Quarterly Schedule of Portfolio Holdings of Registered Management Investment Company (n-q)

March 01 2013 - 2:58PM

Edgar (US Regulatory)

OMB APPROVAL

OMB Number: 3235-0578

Expires: April 30, 2013

Estimated average burden

hours per response.....

5.6

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS

OF REGISTERED MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-01835

Pioneer Value Fund

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Dorothy E. Bourassa, Pioneer Investment Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: (617) 742-7825

Date of fiscal year end: September 30

Date of reporting period: January 31, 2013

Form N-Q is to be used by management investment companies, other than small

business investment companies registered on Form N-5 (239.24 and 274.5 of this

chapter), to file reports with the Commission, not later than 60 days after

close of the first and third fiscal quarters, pursuant to Rule 30b1-5 under

the Investment Company Act of 1940 (17 CFR 270.30b1-5). The Commission may

use the information provided on Form N-Q in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-Q,

and the Commission will make this information public. A registrant is not

required to respond to the collection of information contained in Form N-Q

unless the Form displays a currently valid Office of Management and Budget

("OMB") control number. Please direct comments concerning the accuracy of the

information collection burden estimate and any suggestions for reducing the

burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW,

Washington, DC 20549-0609. The OMB has reviewed this collection of information

under the clearance requirements of 44 U.S.C. ss. 3507.

<PAGE>

ITEM 1. Schedule of Investments.

|

|

|

|

|

Pioneer Value Fund

|

|

|

|

|

|

|

|

Schedule of Investments 12/31/12

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

|

|

Value

|

|

|

|

|

|

COMMON STOCKS - 99.9%

|

|

|

|

|

|

|

|

Energy - 15.5%

|

|

|

|

|

|

|

|

Oil & Gas Equipment & Services - 4.0%

|

|

|

|

|

678,300

|

|

|

Halliburton Co.

|

$

|

23,530,227

|

|

|

408,300

|

|

|

Schlumberger, Ltd.

|

|

28,291,107

|

|

|

|

|

|

|

$

|

51,821,334

|

|

|

|

|

|

Integrated Oil & Gas - 7.4%

|

|

|

|

|

550,200

|

|

|

Chevron Corp.

|

$

|

59,498,628

|

|

|

476,600

|

|

|

Occidental Petroleum Corp.

|

|

36,512,326

|

|

|

|

|

|

|

$

|

96,010,954

|

|

|

|

|

|

Oil & Gas Exploration & Production - 4.1%

|

|

|

|

|

1,743,700

|

|

|

Marathon Oil Corp.

|

$

|

53,461,842

|

|

|

|

|

|

Total Energy

|

$

|

201,294,130

|

|

|

|

|

|

Materials - 2.1%

|

|

|

|

|

|

|

|

Diversified Metals & Mining - 2.1%

|

|

|

|

|

797,400

|

|

|

Freeport-McMoRan Copper & Gold, Inc.

|

$

|

27,271,080

|

|

|

|

|

|

Total Materials

|

$

|

27,271,080

|

|

|

|

|

|

Capital Goods - 7.9%

|

|

|

|

|

|

|

|

Aerospace & Defense - 4.5%

|

|

|

|

|

477,400

|

|

|

Honeywell International, Inc.

|

$

|

30,300,578

|

|

|

342,700

|

|

|

United Technologies Corp.

|

|

28,104,827

|

|

|

|

|

|

|

$

|

58,405,405

|

|

|

|

|

|

Industrial Conglomerates - 3.4%

|

|

|

|

|

2,120,800

|

|

|

General Electric Co.

|

$

|

44,515,592

|

|

|

|

|

|

Total Capital Goods

|

$

|

102,920,997

|

|

|

|

|

|

Transportation - 1.0%

|

|

|

|

|

|

|

|

Railroads - 1.0%

|

|

|

|

|

672,500

|

|

|

CSX Corp.

