware Secretary of State”).

No fractional shares of DTI Common Stock will be issued in connection with the First Merger, and no certificates or scrip for any such

fractional shares will be issued. Any holder of SDPI Common Stock who would otherwise be entitled to receive a fraction of a share of DTI Common Stock will, in lieu of such fraction of a share and upon surrender of such holder’s certificates

representing shares of SDPI Common Stock outstanding as of immediately prior to the First Effective Time or book-entry positions representing non-certificates shares of SDPI Common Stock, will be paid in cash

the dollar amount (rounded to the nearest whole cent), without interest and subject to any required tax withholding, determined by multiplying such fraction by the average of the daily volume weighted average trading price per share of DTI Common

Stock on Nasdaq on each of the five consecutive trading days ending on (and including) the trading day that is three trading days prior to the date of the First Effective Time.

Holders of DTI Common Stock prior to the Merger will continue to own their existing shares of DTI Common Stock.

The closing of the Merger will take place on the second business days after the satisfaction, or, to the extent permitted under the Merger

Agreement and applicable legal requirements, waiver of the last to be satisfied or waiver of all conditions to the parties’ respective obligations to effect the Merger (the “Closing”). The date on which the Closing actually takes

place is referred to herein as the “Closing Date.”

The board of directors of DTI (the “DTI Board”) has unanimously

(i) determined that the Merger Agreement and the various transactions contemplated by the Merger Agreement, including the Merger and the payment of the Merger Consideration (together, the “Transactions”), are advisable and in the best

interests of DTI and its stockholders and (ii) approved the Merger Agreement and the Transactions, including the Merger and the Merger Consideration, on the terms and subject to the conditions set forth in the Merger Agreement.

The Special Committee (the “Special Committee”) of the board of directors of SDPI (the “SDPI Board”) has unanimously

(i) determined that the Merger Agreement and the various transactions contemplated by the Merger Agreement, including the Merger and the payment of the Merger Consideration (together, the “Transactions”), are advisable and in the

bests interests of SDPI and its stockholders, (ii) approved the Merger Agreement and the transactions contemplated thereby, including the Merger, (iii) recommended that the SDPI Board approve the Merger Agreement and the transactions

contemplated thereby, including the Merger, on the terms and subject to the conditions set forth in the Merger Agreement, and (iv) resolved and recommended that the SDPI Board resolve to (a) direct that the Merger Agreement and the Merger

be submitted to a vote of the SDPI stockholders for approval and (b) recommend approval of the Merger Agreement and the Merger by the SDPI stockholders at the SDPI Special Meeting (as defined below).

The SDPI Board (acting, in part, based upon the recommendation of the Special Committee) has unanimously (i) determined that the Merger

Agreement and the transactions contemplated thereby, including the Merger, are in the best interests of SDPI and its stockholders, (ii) approved the Merger Agreement and the transactions contemplated thereby, including the Merger, on the terms

and subject to the conditions set forth in the Merger Agreement, (iii) directed that the Merger Agreement be submitted to a vote of the SDPI stockholders for approval and (iv) resolved to recommend approval of the Merger Agreement by the

SDPI stockholders at the SDPI Special Meeting (defined below).

In connection with the Merger, SDPI will hold a special meeting of its

stockholders (as the same may be adjourned or postponed, the “SDPI Special Meeting”). At the SDPI Special Meeting, the SDPI stockholders will be asked to consider and vote on proposals to (i) approve the Merger Agreement and the

transactions contemplated thereby (the “Merger Proposal”) (ii) vote on a non-binding advisory proposal to approve compensation that will or may become payable by SDPI to its named executive officers in connection with the Merger, and (iii)

approve the adjournment of the SDPI Special Meeting to a later date or dates,

2

if necessary or appropriate, to solicit additional proxies in the event there are not sufficient votes at the time of the SDPI Special Meeting to approve the Merger Proposal (the

“Adjournment Proposal”). Concurrently with the execution of the Merger Agreement, and as a condition and inducement to the willingness of DTI to enter into the Merger Agreement, DTI entered into a Voting and Support Agreement (the

“Voting and Support Agreement”) with each of (a) G. Troy Meier, (b) Annette Meier, (c) Meier Family Holding Company, LLC, and (d) Meier Management Company, LLC (together, the “Supporting Shareholders”), who in

the aggregate beneficially own shares of SDPI Common Stock representing approximately forty percent (40%) of the voting power of SDPI’s outstanding capital stock in the aggregate as of the date of this Transaction Statement and any voting

securities of SDPI acquired after the date of the Voting and Support Agreement and prior to the record date for the Special Meeting owned beneficially or of record by such shareholder (the “Covered Shares”). Under the Voting and Support

Agreement, the Supporting Shareholders agreed to, among other things, vote the Covered Shares in favor of the Merger Proposal and the Adjournment Proposal at the SDPI Special Meeting.

Concurrently with the filing of this Transaction Statement, DTI is filing with the SEC a Registration Statement on Form S-4, which includes a proxy statement/prospectus of DTI and SDPI (the “Proxy Statement/Prospectus”) in connection with the Merger Agreement and the transactions contemplated thereby. A copy of the Proxy

Statement/Prospectus is attached hereto as Exhibit (a)(1). A copy of the Merger Agreement is attached as Annex A to the Proxy Statement/Prospectus. All references in this Transaction Statement to Items numbered 1001 to 1016 are references to Items

contained in Regulation M-A under the Exchange Act.

Pursuant to General Instruction F to Schedule

13E-3, the information contained in the Proxy Statement/Prospectus, including all annexes thereto, is expressly incorporated by reference in its entirety and responses to each item herein are qualified in

their entirety by the information contained in the Proxy Statement/Prospectus and the annexes thereto. The cross-references below are being supplied pursuant to General Instructions G to Schedule 13E-3 and

show the location in the Proxy Statement/Prospectus of the information required to be included in response to the items of Schedule 13E-3. As of the date hereof, the Proxy Statement/Prospectus is in

preliminary form and is subject to completion. Terms used but not defined in this Transaction Statement have the meanings given to them in the Proxy Statement/Prospectus.

All information concerning SDPI contained in, or incorporated by reference into, this Transaction Statement was supplied by SDPI. Similarly,

all information concerning any other filing person contained in, or incorporated by reference into, this Transaction Statement was supplied by such filing person.

| ITEM 1. |

SUMMARY TERM SHEET |

Regulation M-A Item 1001

The information set forth in the Proxy Statement/Prospectus under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers”

| ITEM 2. |

SUBJECT COMPANY INFORMATION |

Regulation M-A Item 1002

| (a) |

Name and Address. The information set forth in the Proxy Statement/Prospectus under the following

captions is incorporated herein by reference: |

“Summary Term Sheet—Parties to the Merger”

“Parties to the Merger”

| (b) |

Securities. The information set forth in the Proxy Statement/Prospectus under the following captions is

incorporated herein by reference: |

“Special Meeting of SDPI Stockholders”

“Special Factors—Interests of DTI Directors and Officers in the Merger”

3

“Special Factors—Interests of SDPI Directors and Officers in the Merger”

“Special Factors—Certain Effects of the Merger”

“Important Information Regarding DTI—Market Price of DTI Common Stock”

“Important Information Regarding SDPI”

| (c) |

Trading Market and Price. The information set forth in the Proxy Statement/Prospectus under the

following caption is incorporated herein by reference: |

“Important Information Regarding DTI—Market Price

of DTI Common Stock”

“Important Information Regarding SDPI—Market Price of SDPI Common Stock”

| (d) |

Dividends. The information set forth in the Proxy Statement/Prospectus under the following caption is

incorporated herein by reference: |

“Description of DTI Common Stock—Dividends”

