UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

————————————

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 8, 2016 (February 4, 2016)

————————————

PRAXAIR, INC.

(Exact name of registrant as specified in its charter)

————————————

|

Delaware

|

1-11037

|

06-1249050

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission file number)

|

(I.R.S. Employer

Identification No.)

|

39 Old Ridgebury Road

Danbury, CT 06810-5113

(Address of principal executive offices)

(203) 837-2000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

————————————

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

On February 4, 2016, Praxair, Inc. (the “Company”) priced an offering of €550,000,000 aggregate principal amount of 1.200% notes due February 12, 2024 (the “Euro Notes”) and an offering of $275,000,000 aggregate principal amount of 3.200% notes due January 30, 2026 (the “New USD Notes” and, togerther with the Euro Notes, the “Notes”). The New USD Notes will be part of the same series as the $450,000,000 of 3.200% Notes due 2026 that the Company issued on September 24, 2015. The New USD Notes were priced to yield approximately 2.95% per annum. The Euro Notes offering is expected to close on February 12, 2016, and the USD Notes offering is expected to close on February 11, 2016. The Notes were offered pursuant to the Company’s shelf registration statement on Form S-3 filed with the Securities and Exchange Commission (“SEC”) on May 12, 2015. The material terms of the Notes are described in the Company’s prospectus supplements dated February 4, 2016 filed with the SEC on February 5, 2016.

In connection with the pricing of the Euro Notes, the Company entered into a Terms Agreement dated February 4, 2016 (the “Euro Terms Agreement”) with Credit Suisse Securities (Europe) Limited, Deutsche Bank AG, London Branch and Merrill Lynch International, and the other underwriters (the “Euro Underwriters”). Pursuant to and subject to the terms and conditions of the Euro Terms Agreement, the Euro Underwriters agreed to purchase the Euro Notes from the Company for resale in the registered offering. The Euro Terms Agreement is filed as Exhibit 1.1 to this Form 8-K.

In connection with the pricing of the USD Notes, the Company entered into a Terms Agreement dated February 4, 2016 (the “USD Terms Agreement”) with J.P. Morgan Securities LLC, Mizuho Securities USA Inc. and Wells Fargo Securities, LLC, as underwriters (the “USD Underwriters”). Pursuant to and subject to the terms and conditions of the USD Terms Agreement, the USD Underwriters agreed to purchase the USD Notes from the Company for resale in the registered offering. The USD Terms Agreement is filed as Exhibit 1.2 to this Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed herewith:

|

Exhibit No.

|

Description

|

|

1.1

1.2

|

Terms Agreement dated February 4, 2016 (Euro Notes)

Terms Agreement dated February 4, 2016 (USD Notes)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 8, 2016

|

PRAXAIR, INC.

By: /s/ Guillermo Bichara

Guillermo Bichara

Vice President, General Counsel,

and Corporate Secretary

|

Exhibit Index

|

Exhibit No.

|

Description

|

|

1.1

1.2

|

Terms Agreement dated February 4, 2016 (Euro Notes)

Terms Agreement dated February 4, 2016 (USD Notes)

|

EXHIBIT 1.1

TERMS AGREEMENT

February 4, 2016

Praxair, Inc.

39 Old Ridgebury Road

Danbury, Connecticut 06810-5113

Ladies and Gentlemen:

We, Credit Suisse Securities (Europe) Limited, Deutsche Bank AG, London Branch and Merrill Lynch International (the “Representatives”), acting on behalf of the several underwriters named in Schedule I attached hereto (the “Underwriters”), understand that Praxair, Inc., a Delaware corporation (the “Company”), proposes to issue and sell €550,000,000 aggregate principal amount of its 1.200% Notes due 2024 (the “Offered Securities”), covered by the registration statement on Form S-3 (No. 333-204093) (the “Registration Statement”) filed by the Company. Subject to the terms and conditions set forth herein or incorporated by reference herein, the Underwriters named in Schedule I attached hereto agree to purchase, severally and not jointly, the Offered Securities in the amounts set forth opposite our respective names on such Schedule. The closing in respect of the purchase and sale of the Offered Securities shall occur on February 12, 2016 by 10:00 a.m. (the “Closing Date”).