|

$

|

13,268,425

|

|

|

|

|

|

Total Transportation

|

$

|

13,268,425

|

|

|

|

|

|

Media - 6.9%

|

|

|

|

|

|

|

|

Cable & Satellite - 2.1%

|

|

|

|

|

714,800

|

|

|

Comcast Corp.

|

$

|

26,719,224

|

|

|

|

|

|

Movies & Entertainment - 4.8%

|

|

|

|

|

1,193,200

|

|

|

News Corp.

|

$

|

30,474,328

|

|

|

649,800

|

|

|

The Walt Disney Co.

|

|

32,353,542

|

|

|

|

|

|

|

$

|

62,827,870

|

|

|

|

|

|

Total Media

|

$

|

89,547,094

|

|

|

|

|

|

Retailing - 1.5%

|

|

|

|

|

|

|

|

Department Stores - 1.5%

|

|

|

|

|

504,800

|

|

|

Macy's, Inc.

|

$

|

19,697,296

|

|

|

|

|

|

Total Retailing

|

$

|

19,697,296

|

|

|

|

|

|

Food & Staples Retailing - 3.4%

|

|

|

|

|

|

|

|

Drug Retail - 1.3%

|

|

|

|

|

352,700

|

|

|

CVS Caremark Corp.

|

$

|

17,053,045

|

|

|

|

|

|

Hypermarkets & Super Centers - 2.1%

|

|

|

|

|

401,900

|

|

|

Wal-Mart Stores, Inc.

|

$

|

27,421,637

|

|

|

|

|

|

Total Food & Staples Retailing

|

$

|

44,474,682

|

|

|

|

|

|

Food, Beverage & Tobacco - 4.3%

|

|

|

|

|

|

|

|

Soft Drinks - 1.1%

|

|

|

|

|

432,800

|

|

|

Coca-Cola Enterprises, Inc.

|

$

|

13,732,744

|

|

|

|

|

|

Tobacco - 3.2%

|

|

|

|

|

659,200

|

|

|

Altria Group, Inc.

|

$

|

20,712,064

|

|

|

248,800

|

|

|

Philip Morris International, Inc.

|

|

20,809,632

|

|

|

|

|

|

|

$

|

41,521,696

|

|

|

|

|

|

Total Food, Beverage & Tobacco

|

$

|

55,254,440

|

|

|

|

|

|

Health Care Equipment & Services - 5.2%

|

|

|

|

|

|

|

|

Health Care Equipment - 2.4%

|

|

|

|

|

535,700

|

|

|

Covidien Plc

|

$

|

30,931,318

|

|

|

|

|

|

Managed Health Care - 2.8%

|

|

|

|

|

679,700

|

|

|

UnitedHealth Group, Inc.

|

$

|

36,866,928

|

|

|

|

|

|

Total Health Care Equipment & Services

|

$

|

67,798,246

|

|

|

|

|

|

Pharmaceuticals, Biotechnology & Life Sciences - 15.0%

|

|

|

|

|

|

|

Biotechnology - 2.5%

|

|

|

|

|

368,400

|

|

|

Amgen, Inc.

|

$

|

31,800,288

|

|

|

|

|

|

Pharmaceuticals - 12.5%

|

|

|

|

|

673,600

|

|

|

Johnson & Johnson

|

$

|

47,219,360

|

|

|

1,181,200

|

|

|

Merck & Co., Inc.

|

|

48,358,328

|

|

|

2,679,500

|

|

|

Pfizer, Inc.

|

|

67,201,860

|

|

|

|

|

|

|

$

|

162,779,548

|

|

|

|

|

|

Total Pharmaceuticals, Biotechnology & Life Sciences

|

$

|

194,579,836

|

|

|

|

|

|

Banks - 6.8%

|

|

|

|

|

|

|

|

Diversified Banks - 3.1%

|

|

|

|

|

1,181,700

|

|

|

Wells Fargo & Co.

|

$

|

40,390,506

|

|

|

|

|

|

Regional Banks - 3.7%

|

|

|

|

|

457,500

|

|

|

BB&T Corp.

