Sixth graph, first sentence of release should read: Cash flow,

as measured by earnings before interest, taxes, depreciation and

amortization (EBITDA), increased to $2,493,000 for the fourth

quarter and $9,265,000 for 2011...(sted...increased to $3,119,000

for the fourth quarter and $11,258,000 for 2011...)

The corrected release reads:

AMERICAN SHARED HOSPITAL SERVICES REPORTS

FOURTH QUARTER AND 2011 RESULTS

AMERICAN SHARED HOSPITAL SERVICES (NYSE AMEX:AMS),

a leading provider of turnkey technology solutions for advanced

radiosurgical and radiation therapy services, today announced

financial results for the fourth quarter and 2011.

Fourth Quarter Results

For the three months ended December 31, 2011, revenue increased

8.4% to $4,500,000 compared to $4,152,000 for the fourth quarter of

2010. Net income for the fourth quarter of 2011 rose to $244,000,

or $0.05 per share. This compares to net income of $40,000, or

$0.00 per share, for the fourth quarter of 2010.

The number of procedures performed on Gamma Knife® PerfexionTM

systems supplied by AMS increased 7.6% for the fourth quarter of

2011, and increased 7.1% for 2011, compared to the fourth quarter

and 2010, respectively. The total number of procedures performed in

AMS' Gamma Knife business increased 11.4% for this year's fourth

quarter, and increased 4.8% for 2011, compared to the fourth

quarter and 2010, respectively.

Gross margin for this year's fourth quarter decreased to 39.5%

compared to 46.1% for the fourth quarter of 2010. This was

primarily the result of an increase in depreciation expense

associated with the upgrade of a number of Gamma Knife systems to

Perfexion specifications during the past year. Gross margin also

was affected to a lesser extent by the initiation of patient

treatments during the quarter of the new devices supplied by AMS to

St. Vincent's Medical Center in Jacksonville, Florida and Baskent

University in Adana, Turkey.

Selling and administrative expenses for the fourth quarter of

2011 decreased 16.4% to $840,000 compared to $1,005,000 for the

fourth quarter of 2010. Reflecting the addition of new Perfexion

systems to AMS' Gamma Knife portfolio, interest expense increased

to $613,000 for this year's fourth quarter compared to $562,000 for

the fourth quarter last year.

Cash flow, as measured by earnings before interest, taxes,

depreciation and amortization (EBITDA), increased to $2,493,000 for

the fourth quarter and $9,265,000 for 2011, compared to $2,159,000

for the fourth quarter and $8,211,000 for 2010.

Balance Sheet Highlights

At December 31, 2011, AMS cash, cash equivalents and

certificates of deposit increased to $11,580,000 compared to

$10,438,000 at December 31, 2010. Shareholders' equity at December

31, 2011 was $25,171,000, or $5.46 per outstanding share. This

compares to shareholders' equity at December 31, 2010 of

$23,044,000, or $5.01 per outstanding share.

Twelve Month Results

For the twelve months ended December 31, 2011, revenue increased

to $22,221,000, consisting of medical services revenue of

$17,237,000 and revenue from equipment sales of $4,984,000. This

compares to medical services revenue of $16,675,000 for 2010. Net

income for 2011 increased to $506,000, or $0.11 per diluted share,

compared to net income for 2010 of $57,000, or 0.01 per diluted

share.

In March 2011 AMS announced a contract to upgrade a Gamma Knife

to Perfexion specifications at Lehigh Valley Hospital in Allentown,

Pennsylvania. As part of this upgrade, AMS agreed to the early

termination of the existing 10-year lease on the Gamma Knife system

it supplied to Lehigh in 2004, and Lehigh agreed to purchase the

Perfexion system. Pre-tax income from this transaction of $844,000

was recognized in the third quarter of 2011.

CEO Comments

Chairman and Chief Executive Officer Ernest A. Bates, M.D.,

said, "We are pleased with our fourth quarter growth, which

featured initial revenue from our newest Perfexion site, St.

