Elbit Imaging Announces Amendment to the 2014 Restructuring Plan of Its Subsidiary, Plaza Centers

November 07 2016 - 10:29AM

Elbit Imaging Ltd. (“EI” or the

“Company”) (TASE:EMITF) (NASDAQ:EMITF) announced

today, in further to its announcement dated on July 21, 2014,

regarding the restructuring plan approval of

Plaza Centers

N.V. ("Plaza") (LSE:PLAZ), an indirect subsidiary (45%) of

the Company, the following updates:

- Under the Restructuring Plan, principal payments under the

notes (both those that are traded on the Tel Aviv Stock Exchange

and those held by Polish investors) issued by Plaza and originally

due in the years 2013 to 2015 were deferred for a period of four

and a half years, and principal payments originally due in 2016 and

2017 were deferred for a period of one year (the “Extended

Repayment Schedule”).

- The Restructuring Plan further provides that, if Plaza does not

prepay an aggregate amount of at least NIS 434,000,000

(approximately €103 million) on the principal of the notes on or

before 1 December 2016 (the “Early Prepayment”),

the principal payments due under the Extended Repayment Schedule

will be advanced by one year (the “Accelerated Repayment

Schedule”).

- Since the Restructuring Plan became effective, Plaza has made

Early Prepayments of an aggregate amount of approximately NIS 142.5

million (approximately €34 million) and has repaid a total amount

of approximately €71 million on account of principal and interest

(on top of the issuance to the bondholders of 13.21% of its

outstanding share capital). At the same time, Plaza continues to

implement an aggressive cost cutting plan in order to reduce its

general and administrative expenses (such expenses were reduced by

approximately 20% over the mentioned period).

- Plaza is currently in active negotiations on several disposal

transactions with a total negotiated value of approximately €140

million (with an estimated €71 million expected net proceeds to the

Company) and, although there is no certainty that the transactions

will be completed, it is expected that the closing of these

transactions will take place within few months after 1 December

2016.

- The enforcement of the Accelerated Repayment Schedule would add

significant pressure to Plaza’s liquidity and result in an

acceleration of the asset sales, which is likely to have an adverse

impact upon the value achieved on any disposals. The Accelerated

Repayment Schedule may, therefore, adversely affect the position of

Plaza’s stakeholders, including its shareholders and

creditors.

- Accordingly, Plaza has a strong preference to continue

operating on the basis of the Extended Repayment Schedule. In order

to ensure that the Extended Repayment Schedule remains applicable,

in the event that the closing of the aforementioned transactions

takes longer than anticipated, Plaza is proposing to seek, from its

bondholders, a relaxation of the terms of the Early Prepayment

required to maintain the Extended Repayment Schedule.

- The proposed amendments sought by Plaza comprise the

postponement of the Early Prepayment date by up to four (4) months,

and the reduction of the total amount of the required Early

Prepayments to at least NIS 382,000,000 (a reduction of up to 12%

from the original amount) (the “Requested

Amendment”). Apart from this Requested Amendment, Plaza

intends to fully comply with the repayment schedule of the notes.

Plaza intends to implement the Requested Amendment through a

consensual process with its bondholders and will shortly be

initiating discussions with its bondholders in order to seek their

consent to the Requested Amendment.

- Plaza has made considerable progress in creating value and

generating proceeds from its assets and appreciates the continued

support of its stakeholders in order to be able to continue the

implementation of the approved Restructuring Plan.

The Company will update regarding any new

developments.

About Elbit Imaging Ltd.

Elbit Imaging Ltd. operates in the following

principal fields of business: (i) Commercial centers - initiation,

construction, and sale of commercial centers and other mixed-use

property projects, predominantly in the retail sector, located in

Central and Eastern Europe. In certain circumstances and depending

on market conditions, the Group operates and manages commercial

centers prior to their sale. (ii) Hotel - operation and

management of the Radisson hotel Complex in Bucharest, Romania.

(iii) Medical industries and devices - (a) research and

development, production and marketing of magnetic resonance imaging

guided focused ultrasound treatment equipment, and (b) development

of stem cell population expansion technologies and stem cell

therapy products for transplantation and regenerative medicine.

(iv) Plots in India - plots designated for sale initially

designated to residential projects.

Any forward-looking statements in our releases

include statements regarding the intent, belief or current

expectations of Elbit Imaging Ltd. and our management about our

business, financial condition, results of operations, and its

relationship with its employees and the condition of our

properties. Words such as “believe,” “expect,” “intend,” “estimate”

and similar expressions are intended to identify forward-looking

statements but are not the exclusive means of identifying such

statements. Actual results may differ materially from those

projected, expressed or implied in the forward-looking statements

as a result of various factors including, without limitation, a

change in market conditions, a decision to deploy the cash for

other business opportunities and the factors set forth in our

filings with the Securities and Exchange Commission including,

without limitation, Item 3.D of our annual report on Form 20-F for

the fiscal year ended December 31, 2015, under the caption “Risk

Factors.” Any forward-looking statements contained in our releases

speak only as of the date of such release, and we caution existing

and prospective investors not to place undue reliance on such

statements. Such forward-looking statements do not purport to be

predictions of future events or circumstances, and therefore, there

can be no assurance that any forward-looking statement contained in

our releases will prove to be accurate. We undertake no obligation

to update or revise any forward-looking statements.

For Further Information:

Company Contact

Ron Hadassi

Chairman of the Board of Directors

Tel: +972-3-608-6048

Fax: +972-3-608-6050

ron@elbitimaging.com

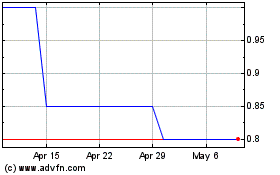

Elbit Imaging (CE) (USOTC:EMITF)

Historical Stock Chart

From Aug 2024 to Sep 2024

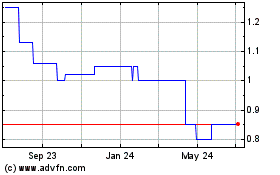

Elbit Imaging (CE) (USOTC:EMITF)

Historical Stock Chart

From Sep 2023 to Sep 2024