All the provisions contained in the Praxair, Inc. Standard Underwriting Agreement Provisions (May 12, 2015 edition), other than the form of Delayed Delivery Contract attached thereto as Annex I and Terms Agreement attached thereto as Annex II (the “Standard Provisions”), a copy of which is filed as an exhibit to the Registration Statement, are incorporated herein by reference in their entirety and shall be deemed to be a part of this Terms Agreement to the same extent as if the Standard Provisions had been set forth in full herein. Terms defined in the Standard Provisions are used herein as therein defined.

For purposes of Sections 2 and 7 of the Standard Provisions, the only information furnished to the Company by any Underwriter for use in the U.S. Prospectus consists of the following information in the U.S. Prospectus furnished on behalf of each Underwriter: the last paragraph at the bottom of the prospectus supplement cover page concerning the terms of the offering by the Underwriters, and the information contained in the third paragraph, the sixth and seventh sentences of the sixth paragraph and the seventh, eighth, tenth, eleventh and twelfth paragraphs under the caption “Underwriting” in the prospectus supplement.

Notwithstanding any other term of this Agreement or any other agreements, arrangements, or understanding between the Underwriters and the Company, the Company acknowledges, accepts, and agrees to be bound by:

(i) the effect of the exercise of Bail-in Powers by the Relevant Resolution Authority in relation to any BRRD Liability of the Underwriters to the Company under this agreement, that (without limitation) may include and result in any of the following, or some combination thereof:

i. the reduction of all, or a portion, of the BRRD Liability or outstanding amounts due thereon;

ii. the conversion of all, or a portion, of the BRRD Liability into shares, other securities or other obligations of the Underwriters or another person (and the issue to or conferral on the Company of such shares, securities or obligations;

iii. the cancellation of the BRRD Liability;

iv. the amendment or alteration of any interest, if applicable, thereon, the maturity or the dates on which any payments are due, including by suspending payment for a temporary period;

(ii) the variation of the terms of this Agreement, as deemed necessary by the Relevant Resolution Authority, to give effect to the exercise of Bail-in Powers by the Relevant Resolution Authority.

(iii) “Bail-in Legislation” means in relation to a member state of the European Economic Area which has implemented, or which at any time implements, the BRRD, the relevant implementing law, regulation, rule or requirement as described in the EU Bail-in Legislation Schedule from time to time; “Bail-in Powers” means any Write-down and Conversion Powers as defined in relation to the relevant Bail-in Legislation; “BRRD” means Directive 2014/59/EU establishing a framework for the recovery and resolution of credit institutions and investment firms; “EU Bail-in Legislation Schedule” means the document described as such, then in effect, and published by the Loan Market Association (or any successor person) from time to time at http://www.lma.eu.com/; “BRRD Liability” has the same meaning as in such laws, regulations, rules or requirements implementing the BRRD under the applicable Bail-in Legislation; and “Relevant Resolution Authority” means the resolution authority with the ability to exercise any Bail-in Powers in relation to the Underwriters.

The Underwriters agree as between themselves that they will be bound by and will comply with the International Capital Markets Association Agreement Among Managers Version 1/New York Law Schedule (the “Agreement Among Managers”) as amended in the manner set out below. For purposes of the Agreement Among Managers, “Managers” means the Underwriters, “Lead Manager” means the Representatives, “Settlement Lead Manager” means Merrill Lynch International, “Stabilizing Manager” means Merrill Lynch International and “Subscription Agreement” means the Underwriting Agreement. Clause 3 of the Agreement Among Managers shall be deleted in its entirety and replaced with Section 8 of the Standard Provisions.

Date of Basic Prospectus: May 12, 2015

Date of Preliminary Prospectus Supplement: February 4, 2016

Date of Prospectus Supplement: February 4, 2016

Time of Sale: 10:55 a.m., New York City time on February 4, 2016

Names and Addresses of Representatives:

Credit Suisse Securities (Europe) Limited

One Cabot Square

London E14 4QJ

Deutsche Bank AG, London Branch

Winchester House

1 Great Winchester Street

London EC2N 2DB

Merrill Lynch International

2 King Edward Street

London EC1A 1HQ

The Offered Securities shall have the following terms:

|

Title:

|

1.200% Notes due 2024

|

|

Maturity:

|

February 12, 2024

|

|

Interest Rate:

|

1.200% per annum

|

|

Interest Payment Dates:

|

Interest will be payable annually in arrears on February 12 of each year, commencing February 12, 2017.

|

|

Redemption Provisions:

|

The Company may redeem the Offered Securities at its option, at any time in whole or from time to time in part.