Vincent's Medical Center, and the Elekta AxesseTM Radiosurgery

system we supplied to the Kisla Campus of Baskent University under

a contract announced in March, 2011. For sites in operation for

more than one year, same site revenue increased 9% over the third

quarter of 2011.

"Our strategy to upgrade many of our existing Gamma Knife sites

to Gamma Knife Perfexion specifications, and to expand our base of

Perfexion clients, is delivering the growth we are striving for.

The higher throughput and increased clinical utility of the

Perfexion units compared to the Gamma Knife units they replace is

allowing us to realize significant incremental revenue within just

a few months of installation. We expect this trend to continue. As

a result, while higher depreciation expense associated with the new

Perfexion units affected gross margin in the second half of 2011,

gross margin should improve in 2012 with the additional gains in

revenue we anticipate.

"In January, 2012, AMS entered into a contract to supply its

twelfth Perfexion system in the United States to Sacred Heart

Health System in Pensacola, Florida. Pending regulatory approval,

patient treatments on this Perfexion system are expected to begin

later this year. We are pleased to welcome Sacred Heart Health

System as a new AMS client. We are seeing increased opportunities

to place Gamma Knife Perfexions at new and existing AMS sites both

in the U.S. and internationally." Dr. Bates noted that the

Perfexion unit AMS will supply to Florence Nightingale Hospital

Group in Istanbul, Turkey is expected to begin treating patients in

the second quarter, and the Gamma Knife unit AMS will provide to

Hospital Central FAP in Lima, Peru and the linear accelerator site

in São Paulo, Brazil are expected to begin treating patients later

this year.

Dr. Bates continued, "Also in January, 2012, Mevion Medical

Systems, formerly Still River Systems, announced a $45 million

investment in Mevion by a group of leading private venture capital

firms. After this funding, AMS owns approximately 1% of Mevion, the

manufacturer of the MEVION S250 Proton Therapy System. Proton

therapy permits more precise dose targeting at predictable tissue

depth than conventional X-rays, allowing the treatment of targets

adjacent to critical structures without inadvertent damage.

However, due to the high cost, large footprint, and technical

complexity of traditional proton systems, the availability of

proton therapy currently is limited. The MEVION S250 significantly

reduces the cost, size and complexity to levels similar to other

modern X-ray radiation therapy devices, and promises to bring

accessibility, affordability and practicality to proton

therapy.

"Just yesterday, Mevion announced that it has received CE Mark

certification for the MEVION S250 Proton Therapy System. This

important commercial milestone indicates that Mevion has completed

its development in compliance with the European Union's Medical

Device Directive. The CE Marking allows the MEVION S250 to be

marketed, sold, and installed in the European Union and in any

country recognizing CE Mark approval.

"AMS is developing proton therapy centers in Boston,

Massachusetts, Orlando, Florida and Long Beach, California which

are expected to employ the MEVION S250 proton therapy device. The

MEVION S250 at Barnes Jewish Hospital in St. Louis is now producing

a powerful 250 MeV energy beam. Mevion has filed a 510(k)

application for marketing clearance with the FDA. We are also

developing a two room proton therapy center in Dayton, Ohio.

"Finally, I am pleased to report that a U.S. patent has been

allowed on a variety of technologies jointly owned by AMS and NBBJ

LP, a leading global architecture and design firm, that are

designed to increase efficiency and improve patient outcomes in the

operating room. These technologies, which we will incorporate in

our Operating Room for the 21st Century concept, have applications

ranging from novel operating room lighting systems to innovative

operating table design. We believe they have the potential to

improve patient safety and comfort, surgical team efficiency and

satisfaction, and enhance returns for healthcare institutions."

Earnings Conference Call

American Shared has scheduled a conference call at 12:00 p.m.

PST (3:00 p.m. EST) today. To participate in the live call, dial

(800) 588-4973 at least 5 minutes prior to the scheduled start

time. A simultaneous WebCast of the call may be accessed through

the Company's website, www.ashs.com, or through CCBN,

www.earnings.com (individual investors) or www.streetevents.com

(institutional investors). A replay will be available for 30 days

at these same internet addresses, or by calling (888) 843-7419,

pass code 31962119.