“Important Information Regarding SDPI—Dividends”

| (e) |

Prior Public Offerings. The information set forth in the Proxy Statement/Prospectus under the following

caption is incorporated herein by reference: |

“Important Information Regarding SDPI—Prior Public

Offerings”

| (f) |

Prior Stock Purchases. The information set forth in the Proxy Statement/Prospectus under the following

caption is incorporated herein by reference: |

“Important Information Regarding SDPI—Prior Stock

Purchases”

| ITEM 3. |

IDENTITY AND BACKGROUND OF FILING PERSON |

Regulation M-A Item 1003

| (a) through |

(b) Name and Address; Business and Background of Entities. SDPI is the issuer of the equity

securities that are the subject of the Rule 13e-3 transaction reported hereby. |

The information set forth in the Proxy Statement/Prospectus under the following captions is incorporated herein by reference:

“Summary Term Sheet—Parties to the Merger”

“Parties to the Merger”

“Where You Can Find More Information”

| (c) |

Business and Background of Natural Persons. The information set forth in the Proxy Statement/Prospectus

under the following captions is incorporated herein by reference: |

“Important Information Regarding Schedule 13e-3 Filing Parties Other than DTI and SDPI—Name and Address; Business and Background of Schedule 13e-3 Individual Filing Parties other than DTI and SDPI”

“Where You Can Find More Information”

| ITEM 4. |

TERMS OF THE TRANSACTION |

Regulation M-A Item 1004

| (a) |

Material Terms. The information set forth in the Proxy Statement/Prospectus under the following captions

is incorporated herein by reference: |

“Summary Term Sheet”

4

“Questions and Answers”

“Special Factors—General”

“Special Factors—Background of the Merger”

“Special Factors— Reasons for the Merger and Recommendation of the SDPI Special Committee and the SDPI Board; Fairness”

“Special Factors— Reasons for the Merger of the Schedule 13e-3 Filing Parties

other than SDPI; Fairness”

“Special Factors—Intent to Vote”

“Special Factors— Unaudited Prospective Financial Information”

“Special Factors— Opinion of Piper Sandler”

“Special Factors— Plans for SDPI After the Merger”

“Special Factors—Certain Effects of the Merger”

“Special Factors— Governance of SDPI After the Merger”

“Special Factors— Interests of DTI Directors and Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

“Special Factors— Certain Related Party Agreements between DTI and Other Filing Parties”

“Special Factors— Delisting and Deregistration of SDPI Common Stock”

“Special Factors— Litigation Related to the Merger”

“Special Factors— Availability of Documents”

“The Merger Agreement”

“Description of the Differences Between DTI Capital Stock and SDPI Capital Stock”

“Special Meeting of SDPI Stockholders”

“Material U.S. Federal Income Tax Consequences of the Merger”

“Annex A: Merger Agreement”

| (c) |

Different Terms. The information set forth in the Proxy Statement/Prospectus under the following

captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors— Interests of DTI Directors and Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

“The Merger Agreement”

“Annex A: Merger Agreement”

| (d) |

Appraisal Rights. The information set forth in the Proxy Statement/Prospectus under the following

captions is incorporated herein by reference: |

“Special Meeting of SDPI Stockholders—Dissenters’

Rights”

“Dissenters’ Rights”

| (e) |

Provisions for Unaffiliated Security Holders. The information set forth in the Proxy

Statement/Prospectus under the following caption is incorporated herein by reference: |

“Provisions for

Unaffiliated Stockholders of SDPI”

| (f) |

Eligibility for Listing or Trading. The information set forth in the Proxy Statement/Prospectus under

the following captions is incorporated herein by reference: |

“Summary Term Sheet—Listing of DTI Common

Stock”

“Special Factors—Plans for SDPI After the Merger; Delisting and Deregistration of SDPI Common Stock”

“Delisting and Deregistration of SDPI Common Stock”

5

| ITEM 5. |

PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS |

Regulation M-A Item 1005

| (a) |

Transactions. The information set forth in the Proxy Statement/Prospectus under the following captions

is incorporated herein by reference: |

“Summary Term Sheet”

“Parties to the Merger”

“Special Factors— Interests of DTI Directors and Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

“Important Information Regarding SDPI”

“Past Contacts, Transactions, Negotiations and Agreements”

“Where You Can Find More Information”

| (b) through |

(c) Significant Corporate Events; Negotiations or Contacts. The information set forth in the Proxy

Statement/Prospectus under the following captions is incorporated herein by reference: |

“Summary Term

Sheet”

“Special Factors—General”

“Special Factors—Background of the Merger”

“Special Factors— Reasons for the Merger and Recommendation of the SDPI Special Committee and the SDPI Board; Fairness”

“Special Factors— Interests of DTI Directors and Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

“The Merger Agreement”

“Important Information Regarding SDPI”

“Past Contacts, Transactions, Negotiations and Agreements”

“Annex A: Merger Agreement”

| (e) |

Agreements Involving the Subject Company’s Securities. The information set forth in the Proxy

Statement/Prospectus under the following captions is incorporated herein by reference: |

“Summary Term

Sheet”

“Questions and Answers”

“Special Factors—Certain Effects of the Merger”

“Special Factors— Interests of DTI Directors and Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

“The Merger Agreement —Treatment of SDPI Equity Awards”

“The Merger Agreement”

“Important Information Regarding SDPI”

“Past Contacts, Transactions, Negotiations and Agreements”

“Where You Can Find More Information”

“Annex A: Merger Agreement”

| ITEM 6. |

PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS. |

Regulation M-A Item 1006

| (b) |

Use of Securities Acquired. The information set forth in the Proxy Statement/Prospectus under the

following captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors—General”

“Special Factors—Certain Effects of the Merger”

“Special Factors— Reasons for the Merger and Recommendation of the SDPI Special Committee and the SDPI Board; Fairness”

“Special Factors—Delisting and Deregistration of SDPI Common Stock”

“Special Factors—Interests of Certain Persons in the Merger”

“The Merger Agreement”

“Annex A: Merger Agreement”

6

| (c)(1) through |

(8) Plans. The information set forth in the Proxy Statement/Prospectus under the following captions

is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors—Certain Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors— Reasons for the Merger and Recommendation of the SDPI Special Committee and the SDPI Board; Fairness”

“Special Factors— Interests of DTI Directors and Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

“Special Factors—Delisting and Deregistration of SDPI Common Stock”

“The Merger Agreement”

“Special Meeting of SDPI Stockholders”

“Annex A: Merger Agreement”

| ITEM 7. |

PURPOSES, ALTERNATIVES, REASONS AND EFFECTS |

Regulation M-A Item 1013

| (a) |

Purposes. The information set forth in the Proxy Statement/Prospectus under the following captions is

incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors—Certain Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors— Reasons for the Merger and Recommendation of the SDPI Special Committee and the SDPI Board; Fairness”

“Special Factors— Interests of DTI Directors and Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

| (b) |

Alternatives. The information set forth in the Proxy Statement/Prospectus under the following captions

is incorporated herein by reference: |

“Summary Term Sheet”

“Special Factors—Background of the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Special Factors— Reasons for the Merger and Recommendation of the SDPI Special Committee and the SDPI Board; Fairness”

“Special Factors— Interests of DTI Directors and Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

“Special Factors—Opinion of Piper Sandler”

“Annex B: Opinion of Piper Sandler”

| (c) |

Reasons. The information set forth in the Proxy Statement/Prospectus under the following captions is

incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors—Certain Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors— Reasons for the Merger and Recommendation of the SDPI Special Committee and the SDPI Board; Fairness”

“Special Factors—Opinion of Piper Sandler”

7

“Special Factors— Interests of DTI Directors and Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

“Annex B: Opinion of Piper Sandler”

| (d) |

Effects. The information set forth in the Proxy Statement/Prospectus under the following captions is

incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors—Certain Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—Primary Benefits and Detriments of the Merger”

“Special Factors— Reasons for the Merger and Recommendation of the SDPI Special Committee and the SDPI Board; Fairness”

“Special Factors— Interests of DTI Directors and Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