The redemption price for the Offered Securities to be redeemed on any redemption date will be equal to the greater of:

(1) the principal amount of the Offered Securities being redeemed plus accrued and unpaid interest to the redemption date; or

(2) the sum of the present values of the principal amount of the Offered Securities, together with the scheduled annual payments of interest (exclusive of interest to the redemption date) from the redemption date to the maturity date of the Offered Securities, in each case discounted to the redemption date on an ACTUAL/ACTUAL (ICMA) day count basis at the applicable Comparable Government Bond Rate (as defined below), plus 20 basis points, plus accrued and unpaid interest on the principal amount of the Offered Securities to the redemption date.

|

| |

“Comparable Government Bond Rate” means the yield to maturity, expressed as a percentage (rounded to three decimal places, with 0.0005 being rounded upwards), on the third business day prior to the date fixed for redemption, of the Comparable Government Bond (as defined below) on the basis of the middle market price of the Comparable Government Bond prevailing at 11:00 a.m. (London time) on such business day as determined by an independent investment bank selected by the Company.

“Comparable Government Bond” means, in relation to any Comparable Government Bond Rate calculation, at the discretion of an independent investment bank selected by the Company, a German government bond whose maturity is closest to the maturity of the Offered Securities to be redeemed, or if such independent investment bank in its discretion determines that such similar bond is not in issue, such other German government bond as such independent investment bank may, with the advice of three brokers of, and/or market makers in, German government bonds selected by the Company, determine to be appropriate for determining the Comparable Government Bond Rate.

In addition, the Company has the option to redeem the Offered Securities under the circumstances described in the Preliminary Prospectus Supplement under the caption “Description of the Notes – Redemption Upon Tax Event.”

|

|

Purchase Price:

|

99.562% of the principal amount thereof

|

|

Initial Offering Price:

|

99.962% of the principal amount thereof, plus accrued interest, if any, from February 12, 2016

|

|

Additional Terms:

|

The Offered Securities will be issued only in registered form in denominations of €100,000 and integral multiples of €1,000 in excess thereof.

Delivery of the Offered Securities shall be made in book-entry form through a common depositary for Clearstream Banking, société anonyme and Euroclear Bank S.A./N.V., as operator of the Euroclear system.

|

which terms shall be set forth in a pricing term sheet substantially in the form of Exhibit 1 attached hereto (the “Pricing Term Sheet”).

The Offered Securities will be made available for checking and packaging at the offices of Davis Polk & Wardwell LLP at least 24 hours prior to the Closing Date.

This Terms Agreement may be executed in one or more counterparts, all of which counterparts shall constitute one and the same instrument.

[Signature pages follow]

If the foregoing is in accordance with your understanding of our agreement, kindly sign and return to us the enclosed duplicate hereof, whereupon it will become a binding agreement among the Company, and the several Underwriters in accordance with its terms.

Very truly yours,

CREDIT SUISSE SECURITIES (EUROPE) LIMITED

DEUTSCHE BANK AG, LONDON BRANCH

MERRILL LYNCH INTERNATIONAL

|

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

|

|

BNY MELLON CAPITAL MARKETS, LLC

|

|

ITAU BBA USA SECURITIES, INC.

|

|

THE TORONTO-DOMINION BANK

|

|

THE WILLIAMS CAPITAL GROUP, L.P.

|

|

|

[Signature Page to Terms Agreement]

|

CREDIT SUISSE SECURITIES (EUROPE) LIMITED

By: /s/ Scott J. Roose

Scott J. Roose

Managing Director

By: /s/ Sandeep Agarwal

Sandeep Agarwal

Managing Director

|

|

[Signature Page to Terms Agreement]

|

DEUTSCHE BANK AG, LONDON BRANCH

By: /s/ Patrick M. Kaufer

Patrick M. Kaufer

Managing Director

By: /s/ Ben-Zion Smilchensky

Ben-Zion Smilchensky

Managing Director

|

|

[Signature Page to Terms Agreement]

|

MERRILL LYNCH INTERNATIONAL

By: /s/ Julien Ronan

Julien Ronan

Managing Director

|

|

[Signature Page to Terms Agreement]

|

ANZ SECURITIES, INC.

