inTEST Reports Third Quarter 2004 Results CHERRY HILL, N.J., Oct.

27 /PRNewswire-FirstCall/ -- inTEST Corporation (NASDAQ:INTT), a

leading independent designer, manufacturer and marketer of

semiconductor automatic test equipment (ATE) interface solutions

and temperature management products, today announced its operating

results for the quarter ended September 30, 2004. Net revenues for

the quarter ended September 30, 2004 decreased 14% to $19.5

million, compared to $22.7 million for the second quarter of 2004.

Net income for the third quarter of 2004 was $1.2 million or $0.14

per diluted share, compared to net income of $2.5 million or $0.29

per diluted share for the second quarter of 2004. Robert E.

Matthiessen, President and Chief Executive Officer of inTEST said,

"Late in the third quarter, we saw a significant weakening in the

level of our orders in two of our three product segments as several

customers either postponed scheduled shipments or canceled orders.

In addition, we had higher than expected levels of inventory

obsolescence and product warranty expenses during the third

quarter, along with higher materials costs related to product mix.

Bookings declined to $11.8 million in the third quarter of 2004,

compared to $25.2 million for the second quarter of 2004, while our

backlog at the end of the third quarter was $8.7 million, down from

$16.2 million at the end of the second quarter of 2004. Based on

public disclosures of other companies in our industry, we believe

the weaker demand is affecting the entire industry." Hugh T. Regan,

Jr., Treasurer and Chief Financial Officer of inTEST said, "Our

focus is now on implementing targeted cost containment strategies

to bring our operating expenses inline with expected business

levels and to offset further anticipated market weakness. Despite

this, we will continue to invest in research and development, as

new product innovations allow us to effectively support our

customers and continue to differentiate inTEST products. Based upon

current customer forecasts and business conditions, we expect net

revenues for the fourth quarter ending December 31, 2004, to be in

the range of $12.5 million to $15 million, with pre-tax loss to be

in the range of ($0.22) to ($0.38) per diluted share prior to the

effect of the cost containment strategies we will implement."

Investor Conference Call / Webcast Details inTEST will review third

quarter results and discuss management's expectations for the

fourth quarter of 2004 and current views of the industry today,

October 27, 2004, at 5PM EDT. The conference call will be available

at http://www.intest.com/ and by telephone at (973) 409-9261. A

replay will be available from 8PM EDT on October 27 through

midnight on November 3 at http://www.intest.com/ and by telephone

at (973) 341-3080. The confirmation identification for both the

live call and the replay is 5245564. About inTEST Corporation

inTEST Corporation is a leading independent designer, manufacturer

and marketer of ATE interface solutions and temperature management

products, which are used by semiconductor manufacturers to perform

final testing of integrated circuits (ICs) and wafers. The

Company's high-performance products are designed to enable

semiconductor manufacturers to improve the speed, reliability,

efficiency and profitability of IC test processes. Specific

products include positioner and docking hardware products,

temperature management systems and customized interface solutions.

The Company has established strong relationships with semiconductor

manufacturers globally, which it supports through a network of

local offices. For more information visit http://www.intest.com/.

CONTACTS: Hugh T. Regan, Jr., Treasurer and Chief Financial

Officer, inTEST Corporation 856-424-6886, ext 201. David Pasquale,

646-536-7006, or Andrew Rodriguez, 646-536-7032 Both of The Ruth

Group, http://www.theruthgroup.com/ Forward-Looking Statements:

This press release includes forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These statements do not convey historical information, but relate

to predicted or potential future events that are based upon

management's current expectations. These statements are subject to

risks and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements. In

addition to the factors mentioned in this press release, such risks

and uncertainties include, but are not limited to, changes in

business conditions and the economy, generally; changes in the

demand for semiconductors, generally; changes in the rates of, and

timing of, capital expenditures by semiconductor manufacturers;

progress of product development programs; increases in raw material

and fabrication costs associated with our products; and other risk

factors set forth from time to time in our SEC filings, including,

but not limited to, our periodic reports on Form 10-K and Form

10-Q. The Company undertakes no obligation to update the

information in this press release to reflect events or

circumstances after the date hereof or to reflect the occurrence of

anticipated or unanticipated events. (Financials Attached) SELECTED

FINANCIAL DATA (In thousands, except per share data) Condensed

Consolidated Statements of Operations Data: Three Months Ended Nine

Months Ended 9/30/2004 6/30/2004 9/30/2003 9/30/2004 9/30/2003 Net

revenues $19,509 $22,714 $12,725 $59,231 $33,183 Gross margin 7,783

10,416 5,471 25,410 12,929 Operating expenses: Selling expense

3,226 3,358 2,976 9,289 7,234 Engineering and product development

expense 1,852 1,841 1,709 5,346 4,657 General and administrative

expense 1,884 2,080 1,480 5,700 4,328 Operating income (loss) 821

3,137 (694) 5,075 (3,290) Other income 36 48 29 90 126 Earnings

(loss) before income taxes 857 3,185 (665) 5,165 (3,164) Income tax

expense (benefit) (384) 680 2,115 421 1,402 Net earnings (loss)

1,241 2,505 (2,780) 4,744 (4,566) Net earnings (loss) per share -

basic $0.15 $0.30 $(0.33) $0.56 $(0.55) Weighted average shares

outstanding - basic 8,500 8,363 8,326 8,409 8,325 Net earnings

(loss) per share - diluted $0.14 $0.29 $(0.33) $0.54 $(0.55)

Weighted average shares outstanding - diluted 8,902 8,704 8,326

8,777 8,325 Condensed Consolidated Balance Sheets Data: As of:

9/30/2004 6/30/2004 12/31/2003 Cash and cash equivalents $6,953

$5,659 $5,116 Trade accounts and notes receivable, net 12,045

14,882 9,183 Inventories 10,532 9,774 7,332 Total current assets

31,044 31,483 22,939 Net property and equipment 4,402 4,269 4,539

Total assets 38,748 38,237 29,977 Accounts payable 4,804 6,417

3,507 Accrued expenses 4,487 4,682 3,391 Total current liabilities

9,899 12,156 7,269 Noncurrent liabilities 45 69 117 Total

stockholders' equity 28,804 26,012 22,591 DATASOURCE: inTEST

Corporation CONTACT: Hugh T. Regan, Jr., Treasurer and Chief

Financial Officer, inTEST Corporation, +1-856-424-6886, ext 201.;

or David Pasquale, +1-646-536-7006, or Andrew Rodriguez,

646-536-7032, both of The Ruth Group, http://www.theruthgroup.com/

Web site: http://www.intest.com/

Copyright

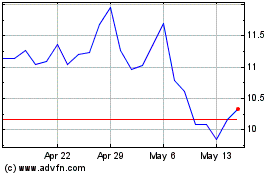

inTest (AMEX:INTT)

Historical Stock Chart

From May 2024 to Jun 2024

inTest (AMEX:INTT)

Historical Stock Chart

From Jun 2023 to Jun 2024