The Bancorp, Inc. ("The Bancorp") (NASDAQ: TBBK), a financial

holding company, today reported financial results for third quarter

2016.

Highlights

- Net interest income increased 32% to

$23.5 million for the quarter ended September 30, 2016 compared to

$17.8 million for the quarter ended September 30, 2015.

- Net interest margin increased to 2.69%

for the quarter ended September 30, 2016 compared to 2.34% for the

quarter ended September 30, 2015.

- Loans and continuing operations loans

held for sale increased 31% to $1.76 billion at September 30, 2016

compared to $1.35 billion at September 30, 2015.

- Direct lease financing increased 49% to

$332.6 million from $223.9 million at September 30, 2015.

- Small Business Administration (“SBA”)

loans increased 24% to $349.6 million from $280.9 million at

September 30, 2015.

- Security backed lines of credit

(“SBLOC”) increased 15% to $621.5 million from $539.2 million at

September 30, 2015.

- Prepaid card fee income increased 7% to

$12.2 million for the quarter ended September 30, 2016 from $11.5

million for the quarter ended September 30, 2015.

- Gross dollar volume (“GDV”) (1)

increased 11% to $10.5 billion for Q3 2016 from $9.5 billion for Q3

2015.

- Assets held for sale from discontinued

operations decreased 34% from December 31, 2015 reflecting a $64

million sale of discontinued loans during the quarter.

- The rate on our average deposits and

interest bearing liabilities of $3.83 billion in Q3 2016 was 0.33%

with a rate of 0.12% for $1.81 billion of average prepaid card

deposits.

- Average prepaid card deposits, which

are among the lowest cost of our deposits, grew 18% in third

quarter 2016 compared to third quarter 2015.

- Completion of the BSA lookback

consultant engagement.

- Reduction in staff positions by

approximately 20% at the end of the quarter.

- Consummation of common equity offering

of approximately $75 million.

- Book value per common share at

September 30, 2016 of $6.13 per share. The Bancorp and its

subsidiary, The Bancorp Bank, remain well capitalized.

The Bancorp reported a net loss of $25.5 million, or $0.54 loss

per diluted share, for the quarter ended September 30, 2016

compared to net loss of $5.6 million, or $0.15 loss per diluted

share, for the quarter ended September 30, 2015. Net loss from

continuing operations for the quarter ended September 30, 2016 was

$1.5 million or a loss of $0.03 per diluted share compared to net

loss from continuing operations of $7.6 million or a loss of $0.20

per diluted share for the quarter ended September 30, 2015. Loss

from continuing operations does not include any income which may

result from the reinvestment of the proceeds from sales of the

remaining assets in The Bancorp’s discontinued operations. Tier one

capital to assets, tier one capital to risk-weighted assets,

total capital to risk-weighted assets and common equity-tier 1

ratios were 7.81%, 15.12%, 15.40% and 15.12% compared to well

capitalized minimums of 5%, 8%, 10% and 6.5%.

Damian Kozlowski, The Bancorp’s Chief Executive Officer, said,

“Last quarter on my first earnings call, I committed to the

completion of a business plan which would emphasize continuing

revenue growth and expense reductions, and thereby support

increased earnings and reduced volatility. We have completed that

integrated and comprehensive business plan and are focused on

accelerating related expense reductions while supporting continued

strong revenue growth. We are moving ahead in multiple areas to

achieve the related goal of a 20 to 25% reduction in non interest

expense. In the fourth quarter, we should see the impact of the end

of third quarter staff reductions. The business plan also

comprehensively addresses the completion of resolving regulatory

requirements and expectations. We made related progress with our

regulatory issues with the completion of the BSA lookback which

will no longer impact earnings. Strong revenue growth continued

this quarter, and our core lending businesses drove a 32% increase

over prior year quarter net interest income. Our non-interest

income reflected 7% growth in prepaid card fees to $12.2 million.