“Special Factors—Delisting and Deregistration of SDPI Common Stock”

“The Merger Agreement”

“Material U.S. Federal Income Tax Consequences of the Merger”

“Annex A: Merger Agreement”

| ITEM 8. |

FAIRNESS OF THE TRANSACTION |

Regulation M-A Item 1014

| (a) through |

(b) Fairness; Factors Considered in Determining Fairness. Piper Sandler & Co. (“Piper

Sandler”) was not requested to, and it did not, provide to DTI or any other person any (i) opinion (whether as to the fairness of any consideration, including, without limitation, the Merger Consideration, or otherwise), (ii) valuation of

SDPI for the purpose of assessing the fairness of the Merger Consideration to any person, or (iii) recommendation as to how to vote or act on any matters relating to the proposed Merger or otherwise. Energy Capital Solutions, LLC’s

(“ECS”) discussion materials dated January 31, 2024 should not be construed as creating any fiduciary duty on ECS’s part to DTI or any other person and such materials are not intended to be, and do not constitute, a

recommendation to DTI or any other person in respect of the Merger. |

The information set forth in the Proxy

Statement/Prospectus under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors—Background of the Merger”

“Special Factors— Reasons for the Merger and Recommendation of the SDPI Special Committee and the SDPI Board; Fairness”

“Special Factors—Opinion of Piper Sandler”

“Special Factors— Interests of DTI Directors and Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

“Annex B: Opinion of Piper Sandler”

| (c) |

Approval of Security Holders. The information set forth in the Proxy Statement/Prospectus under the

following captions is incorporated herein by reference: |

“Questions and Answers”

“Special Factors— Reasons for the Merger and Recommendation of the SDPI Special Committee and the SDPI Board; Fairness”

“The Merger Agreement—SDPI Stockholders’ Meeting”

“Special Meeting of SDPI Stockholders”

8

| (d) |

Unaffiliated Representative. The information set forth in the Proxy Statement/Prospectus under the

following captions is incorporated herein by reference: |

“Summary Term Sheet”

“Special Factors—Certain Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors— Reasons for the Merger and Recommendation of the SDPI Special Committee and the SDPI Board; Fairness”

“Special Factors— Interests of DTI Directors and Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

“The Merger Agreement”

“Annex B: Opinion of Piper Sandler”

| (e) |

Approval of Directors. The information set forth in the Proxy Statement/Prospectus under the following

captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

“Special Factors—Background of the Merger”

“Special Factors— Reasons for the Merger and Recommendation of the SDPI Special Committee and the SDPI Board; Fairness”

| (f) |

Other Offers. Not Applicable. |

| ITEM 9. |

REPORTS, OPINIONS, APPRAISALS AND CERTAIN NEGOTIATIONS |

Regulation M-A Item 1015

| (a) through |

(b) Report, Opinion or Appraisal; Preparer and Summary of the Report, Opinion or Appraisal. The

discussion materials prepared by ECS and provided to DTI and the DTI Board, dated as of January 31, 2024, are set forth as Exhibit (c)(7) and incorporated herein by reference. The discussion materials prepared by Piper Sandler and provided either to

the SDPI Special Committee or the SDPI Board, dated as of October 12, 2023, January 3, 2024, January 15, 2024, February 6, 2024, and March 6, 2024 are set forth as Exhibits (c)(2) through (c)(6) hereto and are incorporated herein by

reference. |

The information set forth in the Proxy Statement/Prospectus under the following captions is incorporated

herein by reference:

“Summary Term Sheet—The Merger”

“Special Factors— Reasons for the Merger and Recommendation of the SDPI Special Committee and the SDPI Board; Fairness”

“Summary Term Sheet—Opinion of Piper Sandler”

“Special Factors—Certain Effects of the Merger”

“Special Factors—Background of the Merger”

“Special Factors—Opinion of Piper Sandler”

“Where You Can Find More Information”

“Annex B: Opinion of Piper Sandler”

The written opinion of Piper Sandler is attached to the Proxy Statement/Prospectus as Annex B and is incorporated herein by reference.

| (c) |

Availability of Documents. The reports, opinions or appraisals referenced in this Item 9 are filed

herewith and will be made available for inspection and copying at the principal executive offices of DTI and SDPI during its regular business hours by any interested equity security holder of SDPI Common Stock or by any representative who has been

so designated in writing upon written request and at the expense of the requesting security holder. |

9

| ITEM 10. |

SOURCE AND AMOUNTS OF FUNDS OR OTHER CONSIDERATION |

Regulation M-A Item 1007

| (a) through |

(b),(d) Source of Funds; Conditions; Borrowed Funds. The information set forth in the Proxy

Statement/Prospectus under the following captions is incorporated herein by reference: |

“Summary Term

Sheet—The Merger Consideration”

“Summary Term Sheet—The Merger Agreement”

“Summary Term Sheet—Termination Fees and Expenses”

“Special Factors—Background of the Merger”

“Special Factors— Reasons for the Merger and Recommendation of the SDPI Special Committee and the SDPI Board; Fairness”

“Special Factors— Interests of DTI Directors and Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

| (c) |

Expenses. The information set forth in the Proxy Statement/Prospectus under the following captions is

incorporated herein by reference: |

“Summary Term Sheet—Termination Fees and Expenses”

“Special Meeting of SDPI Stockholders—Solicitation of Proxies”

“The Merger Agreement—Expenses”

| ITEM 11. |

INTEREST IN SECURITIES OF THE SUBJECT COMPANY |

Regulation M-A Item 1008

| (a) through |

(b) Securities Ownership; Securities Transactions. The information set forth in the Proxy

Statement/Prospectus under the following captions is incorporated herein by reference: |

“Summary Term

Sheet—Parties to the Merger”

“Summary Term Sheet—The Merger”

“Parties to the Merger”

“Special Factors—Certain Effects of the Merger”

“Special Factors— Interests of DTI Directors and Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

“Special Factors—Treatment of SDPI Equity Awards”

“The Merger Agreement”

| ITEM 12. |

THE SOLICITATION OR RECOMMENDATION |

Regulation M-A Item 1012

| (d) |

Intent to Tender or Vote in a Going-Private Transaction. The information set forth in the Proxy

Statement/Prospectus under the following captions is incorporated herein by reference: |

“Questions and

Answers”

“Special Meeting of SDPI Stockholders”

| (e) |

Recommendations of Others. The information set forth in the Proxy Statement/Prospectus under the

following captions is incorporated herein by reference: |

“Summary Term Sheet”

“Questions and Answers”

10

“Special Factors— Reasons for the Merger and Recommendation of the SDPI

Special Committee and the SDPI Board; Fairness”

“Special Factors— Interests of DTI Directors and Officers in the

Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

“The Merger Agreement—Conditions to the Merger”

| ITEM 13. |

FINANCIAL INFORMATION |

Regulation M-A Item 1010

| (a) |

Financial Statements. The information set forth in the Proxy Statement/Prospectus under the following

captions is incorporated herein by reference: |

“Special Factors—Certain Effects of the Merger”

“Important Information Regarding SDPI—Summary Financial Information”

“Where You Can Find More Information”

SDPI’s Annual Report on Form 10-K for the year ended December 31, 2023 is incorporated

herein by reference.

| (b) |

Pro Forma Information. Not applicable. |

| ITEM 14. |

PERSONS/ASSETS, RETAINED, EMPLOYED, COMPENSATED OR USED |

Regulation M-A Item 1009

| (a) through |

(b) Solicitations or Recommendations; Employees and Corporate Assets. The information set forth in

the Proxy Statement/Prospectus under the following captions is incorporated herein by reference: |

“Summary Term

Sheet”

“Questions and Answers”

“Special Factors—Background of the Merger”

“Special Factors— Reasons for the Merger and Recommendation of the SDPI Special Committee and the SDPI Board; Fairness”

“Special Factors— Interests of DTI Directors and Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

