false

0001378140

0001378140

2024-07-25

2024-07-25

0001378140

OPTT:CommonStock0.001ParValueMember

2024-07-25

2024-07-25

0001378140

OPTT:SeriesPreferredStockPurchaseRightsMember

2024-07-25

2024-07-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

Current

Report Pursuant to Section 13 or 15(d) of

the

Securities Act of 1934

Date

of Report (Date of earliest event reported): July 25, 2024

Ocean

Power Technologies, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-33417 |

|

22-2535818 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

28 Engelhard Drive, Suite B

Monroe Township, New Jersey |

|

08831 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(609)

730-0400

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CRF 240.133-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol (s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 Par Value |

|

OPTT |

|

NYSE

American |

| Series

A Preferred Stock Purchase Rights |

|

N/A |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

July 25, 2024, Ocean Power Technologies, Inc. (the “Company”) issued a press release announcing its financial results for

its fiscal fourth quarter and fiscal year ended April 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report

and is incorporated herein by reference.

In

accordance with General Instruction B.2 of Form 8-K, the information set forth in Item 2.02 and in the attached Exhibit 99.1 shall be

deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended.

Item

9.01 Financial Statements and Exhibits.

*Furnished

herewith.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

July 25, 2024

| |

OCEAN

POWER TECHNOLOGIES, INC. |

| |

|

| |

/s/

Philipp Stratmann |

| |

Philipp

Stratmann |

| |

President

and Chief Executive Officer |

Exhibit

99.1

Ocean

Power Technologies, Inc.

Announces

Fourth Quarter and Full Year Fiscal 2024 Results

Significant

Improvement in Revenue and Gross Margin

MONROE

TOWNSHIP, N.J., July 25, 2024 (GLOBE NEWSWIRE) – Ocean Power Technologies, Inc. (“OPT” or “the Company”) (NYSE American: OPTT),

today announced financial results for its fiscal fourth quarter (“4Q24”) and full-year ended April 30, 2024 (“FY24”). Highlights include:

4Q24

and RECENT HIGHLIGHTS

| |

● |

Backlog

at April 30, 2024 is $4.9 million, a 25% increase over the prior year. |

| |

● |

Pipeline

at April 30, 2024 stood at $71.6 million |

| |

● |

In

July 2024 we announced a contract for immediate delivery of a PowerBuoy equipped with Merrows, our Artificial Intelligence capable

Maritime Domain Awareness Solution, in the Midde East. This order follows our previous announcement of the customer’s selection of

OPT as a preferred supplier for Merrows equipped buoys in the region. This shipment for a solar and wind powered system highlights

our ability to service almost all marine environments across the globe. |

| |

● |

In

June 2024 we announced the signing of an Original Equipment Manufacturer agreement with Teledyne Marine, a key supplier of maritime

technology inclusive of connectors, instruments, and vehicles. This strategic partnership will enhance OPT’s product offerings and

drive innovation within the industry providing customers with a turnkey system. Joining forces with Teledyne allows us to leverage

Teledyne’s best-in-class offerings to deliver superior sensor and ocean technology products to our customers. We believe this partnership

further accelerates our growth and enables an additional revenue stream. |

| |

● |

In

April 2024 we announced a strategic alliance with Red Cat Holdings, Inc., a leading aerial drone technology firm specializing in

the integration of robotic hardware and software across military, government, and commercial sectors. This collaboration signifies

a material step forward in enhancing maritime domain awareness capabilities for air, sea, and subsea defense and security missions.

