- Quarterly net income attributable to

the Partnership of $10.9 million, or $0.39 per unit

- Quarterly MLP distributable cash flow

of $11.8 million

- Increased quarterly cash distribution

by 2.89% to $0.3450 per unit

- Final Internal Revenue Service

regulations uphold previous favorable private letter ruling granted

on ethylene to Westlake Chemical Corporation

Westlake Chemical Partners LP (NYSE: WLKP) (the "Partnership")

today reported net income attributable to the Partnership of $10.9

million, or $0.39 per limited partner unit, for the three months

ended December 31, 2016, an increase of $0.1 million

compared to fourth quarter 2015 net income attributable to the

Partnership of $10.8 million. The increase in net income

attributable to the Partnership as compared to the prior-year

period was primarily due to higher production volumes at Westlake

Chemical OpCo LP’s (“OpCo”) Petro 1 facility in Lake Charles,

Louisiana resulting from the 250 million pound ethylene expansion

completed in July 2016. For the three months ended

December 31, 2016, cash flow from operations was

$110.4 million, a decrease of $10.9 million compared to fourth

quarter 2015 cash flow from operations of $121.3 million. This

decrease in cash flow from operations was due to an increase in

working capital, partially offset by increased production. For the

three months ended December 31, 2016, MLP distributable

cash flow was $11.8 million, an increase of $1.7 million

compared to fourth quarter 2015 MLP distributable cash flow of

$10.1 million. The increase in MLP distributable cash flow as

compared to the prior-year period was primarily due to higher

production volumes at Petro 1 resulting from the 250 million pound

ethylene expansion project.

The fourth quarter 2016 net income attributable to the

Partnership of $10.9 million, or $0.39 per limited partner unit,

increased by $2.2 million from third quarter 2016 net income

attributable to the Partnership of $8.7 million, or $0.32 per

limited partner unit. Fourth quarter 2016 cash flow from operations

of $110.4 million increased by $118.3 million compared to third

quarter 2016 cash flow from operations of $(7.9) million. Fourth

quarter 2016 MLP distributable cash flow of $11.8 million increased

by $5.0 million compared to third quarter 2016 MLP distributable

cash flow of $6.8 million. The increase in net income attributable

to the Partnership, cash flow from operations and MLP distributable

cash flow as compared to the prior quarter was primarily due to

higher production volumes, lower capital expenditures at Petro 1

and a decrease in working capital following the completion of the

250 million pound ethylene expansion at Petro 1 in July 2016.

For the full year 2016, net income attributable to the

Partnership of $40.9 million, or $1.50 per limited partner unit,

increased by $1.1 million when compared to full year 2015 net

income attributable to the Partnership of $39.8 million, or $1.47

per unit. Cash flow from operations of $287.7 million for 2016

decreased by $164.7 million when compared to cash flow from

operations of $452.4 million for 2015 due to lower production at

Petro 1 and an unplanned outage at OpCo’s facility in Calvert City,

Kentucky, increases in working capital and turnaround expenditures

at Petro 1. MLP distributable cash flow of $32.4 million for 2016

decreased by $5.3 million, when compared to 2015 MLP distributable

cash flow of $37.7 million, primarily as a result of lower

production due to the Petro 1 expansion project as well as the

unplanned outage at Calvert City in June and July 2016.

On January 19, 2017, the Internal Revenue Service

(“IRS”) and U.S. Department of Treasury (“Treasury”) issued final

regulations under section 7704(d)(1)(E) of the Internal Revenue

Code (the “Code”) relating to qualifying income from the

processing, refining and transportation of minerals or natural

resources, which allows a business to be treated as a partnership

for U.S. federal tax purposes. Our sponsor, Westlake Chemical

Corporation (“Westlake”), previously requested and received a

favorable private letter ruling from the IRS prior to the formation

and initial public offering of the Partnership to the effect that

the production, transportation, storage and marketing of ethylene

constitutes “qualifying income” within the meaning of section

7704(d)(1)(E). The final regulations issued by the IRS and Treasury

uphold Westlake’s private letter ruling and holds that the

Partnership’s activities constitute “qualifying income.”

On January 27, 2017, the Board of Directors of

Westlake Chemical Partners GP LLC, the general partner of the

Partnership, announced a quarterly distribution for the fourth

quarter of 2016 of $0.3450 per limited partner unit to be payable

on February 22, 2017 to unit holders of record as of

February 7, 2017. The fourth quarter 2016 distribution

increased 12.0% compared to the fourth quarter 2015 distribution

and 2.89% compared to the third quarter 2016 distribution. MLP

distributable cash flow provided coverage of 1.26x the declared

distributions for the fourth quarter of 2016. The increase in cash

distributions is in line with the Partnership's targeted low

double-digit distribution growth.

