CHERRY HILL, N.J., April 1 /PRNewswire-FirstCall/ -- inTEST

Corporation (NASDAQ:INTT), an independent designer, manufacturer

and marketer of semiconductor automatic test equipment (ATE)

interface solutions and temperature management products, today

announced preliminary unaudited results for the quarter and year

ended December 31, 2008. All historical financial information

presented in this document is unaudited, is based upon management's

internal figures, and is subject to change. Net revenues for the

quarter ended December 31, 2008 were $6.8 million, compared to $9.2

million for the third quarter of 2008. Our net loss for the fourth

quarter of 2008 was $(4.7) million or $(0.47) per diluted share,

compared to a net loss of $(2.0) million or $(0.22) per diluted

share for the third quarter of 2008. The net loss for the fourth

quarter of 2008 included charges for the impairment of certain

long-lived assets of $(1.2) million or $(0.13) per diluted share,

charges for the impairment of goodwill related to a prior

acquisition of $(130,000) or $(0.01) per diluted share and

restructuring charges of $(456,000) or $(0.05) per diluted share.

The net loss for the third quarter of 2008 included charges for the

impairment of certain long-lived assets of $(133,000) or $(0.01)

per diluted share and restructuring charges of $(61,000) or $(0.01)

per diluted share. The impairment and restructuring charges

recorded during the third and fourth quarters of 2008 were incurred

by our Manipulator and Docking Hardware and our Tester Interface

product segments. The restructuring charges consist of one-time

termination benefits, as a result of our recent workforce

reductions in these segments, and facility closure costs, as a

result of our decision to shut our manufacturing facility in

Amerang, Germany and our sales office in the UK. Net revenues for

the year ended December 31, 2008 were $38.8 million, compared to

$48.7 million for 2007. Our net loss for the year ended December

31, 2008 was $(9.4) million or $(0.99) per diluted share, compared

to a net loss of $(6.7) million or $(0.73) per diluted share for

2007. The net loss for 2008 included charges for the impairment of

certain long-lived assets of $(1.4) million or $(0.15) per diluted

share, charges for the impairment of goodwill related to a prior

acquisition of $(130,000) or $(0.01) per diluted share and

restructuring charges of $(717,000) or $(0.08) per diluted share.

The net loss for 2007 included charges for the impairment of

goodwill related to prior acquisitions of $(2.8) million or $(0.31)

per diluted share and charges for the impairment of certain

long-lived assets of $(535,000) or $(0.06) per diluted share. The

impairment and restructuring charges recorded during 2008 were

incurred by our Manipulator and Docking Hardware and our Tester

Interface product segments. The restructuring charges consist of

one-time termination benefits as a result of our recent workforce

reductions in these segments, and facility closure costs, as a

result of our decision to shut our manufacturing facility in

Amerang, Germany and our sales office in the UK. Robert E.

Matthiessen, President and Chief Executive Officer of inTEST

commented, "The continuing weakness and turmoil of the

macroeconomic environment that began in 2008, worsened in 2009,

resulting in a significant reduction in equipment utilization rates

in the semiconductor industry. Our bookings for the fourth quarter

of 2008 decreased to $6.3 million as compared to $8.2 million in

the third quarter. While we presently see some positive indicators

in certain of our segments, we continue to remain focused on

methods to restructure our business and reduce our cash burn. As a

result of our continued operating losses in the first quarter of

2009, however, as of March 27, 2009, our cash and cash equivalents

have declined to approximately $5.1 million." The Company also

announced that in light of its ongoing evaluations of its business

segments and cash requirements, it is unable to file its Form 10-K

for the period ended December 31, 2008 within the prescribed period

of time and has filed a Notification of Late Filing on Form 12b-25

with the SEC. The Company also anticipates that the report of its

independent registered public accounting firm will express

substantial doubt about the Company's ability to continue as a

going concern. The Company will hold a conference call with

investors and analysts after it files it Annual Report on Form 10-K

to discuss its fourth quarter and year end 2008 results and

management's current expectations and views of the industry. An

announcement of the date and time and call-in information will be

made at that time. Mr. Matthiessen further stated that the Company

has retained Amper, Politziner & Mattia, LLP as financial

advisors to explore the Company's strategic alternatives to enhance

operating performance and stockholder value. These initiatives may

include further restructuring actions, a business combination or

merger with a strategic or financial investor, the possible

divestiture of certain under-performing assets and operations, or a

transaction pursuant to which the Company would "go private." About

inTEST Corporation inTEST Corporation is an independent designer,

manufacturer and marketer of ATE interface solutions and

temperature management products, which are used by semiconductor

manufacturers to perform final testing of integrated circuits (ICs)

and wafers. The Company's high-performance products are designed to

enable semiconductor manufacturers to improve the speed,

reliability, efficiency and profitability of IC test processes.

