Evergreen Closed-End Funds Declare Monthly Dividends

September 24 2009 - 5:31PM

Business Wire

Evergreen Investments today announced the dividend declaration

for Evergreen Income Advantage Fund (NYSE Amex:EAD), Evergreen

Utilities and High Income Fund (NYSE Amex:ERH), Evergreen

International Balanced Income Fund (NYSE:EBI), and Evergreen

Multi-Sector Income Fund (NYSE Amex:ERC). Evergreen also announced

a reduction in the monthly dividend rate of Evergreen International

Balanced Income Fund and a shift in portfolio management

responsibilities for Evergreen Multi-Sector Income Fund.

Evergreen Income Advantage Fund is a closed-end high-yield bond

fund. The Fund's investment objective is to seek a high level of

current income. The Fund may, as a secondary objective, seek

capital appreciation to the extent it is consistent with its

investment objective.

Evergreen Income Advantage Fund declared the following monthly

dividend from ordinary income:

Declaration Date Ex-dividend

Date Record Date

Payable Date Dividend

rate/share September 24, 2009 October 12, 2009 October 14,

2009 November 2, 2009

$0.0929 / share

Evergreen Utilities and High Income Fund is a closed-end equity

and high-yield bond fund. The Fund’s primary investment objective

is to seek a high level of current income and moderate capital

growth, with emphasis on providing tax-advantaged dividend

income.

Evergreen Utilities and High Income Fund declared the following

monthly dividend from ordinary income:

Declaration Date Ex-dividend

Date Record Date

Payable Date Dividend

rate/share

September 24, 2009

October 12, 2009 October 14, 2009 November 2, 2009

$0.11 / share

Evergreen International Balanced Income Fund is a closed-end

fund investing primarily in international stocks and bonds. The

Fund's investment objective is to seek to provide a high level of

income. The dividend below is a reduction in the stable dividend

rate equal to $0.02025 per common share. The reduction in the

dividend rate is primarily attributable to changing conditions in

the international equity markets. At the new distribution rate of

$0.06475 per common share, the common share distribution yield will

be 3.89% as a percent of the initial offer price.

Evergreen International Balanced Income Fund declared the

following monthly dividend from ordinary income:

Declaration Date Ex-dividend

Date Record Date

Payable Date Dividend

rate/share September 24, 2009 October 12, 2009 October 14,

2009 November 2, 2009 $0.06475 / share

Evergreen Multi-Sector Income Fund is a closed-end bond fund.

The Fund’s primary investment objective is to seek a high level of

current income consistent with limiting its overall exposure to

domestic interest rate risk.

Evergreen Multi-Sector Income Fund declared the following

monthly dividend from ordinary income:

Declaration Date Ex-dividend

Date Record Date

Payable Date

Dividend rate/share September 24, 2009 October

12, 2009 October 14, 2009 November 2, 2009 $0.1083 / share

Portfolio Management Announcement

Effective immediately, senior portfolio manager Tony Norris will

expand his responsibilities to include oversight of Evergreen

Multi-Sector Income Fund’s asset allocation strategy. Norris, CIO

of Evergreen sub-advisor First International Advisors, LLC, has

been a portfolio manager on the fund since its inception in 2003.

In his oversight of Evergreen Multi-Sector Income Fund, Tony will

work closely with the other managers on the fund to determine the

appropriate mix of international equity and fixed income

exposure.

To make changes to your account, please contact your financial

advisor, brokerage firm, bank, or other nominee with whom your

shares are registered. If your shares are registered with the

funds’ transfer agent, Computershare, please contact them directly

at 800.730.6001 or visit www.computershare.com.

These closed-end funds are no longer offered as an initial

public offering and are only offered through broker/dealers on the

secondary market.

About Evergreen Investments

Evergreen Investments is one of the brand names under which

Wells Fargo & Company (NYSE:WFC) conducts its investment

management business. Wells Fargo & Company is a diversified

financial services company with $1.3 trillion in assets (as of June

30, 2009), providing banking, insurance, investments, mortgage and

consumer finance through almost 11,000 stores and the internet

(WellsFargo.com) across North America and internationally. Wachovia

Global Asset Management is the brand name under which Evergreen

Investments conducts sales and distribution business outside of the

United States. Evergreen Investments serves more than four million

individual and institutional investors through a broad range of

investment products. Led by more than 300 investment professionals,

Evergreen Investments strives to meet client investment objectives

through disciplined, team-based asset management. Evergreen

Investments manages more than $162.5 billion in assets (as of June

30, 2009). Evergreen InvestmentsSM is a service mark of Evergreen

Investment Management Company, LLC. Copyright 2009. Evergreen

Investment Management Company, LLC. For more information on

Evergreen, please visit EvergreenInvestments.com.

Funds: NOT FDIC INSURED | NOT BANK GUARANTEED | MAY LOSE

VALUE

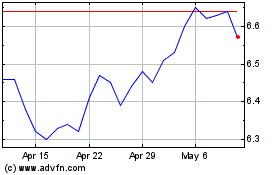

Allspring Income Opportu... (AMEX:EAD)

Historical Stock Chart

From Jun 2024 to Jul 2024

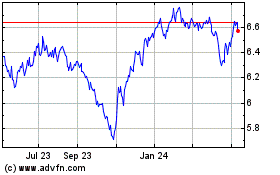

Allspring Income Opportu... (AMEX:EAD)

Historical Stock Chart

From Jul 2023 to Jul 2024