OpCo's sales agreement with Westlake is designed to provide for

stable and predictable cash flows. The sales agreement provides

that 95% of OpCo's ethylene production is sold to Westlake for a

cash margin of $0.10 per pound, net of operating costs, maintenance

capital expenditures and reserves for future turnaround

expenditures.

“This quarter we achieved record production for the first full

quarter following the 250 million pound expansion of the Petro 1

facility, which was completed in July 2016. This quarter’s

performance highlights the strength of the Partnership as we saw

the strongest quarterly coverage ratio since our IPO in August of

2014 while continuing to increase our distributions to unit

holders,” said Albert Chao, President and Chief Executive Officer.

Regarding the IRS’s final regulations regarding qualifying income,

Chao stated “We appreciate the thorough process taken by the IRS

and Treasury Department to reach their final decision and are

pleased that the final regulations reconfirm and properly recognize

these industry practices and remove uncertainty that our activities

will continue to generate qualifying income under the Code.”

The statements in this release and the related teleconference

relating to matters that are not historical facts are

forward-looking statements. These forward-looking statements are

subject to significant risks and uncertainties. Actual results

could differ materially, based on factors including, but not

limited to, operating difficulties; the volume of ethylene that we

are able to sell; the price at which we are able to sell ethylene;

changes in the price and availability of feedstocks; changes in

prevailing economic conditions; actions of Westlake Chemical

Corporation; actions of third parties; inclement or hazardous

weather conditions, including flooding, and the physical impacts of

climate change; environmental hazards; changes in laws and

regulations (or the interpretation thereof); inability to acquire

or maintain necessary permits; inability to obtain necessary

production equipment or replacement parts; technical difficulties

or failures; labor disputes; difficulty collecting receivables;

inability of our customers to take delivery; fires, explosions or

other industrial accidents; our ability to borrow funds and access

capital markets; and other risk factors. For more detailed

information about the factors that could cause actual results to

differ materially, please refer to the Partnership's Annual Report

on Form 10-K for the year ended December 31, 2015, which

was filed with the SEC in March 2016.

This release is intended to be a qualified notice under Treasury

Regulation Section 1.1446-4(b). Brokers and nominees should treat

one hundred percent (100.0%) of the Partnership's distributions to

non-U.S. investors as being attributable to income that is

effectively connected with a United States trade or

business. Accordingly, the Partnership's distributions to non-U.S.

investors are subject to federal income tax withholding at the

highest applicable effective tax rate.

Use of Non-GAAP Financial Measures

This release makes reference to certain “non-GAAP” financial

measures, such as MLP distributable cash flow, as defined in

Regulation G of the U.S. Securities Exchange Act of 1934, as

amended. We report our financial results in accordance with U.S.

generally accepted accounting principles ("GAAP"), but believe that

certain non-GAAP financial measures, such as MLP distributable cash

flow and EBITDA, provide useful supplemental information to

investors regarding the underlying business trends and performance

of our ongoing operations and are useful for period-over-period

comparisons of such operations. These non-GAAP financial measures

should be considered as a supplement to, and not as a substitute

for, or superior to, the financial measures prepared in accordance

with GAAP. A reconciliation of MLP distributable cash flow and

EBITDA to net income and net cash provided by operating activities

can be found in the financial schedules at the end of this release.

We define distributable cash flow as net income plus depreciation

and amortization, less contributions from turnaround reserves and

maintenance capital expenditures. We define MLP distributable cash

flow as distributable cash flow less distributable cash flow

attributable to Westlake's noncontrolling interest in OpCo and

distributions attributable to incentive distribution rights holder.

MLP distributable cash flow does not reflect changes in working

capital balances. We define EBITDA as net income before interest

expense, income taxes, depreciation and amortization. Because MLP

distributable cash flow and EBITDA may be defined differently by

other companies in our industry, our definition of MLP

distributable cash flow and EBITDA may not be comparable to

similarly titled measures of other companies.

Westlake Chemical Partners LP

Westlake Chemical Partners is a limited partnership formed by

Westlake Chemical Corporation to operate, acquire and develop

ethylene production facilities and other qualified assets.

Headquartered in Houston, Texas, the Partnership owns a 13.3%

interest in Westlake Chemical OpCo LP. Westlake Chemical OpCo LP's

assets consist of three ethylene production facilities in Calvert

City, Kentucky, and Lake Charles, Louisiana and an ethylene

pipeline. For more information about Westlake Chemical Partners LP,

please visit http://www.wlkpartners.com.