By: /s/ Charles Lachman

Charles Lachman

President

|

|

[Signature Page to Terms Agreement]

|

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

By: /s/ Alvaro Solis

Alvaro Solis

Managing Director

By: /s/ Sandra de las Cavadas

Sandra de las Cavadas

Executive Director

|

|

[Signature Page to Terms Agreement]

|

BANCO BRADESCO BBI S.A.

By: /s/ Alessandro Decio Farkuh

Alessandro Decio Farkuh

Managing Director

By: /s/ Mauricio Hideki Martins

Mauricio Hideki Martins

Vice President

|

|

[Signature Page to Terms Agreement]

|

BNY MELLON CAPITAL MARKETS, LLC

By: /s/ Phil Benedict

Phil Benedict

Managing Director

|

|

[Signature Page to Terms Agreement]

|

GOLDMAN, SACHS & CO.

By: /s/ Ryan Gilliam

Ryan Gilliam

Vice President

|

|

[Signature Page to Terms Agreement]

|

ITAU BBA USA SECURITIES, INC.

By: /s/ John B. Corcoran

John B. Corcoran

Managing Director

By: /s/ Almir Vignoto

Almir Vignoto

Head of US Operations

Itau Unibanco S.A.

|

|

[Signature Page to Terms Agreement]

|

PNC CAPITAL MARKETS LLC

By: /s/ Rachel Chalich

Rachel Chalich

Senior Associate / AVP

|

|

[Signature Page to Terms Agreement]

|

SOCIÉTÉ GÉNÉRALE

By: /s/ Brendon Moran

Brendon Moran

Global Co-Head of Corporate Origination

|

|

[Signature Page to Terms Agreement]

|

THE TORONTO-DOMINION BANK

By: /s/ Paul Eustace

Paul Eustace

Managing Director

Head of Syndicate

|

|

[Signature Page to Terms Agreement]

|

THE WILLIAMS CAPITAL GROUP, L.P.

By: /s/ David Coard

David Coard

Principal

|

|

[Signature Page to Terms Agreement]

|

The foregoing Terms Agreement

is hereby confirmed as of the

date first above written

PRAXAIR, INC.

By: /s/ Timothy Heenan

Timothy Heenan

Vice President and Treasurer

|

|

[Signature Page to Terms Agreement]

|

SCHEDULE I

|

Underwriters

|

|

Amount of

Offered Securities

to be Purchased

|

|

|

Credit Suisse Securities (Europe) Limited..

|

|

€ |

146,667,000 |

|

|

Deutsche Bank AG, London Branch

|

|

|

146,667,000 |

|

|

Merrill Lynch International.

|

|

|

146,666,000 |

|

|

ANZ Securities, Inc.

|

|

|

11,000,000 |

|

|

Banco Bilbao Vizcaya Argentaria, S.A.

|

|

|

11,000,000 |

|

|

Banco Bradesco BBI S.A.

|

|

|

11,000,000 |

|

|

BNY Mellon Capital Markets, LLC

|

|

|

11,000,000 |

|

|

Goldman, Sachs & Co.

|

|

|

11,000,000 |

|

|

Itau BBA USA Securities, Inc.

|

|

|

11,000,000 |

|

|

PNC Capital Markets LLC

|

|

|

11,000,000 |

|

|

Société Générale

|

|

|

11,000,000 |

|

|

The Toronto-Dominion Bank

|

|

|

11,000,000 |

|

|

The Williams Capital Group, L.P.

|

|

|

11,000,000 |

|

|

Total

|

|

€ |

550,000,000 |

|

EXHIBIT 1

Pricing Term Sheet

Final Term Sheet

Filed pursuant to Rule 433

Dated February 4, 2016

Relating to

Prospectus Supplement dated February 4, 2016 to

Registration Statement No. 333-204093

€550,000,000 1.200% Notes due 2024

|

Issuer:

|

Praxair, Inc.