|

$

|

13,317,825

|

|

|

581,800

|

|

|

PNC Financial Services Group, Inc.

|

|

33,924,758

|

|

|

|

|

|

|

$

|

47,242,583

|

|

|

|

|

|

Total Banks

|

$

|

87,633,089

|

|

|

|

|

|

Diversified Financials - 11.8%

|

|

|

|

|

|

|

|

Other Diversified Financial Services - 5.2%

|

|

|

|

|

1,081,800

|

|

|

Citigroup, Inc.

|

$

|

42,796,008

|

|

|

560,300

|

|

|

JPMorgan Chase & Co.

|

|

24,636,391

|

|

|

|

|

|

|

$

|

67,432,399

|

|

|

|

|

|

Consumer Finance - 5.2%

|

|

|

|

|

703,000

|

|

|

Capital One Financial Corp.

|

$

|

40,724,790

|

|

|

688,000

|

|

|

Discover Financial Services

|

|

26,522,400

|

|

|

|

|

|

|

$

|

67,247,190

|

|

|

|

|

|

Investment Banking & Brokerage - 1.4%

|

|

|

|

|

139,700

|

|

|

The Goldman Sachs Group, Inc.

|

$

|

17,820,132

|

|

|

|

|

|

Total Diversified Financials

|

$

|

152,499,721

|

|

|

|

|

|

Insurance - 6.7%

|

|

|

|

|

|

|

|

Property & Casualty Insurance - 6.7%

|

|

|

|

|

361,900

|

|

|

ACE, Ltd.

|

$

|

28,879,620

|

|

|

340,800

|

|

|

The Chubb Corp.

|

|

25,669,056

|

|

|

448,000

|

|

|

The Travelers Companies, Inc.

|

|

32,175,360

|

|

|

|

|

|

|

$

|

86,724,036

|

|

|

|

|

|

Total Insurance

|

$

|

86,724,036

|

|

|

|

|

|

Software & Services - 4.9%

|

|

|

|

|

|

|

|

Systems Software - 4.9%

|

|

|

|

|

1,459,600

|

|

|

Microsoft Corp.

|

$

|

39,015,108

|

|

|

714,500

|

|

|

Oracle Corp.

|

|

23,807,140

|

|

|

|

|

|

|

$

|

62,822,248

|

|

|

|

|

|

Total Software & Services

|

$

|

62,822,248

|

|

|

|

|

|

Technology Hardware & Equipment - 2.0%

|

|

|

|

|

|

|

|

Communications Equipment - 2.0%

|

|

|

|

|

1,337,600

|

|

|

Cisco Systems, Inc.

|

$

|

26,283,840

|

|

|

|

|

|

Total Technology Hardware & Equipment

|

$

|

26,283,840

|

|

|

|

|

|

Semiconductors & Semiconductor Equipment - 1.6%

|

|

|

|

|

|

|

|

Semiconductors - 1.6%

|

|

|

|

|

1,005,900

|

|

|

Intel Corp.

|

$

|

20,751,717

|

|

|

|

|

|

Total Semiconductors & Semiconductor Equipment

|

$

|

20,751,717

|

|

|

|

|

|

Telecommunication Services - 3.3%

|

|

|

|

|

|

|

|

Integrated Telecommunication Services - 2.0%

|

|

|

|

|

389,800

|

|

|

AT&T, Inc.

|

$

|

13,140,158

|

|

|

297,400

|

|

|

Verizon Communications, Inc.

|

|

12,868,498

|

|

|

|

|

|

|

$

|

26,008,656

|

|

|

|

|

|

Wireless Telecommunication Services - 1.3%

|

|

|

|

|

642,500

|

|

|

Vodafone Group Plc (A.D.R.)

|

$

|

16,184,575

|

|

|

|

|

|

Total Telecommunication Services

|

$

|

42,193,231

|

|

|

|

|

|

TOTAL COMMON STOCKS

|

|

|

|

|

|

|

|

(Cost $1,125,705,469)

|

$

|

1,295,014,108

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENT IN SECURITIES - 99.9%

|

$

|

1,295,014,108

|

|

|

|

|

|

(Cost $1,125,705,468) (a)

|

|

|

|

|

|

|

|

OTHER ASSETS & LIABILITIES - 0.1%

|

$

|

1,856,819

|

|

|

|

|

|

TOTAL NET ASSETS - 100.0%

|

$

|

1,296,870,927

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(A.D.R.)

|

|

American Depositary Receipts.