Westlake Chemical Partners LP Conference Call Information:

A conference call to discuss Westlake Chemical Partners' fourth

quarter and full year 2016 results will be held

February 21, 2017 at 12:00 PM Eastern Time (11:00 AM

Central Time). To access the conference call, dial (855) 765-5686

or (234) 386-2848 for international callers, approximately 10

minutes prior to the scheduled start time and reference passcode

55489298.

A replay of the conference call will be available beginning two

hours after its conclusion until 11:59 p.m. Eastern Time on

February 28, 2017. To hear a replay, dial (855) 859-2056

or (404) 537-3406 for international callers. The replay passcode is

55489298.

The conference call will also be available via webcast at:

http://edge.media-server.com/m/p/g6rkz2s6 and the

earnings release can be obtained via the Partnership web page at:

http://westlakepartners.investorroom.com/news-events.

WESTLAKE CHEMICAL PARTNERS LP ("WESTLAKE PARTNERS")

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended December 31, Twelve

Months Ended December 31, 2016 2015

2016 2015 (In thousands of

dollars, except per unit data) Revenue

Net sales—Westlake Chemical Corporation

("Westlake")

$ 246,860 $ 213,480 $ 853,719 $ 834,918

Net co-product, ethylene and other

sales—third parties

47,077 35,026 133,017 172,303 Total net

sales 293,937 248,506 986,736 1,007,221 Cost of sales 188,202

150,524 595,405 624,339 Gross profit

105,735 97,982 391,331 382,882 Selling, general and administrative

expenses 7,154 5,724 24,887 23,550

Income from operations 98,581 92,258 366,444 359,332

Other

income (expense) Interest expense—Westlake (5,226 ) (1,173 )

(12,607 ) (4,967 ) Other income, net 371 195 601

160 Income before income taxes 93,726 91,280 354,438

354,525 Provision for income taxes 145 105 1,035

672 Net income 93,581 91,175 353,403 353,853

Less: Net income attributable to

noncontrolling interests in Westlake Chemical OpCo LP ("OpCo")

82,730 80,390 312,463 314,022

Net

income attributable to Westlake Partners $ 10,851

$ 10,785 $ 40,940

$ 39,831

Net income per limited partners unit

attributable to Westlake Partners (basic and diluted)

Common units $ 0.39 $ 0.40 $ 1.50 $ 1.47 Subordinated units $ 0.39

$ 0.40 $ 1.50 $ 1.47

Distributions declared per unit $ 0.3450 $ 0.3080 $

1.3230 $ 1.1813 MLP distributable cash flow $

11,762 $ 10,059 $ 32,405 $ 37,730

Distribution declared Limited partner units—public $ 4,463 $

3,985 $ 17,116 $ 15,283 Limited partner units—Westlake 4,872 4,350

18,684 16,683 Incentive distribution rights 142 — 281

— Total distribution declared $ 9,477 $ 8,335

$ 36,081 $ 31,966 EBITDA $ 129,690 $

113,026 $ 465,255 $ 440,702

WESTLAKE CHEMICAL PARTNERS LP ("WESTLAKE PARTNERS")

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

December 31,

2016

December 31,

2015

(In thousands of dollars) ASSETS Current

assets Cash and cash equivalents $ 88,900 $ 169,559 Accounts

receivable, net—Westlake 126,977 39,655 Accounts receivable,

net—third parties 12,085 11,927 Inventories 3,934 3,879 Prepaid

expenses and other current assets 269 267 Total

current assets 232,165 225,287 Property, plant and equipment, net

1,222,238 1,020,469 Other assets, net 100,825 44,593

Total assets $ 1,555,228 $

1,290,349 LIABILITIES AND EQUITY

Current liabilities (accounts payable and accrued liabilities) $

37,777 $ 57,694 Long-term debt payable to Westlake 594,629 384,006

Other liabilities 1,859 1,482 Total liabilities

634,265 443,182 Common unitholders—public 297,367 294,565 Common

unitholder—Westlake 4,813 4,502 Subordinated unitholder—Westlake

42,534 39,786 General partner—Westlake (242,430 ) (242,572 )

Accumulated other comprehensive income 200 280 Total

Westlake Partners partners' capital 102,484 96,561 Noncontrolling

interest in OpCo 818,479 750,606 Total equity 920,963

847,167

Total liabilities and equity $

1,555,228 $ 1,290,349

WESTLAKE CHEMICAL PARTNERS LP ("WESTLAKE PARTNERS")