|

|

Title of Securities:

|

1.200% Notes due 2024

|

|

Principal Amount:

|

€550,000,000

|

|

Maturity Date:

|

February 12, 2024

|

|

Issue Price (Price to Public):

|

99.962% of principal amount

|

|

Coupon (Interest Rate):

|

1.200% per annum

|

|

Re-Offer Yield to Maturity:

|

1.205%

|

|

Benchmark Bund:

|

DBR 2.000% due August 15, 2023

|

|

Benchmark Bund Yield / Price:

|

-0.033% / 115.300%

|

|

Re-Offer Spread to Benchmark Bund:

|

123.8 basis points

|

|

Mid Swaps Yield:

|

0.425%

|

|

Re-Offer Spread to Mid Swaps:

|

78 basis points

|

|

Underwriting Fee:

|

40 basis points

|

|

Proceeds to Issuer (net of underwriting fees but before expenses):

|

€547,591,000

|

|

Interest Payment Dates:

|

Annually in arrears on each February 12, commencing February 12, 2017

|

|

Make-Whole Redemption:

|

Bund +20 basis points

|

|

Day Count:

|

Actual / Actual (ICMA)

|

|

Denominations:

|

€100,000 and integral multiples of €1,000 in excess thereof

|

|

Type of Offering:

|

SEC Registered

|

|

Listing:

|

Application will be made to list the Notes on the New York Stock Exchange

|

|

Trade Date:

|

February 4, 2016

|

|

Settlement Date:

|

February 12, 2016 (T+6)

|

|

Settlement:

|

Euroclear / Clearstream

|

|

Common Code/ISIN:

|

136238426 / XS1362384262

|

|

Joint Bookrunners:

|

Credit Suisse Securities (Europe) Limited , Deutsche Bank AG, London Branch and Merrill Lynch International

|

|

Co-Managers:

|

ANZ Securities, Inc., Banco Bilbao Vizcaya Argentaria, S.A., Banco Bradesco BBI S.A., BNY Mellon Capital Markets, LLC, Goldman, Sachs & Co., Itau BBA USA Securities, Inc., PNC Capital Markets LLC, Société Générale, The Toronto-Dominion Bank, The Williams Capital Group, L.P.

|

| Long-term Debt Ratings* |

|

|

Concurrent Offering:

|

On February 4, 2016, we launched an offering of 3.200% Notes due 2026 (the “new USD notes”) pursuant to a preliminary prospectus supplement dated February 4, 2016. The new USD notes will be of the same series as the $450,000,000 of 3.200% Notes due 2026 that we issued on September 24, 2015. The terms and amount of the new USD notes to be offered have not been determined, there can be no assurance that the new USD notes offering will be consummated, and this offering is not conditioned on the consummation of the new USD notes offering.

|

* Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

We expect that delivery of the notes will be made to investors on or about February 12, 2016, which will be the sixth business day following the date of this final term sheet (such settlement being referred to as “T+6”). Under Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the secondary market are required to settle in three business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade notes prior to the delivery of the notes hereunder will be required, by virtue of the fact that the notes initially settle in T+6, to specify an alternate settlement arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the notes who wish to trade the notes prior to their date of delivery hereunder should consult their advisors.

The issuer has filed a registration statement (including a prospectus, as supplemented) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus (as supplemented) in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Credit Suisse Securities (Europe) Limited, toll-free at (800) 221-1037, Deutsche Bank AG, London Branch, toll free at (800) 503-4611 or Merrill Lynch International, toll free at (800) 294-1322.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

EXHIBIT 1.2

TERMS AGREEMENT

February 4, 2016

Praxair, Inc.

39 Old Ridgebury Road

Danbury, Connecticut 06810-5113

Ladies and Gentlemen:

We, J.P. Morgan Securities LLC, Mizuho Securities USA Inc. and Wells Fargo Securities, LLC (the “Representatives”), acting on behalf of the several underwriters named in Schedule I attached hereto (the “Underwriters”), understand that Praxair, Inc., a Delaware corporation (the “Company”), proposes to issue and sell $275,000,000 aggregate principal amount of its 3.200% Notes due 2026 (the “Offered Securities”), covered by the registration statement on Form S-3 (No. 333-204093) (the “Registration Statement”) filed by the Company. The Offered Securities will be treated as part of the same series as, and will have the same terms as, the Company’s 3.200% Notes due 2026 outstanding on the date hereof, other than as described in the Prospectus Supplement. Subject to the terms and conditions set forth herein or incorporated by reference herein, the Underwriters named in Schedule I attached hereto agree to purchase, severally and not jointly, the Offered Securities in the amounts set forth opposite our respective names on such Schedule. The closing in respect of the purchase and sale of the Offered Securities shall occur on February 11, 2016 by 10:00 a.m. (the “Closing Date”).