Through this relationship, OPT’s PowerBuoy and WAM-V platforms will be integrated with Red Cat’s Drones, facilitating a new era of

autonomous vehicle deployment. By combining our sustainable, ocean-powered solutions with Red Cat’s advanced drone technology, we

believe we are setting a new standard for naval and border protection operations. |

| |

● |

Also

in April 2024, we signed a teaming agreement with a major international defense contractor to provide our Merrows suite of solutions

with a focus on certain geographic regions. Under the terms of the agreement, the defense contractor will have exclusive rights to

provide OPT’s MDAS solution within certain international geographic regions. Leveraging OPT’s cutting-edge technology alongside the

international contractor’s extensive expertise in defense, homeland security, and commercial programs, the collaboration should strengthen

the contractor’s capabilities in maritime security and surveillance. This collaboration underscores the opportunity and our commitment

to enhancing maritime security globally and positions us to achieve remarkable advancements in this field. |

FY24

and OTHER HIGHLIGHTS

| |

● |

Revenues

for FY24 increased 102% to $5.5 million, over FY23. |

| |

● |

Gross

profit for FY24 was 51% and $2.8 million, as compared to 9% and $0.2 million in FY23. |

| |

● |

We

recently partnered with Unique Group, a UAE headquartered global innovator in subsea technologies and engineering, to collaborate

to deploy OPT’s WAM-V’s in the UAE and other countries in the Gulf Collaboration Council (“GCC”) region. Integrating OPT’s commercially

available vehicles with Unique’s leading position in the offshore energy industry in the UAE should accelerate the adoption of USVs

in the region. Working with Unique Group should further accelerate our efforts to deploy USVs globally. The GCC in general, and the

UAE specifically, are rapidly becoming a major focus area for us as we continue our growth in both the defense and security, and

offshore energy industries. |

| |

● |

Back

home in the USA, we signed a reseller agreement with Survey Equipment Services, Inc. (SES), a specialist in the supply of Marine

Survey and Navigation equipment. The agreement focuses on the provision of OPT’s WAM-Vs domestically. This agreement allows us to

leverage SES’s offering of survey and navigation equipment and deploy WAM-V’s to SES’s customer base. This partnership further accelerates

our growth and enables additional revenue stream. |

| |

● |

Most

recently, we entered into a Memorandum of Understanding with AltaSea at the Port of Los Angeles. The joint aim is to explore exciting

opportunities within the Blue Economy and partnering with AltaSea provides additional opportunities for staging our renewable energy

PowerBuoys and WAM-V unmanned surface vehicles for projects in the Pacific Ocean. |

| |

● |

In

February 2024, we received multiple orders for fully integrated WAM-V Unmanned Surface Vehicles (USVs) from clients in Latin America,

highlighting the wide-ranging capabilities and applications of the WAM-V USVs and the opportunities for growth in this region. |

| |

● |

In

November 2023 we announced that we had substantially completed our research and development phase and are now primarily focused on

commercial activities. This pivot to commercial activities has enabled a reduction and reallocation of headcount and a material reduction

in third-party expenditures. As a result, the majority of OPT’s employees are now dedicated to customer delivery. We expect that

recent meaningful contract wins, the growth in our commercial pipeline, and the corresponding savings will enable us to reach profitability

during the second half of calendar year 2025. |

| |

● |

During

the first quarter of fiscal 2024 we announced a groundbreaking milestone: the successful demonstration of the WAM-V attaching itself

remotely to a buoy and establishing a connection that will enable charging, exemplifying OPT’s advanced autonomous capabilities.

This paves the way for a future where autonomous vessels can operate for extended durations, opening doors to various applications

within the maritime domain |

Management

Commentary – Dr. Philipp Stratmann, OPT’s President and Chief Executive Officer

“Fiscal

2024 was a landmark year for OPT, resulting in significant increases in pipeline, backlog, revenue, and gross margin. As a result of

the foundation and opportunities achieved during fiscal 2024, we remain on track to achieve our previously stated goal of attaining profitability

during the second half of calendar 2025. Moving forward, we plan to leverage these opportunities to increase our market presence, expand

our geographical focus, and improve operational efficiencies. We are confident that these efforts will drive sustainable growth and create

long-term value for our shareholders.”

