inTEST Reports Fourth Quarter and Full Year 2004 Results CHERRY

HILL, N.J., March 2 /PRNewswire-FirstCall/ -- inTEST Corporation

(NASDAQ:INTT), a leading independent designer, manufacturer and

marketer of semiconductor automatic test equipment (ATE) interface

solutions and temperature management products, today announced

results for the quarter and full year ended December 31, 2004. Net

revenues for the full year ended December 31, 2004 increased 48% to

$71.2 million, compared to $48.0 million for the year ended

December 31, 2003. Net income for the full year 2004 was $1.3

million or $0.14 per diluted share, compared to a loss of $5.5

million or ($0.65) per diluted share in 2003. Net revenues for the

quarter ended December 31, 2004 decreased 39% to $12.0 million,

compared to $19.5 million for the third quarter of 2004. Net loss

for the fourth quarter of 2004 was $3.5 million or ($0.40) per

diluted share, compared to net income of $1.2 million or $0.14 per

diluted share for the third quarter of 2004. Results for the fourth

quarter of 2004 include restructuring and other costs of

approximately $600,000 or $0.07 per diluted share as a result of

the Company's previously announced organizational changes. Robert

E. Matthiessen, President and Chief Executive Officer of inTEST

commented, "We achieved profitability on a full year basis in 2004

for the first time since 2000. While we were profitable in the

first three quarters of 2004, we experienced a significant order

decline during the third quarter, which continued into the fourth

quarter. This pattern was similar to that experienced by other

companies in the semiconductor industry. As a result, we took

action in November to further reduce our cost structure with the

goal of returning to sustained profitability. In line with the

above, bookings for the fourth quarter decreased to $9.3 million,

compared to $11.8 million for the third quarter of 2004 and $25.1

million in the second quarter of 2004." "While we have seen some

indications that the fourth quarter may represent a trough, it is

still too early to forecast this. In terms of our outlook, based on

current customer forecasts we remain cautious about our business

prospects for the first quarter of 2005, and expect that our

bookings level in the first quarter will be at the same approximate

level as the fourth quarter of 2004. Overall, we expect our

business environment will remain challenging in 2005. At the same

time, we are confident that with our extensive portfolio of

proprietary technologies and solutions, along with our streamlined

organization and cost structure, inTEST will be able to effectively

meet the needs and expectations of the fluid ATE market." Hugh T.

Regan, Jr., Treasurer and Chief Financial Officer of inTEST said,

"The cost containment actions we made in November are expected to

significantly improve inTEST's competitive position and financial

model. While the specific actions we took in the fourth quarter

resulted in severance costs, we expect that these actions along

with our other cost containment initiatives currently being

implemented will reduce our annual operating expense structure by

approximately $5.5 to $6.0 million giving inTEST increased

operating leverage. For the quarter ending March 31, 2005, we

expect net revenues to be in the range of $9.5 million to $11.5

million, with a pre-tax loss in the range of $(0.15) to $(0.25) per

diluted share. This guidance is before any additional costs

associated with our continued restructuring." Investor Conference

Call / Webcast Details inTEST will review fourth quarter and full

year 2004 results and discuss management's expectations for the

first quarter of 2005 and current views of the industry today,

March 2, 2005, at 5PM EST. The conference call will be available at

http://www.intest.com/ and by telephone at (913) 981-5520. A replay

will be available from 8PM EST on March 2 through midnight on March

9 at http://www.intest.com/ and by telephone at (719) 457-0820. The

confirmation identification for both the live call and the replay

is 6045568. About inTEST Corporation inTEST Corporation is a

leading independent designer, manufacturer and marketer of ATE

interface solutions and temperature management products, which are

used by semiconductor manufacturers to perform final testing of

integrated circuits (ICs) and wafers. The Company's

high-performance products are designed to enable semiconductor

manufacturers to improve the speed, reliability, efficiency and

profitability of IC test processes. Specific products include

positioner and docking hardware products, temperature management

systems and customized interface solutions. The Company has

established strong relationships with semiconductor manufacturers

globally, which it supports through a network of local offices. For

more information visit http://www.intest.com/. CONTACTS: Hugh T.