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

Non-income producing security.

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

|

At December 31, 2012, the net unrealized gain on investments based on

|

|

|

|

|

|

cost for federal income tax purposes of $1,127,333,759 was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aggregate gross unrealized gain for all investments in which

|

|

|

|

|

|

there is an excess of value over tax cost

|

$

|

178,583,571

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aggregate gross unrealized loss for all investments in which

|

|

|

|

|

|

there is an excess of tax cost over value

|

|

(10,903,222)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net unrealized gain

|

$

|

167,680,349

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below.

|

|

|

|

|

|

|

|

|

|

Level 1 – quoted prices in active markets for identical securities

|

|

|

|

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

|

|

Level 3 – significant unobservable inputs (including the Fund's own assumptions in determining fair value of investments)

|

|

|

|

|

|

|

|

|

|

Generally, equity securities are categorized as Level 1, fixed income securities and senior loans as Level 2 and securities valued

|

|

using fair value methods (other than prices supplied by independent pricing services) are categorized as Level 3.

|

|

See Notes to Financial Statements - Note 1A.

|

|

|

|

The following is a summary of the inputs used as of December 31, 2012, in valuing the Fund's assets:

|

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Common Stocks

|

|

$

|

1,295,014,108

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

1,295,014,108

|

|

|

Total

|

|

$

|

1,295,014,108

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

1,295,014,108

|

|

ITEM 2. CONTROLS AND PROCEDURES. (a) Disclose the conclusions of the registrant's principal executive and principal financial officers, or persons performing similar functions, regarding the effectiveness of the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act (17 CFR 270.30a-3(c))) as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the Act (17 CFR 270.30a-3(b))) and Rule 13a-15(b) or 15d-15(b) under the Exchange Act (17 CFR 240.13a-15(b) or 240.15d-15(b)). The registrant's principal executive officer and principal financial officer have concluded that the registrant's disclosure controls and procedures are effective based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report. (b) Disclose any change in the registrant's internal controls over financial reporting (as defined in Rule 30a-3(d) under the Act (17 CFR 270.30a-3(d)) that occurred during the registrant's last fiscal quarter that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting. There were no significant changes in the registrant's internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting. ITEM 3. EXHIBITS. (a) A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Act (17 CFR 270.30a-2(a)). Filed herewith. <PAGE> SIGNATURES [See General Instruction F] Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. (Registrant) Pioneer Value Fund By (Signature and Title)* /s/ John F. Cogan, Jr. John F. Cogan, Jr, President Date March 1, 2013 Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. By (Signature and Title)* /s/ John F. Cogan, Jr. John F. Cogan, Jr., President Date March 1, 2013 By (Signature and Title)* /s/ Mark Bradley Mark Bradley, Treasurer Date March 1, 2013 * Print the name and title of each signing officer under his or her signature.

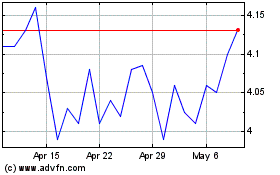

GAMCO Global Gold Natura... (AMEX:GGN)

Historical Stock Chart

From Jun 2024 to Jul 2024

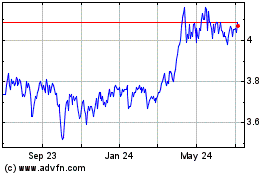

GAMCO Global Gold Natura... (AMEX:GGN)

Historical Stock Chart

From Jul 2023 to Jul 2024