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

Twelve Months Ended December 31, 2016

2015 (In thousands of dollars)

Cash flows from operating activities Net income $ 353,403 $

353,853 Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 98,210 81,210

Other balance sheet changes (163,887 ) 17,479 Net cash

provided by operating activities 287,726 452,542

Cash flows from

investing activities Additions to property, plant and equipment

(299,638 ) (231,185 ) Proceeds from disposition of assets 157

— Net cash used for investing activities (299,481 )

(231,185 )

Cash flows from financing activities Proceeds

from debt payable to Westlake 212,175 291,709 Repayment of debt

payable to Westlake (1,552 ) (135,341 ) Quarterly distributions to

noncontrolling interest retained in OpCo by Westlake (244,590 )

(310,842 ) Quarterly distributions to unitholders (34,937 ) (31,074

) Net cash used for financing activities (68,904 ) (185,548 ) Net

(decrease) increase in cash and cash equivalents (80,659 ) 35,809

Cash and cash equivalents at beginning of the year 169,559

133,750 Cash and cash equivalents at end of the year $

88,900 $ 169,559

WESTLAKE CHEMICAL

PARTNERS LP ("WESTLAKE PARTNERS") RECONCILIATION OF

MLP DISTRIBUTABLE CASH FLOW TO NET INCOME AND NET CASH (USED

FOR) PROVIDED BY OPERATING ACTIVITIES (Unaudited)

Three

Months Ended

September 30,

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2016 2016 2015 2016

2015

(In thousands of dollars)

Net cash (used for) provided by

operating activities

$ (7,907 ) $ 110,356 $

121,339 $ 287,726 $ 452,542

Changes in operating assets and

liabilities and other

83,835 (16,820 ) (30,261 ) 66,021 (99,145 ) Deferred income taxes

(69 ) 45 97

(344 ) 456

Net income

$ 75,859 $ 93,581 $

91,175 $ 353,403 $ 353,853 Add:

Distributable cash flow attributable to

noncontrolling interests in OpCo

(55,853 ) (89,620 ) (75,650 ) (258,560 ) (301,215 ) Incentive

distribution rights (91 ) (142 ) — (281 ) — Maintenance capital

expenditures (21,747 ) (16,744 ) (18,989 ) (120,353 ) (67,935 )

Contribution to turnaround reserves (17,625 ) (6,051 ) (7,050 )

(40,014 ) (28,183 ) Depreciation and amortization 26,290

30,738 20,573

98,210 81,210

MLP

distributable cash flow $ 6,833

$ 11,762 $

10,059 $ 32,405

$ 37,730

WESTLAKE CHEMICAL PARTNERS LP ("WESTLAKE PARTNERS")

RECONCILIATION OF EBITDA TO NET INCOME AND NET CASH (USED

FOR) PROVIDED BY OPERATING ACTIVITIES (Unaudited)

Three Months

Ended

September 30,

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2016 2016 2015 2016

2015

(In thousands of dollars)

Net cash (used for) provided by

operating activities

$ (7,907 ) $ 110,356 $

121,339 $ 287,726 $ 452,542

Changes in operating assets and

liabilities and other

83,835 (16,820 ) (30,261 ) 66,021 (99,145 ) Deferred income taxes

(69 ) 45 97

(344 ) 456

Net income $

75,859 $ 93,581 $ 91,175

$ 353,403 $ 353,853 Add: Provision for

income taxes 194 145 105 1,035 672 Interest expense 4,947 5,226

1,173 12,607 4,967 Depreciation and amortization 26,290

30,738 20,573

98,210 81,210

EBITDA

$ 107,290 $

129,690 $ 113,026

$ 465,255 $

440,702

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170221005422/en/

Westlake Chemical Partners LPInvestorsSteve Bender,

713-585-2900orMediaL. Benjamin Ederington, 713-585-2900

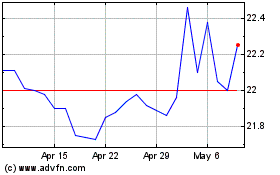

Westlake Chemical Partners (NYSE:WLKP)

Historical Stock Chart

From Aug 2024 to Sep 2024

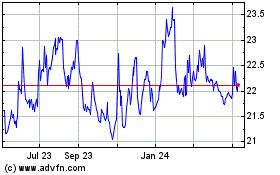

Westlake Chemical Partners (NYSE:WLKP)

Historical Stock Chart

From Sep 2023 to Sep 2024