“Special Factors—Fees and Expenses”

| ITEM 15. |

ADDITIONAL INFORMATION |

Regulation M-A Item 1011

| (c) |

Golden Parachute Compensation. The information set forth in the Proxy Statement/Prospectus under the

following caption is incorporated herein by reference. |

“Special Factors— Interests of DTI Directors and

Officers in the Merger”

“Special Factors— Interests of SDPI Directors and Officers in the Merger”

| (c) |

Other Material Information. The information set forth in the Proxy Statement/Prospectus, including all

annexes thereto, is incorporated herein by reference. |

11

Regulation M-A Item 1016

|

|

|

| Exhibit No. |

|

Description |

|

|

| (a)(1) |

|

Proxy Statement/Prospectus (incorporated herein by reference to Drilling Tools International Corporation’s

Registration Statement on Form S-4 filed with the SEC on May 10, 2024) |

|

|

| (a)(2) |

|

Letter to the Stockholders of SDPI (incorporated herein by reference to the Proxy Statement/Prospectus)

|

|

|

| (a)(3) |

|

Form of Proxy Card and Voting Instructions for the SDPI Special Meeting (incorporated herein by reference to the Proxy Statement/Prospectus)

|

|

|

| (a)(4) |

|

Notice of Special Meeting of Stockholders of SDPI (incorporated herein by reference to the Proxy Statement/Prospectus)

|

|

|

| (a)(5) |

|

Press Release of SDPI, dated March 7, 2024 (incorporated by reference to Exhibit 99.1 to SDPI’s Current Report on Form 8-K filed with the SEC on March 7, 2024) |

|

|

| (a)(6) |

|

Press Release of DTI, dated March 7, 2024 (incorporated by reference to Exhibit 99.1 to DTI’s Current Report on Form 8-K filed with the SEC on March 7, 2024) |

|

|

| (a)(7) |

|

Earnings Release of SDPI, dated March 7, 2024 (incorporated by reference to Exhibit 99.1 to SDPI’s Current Report on Form 8-K filed with the SEC on March 7, 2024) |

|

|

| (a)(8) |

|

Earnings Release of DTI, dated March 7, 2024 (incorporated by reference to Exhibit 99.1 to DTI’s Current Report on Form 8-K filed with the SEC on March 7, 2024) |

|

|

| (c)(1) |

|

Opinion of Piper Sandler

& Co. (incorporated herein by reference to Annex B of the Proxy Statement/Prospectus) |

|

|

| (c)(2) |

|

Discussion materials prepared by Piper Sandler & Co., dated October 12, 2023 |

|

|

| (c)(3) |

|

Discussion materials prepared by Piper Sandler & Co., dated January 3, 2024 |

|

|

| (c)(4) |

|

Discussion materials prepared by Piper Sandler & Co., dated January 15, 2024 |

|

|

| (c)(5) |

|

Discussion materials prepared by Piper Sandler & Co., dated February 6, 2024 |

|

|

| (c)(6) |

|

Discussion materials prepared by Piper Sandler & Co., dated March 6, 2024 |

|

|

| (c)(7) |

|

Discussion materials prepared by Energy Capital Solutions, LLC, dated January 31, 2024, for the Board of Directors of DTI |

|

|

| (d)(1) |

|

Agreement and Plan of Merger, dated as of March

6, 2024, by and among SDPI, DTI, Merger Sub I, and Merger Sub II (incorporated by reference herein to Exhibit 2.1 to SDPI’s Current Report on Form 8-K filed with the SEC on March 7, 2024)

|

|

|

| (d)(2) |

|

Voting and Support Agreement, dated as of March

6, 2024 (incorporated by reference herein to Exhibit 10.1 to SDPI’s Current Report on Form 8-K filed with the SEC on March 7, 2024) |

|

|

| (f)(1) |

|

Articles of Incorporation (incorporated by reference herein to Exhibit 3.1 to SDPI’s Registration Statement on Form S-1 filed with the SEC on April 7, 2014) |

|

|

| (f)(2) |

|

Articles of Amendment to Articles of Incorporation (incorporated by reference to Exhibit 3.5 to Amendment No.

2 to SDPI’s Registration Statement on Form S-01 filed with the SEC on May 6, 2014) |

|

|

| (f)(3) |

|

Title 16, Chapter 10a, Part 13 Dissenters’ Rights (incorporated by reference to Annex C

of the Proxy Statement/Prospectus) |

|

|

| (g) |

|

None. |

|

|

| 107 |

|

Filing Fee Table. |

12

SIGNATURES

After due inquiry and to the best of each of the undersigned’s knowledge and belief, each of the undersigned certifies that the information set forth in

this statement is true, complete and correct.

Dated as of May 10, 2024

|

|

|

| DRILLING TOOLS INTERNATIONAL CORPORATION |

|

|

| By: |

|

/s/ R. Wayne Prejean |

| Name: |

|

R. Wayne Prejean |

| Title: |

|

President and Chief Executive Officer |

|

| SUPERIOR DRILLING PRODUCTS, INC. |

|

|

| By: |

|

/s/ G. Troy Meier |

| Name: |

|

G. Troy Meier |

| Title: |

|

Chief Executive Officer and Chairman |

|

| DTI MERGER SUB I, INC. |

|

|

| By: |

|

/s/ R. Wayne Prejean |

| Name: |

|

R. Wayne Prejean |

| Title: |

|

President and Secretary |

|

| DTI MERGER SUB II, LLC |

|

|

| By: |

|

/s/ R. Wayne Prejean |

| Name: |

|

R. Wayne Prejean |

| Title: |

|

President and Secretary |

|

| MEIER FAMILY HOLDING COMPANY, LLC |

|

|

| By: |

|

/s/ G. Troy Meier |

| Name: |

|

G. Troy Meier |

| Title: |

|

Manager |

|

|

| By: |

|

/s/ Annette Meier |

| Name: |

|

Annette Meier |

| Title: |

|

Manager |

|

| MEIER MANAGEMENT COMPANY, LLC |

|

|

| By: |

|

/s/ G. Troy Meier |

| Name: |

|

G. Troy Meier |

| Title: |

|

Manager |

|

|

| By: |

|

/s/ Annette Meier |

| Name: |

|

Annette Meier |

| Title: |

|

Manager |

|

|

| By: |

|

/s/ G. Troy Meier |

| Name: |

|

G. TROY MEIER, individually |

|

|

| By: |

|

/s/ Annette Meier |

| Name: |

|

ANNETTE MEIER, individually |

13

CO CONF NFI IDE DENT NTA AL L DR DRA AF FT T – – S SU UBJ BJE

EC CT T T TO O RE REV VIIS SIIO ON N CONFIDENTIAL DRAFT – SUBJECT TO REVISION Exhibit (c)(2) October 12, 2023 Discussion Materials Prepared for CONFIDENTIAL PIPER SANDLER | 1

