Ladder Capital Corp Announces Pricing of Secondary Public Offering of Class A Common Stock

December 07 2016 - 8:00AM

Business Wire

Ladder Capital Corp (NYSE:LADR) (“Ladder” or the “Company”)

announced today that the previously announced underwritten

secondary public offering of 10,000,000 shares of the Company’s

Class A common stock priced at a price to the public of $13.60 per

share. The offering consists entirely of secondary shares to be

sold by certain affiliates of Alberta Investment Management Corp.,

GI Partners, Northgate Capital and TowerBrook Capital Partners

(collectively, the “Selling Stockholders”), and the Company will

not receive any proceeds from the offering. Certain of the Selling

Stockholders have also granted the underwriters a 30-day option to

purchase up to an additional 1,500,000 shares. BofA Merrill Lynch,

Deutsche Bank Securities and Wells Fargo Securities are acting as

joint book-running managers and as representatives of the

underwriters for the offering. Additional book-running managers are

Barclays, Citigroup and J.P. Morgan. FBR, JMP Securities and Keefe,

Bruyette & Woods, a Stifel Company, are acting as co-managers

for the offering. The offering is expected to close on December 12,

2016, subject to customary closing conditions.

A shelf registration statement (including prospectus) relating

to the shares has been filed with the Securities and Exchange

Commission (the “SEC”) and has become effective. Before you invest,

you should read the prospectus and other documents filed by Ladder

with the SEC for more complete information about Ladder and this

offering. You may get these documents for free by visiting EDGAR on

the SEC website at www.sec.gov. Alternatively, copies of the

prospectus supplement and accompanying prospectus, when available,

may be obtained from BofA Merrill Lynch, 200 North College Street,

3rd floor, Charlotte, NC 28255-0001, Attn: Prospectus Department or

via email: dg.prospectus_requests@baml.com; Deutsche Bank

Securities Inc., Prospectus Group, 60 Wall Street, New York, NY

10005, via telephone: 1-800-503-4611 or via email:

prospectus.cpdg@db.com; or Wells Fargo Securities, LLC, 375 Park

Avenue New York, NY 10152, Attention: Equity Syndicate Department,

via telephone: 1-800-326-5897 or via email:

cmclientsupport@wellsfargo.com.

The offering of these securities will be made only by means of a

prospectus supplement and the accompanying prospectus. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy these securities, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Ladder

Ladder is an internally-managed real estate investment trust

that is a leader in commercial real estate finance. Ladder

originates and invests in a diverse portfolio of commercial real

estate and real estate-related assets, focusing on senior secured

assets. Ladder’s investment activities include: (i) direct

origination of commercial real estate first mortgage loans; (ii)

investments in investment grade securities secured by first

mortgage loans on commercial real estate; and (iii) investments in

net leased and other commercial real estate equity. Founded in

2008, Ladder is run by a highly experienced management team with

extensive expertise in all aspects of the commercial real estate

industry, including origination, credit, underwriting, structuring,

capital markets and asset management. Led by Brian Harris, the

Company’s Chief Executive Officer, Ladder is headquartered in New

York City and has branches in Los Angeles and Boca Raton.

Safe Harbor for Forward-Looking and Cautionary

Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, including statements regarding the offering. These

statements are not historical facts but rather are based on the

Company’s current expectations, estimates and projections regarding

the Company’s business, operations and other factors relating

thereto. Words such as “may,” “will,” “could,” “would,” “should,”

“anticipate,” “predict,” “potential,” “continue,” “expects,”

“intends,” “plans,” “projects,” “believes,” “estimates” and similar

expressions are used to identify these forward-looking statements.

These statements are only predictions and as such are not

guarantees of future performance and involve risks, uncertainties

and assumptions that are difficult to predict. Actual results may

differ materially from those in the forward-looking statements as a

result of a number of factors, including those described from time

to time in the Company’s filings with the SEC.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161207005420/en/

Investor Relations:Ladder Capital Corp Investor

Relations917-369-3207investor.relations@laddercapital.com

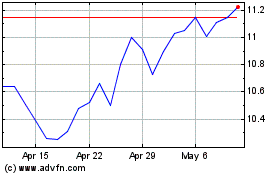

Ladder Capital (NYSE:LADR)

Historical Stock Chart

From Apr 2024 to May 2024

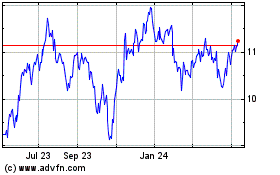

Ladder Capital (NYSE:LADR)

Historical Stock Chart

From May 2023 to May 2024