Credit losses in our continuing operations which we believe to be

lower risk lines of business, continue to be low. We were extremely

disappointed that an issue arose with a large lending relationship

in discontinued operations which resulted in a third quarter loss.

The results of the third quarter reflected a fair value

mark in connection with a secured commercial real estate

loan held in discontinued operations. That loan, in the principal

amount of $41.9 million, became non-performing after quarter end

due to the failure to make required principal payments. Based on a

preliminary estimate of the collateral value by an independent

certified appraiser, the fair value was reduced by $23.9 million

and that amount was recorded as a charge to earnings. The appraisal

estimate is preliminary, possibly subject to change based upon a

full appraisal which is in process. The appraiser is considering

recent market changes and pending lease renewals.”

Conference Call Webcast

You may access the LIVE webcast of The Bancorp's Quarterly

Earnings Conference Call at 8:00 AM ET Friday, October 28, 2016 by

clicking on the webcast link on Bancorp's homepage at

www.thebancorp.com. Or, you may dial 844.775.2543, access code

96088598. You may listen to the replay of the webcast following the

live call on The Bancorp's investor relations website or

telephonically until Friday, November 4, 2016 by dialing

855.859.2056, access code 96088598.

About The Bancorp

With operations in the US and Europe, The Bancorp, Inc. (NASDAQ:

TBBK) is dedicated to serving the unique needs of non-bank

financial service companies, ranging from entrepreneurial start-ups

to those on the Fortune 500. The company’s chief financial

institution, The Bancorp Bank (Member FDIC, Equal Housing Lender),

has been repeatedly recognized in the payments industry as the Top

Issuer of Prepaid Cards (US), a top merchant sponsor bank, and a

top ACH originator. Specialized lending distinctions include

National Preferred SBA Lender, a leading provider of

securities-backed lines of credit, and one of the few bank-owned

commercial leasing groups in the nation. For more information

please visit www.thebancorp.com.

Forward-Looking Statements

Statements in this earnings release regarding Bancorp’s business

which are not historical facts are "forward-looking statements"

that involve risks and uncertainties. These statements may be

identified by the use of forward-looking terminology, including but

not limited to the words “may,” “believe,” “will,” “expect,”

“look,” “anticipate,” “estimate,” “continue,” or similar words. For

further discussion of the risks and uncertainties to which these

forward-looking statements may be subject, see Bancorp’s filings

with the SEC, including the “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” sections of those filings. These risks and

uncertainties could cause actual results to differ materially from

those projected in the forward-looking statements. The

forward-looking statements speak only as of the date of this press

release. The Bancorp does not undertake to publicly revise or

update forward-looking statements in this press release to reflect

events or circumstances that arise after the date of this

presentation, except as may be required under applicable law.

The Bancorp, Inc. Financial highlights

(unaudited) Three months ended Nine

months ended September 30, September 30,

Condensed income

statement 2016 2015 2016 2015 (dollars in

thousands except per share data) Net interest income $

23,542 $ 17,798 $ 64,988 $ 51,349

Provision for loan and lease losses 750 625

1,810 1,800 Non-interest income

Service fees on deposit accounts 1,510 1,919 3,335 5,579 Card

payment and ACH processing fees 1,459 1,493 4,183 4,242 Prepaid

card fees 12,249 11,492 39,333 35,752 Gain (loss) on sale of loans

903 (830 ) 809 6,747 Gain on sale of investment securities 981 (335

) 3,131 (62 ) Change in value of investment in unconsolidated

entity 811 1,040 (12,313 ) 3,141 Leasing income 588 552 1,456 1,727

Debit card income (45 ) 427 (202 ) 1,358 Affinity fees 1,091 1,083

3,507 2,391 Other non-interest income 886 458

5,422 1,925 Total non-interest

income 20,433 17,299 48,661 62,800 Non-interest expense Bank

Secrecy Act and lookback consulting expenses 1,340 11,687 29,076

26,643 Other non-interest expense 43,370

36,108 127,908 108,446 Total

non-interest expense 44,710 47,795

156,984 135,089 Loss from continuing

operations before income tax expense (1,485 ) (13,323 ) (45,145 )