4Q24

FINANCIALS

| |

● |

Revenues

for the 4Q23 were $1.6 million, 60% growth over 4Q23 revenues. |

| |

● |

Operating

expenses were $7.6 million in the 4Q24, down from $8.8 million in Q423 |

| |

● |

Net

loss was $6.7 million for 4Q24, as compared to a net loss of $9.5 million for 4Q23 |

FY24

FINANCIALS

| |

● |

Revenues

for FY24 increased to $5.5 million, a 102% increase over FY23 revenue of $2.7 million. |

| |

● |

Gross

profit for FY24 was $2.8 million, as compared to a gross profit of $0.2 million for FY23. |

| |

● |

Operating

expenses were $32.2 million in FY24, as compared to $28.3 million in FY23. FY24 included extraordinary expenses of $3.9 million. |

| |

● |

Net

loss was $27.5 million for FY24, as compared to a net loss of $26.3 million for FY23 |

| |

● |

Backlog

was $4.9 million as of April 30, 2024 as compared to $4.0 million at April 30, 2023. Our backlog includes unfilled firm written

orders for our products and services from commercial or governmental customers, which we call orders. We believe the disclosure of

orders is a useful metric for investors, as it helps support our future revenue expectations and adds validity to our strategic growth

plan. Company management uses orders as a tool to manage expected growth, budget and cash requirements, and to monitor the success

of our sales and marketing efforts. If any of our orders were to be terminated, delayed or revised downward, our orders and our backlog

would be reduced by the expected value of the remaining terms of such contract. |

Balance

Sheet:

| |

● |

Combined

cash, unrestricted cash, cash equivalents and short-term investments as of April 30, 2024, was $3.3 million, which compares to $34.9

million at the beginning of the fiscal year. |

| |

● |

The

Company continues to have no bank debt as of April 30, 2024. |

| |

● |

Net

cash used in operating activities for FY24 was approximately $29.8 million, compared to $21.7 million FY23. |

Introduction

of Fiscal 2025 Annual Guidance

The

Company is also introducing the following select guidance for full-year fiscal 2024:

| |

a. |

Contracted

orders for FY25 are expected to be approximately $12.5 million. This represents growth of almost 2x over FY24. |

The

Company’s anticipated order growth will be driven primarily by the continued ramp in its DaaS line, WAM-V sales and leases.

Conference

Call & Webcast

As

previously announced, a conference call to discuss OPT’s financial results will be held tomorrow morning, Friday, July 26, 2024, at 9:00

a.m. Eastern time. Philipp Stratmann, CEO, and Bob Powers, CFO will host the call.

| |

a. |

The

dial-in numbers for the conference call are 877-407-8291 or 201-689-8345. |

| |

|

|

| |

a. |

Live

webcast: Link to 4Q23 Webcast for OPT |

| |

|

|

| |

a. |

Call

Replay: Will be available by telephone approximately two hours after the call’s completion until August 26, 2024. You may access

the replay by dialing 877-660-6853 from the U.S. or 201-612-7415 for international callers and using the Conference

ID 1374 7852. |

| |

|

|

| |

a. |

Webcast

Replay: The archived webcast will also be available on the OPT investor relations section of its website. |

About

Ocean Power Technologies

OPT

provides intelligent maritime solutions and services that enable safer, cleaner, and more productive ocean operations for the defense

and security, oil and gas, science and research, and offshore wind markets. Our PowerBuoy® platforms provide clean and reliable electric

power and real-time data communications for remote maritime and subsea applications. We also provide WAM-V® autonomous surface vessels

(ASVs) and marine robotics services. The Company’s headquarters is located in Monroe Township, New Jersey and has an additional office

in Richmond, California. To learn more, visit www.OceanPowerTechnologies.com.

Non-GAAP

Measures: Pipeline

Pipeline

is not a term recognized under United States generally accepted accounting principles; however, it is a common measurement used in our

industry. Our methodology for determining pipeline may not be comparable to the methodologies used by other companies. Pipeline is a

representation of the journey potential customers take from the moment they become aware of our products and service to the moment they

become a paying customer. The sales pipeline is divided into a series of phases, each representing a different milestone in the customer

journey. It is a tool we use to track sales progress, identify potential roadblocks, and make data-driven decisions to improve our sales

performance. Revenue estimates derived from our pipeline can be subject to change due to project accelerations, cancellations or delays

due to various factors. These factors can also cause revenue amounts to be realized in periods and at levels different than originally

projected.