All the provisions contained in the Praxair, Inc. Standard Underwriting Agreement Provisions (May 12, 2015 edition), other than the form of Delayed Delivery Contract attached thereto as Annex I and Terms Agreement attached thereto as Annex II (the “Standard Provisions”), a copy of which is filed as an exhibit to the Registration Statement, are incorporated herein by reference in their entirety and shall be deemed to be a part of this Terms Agreement to the same extent as if the Standard Provisions had been set forth in full herein. Terms defined in the Standard Provisions are used herein as therein defined.

For purposes of Sections 2 and 7 of the Standard Provisions, the only information furnished to the Company by any Underwriter for use in the U.S. Prospectus consists of the following information in the U.S. Prospectus furnished on behalf of each Underwriter: the last paragraph at the bottom of the prospectus supplement cover page concerning the terms of the offering by the Underwriters, and the information contained in the third paragraph, the third, fourth and fifth sentences of the sixth paragraph and the eighth, ninth and tenth paragraphs under the caption “Underwriting” in the prospectus supplement.

Date of Basic Prospectus: May 12, 2015

Date of Preliminary Prospectus Supplement: February 4, 2016

Date of Prospectus Supplement: February 4, 2016

Time of Sale: 3:00 p.m., New York City time on February 4, 2016

Names and Addresses of Representatives:

J.P. Morgan Securities LLC

383 Madison Avenue

New York, New York 10179

Mizuho Securities USA Inc.

320 Park Avenue, 12th Floor

New York, NY 10022

Wells Fargo Securities, LLC

550 South Tryon Street, 5th Floor

Charlotte, North Carolina 28202

The Offered Securities shall have the following terms:

|

Title:

|

3.200% Notes due 2026

|

|

Maturity:

|

January 30, 2026

|

|

Interest Rate:

|

3.200% per annum

|

|

Interest Payment Dates:

|

Interest will be payable on January 30 and July 30 of each year, commencing July 30, 2016.

|

|

Day Count Convention:

|

30/360 days

|

|

Redemption Provisions:

|

The Company may redeem the Offered Securities at its option, at any time in whole or from time to time in part.

The redemption price for the Offered Securities to be redeemed on any redemption date that is prior to the 2026 Notes Par Call Date will be equal to the greater of: (1) the principal amount of the Offered Securities being redeemed plus accrued and unpaid interest to the redemption date or (2) the 2026 Make-Whole Amount for the Offered Securities being redeemed.

The redemption price for the Offered Securities to be redeemed on any redemption date that is on or after the 2026 Notes Par Call Date will be equal to 100% of the principal amount of the Offered Securities being redeemed on the redemption date, plus accrued and unpaid interest to the redemption date.

|

| |

“2026 Notes Par Call Date” means October 30, 2025.

“2026 Make-Whole Amount” means, as determined by a 2026 Quotation Agent, the sum of the present values of the principal amount of the Offered Securities to be redeemed, together with the scheduled payments of interest (exclusive of interest to the redemption date) from the redemption date to the maturity date of the Offered Securities being redeemed (assuming, for this purpose, that the Offered Securities matured on the 2026 Notes Par Call Date), in each case discounted to the redemption date on a semi-annual basis, assuming a 360-day year consisting of twelve 30-day months, at the 2026 Adjusted Treasury Rate, plus accrued and unpaid interest on the principal amount of the Offered Securities being redeemed to the redemption date.