(22,740 ) Income tax expense (benefit) 55

(5,706 ) (15,324 ) (10,817 ) Net loss from continuing

operations (1,540 ) (7,617 ) (29,821 ) (11,923 ) Net income (loss)

from discontinued operations, net of tax (23,993 )

2,042 (37,984 ) 6,736 Net loss

available to common shareholders $ (25,533 ) $ (5,575 ) $ (67,805 )

$ (5,187 ) Net loss per share from continuing operations -

basic $ (0.03 ) $ (0.20 ) $ (0.73 ) $ (0.32 ) Net income (loss) per

share from discontinued operations - basic $ (0.51 ) $ 0.05

$ (0.93 ) $ 0.18 Net loss per share – basic $ (0.54 ) $

(0.15 ) $ (1.66 ) $ (0.14 ) Net loss per share from

continuing operations - diluted $ (0.03 ) $ (0.20 ) $ (0.73 ) $

(0.32 ) Net income (loss) per share from discontinued operations -

diluted $ (0.51 ) $ 0.05 $ (0.93 ) $ 0.18 Net loss

per share - diluted $ (0.54 ) $ (0.15 ) $ (1.66 ) $ (0.14 ) Common

stock shares outstanding 55,319,204 37,758,322 55,319,204

37,758,322 (a) For loss periods the weighted averages

shares - basic is used in both the basic and diluted computations.

Balance sheet September

30, June 30, December 31, September 30, 2016 2016 2015 2015

(dollars in thousands)

Assets: Cash and cash equivalents

Cash and due from banks $ 4,061 $ 4,006 $ 7,643 $ 4,002 Interest

earning deposits at Federal Reserve Bank 312,605 528,094 1,147,519

995,441 Securities sold under agreements to resell 39,463

39,360 - 37,970

Total cash and cash equivalents 356,129

571,460 1,155,162 1,037,413

Investment securities, available-for-sale, at fair value

1,334,927 1,328,693 1,070,098 1,316,705 Investment securities,

held-to-maturity 93,495 93,537 93,590 93,604 Loans held for sale,

at fair value 562,957 441,593 489,938 354,600 Loans, net of

deferred fees and costs 1,198,237 1,182,106 1,078,077 994,518

Allowance for loan and lease losses (6,058 ) (5,398 )

(4,400 ) (4,194 ) Loans, net 1,192,179

1,176,708 1,073,677 990,324

Federal Home Loan Bank & Atlantic Community Bancshares

stock 11,014 12,289 1,062 1,063 Premises and equipment, net 21,797

22,429 21,631 18,893 Accrued interest receivable 10,496 10,271

9,471 11,232 Intangible assets, net 5,682 6,074 4,929 5,248

Deferred tax asset, net 29,765 28,870 36,207 33,857 Investment in

unconsolidated entity 157,396 162,275 178,520 186,656 Assets held

for sale from discontinued operations 386,155 487,373 583,909

611,729 Other assets 55,435 60,203

47,629 53,123 Total assets $ 4,217,427

$ 4,401,775 $ 4,765,823 $ 4,714,447

Liabilities: Deposits Demand and interest checking $

3,364,103 $ 3,569,669 $ 3,602,376 $ 4,002,638 Savings and money

market 402,832 389,851 383,832 376,577 Time deposits -

101,160 428,549 -

Total deposits 3,766,935 4,060,680

4,414,757 4,379,215 Securities

sold under agreements to repurchase 353 318 925 1,034 Short-term

borrowings 70,000 - - - Subordinated debenture 13,401 13,401 13,401

13,401 Other liabilities 27,744 37,094

16,739 7,100 Total liabilities $

3,878,433 $ 4,111,493 $ 4,445,822 $ 4,400,750

Shareholders' equity: Common stock -

authorized, 75,000,000 shares of $1.00 par value; 55,419,204 and

37,858,237 shares issued at September 30, 2016 and 2015,

respectively 55,419 37,945 37,861 37,858 Treasury stock (100,000

shares) (866 ) (866 ) (866 ) (866 ) Additional paid-in capital

359,793 301,680 300,549 299,470 Accumulated deficit (83,253 )