Forward-Looking

Statements

This

release may contain forward-looking statements that are within the safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements are identified by certain words or phrases such as “may”, “will”, “aim”, “will likely result”,

“believe”, “expect”, “will continue”, “anticipate”, “estimate”, “intend”, “plan”, “contemplate”, “seek to”, “future”, “objective”, “goal”,

“project”, “should”, “will pursue” and similar expressions or variations of such expressions. These forward-looking statements reflect

the Company’s current expectations about its future plans and performance. These forward-looking statements rely on a number of assumptions

and estimates that could be inaccurate and subject to risks and uncertainties. Actual results could vary materially from those anticipated

or expressed in any forward-looking statement made by the Company. Please refer to the Company’s most recent Forms 10-Q and 10-K and

subsequent filings with the U.S. Securities and Exchange Commission for further discussion of these risks and uncertainties.. Except

as may be required by applicable law, the Company undertakes no, and expressly disclaims any, obligation to publicly update or revise

any forward-looking statements, whether as a result of new information, future events, circumstances or otherwise after the date of this

press release, and you are cautioned not to rely upon them unduly,

Financial

Tables Follow

Additional

information may be found in the Company’s Annual Report on Form 10-K that will be filed with the U.S. Securities and Exchange Commission.

The Form 10-K is accessible at www.sec.gov or the Investor Relations section of the Company’s website (www.OceanPowerTechnologies.com/investor-relations).

Contact

Information

Investors:

609-730-0400 x401 or InvestorRelations@oceanpowertech.com

Media:

609-730-0400 x402 or MediaRelations@oceanpowertech.com

Ocean

Power Technologies, Inc. and Subsidiaries

Consolidated

Balance Sheets

(in

thousands, except share data)

| | |

April

30, 2024 | |

April

30, 2023 |

| ASSETS | |

| |

|

| Current assets: | |

| | | |

| | |

| Cash

and cash equivalents | |

$ | 3,151 | | |

$ | 6,883 | |

| Short-term

investments | |

| — | | |

| 27,790 | |

| Restricted

cash, short-term | |

| — | | |

| 65 | |

| Accounts

receivable | |

| 796 | | |

| 745 | |

| Contract

assets | |

| 18 | | |

| 152 | |

| Inventory | |

| 4,831 | | |

| 1,044 | |

| Other

current assets | |

| 1,747 | | |

| 994 | |

| Total

current assets | |

$ | 10,543 | | |

$ | 37,673 | |

| Property and equipment, net | |

| 3,443 | | |

| 1,280 | |

| Intangibles, net | |

| 3,622 | | |

| 3,978 | |

| Right-of-use assets, net | |

| 2,405 | | |

| 1,751 | |

| Restricted cash, long-term | |

| 154 | | |

| 155 | |

| Goodwill | |

| 8,537 | | |

| 8,537 | |

| Total

assets | |

$ | 28,704 | | |

$ | 53,374 | |

| LIABILITIES AND SHAREHOLDERS’

EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts

payable | |

$ | 3,366 | | |

$ | 952 | |

| Earn out

payable | |

| 1,130 | | |

| 1,500 | |

| Accrued

expenses | |

| 1,787 | | |

| 2,346 | |

| Contract

liabilities | |

| 302 | | |

| 1,378 | |

| Right-of-use

liabilities, current portion | |

| 774 | | |

| 529 | |

| Contingent

liabilities, current portion | |

| — | | |

| 1,202 | |

| Total

current liabilities | |

$ | 7,359 | | |

$ | 7,907 | |

| Deferred tax liability | |

| 203 | | |

| 203 | |

| Right-of-use

liabilities, less current portion | |

| 1,798 | | |

| 1,311 | |

| Total

liabilities | |

$ | 9,360 | | |

$ | 9,421 | |

| Commitments and contingencies

(Note 15) | |

| | | |

| | |

| Shareholders’ Equity: | |

| | | |

| | |

| Preferred

stock, $0.001 par value; authorized 5,000,000 shares, none issued or outstanding | |