Regan, Jr., Treasurer and Chief Financial Officer, inTEST

Corporation 856-424-6886, ext 201. David Pasquale, 646-536-7006, or

Abbas Qasim, 646-536-7014 Both of The Ruth Group,

http://www.theruthgroup.com/ Forward-Looking Statements: This press

release includes forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. These

statements do not convey historical information, but relate to

predicted or potential future events that are based upon

management's current expectations. These statements are subject to

risks and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements. In

addition to the factors mentioned in this press release, such risks

and uncertainties include, but are not limited to, changes in

business conditions and the economy, generally; changes in the

demand for semiconductors, generally; changes in the rates of, and

timing of, capital expenditures by semiconductor manufacturers;

progress of product development programs; increases in raw material

and fabrication costs associated with our products; implementation

of additional restructuring initiatives; costs associated with

compliance with Sarbanes Oxley and other risk factors set forth

from time to time in our SEC filings, including, but not limited

to, our periodic reports on Form 10-K and Form 10-Q. The Company

undertakes no obligation to update the information in this press

release to reflect events or circumstances after the date hereof or

to reflect the occurrence of anticipated or unanticipated events.

SELECTED FINANCIAL DATA (In thousands, except per share data)

Condensed Consolidated Statements of Operations Data: Three Months

Ended Year Ended 12/31/ 12/31/ 9/30/ 12/31/ 12/31/ 2004 2003 2004

2004 2003 Net revenues $11,980 $14,845 $19,509 $71,211 $48,028

Gross margin 3,187 5,920 7,783 28,597 18,849 Operating expenses:

Selling expense 3,125 2,956 3,226 12,414 10,190 Engineering and

product development expense 1,735 1,745 1,852 7,081 6,402 General

and administrative expense 1,736 1,763 1,884 7,436 6,091 Operating

income (loss) (3,409) (544) 821 1,666 (3,834) Other income

(expense) (88) 98 36 2 224 Earnings (loss) before income taxes

(3,497) (446) 857 1,668 (3,610) Income tax expense (benefit) (23)

439 (384) 398 1,841 Net earnings (loss) (3,474) (885) 1,241 1,270

(5,451) Net earnings (loss) per share - basic $(0.40) $(0.11) $0.15

$0.14 $(0.65) Weighted average shares outstanding - basic 8,691

8,354 8,500 8,480 8,332 Net earnings (loss) per share - diluted

$(0.40) $(0.11) $0.14 $0.14 $(0.65) Weighted average shares

outstanding - diluted 8,691 8,354 8,902 8,804 8,332 Condensed

Consolidated Balance Sheets Data: As of: 12/31/2004 9/30/2004

12/31/2003 Cash and cash equivalents $7,686 $6,953 $5,116 Trade

accounts and notes receivable, net 6,771 12,045 9,183 Inventories

9,401 10,532 7,332 Total current assets 25,430 31,044 22,939 Net

property and equipment 4,554 4,402 4,539 Total assets 33,267 38,748

29,977 Accounts payable 2,102 4,804 3,507 Accrued expenses 4,327

4,487 3,391 Total current liabilities 7,002 9,899 7,269 Noncurrent

liabilities 47 45 117 Total stockholders' equity 26,118 28,804

22,591 DATASOURCE: inTEST Corporation CONTACT: Hugh T. Regan, Jr.,

Treasurer and Chief Financial Officer of inTEST, +1-856-424-6886,

ext 201; or David Pasquale, +1-646-536-7006, or Abbas Qasim,

+1-646-536-7014, both of The Ruth Group for inTEST Web site:

http://www.intest.com/

Copyright

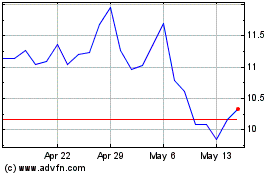

inTest (AMEX:INTT)

Historical Stock Chart

From May 2024 to Jun 2024

inTest (AMEX:INTT)

Historical Stock Chart

From Jun 2023 to Jun 2024