Initial Statement of Beneficial Ownership (3)

November 27 2020 - 1:17PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Stonepeak Texas Midstream Holdco LLC |

2. Date of Event Requiring Statement (MM/DD/YYYY)

11/17/2020

|

3. Issuer Name and Ticker or Trading Symbol

Sanchez Midstream Partners LP [SNMP]

|

|

(Last)

(First)

(Middle)

550 WEST 34TH STREET, 48TH FLOOR |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director ___X___ 10% Owner

_____ Officer (give title below) ___X___ Other (specify below)

/ See Remarks |

|

(Street)

NEW YORK, NY 10001

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Common Units | 4650439 (1) | I (2)(4)(8) | See Footnotes (2)(4)(8) |

| Common Units | 393291 | I (3)(4)(8) | See Footnotes (3)(4)(8) |

| Class C Preferred Units (5) | 36474436 | I (3)(4)(8) | See Footnotes (3)(4)(8) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Warrant | (6) | (6) | Common Units | 2325364 | $0 (7) | I (3)(4)(8) | See Footnotes (3)(4)(8) |

| Explanation of Responses: |

| (1) | This amount includes 140,647 Common Units that are subject to vesting. |

| (2) | These Common Units are owned directly by SP Common Equity Subsidiary LLC ("SPCE Sub"). Stonepeak Catarina Holdings LLC ("Stonepeak Catarina") is the sole member of SPCE Sub. |

| (3) | These Common Units, Class C Preferred Units and Warrant are owned directly by Stonepeak Catarina. |

| (4) | Stonepeak Texas Midstream Holdco LLC is the managing member of Stonepeak Catarina. Stonepeak Catarina Upper Holdings LLC is the majority owner member of Stonepeak Texas Midstream Holdco LLC. Stonepeak Infrastructure Fund (Orion AIV) LP is the managing member of Stonepeak Catarina Upper Holdings LLC. Stonepeak Associates LLC is the managing member of Stonepeak Texas Midstream Holdco LLC and the general partner of Stonepeak Infrastructure Fund (Orion AIV) LP. Stonepeak GP Holdings LP is the sole member of Stonepeak Associates LLC. Stonepeak GP Investors LLC is the general partner of Stonepeak GP Holdings LP. Stonepeak GP Investors Manager LLC is the managing member of Stonepeak GP Investors LLC. Each of Mr. Dorrell and Mr. Vichie serve as a managing member of Stonepeak GP Investors Manager LLC. |

| (5) | The Class C Preferred Units have the same voting rights as the holders of the Common Units but are not convertible into Common Units. |

| (6) | The Warrant may be exercised at any time and from time to time during the period beginning on August 2, 2019 and ending on the later of the seventh anniversary of such date and the date thirty days after the date on which all of the Class C Preferred Units have been redeemed for a number of Junior Securities (which includes equity interests of the Issuer and its general partner that rank junior to the Class C Preferred Units, including, but not limited to, Common Units) equal to 10% of the then-outstanding applicable class of Junior Securities as of the exercise date. |

| (7) | No purchase price will be payable in connection with the exercise of the Warrant. |

| (8) | Each Reporting Person disclaims beneficial ownership of the securities reported herein except to the extent of his or its pecuniary interest therein, and this report shall not be deemed an admission that such Reporting Person is the beneficial owner of such securities for purposes of Section 16 of the Exchange Act, or for any other purpose. |

Remarks:

Exhibit 99.1: Additional Signatures.

Solely for purposes of Section 16 of the Exchange Act, the Reporting Person may be deemed to be a director-by-deputization by virtue of Stonepeak Catarina's contractual right to, based on its current ownership, designate two persons to serve on the board of directors of the General Partner of the Issuer (the "Board"). Jack Howell and Luke Taylor, each an employee of Stonepeak Catarina, are members of the Board. In addition, Michael Bricker and John Steen also serve as members of the Board. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Stonepeak Texas Midstream Holdco LLC

550 WEST 34TH STREET

48TH FLOOR

NEW YORK, NY 10001 |

| X |

| See Remarks |

Signatures

|

| See Exhibit 99.1 | | 11/27/2020 |

| **Signature of Reporting Person | Date |

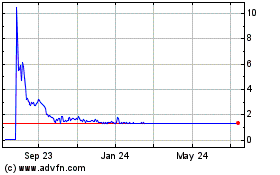

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From Jul 2023 to Jul 2024