(57,721 ) (15,449 ) (33,429 ) Accumulated other comprehensive

income (loss) 7,901 9,244 (2,094

) 10,664 Total shareholders' equity 338,994

290,282 320,001 313,697

Total liabilities and shareholders' equity $

4,217,427 $ 4,401,775 $ 4,765,823 $ 4,714,447

Average balance sheet and net interest income Three months

ended September 30, 2016 Three months ended September 30, 2015

(dollars in thousands) Average Average Average Average

Assets: Balance Interest Rate Balance Interest Rate

Interest-earning assets: Loans net of unearned fees and costs ** $

1,661,807 $ 17,425 4.19 % $ 1,292,533 $ 12,466 3.86 % Leases - bank

qualified* 21,006 418 7.96 % 30,091 530 7.05 % Investment

securities-taxable 1,373,776 8,350 2.43 % 940,590 4,562 1.94 %

Investment securities-nontaxable* 48,683 218 1.79 % 518,691 4,765

3.67 % Interest earning deposits at Federal Reserve Bank 324,179

397 0.49 % 957,078 580 0.24 % Federal funds sold and securities

purchased under agreement to resell 39,392 146

1.48 % 40,705 143 1.41 % Net interest earning

assets 3,468,843 26,954 3.11 % 3,779,688 23,046 2.44 %

Allowance for loan and lease losses (5,267 ) (4,385 ) Assets held

for sale from discontinued operations 459,400 3,891 3.39 % 627,806

6,343 4.04 % Other assets 259,375 286,839

$ 4,182,351 $ 4,689,948

Liabilities

and Shareholders' Equity: Deposits: Demand and interest

checking $ 3,249,801 $ 2,379 0.29 % $ 3,998,798 $ 2,850 0.29 %

Savings and money market 392,045 423 0.43 % 337,793 426 0.50 % Time

76,931 104 0.54 % 410 1

0.98 % Total deposits 3,718,777 2,906 0.31 % 4,337,001 3,277 0.30 %

Short-term borrowings 102,243 153 0.60 % - - 0.00 %

Repurchase agreements 376 - 0.00 % 1,606 1 0.25 % Subordinated debt

13,401 131 3.91 % 13,401

117 3.49 % Total deposits and interest bearing liabilities

3,834,797 3,190 0.33 % 4,352,008 3,395 0.31 % Other

liabilities 19,670 12,957 Total

liabilities 3,854,467 4,364,965 Shareholders' equity

327,884 324,983 $ 4,182,351 $ 4,689,948

Net interest income on tax equivalent basis* $ 27,655 $

25,994 Tax equivalent adjustment 222 1,853

Net interest income $ 27,433 $ 24,141 Net interest margin *

2.69 % 2.34 % * Full taxable equivalent

basis, using a 35% statutory tax rate. ** Includes loans held for

sale.