“2026 Adjusted Treasury Rate” means, with respect, to any redemption date, the sum of (x) either (1) the yield, under the heading that represents the average for the immediately preceding week, appearing in the most recent published statistical release designated “H.15 (519)” or any successor publication that is published weekly by the Board of Governors of the Federal Reserve System and that establishes yields on actively traded United States Treasury securities adjusted to the 2026 Comparable Treasury Issue (if no maturity is within three months before or after the remaining term of the Offered Securities (assuming, for this purpose, that the Offered Securities matured on the 2026 Notes Par Call Date) being redeemed, yields for the two published maturities most closely corresponding to the 2026 Comparable Treasury Issue shall be determined and the 2026 Adjusted Treasury Rate shall be interpolated or extrapolated from such yields on a straight line basis, rounded to the nearest month) or (2) if such release (or any successor release) is not published during the week preceding the calculation date or does not contain such yields, the rate per year equal to the semi-annual equivalent yield to maturity of the 2026 Comparable Treasury Price for such redemption date, in each case calculated on the third business day preceding the redemption date, and (y) 0.200%.

“2026 Comparable Treasury Issue” means the United States Treasury security selected by the Quotation Agent as having a maturity comparable to the remaining term from the redemption date to the maturity date of the Offered Securities being redeemed (assuming, for this purpose, that the Offered Securities matured on the 2026 Notes Par Call Date) that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities of comparable maturity to the remaining term of Offered Securities.

|

| |

“2026 Comparable Treasury Price” means, with respect to any redemption date, if clause (2) of the 2026 Adjusted Treasury Rate is applicable, the average of four, or such lesser number as is obtained by the indenture trustee, 2026 Reference Treasury Dealer Quotations for such redemption date.

“2026 Quotation Agent” means the Reference Treasury Dealer selected by the indenture trustee after consultation with Praxair.

“2026 Reference Treasury Dealer” means each of Citigroup Global Markets Inc., Deutsche Bank Securities Inc., HSBC Securities (USA) Inc. and a primary U.S. Government securities dealer selected by Mitsubishi UFJ Securities (USA), Inc. and their respective successors and assigns, and one other nationally recognized investment banking firm selected by Praxair that is a primary U.S. Government securities dealer.

“2026 Reference Treasury Dealer Quotations” means, with respect to each 2026 Reference Treasury Dealer and any redemption date, the average, as determined by the indenture trustee, of the bid and asked prices for the 2026 Comparable Treasury Issue, expressed in each case as a percentage of its principal amount, quoted in writing to the indenture trustee by such 2026 Reference Treasury Dealer at 5:00 p.m., New York City time, on the third business day preceding such redemption date.

|

|

Purchase Price:

|

101.676% of the principal amount thereof, plus interest deemed to have accrued from January 30, 2016

|

|

Public Offering Price:

|

102.126% of the principal amount thereof, plus interest deemed to have accrued from January 30, 2016

|

|

Additional Terms:

|

None

|

which terms shall be set forth in a pricing term sheet substantially in the form of Exhibit 1 attached hereto (the “Pricing Term Sheet”).

The Offered Securities will be made available for checking and packaging at the offices of Davis Polk & Wardwell LLP at least 24 hours prior to the Closing Date.

We represent that we are authorized to act for the several Underwriters named in Schedule I hereto in connection with this financing and any action under this agreement by any of us will be binding upon all the Underwriters.

This Terms Agreement may be executed in one or more counterparts, all of which counterparts shall constitute one and the same instrument.

[Signature pages follow]

If the foregoing is in accordance with your understanding of our agreement, kindly sign and return to us the enclosed duplicate hereof, whereupon it will become a binding agreement among the Company, and the several Underwriters in accordance with its terms.

|

Very truly yours,

J.P. MORGAN SECURITIES LLC

MIZUHO SECURITIES USA INC.

WELLS FARGO SECURITIES, LLC

On behalf of themselves and

as Representatives of the

Several Underwriters

|

[Signature Page to Terms Agreement]

|

J.P. MORGAN SECURITIES LLC

By: /s/ Som Bhattacharyya

Som Bhattacharyya

Vice President

|

[Signature Page to Terms Agreement]

|

MIZUHO SECURITIES USA INC.

By: /s/ Moshe Tomkiewicz

Moshe Tomkiewicz

Managing Director

|

[Signature Page to Terms Agreement]

|

WELLS FARGO SECURITIES, LLC

By: /s/ Carolyn Hurley

Carolyn Hurley

Director

|

[Signature Page to Terms Agreement]

The foregoing Terms Agreement

is hereby confirmed as of the

date first above written

PRAXAIR, INC.