Specific products include positioner and docking hardware products,

temperature management systems and customized interface solutions.

The Company has established strong relationships with semiconductor

manufacturers globally, which it supports through a network of

local offices. For more information visit http://www.intest.com/.

CONTACT: Hugh T. Regan, Jr., Treasurer and Chief Financial Officer,

inTEST Corporation, 856-424-6886, ext 201. Forward-Looking

Statements: This press release includes forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements do not convey historical information, but

relate to predicted or potential future events that are based upon

management's current expectations. These statements are subject to

risks and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements. In

addition to the factors mentioned in this press release, such risks

and uncertainties include, but are not limited to, changes in

business conditions and the economy, generally; changes in the

demand for semiconductors, generally; changes in the rates of, and

timing of, capital expenditures by semiconductor manufacturers;

progress of product development programs; increases in raw material

and fabrication costs associated with our products; implementation

of additional restructuring initiatives; costs associated with

compliance with Sarbanes Oxley and other risk factors set forth

from time to time in our SEC filings, including, but not limited

to, our periodic reports on Form 10-K and Form 10-Q. The Company

undertakes no obligation to update the information in this press

release to reflect events or circumstances after the date hereof or

to reflect the occurrence of anticipated or unanticipated events.

SELECTED FINANCIAL DATA (Unaudited) (In thousands, except per share

data) Condensed Consolidated Statements of Operations Data: Three

Months Ended Year Ended 12/31/ 12/31/ 9/30/ 12/31/ 12/31/ 2008 2007

2008 2008 2007 Net revenues $6,830 $11,411 $9,159 $38,790 $48,705

Gross margin 1,847 4,595 2,962 13,785 18,695 Operating expenses:

Selling expense 1,695 1,899 1,863 7,875 8,466 Engineering and

product development expense 1,002 1,357 1,235 5,064 5,519 General

and administrative expense 2,024 2,052 1,750 8,062 8,180 Impairment

of long-lived assets 1,244 535 133 1,377 535 Impairment of goodwill

130 2,848 - 130 2,848 Restructuring and other charges 456 - 61 717

- Operating loss (4,704) (4,096) (2,080) (9,440) (6,853) Other

income (expense) (48) (3) 85 119 392 Loss before income taxes

(4,752) (4,099) (1,995) (9,321) (6,461) Income tax expense

(benefit) (93) 81 37 53 278 Net loss (4,659) (4,180) (2,032)

(9,374) (6,739) Net loss per share - basic $(0.47) $(0.45) $(0.22)

$(0.99) $(0.73) Weighted average shares outstanding - basic 9,888

9,268 9,337 9,465 9,215 Net loss per share - diluted $(0.47)

$(0.45) $(0.22) $(0.99) $(0.73) Weighted average shares outstanding

- diluted 9,888 9,268 9,337 9,465 9,215 Condensed Consolidated

Balance Sheets Data: As of: 12/31/2008 9/30/2008 12/31/2007 Cash

and cash equivalents $7,137 $9,945 $12,215 Trade accounts and notes

receivable, net 3,758 5,499 6,034 Inventories 4,193 4,447 5,097

Total current assets 15,797 20,720 24,464 Net property and

equipment 617 1,717 2,198 Total assets 20,252 23,668 27,723

Accounts payable 1,830 2,246 1,923 Accrued expenses 3,095 3,658

3,545 Total current liabilities 5,224 6,215 5,815 Noncurrent

liabilities 1,801 307 401 Total stockholders' equity 13,227 17,146

21,507 DATASOURCE: inTEST Corporation CONTACT: Hugh T. Regan, Jr.,

Treasurer and Chief Financial Officer, inTEST Corporation,

+1-856-424-6886, ext 201 Web Site: http://www.intest.com/

Copyright

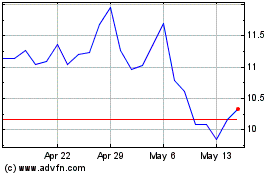

inTest (AMEX:INTT)

Historical Stock Chart

From May 2024 to Jun 2024

inTest (AMEX:INTT)

Historical Stock Chart

From Jun 2023 to Jun 2024