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION Disclaimer Piper Sandler & Co. ( Piper Sandler or “PSC”) has prepared and provided these materials and any related materials (the Confidential Materials ) solely for the use of the Board of Directors (the Board )

of Superior Drilling Products (the Company ) in connection with its consideration of the contemplated transaction. Without Piper Sandler's prior written consent, the Confidential Materials may not be circulated or referred to publicly, disclosed to,

published, relied upon by any other person, or used or relied upon for any other purpose. Notwithstanding anything herein to the contrary, the Company may disclose to any person the U.S. federal income and state income tax treatment and tax

structure of any transaction described herein and all materials of any kind (including tax opinions and other tax analyses) that are provided to the Company relating to such tax treatment and tax structure, without Piper Sandler imposing any

limitation of any kind. The Confidential Materials, including this disclaimer, is subject to, and governed by, any written agreement between the Company and Piper Sandler. Piper Sandler engages directly or through its affiliates in various

activities, including institutional brokerage and investment and wealth management for individuals and institutions. You understand that this engagement does not prevent Piper Sandler and its affiliates from actively trading the debt and equity

securities (or related derivative securities) of third parties, the Company, or other companies which may be the subject of the engagement (for their own account or for the accounts of their customers) or from representing or otherwise providing

financial services to third parties, including competitors of the Company. In preparing the Confidential Materials, Piper Sandler has relied upon and assumed, without assuming any responsibility for investigation or independent verification of the

accuracy and completeness of all information that is available from public sources as well as all other information supplied to it by, or on behalf of, the Company and/or other sources, including tax, accounting, legal and other information provided

to, discussed with or reviewed by Piper Sandler. Piper Sandler is not in any respect responsible for verifying the accuracy or completeness of any such information, conducting any appraisal or valuation of assets or liabilities of any party to the

contemplated transaction, or advising or opining on any solvency or viability issues. As such, Piper Sandler does not assume any liability for the accuracy or completeness of such information. These materials are not intended to provide the sole

basis for evaluating the contemplated transaction or any other matter, and should be considered by the Board as only one factor in discharging its decision-making duties. PIPER SANDLER | 2

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION Disclaimer (cont’d) Piper Sandler does not provide accounting, tax, legal or regulatory advice. Piper Sandler's role in any due diligence review is limited solely to performing such review as it shall deem necessary to

support its own advice and analysis and shall not be on behalf or for the benefit of the Company, or any of its investors, creditors or any transaction counterparty. Forecasts of future results have been provided by the Company to Piper Sandler for

use in its analyses. These forecasts are not necessarily indicative of actual future results, which may be significantly more or less favorable than such forecasts, and as such, analyses performed by Piper Sandler based on Company forecasts may not

prove to be accurate. Accordingly, Piper Sandler does not assume responsibility for the accuracy or completeness of Company forecasts or the analyses Piper Sandler performs based on these forecasts. The Confidential Materials do not address the

underlying business decision of the Company and the Board to engage in the contemplated transaction or any other contemplated transaction, or the relative merits of any strategic alternative referred to herein as compared to any other alternative

that may be available to the Company. The Confidential Materials are necessarily based on economic, monetary, market and other conditions as in effect on, and the information made available to Piper Sandler as of, the date of such Confidential

Materials and Piper Sandler assumes no responsibility for updating or revising the Confidential Materials. PIPER SANDLER | 3

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION (1) Comparable Companies Analysis ($ in millions) Capitalization Enterprise Value To: Market Enterprise EBITDA Equity Value Value 2022 LTM Q2'23 2023P 2024P (2) Cathedral Energy Services $ 156 $ 2 29 n/a n/a 3.2x 2.2x DMC Global

435 725 7.9x 6.7x 7.1x 6.3x Forum Energy Technologies 233 3 48 6.9x 5.6x n/a n/a Hunting 594 6 52 13.0x 8.3x 6.6x 5.1x (3) KLX Energy Services 169 4 07 3.8x n/a 2.7x 2.6x NCS Multistage 37 5 1 3.4x 2.9x 2.6x 2.3x Nine Energy Services 1 54 4 46 5.0x

4.5x 6.0x 5.3x Phoenix Technology Services 2 65 2 98 4.3x 3.3x 3.0x 2.9x Ranger Energy Services 338 3 52 5.2x 4.2x 3.9x 3.5x Solaris Oilfield Infrastructure 460 500 6.1x 5.0x 4.8x 4.1x Median 5.2x 4.8x 3.9x 3.5x (4) Drilling Tools International $ 1

38 $ 1 29 3.1x 2.4x 2.5x n/a Superior Drilling Products $ 24 $ 2 8 6.0x 4.7x 4.6x 2.8x (5) Superior Drilling Products (At Offer) $ 3 0 $ 3 5 7.5x 5.8x 5.7x 3.5x 1) Source: Company provided information, public company filings and Capital IQ as of

October 11, 2023 2) Cathedral pro forma for acquisition of Rime Downhole Technologies in July 2023 and simultaneous refinancing of existing credit / new borrowing PIPER SANDLER | 4 3) Pro forma for acquisition of Greene's Energy Group, completed

March 8, 2023 4) DTI market value assumes fully diluted shares outstanding of ~35.8M prior to the transaction, as implied by SDPI pro forma ownership of 17.1% stated in the bid letter 5) Assumes all SDPI shareholders elect to receive cash

consideration of $1.00 / share

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION (1) Comparable Transactions Analysis ($ in millions) Ratio Of Transaction Value To: Announced Transaction LTM Projected Year Acquiror Target Value Range EBITDA EBITDA (2) (2) 2023 Patterson-UTI Ulterra Drilling Technologies $ 800

4.9x 4.7x 2023 ROC Energy Acquisition Corp. Drilling Tools International 319 7.7x 5.5x 2022 Acquiror A Target A < 50 4.6x n/a 2021 Acquiror B Target B 50 - 100 5.7x 4.0x 2020 Rival Downhole Tools Hunting Energy Services Drilling Tools 19 7.2x n/a

2020 Acquiror C Target C < 50 12.8x 21.4x 2020 Acquiror D Target D 100 - 200 nmf 12.3x 2020 Acquiror E Target E < 50 24.1x n/a (3) 2019 First Reserve Lamons 135 5.7x n/a 2019 Texas Pipe & Supply Alloy Piping Products 82 7.1x n/a 2019

Tenaris IPSCO Tubulars 1, 209 7.4x n/a Median $ 90 7.2x 5.5x (4) Implied DTI / SDPI Transaction Value $ 35 5.8x 3.5x 1) Source: Piper Sandler internal database, Bloomberg, Capital IQ and company filings. Names withheld where Piper Sandler has

proprietary information. 2) Multiples reflect value immediately prior to announcement at market close on July 3, 2023. TTM EBITDA reflects Ulterra 2022 EBITDA. Projected EBITDA reflects PIPER SANDLER | 5 Ulterra 2023P EBITDA 3) Piper Sandler

estimate. Assumes industry average EBITDA margin. 4) Assumes all SDPI shareholders elect to receive cash consideration of $1.00 / share; TTM EBITDA and Projected EBITDA are TTM Q2’23 and 2024P, respectively

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION (1) SDPI and DTI Merger Analysis – LTM Q2 2023 ($ in millions) LTM Q2 2023 n Analysis includes of $3 million base case DTI SDPI Adj. Pro Forma cost synergies attributable to Revenue $ 151. 9 $ 22. 1 $ 174. 0

consolidation of public company costs, Cost of Sales 35. 9 8. 6 44. 5 as mentioned in DTI’s proposal Gross Profit $ 116. 0 $ 13. 4 $ - $ 129. 5 Gross Margin 76% 61% 74% SG&A Expense 61. 9 7. 3 ( 3.0) 66. 2 n Assumes all SDPI

shareholders elect to Adj. EBITDA $ 54. 2 $ 6. 1 $ 3. 0 $ 63. 3 receive stock consideration Adj. EBITDA Margin 36% 28% 36% Contribution (Excl. Synergies) 90% 10% 100% D&A Expense 19. 5 1. 4 20. 8 Interest Expense, Net 1. 4 0. 5 - 1. 9 (2) Other

8. 3 1. 1 9. 3 EBT $ 25. 0 $ 3. 1 $ 31. 2 EBT Margin 16% 14% 18% (3) Income Tax 6. 0 0. 7 7. 5 Net Income $ 19. 0 $ 2. 4 $ 23. 7 (4) Diluted Earnings per Share $ 0.53 $ 0.55 $ Accretion / (Dilution) to DTI 0.02 % Accretion / (Dilution) to DTI 3% 1)

