Current Report Filing (8-k)

March 16 2021 - 8:43AM

Edgar (US Regulatory)

0001136174FALSE00011361742021-03-162021-03-160001136174us-gaap:CommonStockMember2021-03-162021-03-160001136174us-gaap:SeriesAPreferredStockMember2021-03-162021-03-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 16, 2021

Ontrak, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-31932

|

|

88-0464853

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

2120 Colorado Ave., Suite 230, Santa Monica, CA 90404

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (310) 444-4300

(Former name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value

|

OTRK

|

The NASDAQ Global Market

|

|

9.50% Series A Cumulative Perpetual Preferred Stock, $0.0001 par value

|

OTRKP

|

The NASDAQ Global Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Jonathan Mayhew as Chief Executive Officer

The Board of Directors of the Company (the “Board”) appointed Jonathan Mayhew, age 57, to serve as the Chief Executive Officer (the “CEO”) of the Company, with an employment commencement date of April 12, 2021, subject to mutual execution of a final employment agreement.

Prior to his appointment as CEO, Mr. Mayhew most recently served as Executive Vice President and Chief Transformation Officer of CVS Health, where he had enterprise-wide oversight of the entire portfolio of CVS business transformation initiatives and played a key role in shaping CVS Health’s integrated value story. Previously, he was President of U.S. Markets for the Aetna Health Care Business, where he was responsible for $52B in revenue and $4.3B in operating income for all commercial and Medicare lines of business. Prior to joining Aetna, Mr. Mayhew was a founding principal, CEO and President of Freedom Disability.

Mr. Mayhew has no family relationship with any of the executive officers or directors of the Company. There have been no transactions in the past two years to which the Company or any of its subsidiaries was or is to be a party, in which Mr. Mayhew had, or will have, a direct or indirect material interest.

Current CEO, Mr. Terren Peizer was named Executive Chairman effective upon Mr. Mayhew's employment commencement date and will continue to serve as Chairman of the Ontrak Board and remains majority shareholder.

Mayhew Employment Agreement

Under the terms of an offer accepted by Mr. Mayhew in connection with his hiring as CEO of the Company, his base salary will be $525,000 and he is eligible to participate in the Company’s discretionary performance bonus plan with a target bonus equal to one year’s salary based in part on performance by the Company and the executive and the Company’s common stock price. In addition, the offer provides that Mr. Mayhew will receive an initial grant of 400,000 stock options to purchase shares of Company common stock with a per share exercise price equal to the closing price of a share on the date the option is granted and subject to all of the provisions of the Company’s 2017 Stock Incentive Plan (the “Plan”), vesting over three years from date of its grant. The Company expects to enter into an employment agreement with Mr. Mayhew prior to his employment commencement date.

A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. Description

104 Cover Page Interactive Data File (formatted as Inline XBRL).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ontrak, Inc.

|

|

|

|

|

|

|

Date: March 16, 2021

|

|

By:

|

/s/ Brandon H. LaVerne

|

|

|

|

|

Brandon H. LaVerne

|

|

|

|

|

Chief Financial Officer

|

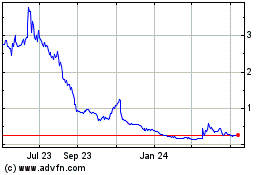

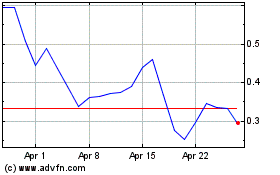

Ontrak (NASDAQ:OTRK)

Historical Stock Chart

From Aug 2024 to Sep 2024

Ontrak (NASDAQ:OTRK)

Historical Stock Chart

From Sep 2023 to Sep 2024