Average balance sheet and net interest income Nine months

ended September 30, 2016 Nine months ended September 30, 2015

(dollars in thousands) Average Average Average Average

Assets: Balance Interest Rate Balance Interest Rate

Interest-earning assets: Loans net of unearned fees and costs ** $

1,543,448 $ 48,061 4.15 % $ 1,192,939 $ 34,231 3.83 % Leases - bank

qualified* 20,618 1,334 8.63 % 23,936 1,247 6.95 % Investment

securities-taxable 1,280,692 22,782 2.37 % 983,557 14,628 1.98 %

Investment securities-nontaxable* 59,892 983 2.19 % 524,913 14,443

3.67 % Interest earning deposits at Federal Reserve Bank 490,037

1,677 0.46 % 1,001,027 1,759 0.23 % Federal funds sold and

securities purchased under agreement to resell 27,414

301 1.46 % 43,724 465 1.42 % Net

interest-earning assets 3,422,101 75,138 2.93 % 3,770,096 66,773

2.36 % Allowance for loan and lease losses (4,538 ) (4,089 )

Assets held for sale 528,168 15,037 3.80 % 743,594 22,275 3.99 %

Other assets 291,973 293,561 $

4,237,704 $ 4,803,162

Liabilities and

Shareholders' Equity: Deposits: Demand and interest checking $

3,325,047 $ 7,217 0.29 % $ 4,122,409 $ 8,293 0.27 % Savings and

money market 390,202 1,028 0.35 % 323,307 1,286 0.53 % Time

103,624 447 0.58 % 1,066 12 1.50

% Total deposits 3,818,873 8,692 0.30 % 4,446,782 9,591 0.29 %

Short-term borrowings 58,056 263 0.60 % - - 0.00 %

Repurchase agreements 812 1 0.16 % 6,598 14 0.28 % Subordinated

debt 13,401 383 3.81 % 13,401

328 3.26 % Total deposits and interest bearing liabilities

3,891,142 9,339 0.32 % 4,466,781 9,933 0.30 % Other

liabilities 21,306 9,702 Total

liabilities 3,912,448 4,476,483 Shareholders' equity

325,256 326,679 $ 4,237,704 $ 4,803,162

Net interest income on tax equivalent basis* 80,836

79,115 Tax equivalent adjustment 811

5,491 Net interest income $ 80,025 $ 73,624 Net interest

margin * 2.57 % 2.32 % * Full taxable

equivalent basis, using a 35% statutory tax rate. ** Includes loans

held for sale.

Allowance for loan

and lease losses: Nine months ended Year ended September 30,

September 30, December 31, 2016 2015

2015 (dollars in thousands) Balance in

the allowance for loan and lease losses at beginning of period (1)

$ 4,400 $ 3,638 $ 3,638 Loans

charged-off: SBA non real estate - 65 111 SBA commercial mortgage

76 - - Direct lease financing 63 9 30 Other consumer loans

39 1,177 1,220 Total 178

1,251 1,361 Recoveries:

SBA non real estate 1 - - Direct lease financing 17 - - Other

consumer loans 8 7 23

Total 26 7 23 Net

charge-offs 152 1,244 1,338 Provision charged to operations

1,810 1,800 2,100 Balance

in allowance for loan and lease losses at end of period $ 6,058

$ 4,194 $ 4,400 Net charge-offs/average loans

0.01 % 0.10 % 0.11 % Net charge-offs/average loans (annualized)

0.01 % 0.14 % 0.11 % Net charge-offs/average assets 0.00 % 0.03 %

0.03 % (1) Excludes activity from assets held for sale

Loan portfolio: September 30, June 30, December 31,

September 30, 2016 2016 2015

2015 (dollars in thousands) SBA non

real estate $ 74,262 $ 71,596 $ 68,887 $ 64,988 SBA commercial

mortgage 117,053 116,617 114,029 116,545 SBA construction

6,317 3,751 6,977 5,191

Total SBA loans 197,632 191,964 189,893 186,724 Direct lease

financing 332,632 315,639 231,514 223,929 SBLOC 621,456 607,017

575,948 539,240 Other specialty lending 20,076 40,543 48,315 12,119

Other consumer loans 19,375 20,005

23,180 23,502 1,191,171 1,175,168

1,068,850 985,514 Unamortized loan fees and costs 7,066

6,938 9,227 9,004

Total loans, net of deferred loan fees and costs $ 1,198,237

$ 1,182,106 $ 1,078,077 $ 994,518

Small business lending portfolio: September 30, June

30, December 31, September 30, 2016 2016

2015 2015 (dollars in thousands)