Source: Company provided information, filings and consensus estimates, as appropriate 2) Other (Net) includes remaining items that were excluded from adjusted EBITDA; For DTI, these include stock option expense, monitoring fees, gain on sale of

property, unrealized gain on equity securities, transaction expenses and other expenses; For SDPI, these include impairment of assets, share-based compensation, net non- cash compensation, gain / loss on disposition of assets and recovery of related

party notes receivable 3) Tax rate assumed to be 24% 4) Assumes DTI fully diluted shares outstanding of ~35.8M prior to the transaction, as implied by SDPI pro forma ownership of 17.1% stated in the bid letter PIPER SANDLER | 6

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION (1) SDPI and DTI Merger Analysis – YTD Q2 2023 Annualized ($ in millions) YTD Q2 2023 Ann. n Analysis includes of $3 million base case DTI SDPI Adj. Pro Forma cost synergies attributable to Revenue $ 157. 4 $ 23. 3 $

180. 7 consolidation of public company costs, Cost of Sales 36. 6 8. 5 45. 1 as mentioned in DTI’s proposal Gross Profit $ 120. 8 $ 14. 8 $ - $ 135. 6 Gross Margin 77% 63% 75% SG&A Expense 64. 6 6. 3 ( 3.0) 67. 9 n Assumes all SDPI

shareholders elect to Adj. EBITDA $ 56. 2 $ 8. 5 $ 3. 0 $ 67. 7 receive stock consideration Adj. EBITDA Margin 36% 36% 37% Contribution (Excl. Synergies) 87% 13% 100% D&A Expense 19. 5 1. 4 20. 8 Interest Expense, Net 1. 8 0. 5 - 2. 4 (2) Other

15. 4 2. 6 18. 0 EBT $ 19. 5 $ 4. 0 $ 26. 5 EBT Margin 12% 17% 15% (3) Income Tax 4. 7 1. 0 6. 4 Net Income $ 14. 8 $ 3. 1 $ 20. 2 (4) Diluted Earnings per Share $ 0.41 $ 0.47 $ Accretion / (Dilution) to DTI 0.05 % Accretion / (Dilution) to DTI 13%

1) Source: Company provided information, filings and consensus estimates, as appropriate 2) Other (Net) includes remaining items that were excluded from adjusted EBITDA; For DTI, these include stock option expense, monitoring fees, gain on sale of

property, unrealized gain on equity securities, transaction expenses and other expenses; For SDPI, these include impairment of assets, share-based compensation, net non- cash compensation, gain / loss on disposition of assets and recovery of related

party notes receivable 3) Tax rate assumed to be 24% 4) Assumes DTI fully diluted shares outstanding of ~35.8M prior to the transaction, as implied by SDPI pro forma ownership of 17.1% stated in the bid letter PIPER SANDLER | 7

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION Pro Forma Ownership Analysis ($ in millions) Percent of SDPI Shareholders Who Elect Stock Consideration 20% 40% 60% 80% 100% SDPI Shares Outstanding 30. 4 30. 4 30. 4 30. 4 30. 4 Cash Offer Price per SDPI Share $ 1. 00 $ 1. 00 $

1. 00 $ 1. 00 $ 1. 00 DTI Shares per SDPI Share 0. 243 0. 243 0. 243 0. 243 0. 243 SDPI Equity Consideration DTI Shares Issued 1. 5 3. 0 4. 4 5. 9 7. 4 DTI Share Price (10/11/2023) $ 3. 84 $ 3. 84 $ 3. 84 $ 3. 84 $ 3. 84 Stock Consideration $ 5. 7 $

11. 3 $ 17. 0 $ 22. 7 $ 28. 4 Cash Consideration 24. 3 18. 2 12. 2 6. 1 - Total SDPI Equity Consideration $ 30. 0 $ 29. 6 $ 29. 2 $ 28. 8 $ 28. 4 Pro Forma Diluted Shares Oustanding (1) DTI Shares Outstanding 35. 8 35. 8 35. 8 35. 8 35. 8 DTI Shares

Issued to SDPI 1. 5 3. 0 4. 4 5. 9 7. 4 Total Pro Forma Shares Oustanding 37. 3 38. 8 40. 2 41. 7 43. 2 Pro Forma Ownership DTI 96% 92% 89% 86% 83% SDPI 4% 8% 11% 14% 17% Total 100% 100% 100% 100% 100% 1) Assumes DTI fully diluted shares outstanding

of ~35.8M prior to the transaction, as implied by SDPI pro forma ownership of 17.1% stated in the bid letter PIPER SANDLER | 8

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

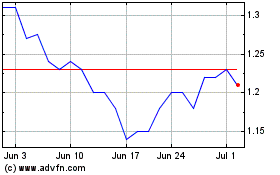

SUBJECT TO REVISION (1) Floating Value of Stock Offer Since DTI Began Trading ($ in millions) (2) Implied Offer Premiums $2.25 VWAP All-Stock All-Cash 1-day 19% 28% $2.00 10-day 19% 27% 30-day 15% 23% 60-day (30%) (25%) $1.75 $1.50 $1.25 $1.00 $1.00

$0.93 $0.81 $0.75 $0.78 $0.50 $0.25 $0.00 (3) SDPI at Market SDPI Rolling 30-Day VWAP SDPI at Offer - All Stock SDPI at Offer - All Cash 1) Source: Capital IQ as of October 11, 2023; DTI began trading on June 21, 2023 following completion of reverse

merger with ROC Energy Acquisition Corp. 2) Premiums calculated as implied SDPI share price (based on both an all-stock offer and all-cash offer) divided by SDPI VWAP; all-stock implied SDPI share price PIPER SANDLER | 9 calculated using DTI share

price as of October 11, 2023 and bid offer rate of 0.243 DTI shares / SDPI share 3) Implied historical SDPI share price based on offer of 0.243 DTI shares per SDPI share

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION (1) Share Price Ratios Since DTI Began Trading ($ in millions) 0.500 R-Squared Correlation - SDPI & DTI Market Prices: 0.434 0.400 0.300 0.243 0.200 0.203 0.100 0.000 (2) SDPI Share Price / DTI Share Price At All-Stock Offer

SDPI Price 1) Source: Capital IQ as of October 11, 2023; DTI began trading on June 21, 2023 following completion of reverse merger with ROC Energy Acquisition Corp. 2) 0.243 DTI shares / SDPI share per bid letter PIPER SANDLER | 10

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION For information on Piper Sandler locations, visit PiperSandler.com. ® Piper Sandler Companies (NYSE: PIPR) is a leading investment bank driven to help clients Realize the Power of Partnership . Securities brokerage and

investment banking services are offered in the U.S. through Piper Sandler & Co., member SIPC and NYSE; in the U.K. through Piper Sandler Ltd., authorized and regulated by the U.K. Financial Conduct Authority; and in Hong Kong through Piper

Sandler Hong Kong Ltd., authorized and regulated by the Securities and Futures Commission Alternative asset management and fixed income advisory services are offered through separately registered advisory affiliates. ©2023. Since 1895. Piper

Sandler Companies. 800 Nicollet Mall, Minneapolis, Minnesota 55402-7036 PIPER SANDLER | 11

CONFIDENT CONFIDENTAL DRAFT – AL DRAFT – SUBJECT SUBJECT TO

REVISION TO REVISION CONFIDENTIAL DRAFT – SUBJECT TO REVISION Exhibit (c)(3) January 3, 2024 Discussion Materials Prepared for CONFIDENTIAL PIPER SANDLER | 1

