Current Report Filing (8-k)

February 10 2016 - 4:27PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 9, 2016

Sanchez Production Partners LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

001-33147

|

11-3742489

|

|

(State or other jurisdiction of

|

(Commission

|

(IRS Employer

|

|

incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

|

1000 Main Street, Suite 3000

|

|

|

Houston, TX

|

77002

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

|

|

|

Registrant’s telephone number, including area code: (713) 783-8000

|

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01Other Events.

On February 9, 2016, the board of directors of the general partner of Sanchez Production Partners LP (the “Partnership”) declared a fourth quarter 2015 cash distribution on its common units of $0.4060 per unit ($1.6240 per unit annualized) payable on February 29, 2016 to holders of record on February 19, 2016. The Partnership also declared a fourth quarter 2015 paid-in-kind distribution of 2.5% on its Class A preferred units and a fourth quarter prorated cash distribution of $0.3815 on its Class B preferred units, each payable on February 29, 2016 to holders of record on February 19, 2016. A copy of the press release announcing the distributions is filed as Exhibit 99.1 hereto and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No.Exhibit

99.1Press Release, dated February 9, 2016

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SANCHEZ PRODUCTION PARTNERS LP

|

|

|

|

|

|

|

|

|

By: Sanchez Production Partners GP LLC,

its general partner

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: February 10, 2016

|

|

|

|

By:

|

/s/ Charles C. Ward

|

|

|

|

|

|

|

|

|

|

Charles C. Ward

|

|

|

|

|

|

|

|

|

|

Chief Financial Officer

|

Exhibit Index

|

|

|

|

Exhibit No.

|

Exhibit

|

|

|

|

| 99.1

|

Press Release, dated February 9, 2016

|

News Release

General Inquiries: (877) 847-0008

www.sanchezpp.com _

Sanchez Production Partners Increases the Distribution on

Its Common Units; Announces Distributions on

Class A and Class B Preferred Units

HOUSTON--(Marketwired)--Feb. 9, 2016--Sanchez Production Partners LP (NYSE MKT: SPP) (“SPP” or the “Partnership”) has declared a fourth quarter 2015 cash distribution on its common units of $0.4060 per unit ($1.6240 per unit annualized), which represents a 1.5% increase over the Partnership’s third quarter 2015 cash distribution on common units.

The Partnership has also declared a fourth quarter 2015 paid-in-kind distribution of 2.5% on its Class A preferred units and a fourth quarter 2015 prorated cash distribution of $0.3815 per unit on its Class B preferred units.

The distributions are payable on Feb. 29, 2016 to holders of record on Feb. 19, 2016.

About the Partnership

Sanchez Production Partners LP (NYSE MKT: SPP) is a publicly-traded limited partnership focused on the acquisition, development, ownership and operation of midstream and other energy production assets. The Partnership owns an oil and natural gas gathering and processing system located in the Eagle Ford Shale in Dimmit and Webb Counties, Texas. The Partnership also currently owns producing reserves in the Eagle Ford Shale in South Texas, the Gulf Coast region of Texas and Louisiana, and across several basins in Oklahoma and Kansas. The

Partnership announced in March 2015 that is exploring the possible divestiture of its assets and operations in Oklahoma and Kansas.

Additional Information

Additional information about SPP can be found in the Partnership’s documents on file with the U.S. Securities and Exchange Commission (www.sec.gov) and in the “Investor Presentation” available on the Partnership’s website.

This press release is intended to be a qualified notice under Treasury Regulation Section 1.1446-4(b). Brokers and nominees should treat one hundred percent (100.0%) of SPP’s distributions to non-U.S. investors as being attributable to income that is effectively connected with a United States trade or business. Accordingly, SPP’s distributions to non-U.S. investors are subject to federal income tax withholding at the highest applicable effective tax rate.

Forward-Looking Statements

This press release contains statements that are considered forward–looking statements. All statements, other than statements of historical fact, that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. These statements are subject to a number of risks, uncertainties and other factors, many of which are beyond our control. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to factors listed in the “Risk Factors” section in our U.S. Securities and Exchange Commission filings and elsewhere in those filings. The forward-looking statements speak only as of the date made, and other than as required by law, we do not intend to publicly update or revise any forward-looking statements as a result of new information, future events or otherwise.

PARTNERSHIP CONTACT

Charles C. Ward

Chief Financial Officer

Sanchez Production Partners GP LLC

(877) 847-0009

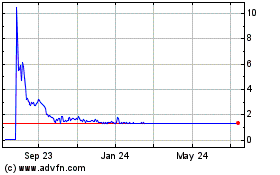

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From Jul 2023 to Jul 2024