Form 8-K/A - Current report: [Amend]

May 14 2024 - 4:18PM

Edgar (US Regulatory)

Form 8-K/A No. 1 date of report 03-06-24

true

0001036262

0001036262

2024-03-06

2024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment No. 1

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

March 6, 2024

Date of Report (Date of earliest event reported)

inTEST Corporation

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

(State or Other Jurisdiction of Incorporation)

|

1-36117

(Commission File Number)

|

22-2370659

(I.R.S. Employer Identification No.)

|

|

804 East Gate Drive, Suite 200, Mt. Laurel, New Jersey 08054

(Address of Principal Executive Offices, including zip code)

|

| |

|

(856) 505-8800

(Registrant's Telephone Number, including area code)

|

| |

|

N/A

(Former name or former address, if changed since last report)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written Communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $0.01 per share

|

INTT

|

NYSE American

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

|

| |

|

Emerging growth company ☐

|

| |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

EXPLANATORY NOTE

This Amendment No. 1 on Form 8-K/A amends the Current Report on Form 8-K of inTEST Corporation (“Company”), filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 12, 2024 (the “Original Form 8-K”). The Original Form 8-K reported, among other things, the Company’s acquisition (the “Acquisition”) of all of the outstanding capital shares of Alfamation S.p.A., an Italian joint-stock company (“Alfamation”). The Company disclosed in the Original Form 8-K that the financial statements and pro forma financial information required by Item 9.01 of Form 8-K relating to the Acquisition would be filed by an amendment to the Original Form 8-K no later than 71 calendar days after the Original Form 8-K was required to be filed. Subsequent to the filing of the Original Form 8-K and upon further analysis, the Company determined that it is not required to file such financial statements or pro forma financial information. Accordingly, the Company hereby amends the Original Form 8-K to eliminate references to the subsequent filing of financial statements required by Item 9.01(a) and pro forma financial information required by Item 9.01(b) relating to the Acquisition.

Further the Original Form 8-K reported Alfamation entered into a lease agreement (the “Lease Agreement”) by and between Alfamation and Elettra Real Estate S.r.l. The description of the material terms of the Lease Agreement contained typographical errors regarding the yearly lease payment. The Lease Agreement provides for a yearly lease payment of €260,000 paid semiannually. Accordingly, the Company hereby amends the Original Form 8-K to correct the information provided in Item 1.01.

Except as described in this Explanatory Note and as set forth in the items included below, the Original Form 8-K is unchanged.

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On March 12, 2024 inTEST Corporation (the “Company”) entered into a stock purchase agreement (the “Purchase Agreement”) by and among inTEST Italy, Inc., a wholly owned subsidiary of the Company (“Buyer”), Mauro Arigossi (“Arigossi”), and Elettra S.S., a company incorporated under the Laws of Italy (“Elettra”, and together with Arigossi, each a “Seller” and collectively, the “Sellers”). In accordance with the Purchase Agreement the Sellers, being the sole legal and beneficial owners of all of the outstanding capital shares of Alfamation S.p.A., an Italian joint-stock company (the “Alfamation”), agreed to sell and the Buyer agreed to purchase all of the outstanding capital shares of Alfamation. Pursuant to the Purchase Agreement, the Buyer agreed to pay to the Sellers an aggregate base purchase price of approximately €20 million comprised of: (i) approximately €18 million in cash; and (ii) 187,432 shares of common stock of the Company, par value $0.01 (the “Shares”); and an additional approximately €542 thousand in cash for assets delivered at closing in excess of agreed upon thresholds (together with the base purchase price, the “Purchase Price”). The cash portion of the Purchase Price is subject to customary adjustments for net working capital, cash and indebtedness, as per the terms of the Purchase Agreement. An indemnification escrow of €2,064,220 was funded at the closing and is available to the Company to satisfy indemnification claims pursuant to the Purchase Agreement until 18 months from the closing date. The Purchase Agreement contains customary representations and warranties, and indemnification, non-competition, non-solicitation, and confidentiality provisions.

In connection with the Purchase Agreement, Alfamation has entered into a lease agreement (the “Lease Agreement”) by and between Alfamation and Elettra Real Estate S.r.l , a limited liability company incorporated under the Laws of Italy (the “Landlord”). The Lease Agreement will last for six years starting on March 12, 2024 and will be automatically renewed for the same period of time unless terminated by either party. Under the terms of the Lease Agreement, Alfamation will lease warehouse and office space totaling about 51,817 square feet. Alfamation will pay to the Landlord a yearly lease payment of €260,000 paid semiannually.

The foregoing summaries of the Purchase Agreement and the Lease Agreement do not purport to be complete and are qualified in their entirety by reference to the Purchase Agreement and Lease Agreement, copies of which are filed with this Current Report on Form 8-K (the “Report”) as Exhibit 10.1 and 10.2, respectively.

|

Item 9.01.

|

Financial Statements and Exhibits

|

(a) Financial statements of businesses or funds acquired.

None.

(b) Pro forma financial information.

None.

(d) Exhibits

The following exhibits were filed or furnished with the Original 8-K on May 12, 2024.

|

Exhibit No.

|

Description

|

|

10.1*

|

|

|

10.2

|

|

|

99.1

|

|

|

99.2

|

|

|

99.3

|

|

|

104

|

Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document

|

| |

*

|

Certain schedules of this exhibit have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally to the Securities and Exchange Commission or its staff a copy of the omitted schedules upon request.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

inTEST CORPORATION

|

|

|

|

|

|

|

| |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Duncan Gilmour

|

|

|

|

|

Duncan Gilmour

Chief Financial Officer, Treasurer and Secretary

|

|

Date: May 14, 2024

v3.24.1.1.u2

Document And Entity Information

|

Mar. 06, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

inTEST Corporation

|

| Document, Type |

8-K/A

|

| Document, Period End Date |

Mar. 06, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

1-36117

|

| Entity, Tax Identification Number |

22-2370659

|

| Entity, Address, Address Line One |

804 East Gate Drive, Suite 200

|

| Entity, Address, City or Town |

Mt. Laurel

|

| Entity, Address, State or Province |

NJ

|

| Entity, Address, Postal Zip Code |

08054

|

| City Area Code |

856

|

| Local Phone Number |

505-8800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

INTT

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Description |

Form 8-K/A No. 1 date of report 03-06-24

|

| Amendment Flag |

true

|

| Entity, Central Index Key |

0001036262

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

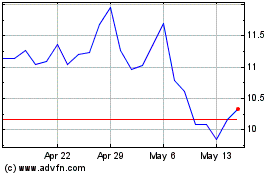

inTest (AMEX:INTT)

Historical Stock Chart

From Apr 2024 to May 2024

inTest (AMEX:INTT)

Historical Stock Chart

From May 2023 to May 2024