About AMS

American Shared Hospital Services provides turnkey technology

solutions for advanced radiosurgical and radiation therapy

services. AMS is the world leader in providing Gamma Knife

radiosurgery equipment, a non-invasive treatment for malignant and

benign brain tumors, vascular malformations and trigeminal

neuralgia (facial pain). The Company also offers the latest IGRT

and IMRT systems, as well as its proprietary Operating Room for the

21st Century® concept. Through its preferred stock investment in

Mevion Medical Systems, Inc., formerly Still River Systems, AMS

also plans to complement these services with the MEVION S250 proton

beam radiation therapy (PBRT) system, which has not yet been

approved by the FDA.

Safe Harbor Statement

This press release may be deemed to contain certain

forward-looking statements with respect to the financial condition,

results of operations and future plans of American Shared Hospital

Services, which involve risks and uncertainties including, but not

limited to, the risks of the Gamma Knife and radiation therapy

businesses, the risks of developing The Operating Room for the 21st

Century program, and the risks of investing in a development-stage

company, Mevion Medical Systems, Inc., without a proven product.

Further information on potential factors that could affect the

financial condition, results of operations and future plans of

American Shared Hospital Services is included in the filings of the

Company with the Securities and Exchange Commission, including the

Company's Annual Report on Form 10-K for the year ended December

31, 2010, the Quarterly Report on Form 10-Q for the quarter ended

March 31, 2011, Form 10-Q and 10-Q/A for the quarter ended June 30,

2011, and Form 10-Q for the quarter ended September 30, 2011, and

the definitive Proxy Statement for the Annual Meeting of

Shareholders held on June 9, 2011.

AMERICAN SHARED HOSPITAL

SERVICES

Selected Financial

Data(unaudited)

Summary of Operations Data

Three months endedDecember 31,

Twelve months endedDecember 31,

2011

2010

2011

2010

Medical services revenue

$

4,500,000

$

4,152,000

$

17,237,000

$

16,675,000

Equipment sales

--

--

4,984,000

--

4,500,000

4,152,000

22,221,000

16,675,000

Costs of revenue

2,716,000

2,237,000

10,078,000

9,466,000

Costs of equipment sales

6,000

--

4,146,000

--

Gross margin

1,778,000

1,915,000

7,997,000

7,209,000

Selling & administrative expense

840,000

1,005,000

4,041,000

4,240,000

Interest expense

613,000

562,000

2,367,000

2,104,000

Operating income

325,000

348,000

1,589,000

865,000

Other income

20,000

18,000

108,000

107,000

Income before income taxes

345,000

366,000

1,697,000

972,000

Income tax expense

(120,000

)

115,000

208,000

166,000

Net income

$

465,000

$

251,000

$

1,489,000

$

806,000

Less: Net income attributable to

non-controlling interest

(221,000

)

(211,000

)

(983,000

)

(749,000

)

Net income attributable to American Shared

Hospital Services

$

244,000

$

40,000

$

506,000

$

57,000

Earnings per common share:

Basic $ 0.05 $ 0.01 $ 0.11 $ 0.01

Assuming dilution

$

0.05

$

0.01

$

0.11

$

0.01

Balance Sheet DataDecember 31,

2011 2010 Cash and cash equivalents $ 2,580,000 $

1,438,000 Certificate of deposit $ 9,000,000 $ 9,000,000 Current

assets $ 17,615,000 $ 15,075,000 Investment in preferred stock $

2,656,000 $ 2,617,000 Total assets $ 74,535,000 $ 65,340,000

Current liabilities $ 9,944,000 $ 7,444,000 Shareholders' equity $

25,171,000 $ 23,044,000

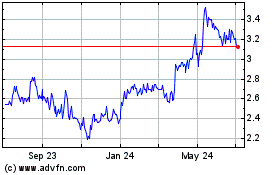

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Jun 2024 to Jul 2024

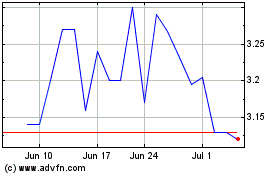

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Jul 2023 to Jul 2024