SBA loans, including deferred fees and costs 203,196 197,544

197,966 194,612 SBA loans included in HFS 146,450

136,660 109,174 86,245

Total SBA loans $ 349,646 $ 334,204 $ 307,140

$ 280,857

Capital ratios:

Tier 1 capital Tier 1 capital Total capital Common equity to

average to risk-weighted to risk-weighted tier 1 to risk assets

ratio assets ratio assets ratio weighted assets As of September 30,

2016 The Bancorp, Inc. 7.81 % 15.12 % 15.40 % 15.12 % The Bancorp

Bank 7.41 % 14.56 % 14.83 % 14.56 % "Well capitalized" institution

(under FDIC regulations) 5.00 % 8.00 % 10.00 % 6.50 % As of

December 31, 2015 The Bancorp, Inc. 7.17 % 14.67 % 14.88 % 14.67 %

The Bancorp Bank 6.90 % 13.98 % 14.18 % 13.98 % "Well capitalized"

institution (under FDIC regulations) 5.00 % 8.00 % 10.00 % 6.50 %

Three months ended Nine months ended September 30,

September 30, 2016 2015

2016 2015

Selected operating

ratios: Return on average assets (annualized) nm nm nm nm

Return on average equity (annualized) nm nm nm nm Net interest

margin 2.69 % 2.34 % 2.57 % 2.32 % Book value per share $ 6.13 $

8.31 $ 6.13 $ 8.31 September 30, June 30, December 31,

September 30, 2016 2016 2015

2015

Asset quality ratios:

Nonperforming loans to total loans (2) 0.58 % 0.53 % 0.22 % 0.25 %

Nonperforming assets to total assets (2) 0.16 % 0.14 % 0.05 % 0.05

% Allowance for loan and lease losses to total loans 0.51 % 0.46 %

0.41 % 0.42 % Nonaccrual loans $ 4,021 $ 3,147 $ 1,927 $

2,157 Other real estate owned - -

- - Total nonperforming assets $ 4,021

$ 3,147 $ 1,927 $ 2,157 Loans 90

days past due still accruing interest $ 2,933 $ 3,172

$ 403 $ 294

(2)

Nonperforming loan and asset ratios

include nonaccrual loans and loans 90 days past due still accruing

interest.

Three months ended September 30, June 30,

December 31, September 30, 2016 2016 2015 2015 (in

thousands)

Gross dollar volume (GDV) (1)

: Prepaid

card GDV $ 10,459,097 $ 11,442,294 $ 9,839,782 $ 9,465,687

(1)

Gross dollar volume represents the total

dollar amount spent on prepaid and debit cards issued by The

Bancorp.

Cumulative Analysis of Marks on

Discontinued Commercial Loan Principal (dollars in millions)

Commercial Mark Loan Principal

Cumulative Chargedowns Cumulative 9.30.16 Marks 6.30.16

Marks % to Principal 16 Largest relationships $ 248 $

248 Add back mark chargedowns to principal 35

Total principal to compare to cumulative marks $ 283 $ 38 $

35 $ 73 26 % Other loans 92

7 - 7 8 % Total

discontinued loan principal $ 340 $ 45 $ 35 $ 80

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161027007009/en/

The Bancorp, Inc.Andres Viroslav,

215-861-7990aviroslav@thebancorp.com

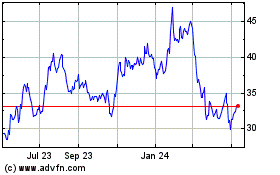

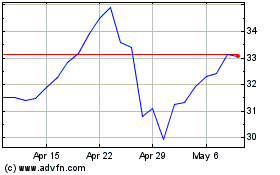

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Aug 2024 to Sep 2024

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Sep 2023 to Sep 2024