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION Disclaimer Piper Sandler & Co. ( Piper Sandler or “PSC”) has prepared and provided these materials and any related materials (the Confidential Materials ) solely for the use of the Board of Directors (the Board )

of Superior Drilling Products (the Company ) in connection with its consideration of the contemplated transaction. Without Piper Sandler's prior written consent, the Confidential Materials may not be circulated or referred to publicly, disclosed to,

published, relied upon by any other person, or used or relied upon for any other purpose. Notwithstanding anything herein to the contrary, the Company may disclose to any person the U.S. federal income and state income tax treatment and tax

structure of any transaction described herein and all materials of any kind (including tax opinions and other tax analyses) that are provided to the Company relating to such tax treatment and tax structure, without Piper Sandler imposing any

limitation of any kind. The Confidential Materials, including this disclaimer, is subject to, and governed by, any written agreement between the Company and Piper Sandler. Piper Sandler engages directly or through its affiliates in various

activities, including institutional brokerage and investment and wealth management for individuals and institutions. You understand that this engagement does not prevent Piper Sandler and its affiliates from actively trading the debt and equity

securities (or related derivative securities) of third parties, the Company, or other companies which may be the subject of the engagement (for their own account or for the accounts of their customers) or from representing or otherwise providing

financial services to third parties, including competitors of the Company. In preparing the Confidential Materials, Piper Sandler has relied upon and assumed, without assuming any responsibility for investigation or independent verification of the

accuracy and completeness of all information that is available from public sources as well as all other information supplied to it by, or on behalf of, the Company and/or other sources, including tax, accounting, legal and other information provided

to, discussed with or reviewed by Piper Sandler. Piper Sandler is not in any respect responsible for verifying the accuracy or completeness of any such information, conducting any appraisal or valuation of assets or liabilities of any party to the

contemplated transaction, or advising or opining on any solvency or viability issues. As such, Piper Sandler does not assume any liability for the accuracy or completeness of such information. These materials are not intended to provide the sole

basis for evaluating the contemplated transaction or any other matter, and should be considered by the Board as only one factor in discharging its decision-making duties. PIPER SANDLER | 2

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION Disclaimer (cont’d) Piper Sandler does not provide accounting, tax, legal or regulatory advice. Piper Sandler's role in any due diligence review is limited solely to performing such review as it shall deem necessary to

support its own advice and analysis and shall not be on behalf or for the benefit of the Company, or any of its investors, creditors or any transaction counterparty. Forecasts of future results have been provided by the Company to Piper Sandler for

use in its analyses. These forecasts are not necessarily indicative of actual future results, which may be significantly more or less favorable than such forecasts, and as such, analyses performed by Piper Sandler based on Company forecasts may not

prove to be accurate. Accordingly, Piper Sandler does not assume responsibility for the accuracy or completeness of Company forecasts or the analyses Piper Sandler performs based on these forecasts. The Confidential Materials do not address the

underlying business decision of the Company and the Board to engage in the contemplated transaction or any other contemplated transaction, or the relative merits of any strategic alternative referred to herein as compared to any other alternative

that may be available to the Company. The Confidential Materials are necessarily based on economic, monetary, market and other conditions as in effect on, and the information made available to Piper Sandler as of, the date of such Confidential

Materials and Piper Sandler assumes no responsibility for updating or revising the Confidential Materials. PIPER SANDLER | 3

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION 1) SDPI and DTI Merger Analysis – 2024P ($ in millions) 2024P n Adjusted to remove DNR revenue in DTI SDPI Adj. Pro Forma 2024P (SDPI) and COGS (DTI), and for Revenue $ 174.4 $ 25.7 $ ( 10.9) $ 189.2 estimated

depreciation expense Cost of Sales 55.0 11.2 (10.9) 55.3 associated with DNR Capex (DTI) Gross Profit $ 119.4 $ 14.6 $ - $ 133.9 Gross Margin 68% 57% 71% SG&A Expense 60.6 6.5 (3.0) 64.1 n Analysis includes of $3 million base case Adj.

EBITDA $ 58.8 $ 8.1 $ (3.0) $ 69.9 cost synergies attributable to Adj. EBITDA Margin 34% 31% 37% Contribution (Excl. Synergies) 81% 19% 100% consolidation of public company costs, (2) as mentioned in DTI’s proposal D&A Expense 28.0 1.3

(2.8) 26.6 Interest Expense, Net 0.0 0.6 - 0.6 (3) Other 0.8 2.1 2.9 EBT $ 30.0 $ 4.0 $ 39.8 n Assumes all SDPI shareholders elect to EBT Margin 17% 16% 21% receive stock consideration (4) Income Tax 6.9 0.8 9.6 Net Income $ 23.1 $ 3.2 $ 30.3

(5) $ 0.65 $ 0.70 Diluted Earnings per Share $ Accretion / (Dilution) to DTI 0.06 % Accretion / (Dilution) to DTI 9% 1) Source: Company provided information, filings and consensus estimates, as appropriate 2) Adjusted to exclude D&A expense

associated with 2024 DNR capex spend by DTI. Assumes D&A equal to 2024P capex 3) Other (Net) includes remaining items that were excluded from adjusted EBITDA; For DTI, these include stock option expense, monitoring fees, gain on sale of

property, unrealized gain on equity securities, transaction expenses and other expenses; For SDPI, these include impairment of assets, share-based compensation, net non- cash compensation, gain / loss on disposition of assets and recovery of related

party notes receivable 4) Tax rate assumed to be 24% 5) Assumes DTI fully diluted shares outstanding of ~35.8M prior to the transaction, as implied by SDPI pro forma ownership of 17.1% stated in the bid letter PIPER SANDLER | 4

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION Pro Forma Ownership Analysis ($ in millions) Percent of SDPI Shareholders Who Elect Stock Consideration 20% 40% 60% 80% 100% SDPI Shares Outstanding 30.4 30.4 30.4 30.4 30.4 Cash Offer Price per SDPI Share $ 1.00 $ 1.00 $ 1.00 $

1.00 $ 1.00 DTI Shares per SDPI Share 0.243 0.243 0.243 0.243 0.243 SDPI Equity Consideration DTI Shares Issued 1.5 3.0 4.4 5.9 7.4 DTI Share Price (01/02/2024) $ 3.28 $ 3.28 $ 3.28 $ 3.28 $ 3.28 Stock Consideration $ 4.8 $ 9.7 $ 14.5 $ 19.4 $ 24.2

Cash Consideration 24.3 18.2 12.2 6.1 - Total SDPI Equity Consideration $ 29.2 $ 27.9 $ 26.7 $ 25.5 $ 24.2 Pro Forma Diluted Shares Oustanding (1) DTI Shares Outstanding 35.8 35.8 35.8 35.8 35.8 DTI Shares Issued to SDPI 1.5 3.0 4.4 5.9 7.4 Total

Pro Forma Shares Oustanding 37.3 38.8 40.2 41.7 43.2 Pro Forma Ownership DTI 96% 92% 89% 86% 83% SDPI 4% 8% 11% 14% 17% Total 100% 100% 100% 100% 100% 1) Assumes DTI fully diluted shares outstanding of ~35.8M prior to the transaction, as implied by

SDPI pro forma ownership of 17.1% stated in the bid letter PIPER SANDLER | 5

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION (1) Floating Value of Stock Offer Since DTI Began Trading ($ in millions) (2) Implied Offer Premiums VWAP All-Stock All-Cash 1-day 12% 41% 10-day 10% 38% 30-day 13% 42% 60-day 9% 37% (3) 1) Source: Capital IQ as of January 2,

2024; DTI began trading on June 21, 2023 following completion of reverse merger with ROC Energy Acquisition Corp. 2) Premiums calculated as implied SDPI share price (based on both an all-stock offer and all-cash offer) divided by SDPI VWAP;

all-stock implied SDPI share price PIPER SANDLER | 6 calculated using DTI share price as of January 2, 2024 and bid offer rate of 0.243 DTI shares / SDPI share 3) Implied historical SDPI share price based on offer of 0.243 DTI shares per SDPI

share

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION (1) Share Price Ratios Since DTI Began Trading ($ in millions) (2) 1) Source: Capital IQ as of January 2, 2024; DTI began trading on June 21, 2023 following completion of reverse merger with ROC Energy Acquisition Corp. 2) 0.243