By: /s/ Timothy Heenan

Timothy Heenan

Vice President and Treasurer

[Signature Page to Terms Agreement]

SCHEDULE I

|

Underwriters

|

|

Amount of

Offered Securities

to be Purchased

|

|

|

J.P. Morgan Securities LLC

|

|

$ |

91,667,000 |

|

|

Mizuho Securities USA Inc.

|

|

|

91,667,000 |

|

|

Wells Fargo Securities, LLC

|

|

|

91,666,000 |

|

|

Total

|

|

$ |

275,000,000 |

|

EXHIBIT 1

Pricing Term Sheet

Final Term Sheet

Filed pursuant to Rule 433

Dated February 4, 2016

Relating to

Prospectus Supplement dated February 4, 2016 to

Registration Statement No. 333-204093

$275,000,000 3.200% Notes due 2026

|

Issuer:

|

Praxair, Inc.

|

|

Trade Date:

|

February 4, 2016

|

| Expected Ratings (Moody's/S&P)*: |

|

|

Settlement Date**:

|

February 11, 2016 (T+5)

|

|

Title of Securities:

|

3.200% Notes due 2026

|

|

Principal Amount:

|

$275,000,000. The notes offered hereby will be part of the same series of notes as the $450,000,000 aggregate principal amount of 3.200% Notes due 2026 issued and sold by Praxair, Inc. on September 24, 2015. Upon settlement, the notes will be fungible with and treated as a single series with these existing notes, and the aggregate principal amount of the existing notes and the notes offered hereby will be $725,000,000.

|

|

CUSIP / ISIN:

|

74005P BQ6 / US74005PBQ63

|

|

Maturity Date:

|

January 30, 2026

|

|

Benchmark Treasury:

|

T 2.250% due November 15, 2025

|

|

Benchmark Treasury Price and Yield:

|

103-13 / 1.867%

|

|

Spread to Benchmark Treasury:

|

+108 basis points

|

|

Yield to Worst:

|

2.947%

|

|

Interest Rate:

|

3.200% per annum

|

|

Public Offering Price (Issue Price):

|

102.126% of the principal amount thereof, plus interest deemed to have accrued since January 30, 2016

|

|

Interest Payment Dates:

|

Semi-annually in arrears on each January 30 and July 30, commencing July 30, 2016

|

|

Interest Record Dates:

|

January 15 and July 15

|

|

Redemption Provisions:

|

|

|

Make-Whole Call:

|

Treasury Rate plus 20 basis points prior to October 30, 2025

|

|

Par Call:

|

On or after October 30, 2025

|

|

Joint Book-Running Managers:

|

J.P. Morgan Securities LLC

Mizuho Securities USA Inc.

Wells Fargo Securities, LLC

|

|

Concurrent Offering:

|

On February 4, 2016, we offered €550 million of 1.200% Notes due 2024 (the “euro offering”) pursuant to a prospectus supplement dated February 4, 2016. The euro offering is expected to close on February 12, 2016.

|

*Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

**We expect that delivery of the notes will be made to investors on or about February 11, 2016, which will be the fifth business day following the date of this final term sheet (such settlement being referred to as “T+5”). Under Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the secondary market are required to settle in three business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade notes prior to the delivery of the notes hereunder will be required, by virtue of the fact that the notes initially settle in T+5, to specify an alternate settlement arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the notes who wish to trade the notes prior to their date of delivery hereunder should consult their advisors.

The issuer has filed a registration statement (including a prospectus, as supplemented) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus (as supplemented) in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling J.P. Morgan Securities LLC, collect at 1-212-834-4533, Mizuho Securities USA Inc., toll free at 1-866-271-7403 or Wells Fargo Securities, LLC, toll free at 1-800-645-3751.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

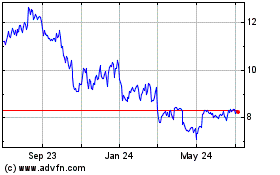

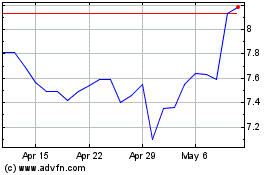

P10 (NYSE:PX)

Historical Stock Chart

From Aug 2024 to Sep 2024

P10 (NYSE:PX)

Historical Stock Chart

From Sep 2023 to Sep 2024