$ | — | | |

$ | — | |

| Common

stock, $0.001 par value; authorized 100,000,000 shares, issued 61,352,731 and 56,304,642 shares, respectively, and outstanding 61,264,714

and 56,263,728 shares, respectively | |

| 61 | | |

| 56 | |

| Treasury

stock, at cost; 88,017 and 40,914 shares, respectively | |

| (369 | ) | |

| (355 | ) |

| Additional

paid-in capital | |

| 327,276 | | |

| 324,393 | |

| Accumulated

deficit | |

| (307,579 | ) | |

| (280,096 | ) |

| Accumulated

other comprehensive loss | |

| (45 | ) | |

| (45 | ) |

| Total

shareholders’ equity | |

| 19,344 | | |

| 43,953 | |

| Total

liabilities and shareholders’ equity | |

$ | 28,704 | | |

$ | 53,374 | |

Ocean

Power Technologies, Inc. and Subsidiaries

Consolidated

Statements of Operations

(in

thousands, except per share data)

| | |

Fiscal

year ended April 30, |

| | |

2024 | |

2023 |

| Revenue | |

$ | 5,525 | | |

$ | 2,732 | |

| Cost of revenue | |

| 2,699 | | |

| 2,496 | |

| Gross

profit | |

| 2,826 | | |

| 236 | |

| Loss/(Gain) from change in

fair value of consideration | |

| (72 | ) | |

| 1,112 | |

| Operating

expenses | |

| 32,229 | | |

| 28,340 | |

| Total

operating expenses | |

| 32,157 | | |

| 29,452 | |

| Operating

loss | |

$ | (29,331 | ) | |

$ | (29,216 | ) |

| Interest income, net | |

| 800 | | |

| 902 | |

| Other income, employee retention

credit | |

| — | | |

| 1,251 | |

| Other income, proceeds from

insurance claim | |

| — | | |

| 458 | |

| Other income | |

| 2 | | |

| — | |

| Loss on disposition of assets

(Note 7) | |

| (210 | ) | |

| — | |

| Foreign

exchange gain | |

| 2 | | |

| 1 | |

| Loss before income taxes | |

$ | (28,737 | ) | |

$ | (26,604 | ) |

| Income

tax benefit | |

| 1,254 | | |

| 278 | |

| Net

loss | |

$ | (27,483 | ) | |

$ | (26,326 | ) |

| Basic

and diluted net loss per share | |

$ | (0.47 | ) | |

$ | (0.47 | ) |

| Weighted

average shares used to compute basic and diluted net loss per share | |

| 59,031,736 | | |

| 55,998,543 | |

OCEAN

POWER TECHNOLOGIES, INC. AND SUBSIDIARIES

Consolidated

Statements of Cash Flows

(in

thousands)