DTI shares / SDPI share per bid letter PIPER SANDLER | 7

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION For information on Piper Sandler locations, visit PiperSandler.com. ® Piper Sandler Companies (NYSE: PIPR) is a leading investment bank driven to help clients Realize the Power of Partnership . Securities brokerage and

investment banking services are offered in the U.S. through Piper Sandler & Co., member SIPC and NYSE; in the U.K. through Piper Sandler Ltd., authorized and regulated by the U.K. Financial Conduct Authority; and in Hong Kong through Piper

Sandler Hong Kong Ltd., authorized and regulated by the Securities and Futures Commission Alternative asset management and fixed income advisory services are offered through separately registered advisory affiliates. ©2023. Since 1895. Piper

Sandler Companies. 800 Nicollet Mall, Minneapolis, Minnesota 55402-7036 PIPER SANDLER | 8

CONFIDENT CONFIDENTAL DRAFT – AL DRAFT – SUBJECT SUBJECT TO

REVISION TO REVISION CONFIDENTIAL DRAFT – SUBJECT TO REVISION Exhibit (c)(4) January 15, 2023 Discussion Materials Prepared For The Board Of Directors Of Dagny INTERNAL REFERENCE Galt = DTI Dagny = SDPI CONFIDENTIAL PIPER SANDLER |

1

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION Disclaimer Piper Sandler & Co. ( Piper Sandler or “PSC”) has prepared and provided these materials and any related materials (the Confidential Materials ) solely for the use of the Board of Directors (the Board )

of Dagny (the Company ) in connection with its consideration of the contemplated transaction. Without Piper Sandler's prior written consent, the Confidential Materials may not be circulated or referred to publicly, disclosed to, published, relied

upon by any other person, or used or relied upon for any other purpose. Notwithstanding anything herein to the contrary, the Company may disclose to any person the U.S. federal income and state income tax treatment and tax structure of any

transaction described herein and all materials of any kind (including tax opinions and other tax analyses) that are provided to the Company relating to such tax treatment and tax structure, without Piper Sandler imposing any limitation of any kind.

The Confidential Materials, including this disclaimer, is subject to, and governed by, any written agreement between the Company and Piper Sandler. Piper Sandler engages directly or through its affiliates in various activities, including

institutional brokerage and investment and wealth management for individuals and institutions. You understand that this engagement does not prevent Piper Sandler and its affiliates from actively trading the debt and equity securities (or related

derivative securities) of third parties, the Company, or other companies which may be the subject of the engagement (for their own account or for the accounts of their customers) or from representing or otherwise providing financial services to

third parties, including competitors of the Company. In preparing the Confidential Materials, Piper Sandler has relied upon and assumed, without assuming any responsibility for investigation or independent verification of the accuracy and

completeness of all information that is available from public sources as well as all other information supplied to it by, or on behalf of, the Company and/or other sources, including tax, accounting, legal and other information provided to,

discussed with or reviewed by Piper Sandler. Piper Sandler is not in any respect responsible for verifying the accuracy or completeness of any such information, conducting any appraisal or valuation of assets or liabilities of any party to the

contemplated transaction, or advising or opining on any solvency or viability issues. As such, Piper Sandler does not assume any liability for the accuracy or completeness of such information. These materials are not intended to provide the sole

basis for evaluating the contemplated transaction or any other matter, and should be considered by the Board as only one factor in discharging its decision-making duties. PIPER SANDLER | 2

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION Disclaimer (cont’d) Piper Sandler does not provide accounting, tax, legal or regulatory advice. Piper Sandler's role in any due diligence review is limited solely to performing such review as it shall deem necessary to

support its own advice and analysis and shall not be on behalf or for the benefit of the Company, or any of its investors, creditors or any transaction counterparty. Forecasts of future results have been provided by the Company to Piper Sandler for

use in its analyses. These forecasts are not necessarily indicative of actual future results, which may be significantly more or less favorable than such forecasts, and as such, analyses performed by Piper Sandler based on Company forecasts may not

prove to be accurate. Accordingly, Piper Sandler does not assume responsibility for the accuracy or completeness of Company forecasts or the analyses Piper Sandler performs based on these forecasts. The Confidential Materials do not address the

underlying business decision of the Company and the Board to engage in the contemplated transaction or any other contemplated transaction, or the relative merits of any strategic alternative referred to herein as compared to any other alternative

that may be available to the Company. The Confidential Materials are necessarily based on economic, monetary, market and other conditions as in effect on, and the information made available to Piper Sandler as of, the date of such Confidential

Materials and Piper Sandler assumes no responsibility for updating or revising the Confidential Materials. PIPER SANDLER | 3

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION Transaction Overview (Dollar and share amounts in millions, except per share amounts) n In the counterproposal, Galt would acquire all of the outstanding shares of Dagny via tender offer, in which Dagny shareholders would

have the option to either exchange for $1.00 worth of Galt shares per Dagny share or receive $1.00 cash per Dagny share l Implies a $27.7 million valuation for Dagny l Analysis assumes floating exchange ratio l Analysis excludes

transaction fees and expenses that are expected to be absorbed by the merged entity Reflects counterproposal exchange ratio. Was 0.243 per Dagny share at time of initial offer letter Dagny Pro Forma Ownership and Implied Equity Consideration Dagny

Capitalization At Offer % of Dagny Shares Tendered for Galt Shares At Market At Offer (2) 0% 25% 50% 75% 100% Dagny Diluted Shares Outstanding 32.1 32.1 Cash Offer Price per Share $ 0.76 $ 1.00 Cash Offer Price per Dagny Share $ 1.00 $ 1.00 $ 1.00 $

1.00 $ 1.00 (1) Implied Dagny Equity Value $ 24.3 $ 3 2.1 Galt Shares per Dagny Share 0.332 0.332 0.332 0.332 0.332 (2) Debt 2.5 2.5 Dagny Fully Diluted Shares Outstanding 32.1 32.1 32.1 32.1 32.1 Less: Cash (4.3) (4.3) Implied Consideration to

Dagny Equity Dagny Net Debt (Excl. Tronco) (1.9) (1.9) Galt Shares Issued to Dagny - 2.7 5.3 8.0 10.7 (3 Less: PV of Tronco Note Payments (2.6) (2.6) Galt Share Price (01/09/2024) $ 3.01 $ 3.01 $ 3.01 $ 3.01 $ 3.01 Dagny Net Debt (4.4) (4.4) Stock

Consideration $ - $ 8.0 $ 16.1 $ 24.1 $ 32.1 Implied Dagny Enterprise Value $ 19.9 $ 2 7.7 Cash Consideration 32.1 24.1 16.1 8.0 - Total Consideration to Dagny Equity $ 32.1 $ 32.1 $ 32.1 $ 32.1 $ 32.1 Impl. Enterprise Val. (Excl. Tronco) $ 22.5 $

30.3 Pro Forma Diluted Shares Oustanding Galt Fully Diluted Shares Outstanding 29.8 29.8 29.8 29.8 29.8 Galt Shares Issued to Dagny - 2.7 5.3 8.0 10.7 Total Pro Forma Shares Oustanding 29.8 32.4 35.1 37.8 40.4 Pro Forma Ownership Galt Pro Forma

Ownership 100% 92% 85% 79% 74% Dagny Pro Forma Ownership - 8% 15% 21% 26% 1) Calculated using Galt spot share price as of January 9, 2024 and $1.00 offer price per Dagny share 2) Dagny diluted shares includes ~1.7M unvested RSUs that will vest upon

change of control PIPER SANDLER | 4 3) Present value of Tronco Note payment schedule provided by management; assumes 30% discount rate Note: Analysis excludes transaction fees and expenses that are expected to be absorbed by the merged

entity

CONFIDENTAL DRAFT – SUBJECT TO REVISION CONFIDENTIAL DRAFT –

SUBJECT TO REVISION Note: Galt Share Price for Exchange Rate Calculation n Galt has calculated exchange rate using Galt’s 20-day VWAP and $1.00 offer price per Dagny Share in initial bid and in presentation to Dagny board n