What is the Future Path for Fair Value on the S&P 500? - Real Time Insight

September 20 2012 - 10:41AM

Zacks

I read this lead-in quote from a respected

sell-side firm on Monday. I have been thinking about the

equity implications of it all week.

"Our forecast that S&P 500 valuation

would remain flat during 2012 given stagnating economic and EPS

growth is proving incorrect. The market response to

the FOMC statement suggests investors believe the Fed has

credibility in terms of its intended policy

actions.

What happens if we assign similar credibility

to the Fed’s economic projections and use them in our earnings and

valuation models? S&P 500 EPS would equal $112 (2013),

$120 (2014), and $128 (2015). Our macroeconomic regression

model based on output gap and inflation points to an expanding

P/E multiple of 12.9x, 14.0x, and 15.1x,

respectively.

But downside risk exists from the ‘fiscal

cliff’."

In light of this quote, I pose a fresh riddle for

all of you this afternoon.

If the Fed’s economic model is throwing up proper

fair value metrics; and the S&P 500 trades 6-12-18 months

ahead; then current S&P 500 fair value bases on 2013 numbers

above. This is $112*12.9=1445. With the S&P 500 trading

1450, we are on fair value right now.

By next spring, the S&P 500 trades on 2014

numbers. This is $120*14.0=1680.

That’s right. Fair value under the Fed’s

economic projections by spring 2013 is 1680 for

the S&P 500. After January’s ‘fiscal cliff’, we have

multiple winter and spring worries to debate

about.

What are your thoughts? Is S&P 500 at

1680 by spring where we are going? If not, what might stand

in our way…after the fiscal cliff?

PRO-ULT SH S&P5 (SPXU): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

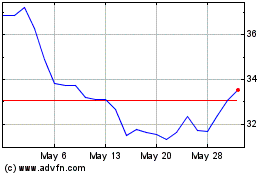

ProShares UltraPro Short... (AMEX:SPXU)

Historical Stock Chart

From Apr 2024 to May 2024

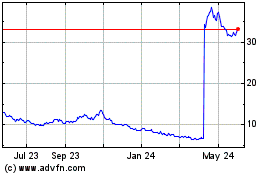

ProShares UltraPro Short... (AMEX:SPXU)

Historical Stock Chart

From May 2023 to May 2024