| | |

Fiscal

year ended April 30, |

| | |

2024 | |

2023 |

| Cash flows from operating

activities: | |

| | | |

| | |

| Net

loss | |

$ | (27,483 | ) | |

$ | (26,326 | ) |

| Adjustments

to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Foreign

exchange gain | |

| (2 | ) | |

| (1 | ) |

| Depreciation

of fixed assets | |

| 420 | | |

| 183 | |

| Amortization

of intangible assets | |

| 148 | | |

| 158 | |

| Amortization

of right-of-use assets | |

| 593 | | |

| 296 | |

| (Accretion

of discount)/amortization of premium on investments | |

| (290 | ) | |

| 113 | |

| Change

in contingent consideration liability | |

| (72 | ) | |

| 1,112 | |

| Loss on

disposal of assets | |

| 210 | | |

| — | |

| Stock

based compensation | |

| 1,155 | | |

| 1,461 | |

| Changes

in operating assets and liabilities, net of acquisitions: | |

| | | |

| | |

| Accounts

receivable | |

| (51 | ) | |

| (262 | ) |

| Contract

assets | |

| 134 | | |

| 234 | |

| Inventory | |

| (3,787 | ) | |

| (602 | ) |

| Other

assets | |

| (753 | ) | |

| (527 | ) |

| Accounts

payable | |

| 2,414 | | |

| 47 | |

| Accrued

expenses | |

| (309 | ) | |

| 1,469 | |

| Earn out

payable | |

| (500 | ) | |

| — | |

| Right-of-use

liabilities | |

| (514 | ) | |

| (311 | ) |

| Contract

liabilities | |

| (1,076 | ) | |

| 1,249 | |

| Net

cash used in operating activities | |

$ | (29,763 | ) | |

$ | (21,707 | ) |

| Cash flows

from investing activities: | |

| | | |

| | |

| Redemptions

of short term investments | |

$ | 35,975 | | |

$ | 64,923 | |

| Purchases

of short term investments | |

| (7,894 | ) | |

| (43,442 | ) |

| Purchases

of property and equipment | |

| (2,585 | ) | |

| (648 | ) |

| Leased

WAM-Vs built and capitalized | |

| — | | |

| (371 | ) |

| Net

cash provided by investing activities | |

$ | 25,496 | | |

$ | 20,462 | |

| Cash flows from financing

activities: | |

| | | |

| | |

| Proceeds

from issuance of common stock - Cantor At The Market offering, net of issuance costs | |

$ | 29 | | |

$ | — | |

| Proceeds

from issuance of common stock - AGP At The Market offering, net of issuance costs | |

| 454 | | |

| — | |

| Cash

paid for tax withholding related to shares withheld | |

| (14 | ) | |

| (14 | ) |

| Net

cash provided by/(used in) financing activities | |

$ | 469 | | |

$ | (14 | ) |

| Effect

of exchange rate changes on cash, cash equivalents and restricted cash | |

$ | — | | |

$ | — | |

| Net decrease

in cash, cash equivalents and restricted cash | |

$ | (3,798 | ) | |

$ | (1,259 | ) |

| Cash,

cash equivalents and restricted cash, beginning of year | |

| 7,103 | | |

$ | 8,362 | |

| Cash,

cash equivalents and restricted cash, end of year | |

$ | 3,305 | | |

$ | 7,103 | |

| | |

| | | |

| | |

| Supplemental disclosure of

noncash investing and financing activities: | |

| | | |

| | |

| Common

stock issued related to bonus and earnout payments | |

$ | 1,250 | | |

$ | — | |

| Operating

right of use asset obtained in exchange for operating lease liability | |

$ | 1,247 | | |

$ | 1,296 | |

v3.24.2

Cover

|

Jul. 25, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 25, 2024

|

| Entity File Number |

001-33417

|

| Entity Registrant Name |

Ocean

Power Technologies, Inc.

|

| Entity Central Index Key |

0001378140

|

| Entity Tax Identification Number |

22-2535818

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

28 Engelhard Drive

|

| Entity Address, Address Line Two |

Suite B

|

| Entity Address, City or Town |

Monroe Township

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

08831

|

| City Area Code |

(609)

|

| Local Phone Number |

730-0400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, $0.001 Par Value |

|

| Title of 12(b) Security |

Common

Stock, $0.001 Par Value

|

| Trading Symbol |

OPTT

|

| Security Exchange Name |

NYSEAMER

|

| Series A Preferred Stock Purchase Rights |

|

| Title of 12(b) Security |

Series

A Preferred Stock Purchase Rights

|

| Trading Symbol |

N/A

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=OPTT_CommonStock0.001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=OPTT_SeriesPreferredStockPurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

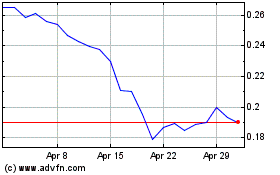

Ocean Power Technologies (AMEX:OPTT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ocean Power Technologies (AMEX:OPTT)

Historical Stock Chart

From Nov 2023 to Nov 2024